Understanding of Bitcoin Series

1. Understanding of Bitcoin: Need for Decentralization and Paradigm Shift to Web 3.0

2. Understanding of Bitcoin: Cryptographic Principles of Bitcoin, Transactions, and the Double-Spending Problem

3. Understanding of Bitcoin: Explaining PBFT Algorithm and Its Applicability in Bitcoin Network

4. Understanding of Bitcoin: Nakamoto Consensus, Proof of Work Mechanism

Short Summary

1. “Bitcoin and the Need for Decentralization” explores the issues of monopoly, excessive commercialism, and centralized communication structures that have led to a growing need for a paradigm shift to Web 3.0.

2. The article highlights how blockchain technology is becoming the key concept that best responds to the concept of decentralization and leads the way in the Web 3.0 era.

3. Through Bitcoin’s P2P electronic cash system, based on cryptographic proof instead of trust in a specific institution, transactions are secure and easy without the need for third-party intermediaries, providing a decentralized system that addresses some of the issues of traditional centralized financial systems.

1.0 Introduction: The Need for Decentralization

Monopoly, excessive commercialism, and the excessive influence of leading platforms are growing issues. Companies such as Facebook, Google, Naver, and Amazon undermine user digital value compensation. It also creates the problem of excessive centralization on the web. Therefore, it is driving the increasing need for a paradigm shift to Web 3.0. Thankfully, decentralization came in as a means of breaking away from platforms that provide centralized communication structures. Furthermore, blockchain is becoming the key concept that best responds to lead the way in the Web 3.0 era.

2.0 Three Types of Decentralisation

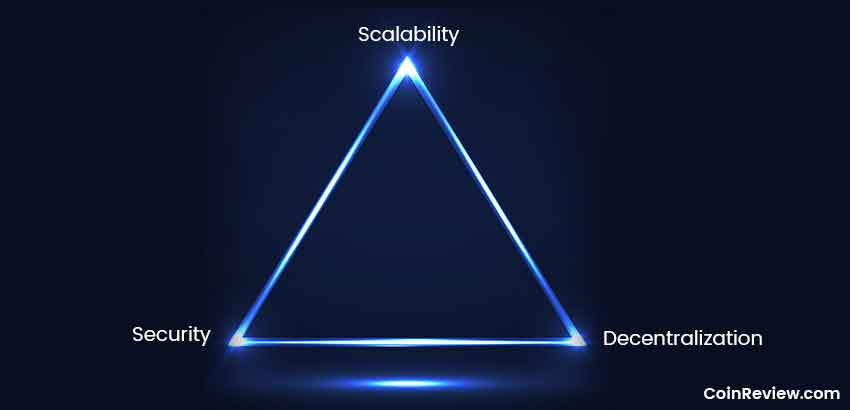

Vitalik Buterin, the founder of Ethereum, which introduced the concept of Smart Contracts, defines decentralization as a means of achieving independence from platforms that provide centralized communication structures. Decentralization has three independent criteria for classification: structural, logical, and political nature.

Image from Vitalik Buterin

- Structural (De)centralization refers to how many computers we need to build a networking system, and how many computers can function despite failures.

- Political (De)centralization refers to how many entities (institutions) control the computers that make up the system.

- Logical Decentralization refers to whether the system’s interface and data structure is uniform, or whether they are as indistinguishable as bees.

If we split the system including both operators and users in half, could each half function independently? As shown in the table above, these three classification criteria can help us better understand the concept of decentralization. Traditional corporations are structurally, politically, and logically centralized around a single CEO. Civil law is dependent on a centralized legislature, while common law comes from the precedent decision of each judge.

While logically in the middle, judicial discretion is more decentralized, making almost all laws structurally centralized. Apart from cases in which the regime controls the language of citizens, as is the case in North Korea, language does not require a centralized infrastructure, and each individual cannot change the grammar or structure of any language. Therefore, it is logically, structurally, and politically decentralized.

Vitalik Buterin’s Perspective on Decentralization

From the perspective of the concept of decentralization advocated by Vitalik Buterin, how does blockchain perform? In fact, blockchain might be the most suitable solution to the problems of the previous generation of the web and the concept of Web 3.0 decentralization. Vitalik Buterin defines the decentralization of blockchain as follows:

“The meaning of Decentralization- Blockchains are politically decentralized (no one controls them) and architecturally decentralized (no infrastructural central point of failure) but they are logically centralized (there is one commonly agreed state and the system behaves like a single computer”

Vitalik Buterin

Blockchain is politically decentralized, meaning no one controls it. It is architecturally decentralized, meaning that there is no single point of failure in the technology infrastructure. However, it is logically centralized, as there is one agreed-upon state and the system behaves like a single computer. Web 3.0 applications that utilize the ecosystem based on this decentralized blockchain are expanding more and more over time. Now, we can encounter them in various forms in our daily lives.

The birth of cryptocurrencies, which we commonly encounter, is the most representative technology of decentralized blockchain systems. Cryptocurrencies are digital assets that utilize cryptography techniques to secure transactions and control the creation of new units. They operate on a decentralized ledger called a blockchain. It allows for secure and transparent transactions without the need for intermediaries such as banks or financial institutions. Blockchain technology provides an immutable, tamper-proof record of all transactions, ensuring transparency and trust in the system.

3.0 Gold standard system

The gold standard system is a longstanding monetary system, where gold becomes a replacement for currency. The use of gold as currency has several reasons.

Firstly, gold is a stable and non-volatile asset that maintains its value over time.

Secondly, gold is a scarce resource that is not easily mined, ensuring its rarity.

