In a significant development for the decentralized finance (DeFi) sector, Uniswap Labs, the company behind the popular Uniswap decentralized exchange (DEX), has agreed to a $175,000 settlement with the U.S. Commodity Futures Trading Commission (CFTC).

The settlement, announced on September 4, 2024, stems from charges related to offering leveraged cryptocurrency trading to U.S. retail investors without proper registration.

What Happened?

The CFTC alleged that Uniswap Labs violated commodity laws by allowing trading of leveraged tokens, which provided amplified exposure to Bitcoin and Ethereum price movements. These tokens, created by a third party, were deemed “leveraged or margined commodity transactions” by the regulator.

The CFTC argued that such high-risk products require special oversight and can only be offered on registered trading platforms, a status Uniswap Labs did not possess.

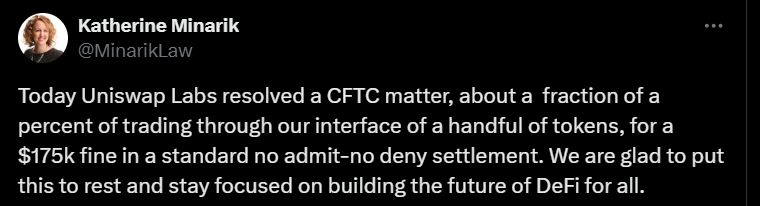

While Uniswap Labs neither admitted nor denied wrongdoing, they agreed to cease violating the Commodity Exchange Act and pay the civil penalty.

Katherine Minarik, Uniswap’s Chief Legal Officer, expressed relief at resolving the matter, stating the company is “glad to put this to rest” and refocus on advancing DeFi technology.

Why This Matters for DeFi

This settlement marks a critical juncture for the DeFi industry, signaling intensified regulatory scrutiny. It suggests that decentralized platforms are not exempt from traditional financial regulations, potentially narrowing the operational gray areas many DeFi projects have inhabited.

The case underscores a growing tension between regulatory efforts to protect retail investors and the DeFi sector’s ethos of financial innovation and accessibility.

Interestingly, the CFTC’s action faced internal dissent. Commissioners Summer Mersinger and Caroline Pham criticized the approach, labeling it “regulation through enforcement.”

They argued that the CFTC should establish clear guidelines for DeFi compliance rather than relying on punitive measures. This disagreement highlights the complex challenges regulators face in adapting existing frameworks to rapidly evolving blockchain technologies.

The Uniswap case is part of a broader regulatory focus on the crypto industry. The U.S. Securities and Exchange Commission (SEC) has also set its sights on Uniswap, previously issuing a Wells Notice regarding potential securities law violations.

Meanwhile, the New York State Attorney General’s office has reportedly subpoenaed venture capital firms about their Uniswap investments, further complicating the regulatory landscape.

This heightened scrutiny raises questions about the future of DeFi innovation in the United States. Industry observers worry that stringent enforcement without clear guidance could stifle development and drive projects overseas.

The crypto community is increasingly calling for tailored regulations that balance investor protection with the unique attributes of decentralized technologies.

For DeFi users, the immediate impact may be a reduction in high-risk product offerings on U.S.-accessible platforms. DeFi protocols might become more cautious about the services they provide to American customers, potentially limiting options but also enhancing safety measures.

Final Word

The Uniswap settlement represents a pivotal moment in the ongoing negotiation between traditional financial regulation and decentralized innovation.

As regulators grapple with applying existing laws to new technologies, the DeFi sector faces the challenge of preserving its core principles of openness and decentralization while operating within legal boundaries.

The outcome of this regulatory balancing act will likely shape the trajectory of DeFi for years to come.

As Uniswap and its peers navigate these turbulent waters, the industry watches closely to see how decentralized finance can evolve to meet regulatory requirements without sacrificing the revolutionary potential that has driven its rapid growth and adoption.

UNI Price Gearing for Bullish Move

On the technical analysis front, UNI price appears unperturbed by the recent development as it launches towards the $6.80 mark.

Following a period of consolidation along the critical $5.590 support over the past day, UNI is set to retest the $6.80 mark, which could open the door for a return to the $8.00 price point and higher.

In the meantime, we don’t see the price of UNI descending below the $5.590 support anytime soon.

UNI Statistics Data

UNI Current Price: $6.50

Market Cap: $3.91B

UNI Circulating Supply: 600.1M

UNI Total Supply: 1B

Market Ranking: #21

Get accurate, winning trading signals: https://learn2.trade/

Best crypto trading bot: https://learn2.trade/crypto-trading-bot

Personal Note From MEXC Team

Check out our MEXC trading page and find out what we have to offer! There are also a ton of interesting articles to get you up to speed with the crypto world. Lastly, join our MEXC Creators project and share your opinion about everything crypto! Happy trading! Learn about interoperability now!

Join MEXC and Get up to $10,000 Bonus!

Sign Up