Introduction: What is INFINIT?

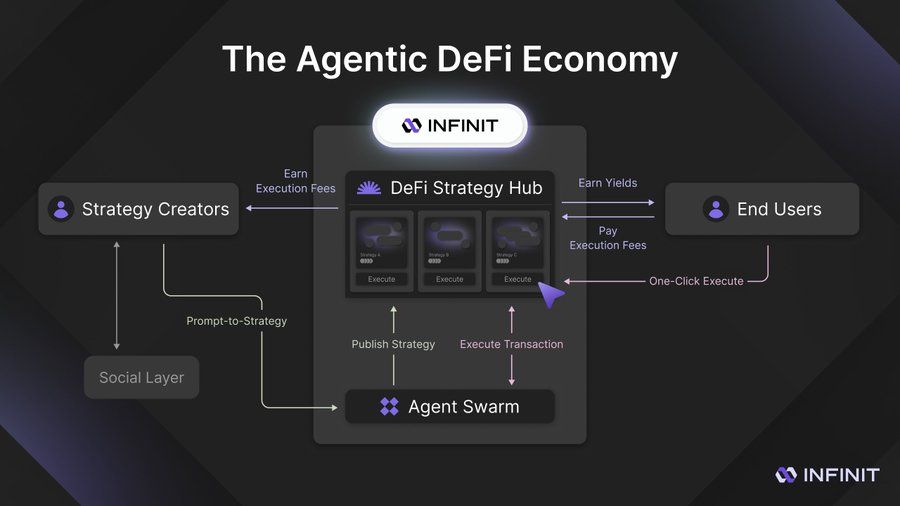

INFINIT is a revolutionary AI-driven DeFi smart platform designed to simplify decentralized financial operations through artificial intelligence agents. As a leading project in the emerging DeFAI (Decentralized Finance + Artificial Intelligence) space, INFINIT transforms complex multi-step DeFi operations into one-click execution while maintaining users’ non-custodial control over their assets.

The core innovation of the platform lies in its intelligent agent system, which helps users discover, evaluate, and execute DeFi opportunities. Whether you are a novice user or an experienced DeFi player, INFINIT provides personalized yield strategy recommendations and automated execution services.

Key takeaways

- INFINIT is an AI-driven DeFi ecosystem, integrating on-chain intelligent analysis, risk management, and asset optimization tools to enhance users’ trading and investment efficiency.

- $IN is the core token of the INFINIT ecosystem, used for paying fees, staking for rewards, participating in governance, and accessing advanced features.

- The product matrix covers intelligent investment advising, risk management dashboards, yield optimization tools, and more, dedicated to creating a “user-friendly + high-efficiency” entry point to DeFi.

- INFINIT Labs has secured strategic financing support, positioning itself for cross-chain expansion and deployment of Web3 AI applications.

1. The core problems INFINIT addresses

CurrentDeFiecosystems face major challenges including:

Operational complexity: Traditional DeFi operations require users to switch between multiple protocols,walletsand chains, posing high technical barriers.

Fragmented information: Yield opportunities are scattered across different protocols and blockchain networks, making it hard to grasp comprehensively.

Difficulty in risk assessment: There is a lack of professional tools to help users evaluate risks of different protocols and strategies.

Timecosts高: Manually monitoring the market and adjusting strategies is time-consuming and labor-intensive.

INFINITaddresses these pain points with AI technology, providing users with an intelligent DeFi experience.

2. INFINIT’s technical architecture: AI-driven DeFi infrastructure

2.1 INFINIT Intelligent Engine

The technical core of INFINIT is its proprietary AI intelligent engine, which can process massive amounts of on-chain data, market information, and user behavior patterns to generate personalized DeFi strategies. The intelligent engine employs a multi-layer architecture design:

Data aggregation layer: Continuously monitoring and aggregating data from numerous DeFi protocols,DEXlending platforms, and liquidity mining opportunities, covering real-time prices, liquidity metrics, APY calculations, and risk assessments across multiple blockchain networks.