Thirdly, gold has an intrinsic value due to its unique physical properties that are highly valued worldwide.

Finally, gold is malleable and portable, making it easy to transport in various forms.

The gold standard system is a monetary system where central banks hold gold and issue currency notes equivalent to the value of the gold to facilitate circulation in the market. After the Bretton Woods Agreement of 1944, the United States established a new international monetary order. It fixes the US dollar to the gold standard and makes it the reserve currency. The fixed exchange rate system was established, where other countries could exchange their currency for US dollars at a fixed rate, which could be converted to gold.

However, the Vietnam War in 1964 led to financial problems in the United States. The US secretly printed more dollars to cover these costs without disclosing the information to other countries. This caused many European countries to withdraw from the gold standard system and demand gold in exchange for their dollars. In 1971, President Nixon abolished the gold standard system and the Bretton Woods system collapsed.

This event reflects the dangers of centralized and monopolistic systems. Despite the issues surrounding the gold standard and the Bretton Woods system, the problem of the US dollar as the reserve currency remains a significant issue for many countries outside the US. The dependence on the US dollar for international trade in oil and other commodities has led to serious foreign exchange issues for many countries.

4.0 Commercial Bank Reserves

From a macro perspective, there exist issues with commercial banks beyond our previous discussion. Commercial banks take customers’ money and supply it as loans to households and businesses. Money in circulation in the market is structurally centralized in a way that it flows back into the banks. Ultimately, it creates an infinite loop. In this repeating process, commercial banks operate in a structure that allows for infinite loans as long as there is a demand for them while keeping only 10% of reserves. The problem with this centralized structure is that if all citizens were to withdraw all of their deposited funds from the banks, the banks would go bankrupt.

From a blockchain/crypto perspective, the issue with commercial banks lies in the centralized structure that they operate in, which can potentially lead to a single point of failure. In the traditional banking system, banks act as intermediaries between borrowers and lenders. It also controls the flow of money and keeps track of all transactions. This creates a centralized structure where banks have control over customers’ funds. Ultimately, it makes them vulnerable to security breaches and operational failures.

Blockchain technology, on the other hand, offers a decentralized structure where distributed ledger records the transactions. It also eliminates the need for intermediaries and provides a more secure and transparent way of handling financial transactions. By utilizing cryptocurrency and smart contracts, the need for traditional banks as intermediaries can be minimized, creating a more decentralized and secure financial system.

5.0 Birth of Bitcoin

The centralized structure of traditional financial markets has brought about various problems of reliability, which have been further exposed in the global financial crisis. In 2008, an anonymous individual named Nakamoto Satoshi introduced a research paper entitled “Bitcoin: A Peer-to-Peer Electronic Cash System” to the public. Nakamoto proposed a currency trading system that allows direct transactions between individuals using cryptographic proof of trust, without relying on specific institutions. The resulting Bitcoin is a blockchain-based P2P electronic currency system that operates without central authorities, and whose ledger of all transactions can be verified through public key electronic signatures.

What is a Whitepaper?

A whitepaper is a document similar in meaning to a business plan report. It is a document for companies or organizations that issue cryptocurrencies to describe their technology, characteristics, and advantages before issuing tokens. If we compare it to stocks, it is similar to the securities declaration document issued during the Initial Public Offering (IPO) process.

The Core Message of the Whitepaper:

- “We developed a P2P electronic currency system called Bitcoin. It is designed based on cryptographic technology rather than trust. It is designed with complete decentralization without any central servers or institutions.”

- “The commercial banks have caused a huge financial bubble of credit through massive loans, leaving only a small portion of the reserve funds that store our money.”

- “We can now safely and easily trade money without the third-party trust institution with electronic money based on cryptographic proof.”

Characteristics of Bitcoin

Bitcoin applies the concept of decentralization without central organization management to trading and transaction verification. It also records the ledger of transactions on a public blockchain system by distributing it to each distributed node. It is highly secure and reflects a high level of transparency based on this security and reliability.

PoW — Proof of Work

Bitcoin was the first cryptocurrency to use the Proof of Work (POW) consensus algorithm. It involves repeatedly finding hashes below a target value to prove participation in the work. This is applicable through the mining function.

What Is Mining?

Mining refers to the process of adding transaction records to the public ledger of Bitcoin on top of the blockchain system. This process is carried out on all network nodes.

6.0 Conclusion

In conclusion, the development of blockchain technology and cryptocurrencies, such as Bitcoin, has brought about a decentralized system that addresses some of the issues of traditional centralized financial systems, including trust and reliability. Bitcoin’s P2P electronic cash system, based on cryptographic proof instead of trust in a specific institution, allows for secure and easy transactions without the need for third-party intermediaries. The use of blockchain technology provides a transparent and highly secure public ledger that ensures the integrity of the transactions. With the use of Proof of Work and mining, transactions are validated and added to the blockchain in a decentralized and trustless manner. The advent of blockchain technology and cryptocurrencies has the potential to revolutionize the financial industry and address the shortcomings of traditional financial systems.

Reference

- 은행의 기능 : 네이버 블로그 (naver.com)

- https://medium.com/@VitalikButerin/the-meaning-of-decentralization-a0c92b76a274

Personal Note From MEXC Team

Check out our MEXC trading page and find out what we have to offer! You can learn more about cryptocurrency industry news. There are also a ton of interesting articles to get you up to speed with the crypto world. Lastly, join our MEXC Creators project and share your opinion about everything crypto! Happy trading!

Join MEXC and Get up to $10,000 Bonus!

Sign Up