Summary

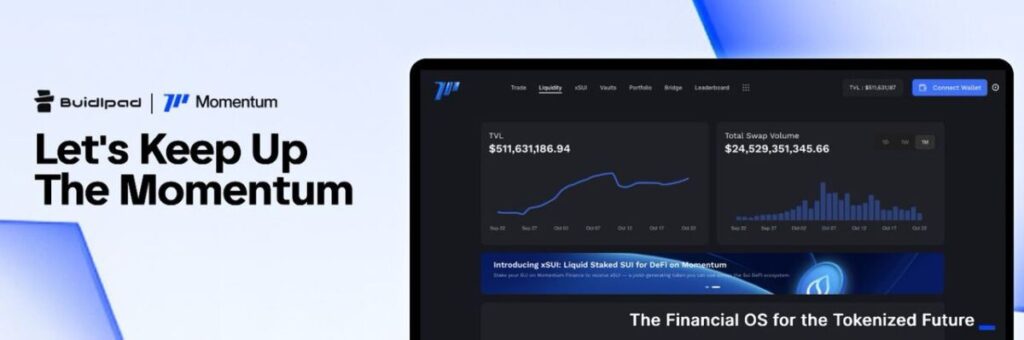

As a core DeFi protocol on the Sui Network, Momentum Finance is more than just a decentralized exchange—it serves as the central liquidity hub that connects users, assets, and multi-chain ecosystems. From token swaps to liquidity mining, staking yields, and cross-chain bridges, Momentum is building a comprehensive DeFi infrastructure for the Move ecosystem.

TL;DR

- Momentum Finance is a decentralized finance (DeFi) protocol built on the Sui blockchain, designed to become the central liquidity engine of the Move ecosystem.

- Its native token, MMT (Momentum Token), powers governance, staking rewards, and revenue sharing within the protocol.

- By offering DEX trading, liquidity mining, staking, and cross-chain bridging, Momentum provides users with a seamless entry point into the Move ecosystem.

- Leveraging the technical advantages of Sui, Momentum delivers a high-performance, low-cost DeFi experience.

1.What Is Momentum Finance?

Momentum Finance is a next-generation DeFi protocol built on the Sui blockchain, aiming to serve as the central liquidity engine of the Move-based ecosystem. Acting as a core piece of infrastructure within Sui, it enables users to engage in decentralized trading, liquidity provision, staking, and cross-chain interactions—all through a unified platform.

Its native token, MMT (Momentum Token), plays a crucial role across the protocol, functioning as the key asset for governance, staking incentives, and revenue distribution.

2.Core Features of Momentum Finance

2.1 Decentralized Exchange (DEX)

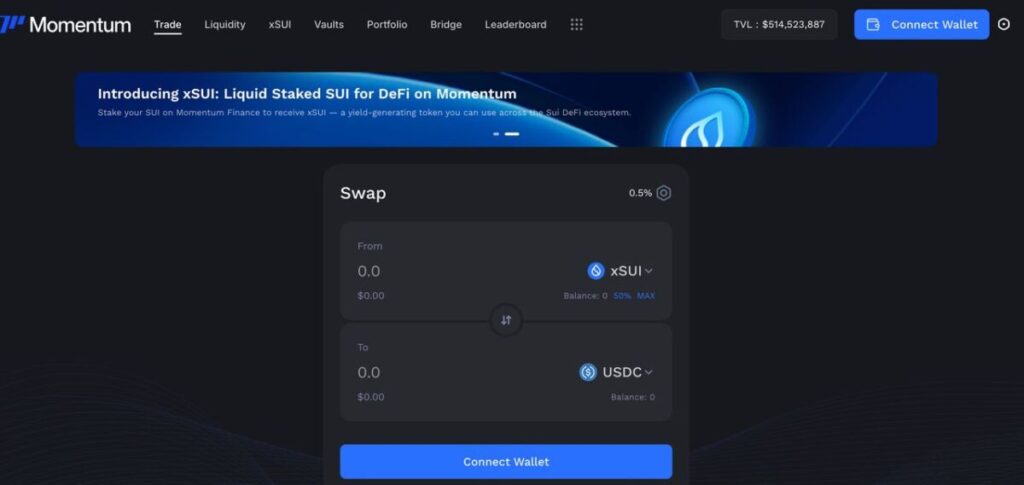

Momentum provides a fast, efficient DEX where users can swap tokens without relying on centralized intermediaries.