Analysis and identification layer: Utilizing machine learning algorithms to identify patterns, predict yield opportunities, and assess risk factors under different protocols and market conditions. The system continuously optimizes the recommendation algorithm by learning from historical performance data and user interactions.

Personalization engine: Creating personalized profiles based on user behaviors, risk tolerance, investment goals, and historical preferences, allowing the platform to provide customized advice that meets the specific needs and constraints of each user.

Execution framework: Achieving seamless execution of complex DeFi strategies through smart contract interactions, processing multi-step processes such as token swaps, liquidity provision, staking, and cross-chain bridging within a single transaction.

2.2 DeFi Agents: Core technological innovation

INFINIT’s DeFi agent system is its most significant technological innovation, introducing autonomous software entities capable of understanding, analyzing, and executing DeFi strategies on behalf of users. Each DeFi agent is specifically responsible for certain aspects of the DeFi ecosystem:

Yield research agent: Continuously scanning multiple protocols to identify high-yield opportunities, analyzingAPYsustainability, protocol security, token release plans, and impermanent loss risks among other factors.

Risk assessment agent: Evaluating the safety and reliability of different protocols, consideringsmart contractaudits,Total Value Locked (TVL),historical performance, and team credibility, among other factors.

Execution agent: Technical aspects of strategy implementation, optimizationGas fees, managementslippage, coordinating multi-chain operations to ensure efficient execution.

Portfolio management agent: Monitoring existing positions, rebalancing portfolios according to market conditions, and recommending optimization plans to maximize returns while maintaining expected risk levels.

2.3 Cross-chain compatibility and multi-chain operations

INFINIT is designed to operate seamlessly across multiple blockchain networks, addressing one of the most critical friction points in DeFi: the fragmentation of liquidity and opportunity across different chains.

The platform’s cross-chain capabilities include:

- Universal protocol integration: SupportingEthereum、Polygon、Arbitrum、Optimismand other major DeFi protocols on primary networks

- Automated bridge management: Smart routing of assets across chains to capture optimal yield opportunities

- Gas fee optimization: Smart Gas fee management across different networks to minimize transaction costs

- Liquidity aggregation: Integrating a unified view of all on-chain opportunities

3. $IN Token: The economic engine driving ecosystem development

3.1 Token basic information

$IN is the native token of INFINIT and is key to guiding, maintaining, and developing the INFINIT ecosystem, facilitating platform growth through value exchange, access control, and governance functions.

Token supply:

- Maximum supply: 1,000,000,000 $IN tokens

- Supply mechanism: The $IN token is non-inflationary, with a fixed hard cap limit.

- Burn mechanism: No burn mechanism, circulation supply will gradually increase according to the release plan but will not exceed the cap.

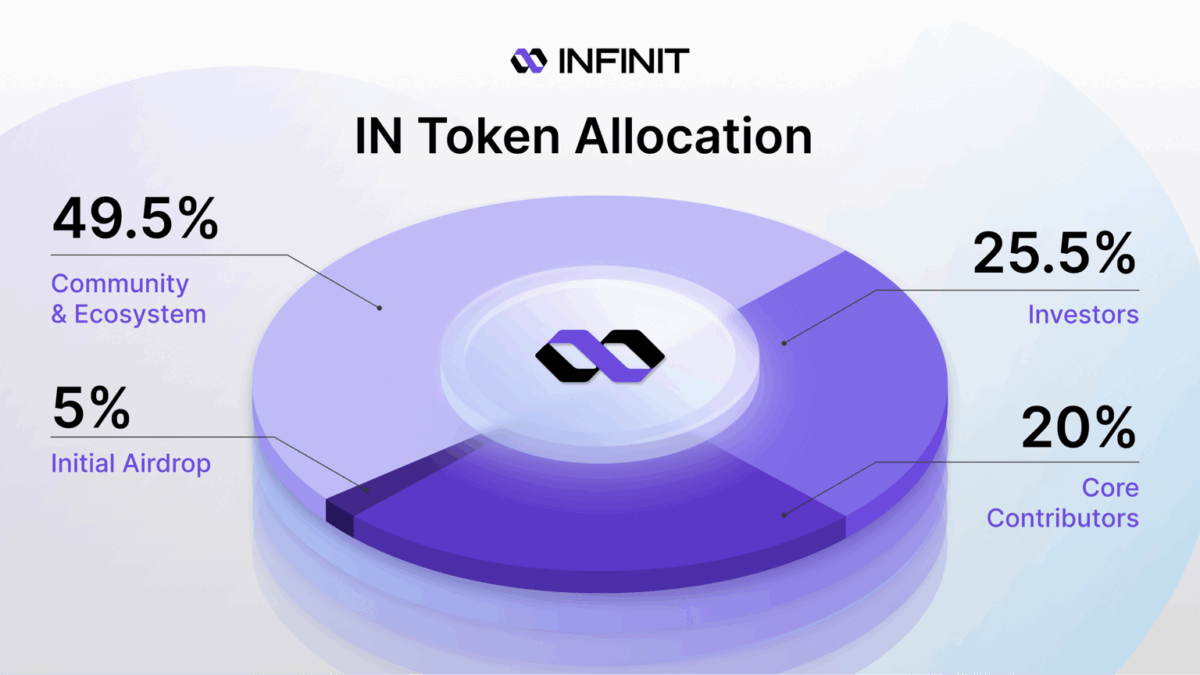

3.2 Token distribution structure

$IN token distribution adopts a balanced approach aimed at ensuring sustainable ecosystem development while rewarding early supporters and active participants:

Core Contributors (20%): Supporting ongoing development

- Allocated to the core contributor team

- 4-year linear release

- Ensures team interests are aligned with long-term platform success, providing stability and continuity for ongoing development.

Investors (25.5%): Guiding initial growth

- Allocated to investors who supported INFINIT at various stages

- 1.5-year release

- Providing necessary capital for platform development, marketing, and ecosystem expansion.

Community and Ecosystem (49.5%): Driving ecosystem growth

- For activities, partnerships, and projects supporting ecosystem development.

- Including strategy creator rewards, user acquisition, and agent infrastructure development.

- 4-year release

Initial airdrop (5%): Rewarding early users

- Rewarding truly active participants who contribute value to the INFINIT ecosystem.

- Unlocked at TGE, airdrop eligibility will be announced soon.

3.3 Token Utility and Value Accumulation Mechanism

Platform access and premium features

$IN token is the primary access mechanism for obtaining advanced AI capabilities and premium features of INFINIT:

- Advanced AI agent capabilities: Access to more complex agents with enhanced analytical and execution abilities.

- Priority execution: Enjoy faster transaction processing and priority access during network congestion.

- Enhanced personalization: Access to more detailed user profiles and personalized strategy recommendations.

- Advanced analytics: Comprehensive portfolio analysis, performance tracking, and market insights.

Staking and rewards system

The staking mechanism incentivizes long-term holding of tokens while providing additional utility and rewards to active participants:

- Staking rewards: Periodic token distribution based on platform revenue and usage metrics.

- Governance participation: Voting rights on platform upgrades, parameter changes, and strategic decisions.

- Exclusive feature access: Early access to new AI agents, testing features, and platform enhancements.

- Revenue sharing: Participating in platform fee distribution based on staking duration and amount.

Governance and decentralization.