Built on the Sui blockchain, it delivers:

- Instant confirmations – enabled by Sui’s parallel transaction execution

- Low-slippage trading – achieved through optimized liquidity pool architecture

- Ultra-low fees – thanks to Sui’s minimal gas costs, far below Ethereum levels

2.2 Liquidity Provision and Mining

Users can earn passive income by providing liquidity to Momentum’s pools. Liquidity providers (LPs) receive:

- Trading fee rewards – a share of the transaction fees

- MMT incentives – distributed through liquidity mining programs

- LP tokens – representing ownership in the liquidity pool, usable in other DeFi strategies

2.3 xSUI Staking Mechanism

Momentum introduces xSUI, a liquid staking solution that lets users stake SUI while keeping their assets liquid.

- Staking rewards – earn validator yields from staked SUI

- Liquid xSUI tokens – representing staked positions, usable across DeFi

- Auto-compounding – reinvests rewards to maximize returns

- Instant redemption – xSUI can be converted back to SUI anytime, along with accrued rewards

This approach solves the traditional problem of locked staking capital, unlocking liquidity for users who still wish to earn yields.

2.4 Yield Vaults

Momentum’s Vaults automate yield optimization strategies for users:

- Auto-compounding – reinvests profits for higher APY

- Strategy diversification – accommodates different risk profiles

- Algorithmic optimization – managed automatically by smart contracts

- Reduced gas costs – minimizes manual intervention and transaction fees

2.5 Cross-Chain Bridge Integration

Momentum integrates several cross-chain bridge protocols, enabling seamless asset movement across networks:

- Sui Bridge – official bridge between Sui and other major blockchains

- Wormhole – decentralized cross-chain transfer protocol

- Squid – cross-chain liquidity routing solution

- LiFi – aggregator that selects the most efficient cross-chain routes

These integrations position Momentum as a gateway into the Sui and Move ecosystems, reducing friction for new users and capital inflows.

2.6 Portfolio Management

Momentum offers a complete dashboard for tracking DeFi positions:

- Asset overview – view all tokens and LP holdings in one place

- Yield tracking – monitor real-time earnings

- Activity history – full record of transactions and staking actions

- Performance analytics – visualize returns and portfolio composition

2.7 Leaderboard and Community Engagement

Momentum adds a social layer to DeFi through competitive rankings:

- Trader leaderboard – highlights top-performing traders

- Liquidity provider ranking – rewards large liquidity contributors

- Yield performance charts – showcases best-performing strategies

- Community rewards – top-ranked users may earn bonus incentives

3.MMT Tokenomics

3.1 Governance

MMT holders participate in decentralized governance, voting on key protocol decisions such as:

- Adjusting protocol parameters

- Allocating treasury funds

- Approving new product integrations or token listings

3.2 Staking Rewards

Users can stake MMT to earn a share of the protocol’s revenue, including:

- Trading fee distribution

- Extra MMT incentives

- Early access to new product launches

- Boosted rewards in liquidity mining programs

3.3 Utility Functions

MMT also serves as a utility token within the ecosystem, offering:

- Fee discounts when used for trading or bridging

- Access to exclusive IDOs or NFT launches

- Unlocking advanced DeFi strategies

- Special partner benefits and airdrops

4.Technical Advantages of Momentum Finance

4.1 Powered by the Sui Blockchain

Sui, developed by Mysten Labs, is a next-generation Layer 1 blockchain built using the Move programming language. Key features include:

- Parallel execution – processes multiple transactions simultaneously

- Object-based model – simplifies asset ownership management

- Instant finality – near real-time transaction confirmation

- Low gas fees – significantly cheaper than Ethereum and other legacy networks

4.2 Security Framework

Momentum prioritizes user and protocol security through:

- Comprehensive smart contract audits by leading cybersecurity firms

- Move’s resource-oriented programming, which prevents common vulnerabilities

- Non-custodial architecture, ensuring users always control their assets

- Timelock protection for critical protocol upgrades

4.3 Optimized User Experience

- Intuitive UI – clean interface designed for beginners and pros alike

- Fast interactions – Sui’s speed ensures near-instant feedback

- Multi-wallet compatibility – supports all major Sui wallets

- Mobile-friendly design – fully responsive across devices

5.Role of Momentum Finance in the Sui Ecosystem

As a key DeFi protocol on Sui, Momentum Finance functions as:

Liquidity Hub

- Enables token swaps and price discovery for Sui assets

- Aggregates liquidity across pools, improving efficiency

- Serves as a launchpad for new Move-based tokens

Yield Aggregator

- Centralizes DeFi yield opportunities

- Offers one-stop management for staking and vaults

- Enhances capital efficiency within the ecosystem

Ecosystem Gateway

- Onboards users and liquidity from other chains

- Lowers entry barriers to the Sui network

- Promotes interoperability across Move-based and non-Move blockchains

6.Key Investment Considerations for MMT

6.1 Potential Advantages

- Early mover advantage in the emerging Sui ecosystem

- Technical edge from Sui’s scalability and low-cost infrastructure

- Strategic positioning as the central liquidity layer

- Diverse yield opportunities through staking, farming, and governance

6.2 Potential Risks

- Smart contract vulnerabilities inherent to all DeFi projects

- Market volatility affecting token value

- Competition from other DEX and DeFi protocols

- Regulatory uncertainty around DeFi operations

- Ecosystem dependency on Sui’s long-term growth

7.Frequently Asked Questions (FAQ)

Q1: What’s the difference between Momentum and MMT? Momentum Finance is the protocol—a DeFi platform built on the Sui blockchain.MMT (Momentum Token) is its native token, used for governance, staking, and utilities within the platform.

Q2: How can I get MMT tokens? You can obtain MMT through:

- Purchasing directly on Momentum’s DEX

- Earning via liquidity mining programs

- Participating in community events or airdrops

- Buying from centralized exchanges (if listed)

Q3: What is impermanent loss, and should I worry about it? Impermanent loss occurs when token prices in a liquidity pool change significantly, affecting your withdrawal value compared to holding tokens separately. It’s a normal risk in liquidity provision, mitigated by trading fees and incentives.

Q4: What’s the difference between xSUI and SUI? xSUI represents staked SUI. Its value gradually increases as staking rewards accumulate. Unlike traditional staking, xSUI can be freely used across DeFi protocols, providing flexibility and higher capital efficiency.

8.Conclusion

Momentum Finance is establishing itself as the central liquidity engine of the Sui and Move ecosystems, offering a full suite of DeFi products—from DEX trading to staking, yield vaults, and cross-chain bridging.

Backed by Sui’s high-performance architecture, it delivers a seamless, low-cost experience for users and developers alike. Its native token, MMT, empowers governance, rewards participation, and underpins all economic activity within the platform.

As the Sui ecosystem grows and Move-based applications gain traction, Momentum Finance has the potential to become a foundational layer of the next generation of DeFi.That said, investors should remain aware of market and technical risks and approach participation with informed caution.

For those exploring opportunities in the Sui ecosystem and Move-powered DeFi, Momentum Finance offers a comprehensive, user-friendly, and forward-looking platform poised to play a pivotal role in the expansion of decentralized finance.

Join MEXC and Get up to $10,000 Bonus!

Sign Up