$IN token promotes decentralized governance of the INFINIT platform, enabling token holders to participate in key decisions that influence the future of the ecosystem:

- Protocol parameters: voting on fee structures, reward distribution rates, and platform operational parameters

- Development priorities: community input on the feature development roadmap and resource allocation

- Partnership decisions: approving major partnerships, integrations, and ecosystem collaborations

- Treasury management: overseeing community treasury funds and allocation decisions

4. Application scenarios and market opportunities of INFINIT

4.1 Empowering retail investors

INFINIT democratizes complex DeFi strategies that were previously accessible only to experienced and technically knowledgeable users:

Simplified liquidity mining: users can access complex liquidity mining strategies via a simple one-click interface

Risk-adjusted strategies: AI agents automatically assess and adjust strategies based on individual risk profiles

Educational integration: the platform provides educational content and explanations alongside strategy recommendations

4.2 Institutional DeFi adoption

The complex AI capabilities and professional-grade features of INFINIT make it suitable for institutional adoption:

Portfolio management: institutions can manage large DeFi portfolios across multiple chains with automated rebalancing and optimization

Risk management: advanced risk assessment and monitoring tools provide the oversight and control required for institutional compliance

Reporting and analytics: comprehensive reporting features allow institutions to meet regulatory and internal reporting requirements

4.3 Developer and strategy creator ecosystem

INFINIT creates opportunities for developers and strategy creators to monetize their expertise:

Strategy marketplace: developers can create and publish custom DeFi strategies that other users can access and execute

AI agent development: technical contributors can develop dedicated AI agents for specific use cases or protocols

Revenue sharing: strategy creators earn from successful strategy implementations and user adoption

5. Project roadmap and development planning

5.1 Short-term development goals

INFINIT’s immediate development focus is on platform refinement, user experience optimization, and ecosystem expansion:

- platform stability continuous testing, auditing, and core platform functionality optimization

- user interface iterative improvements based on feedback and usage patterns

- expanding supported protocols and chains, providing users with more comprehensive DeFi access

- community features, governance mechanisms, and the development of user participation in the project

5.2 Mid-term strategic initiatives

- developing more complex AI agents with enhanced prediction, optimization, and personalization capabilities

- implementing features specifically designed for institutional users, including enhanced reporting, compliance tools, and portfolio management capabilities

- launching comprehensive developer tools, documentation, and incentive programs to encourage third-party agent development

- establishing strategic partnerships with major DeFi protocols, institutional service providers, and technology companies

5.3 Long-term vision

- evolving towards a fully autonomous DeFi economy, where AI agents handle most financial operations with minimal human intervention

- developing industry standards for cross-chain DeFi operations and AI agent interoperability

- simplifying DeFi to make it accessible to mainstream users without technical knowledge

- expanding the INFINIT model into other areas of decentralized finance, including lending, insurance, and derivatives

6. Conclusion: INFINIT leads the future of smart DeFi

INFINIT represents a fundamental evolution in how users interact with decentralized finance, transforming complex, fragmented processes into intuitive, intelligent experiences through its innovative AI-driven agents, cross-chain compatibility, and user-centric design. The platform addresses many key barriers that prevent broader DeFi adoption while upholding the core principles of decentralization and user control.

As a pioneering project in the emerging DeFi AI track, INFINIT merges artificial intelligence with decentralized finance, creating new possibilities for financial services. The $IN token serves as the economic foundation and governance mechanism of this ecosystem, with its well-designed tokenomics balancing immediate utility and long-term value creation.

For investors looking to participate in the next generation of DeFi infrastructure, INFINIT offers a unique opportunity to benefit from the application of AI technology in the financial sector while contributing to the ongoing development of decentralized finance. As the project continues to evolve and mature, INFINIT is expected to become an important bridge connecting the complex DeFi ecosystem with ordinary users.

Recommended Reading:

Best Exchanges to Buy and Trade Bitcoin (BTC) in 2025

What is Towns Protocol (TOWNS)? A Complete Guide to the Decentralized Communication Platform

What is Arch Network? Redefining Bitcoin’s Native DeFi with Non-Bridge Architecture

Disclaimer: This material does not provide advice on investment, tax, legal, financial, accounting, consulting, or any other related services, nor does it constitute an offer to buy, sell, or hold any assets. MEXC Beginner Academy only provides information for reference and does not constitute any investment advice. Please ensure you thoroughly understand the risks involved and invest cautiously; all investment actions taken by users are not related to this site.

Join MEXC and Get up to $10,000 Bonus!

Sign Up