As Bitcoin’s value soars to previously unheard-of heights, the focus is turning to its impending “halving” and whether or not it is influencing the rise. Depending on your point of view, the halving is either a significant development that will increase Bitcoin’s value as a more valuable asset or it is only a technical change that traders have inflated to increase its value. The halving is a change to the core blockchain technology of Bitcoin that is intended to slow down the rate at which new Bitcoins are created.

The creator of Bitcoin, Satoshi Nakamoto, intended for there to be a finite quantity of 21 million units. The halving mechanism, which reduces the rate at which new bitcoins enter circulation, was incorporated by Nakamoto into the programming of the cryptocurrency. As of right now, almost 19 million devices have been manufactured.

Analyzing the Significance of Halving in Blockchain Technology

With blockchain technology, information is recorded in what are known as blocks, which are then added to the chain through a procedure known as mining. Miners develop the blockchain by applying processing power to intricate mathematical puzzles after which, they are rewarded with fresh bitcoin. The quantity of bitcoin that is accessible to miners as rewards is halved at this point. As a result, mining becomes less lucrative, and the amount of new bitcoins produced decreases.

It is predicted that the second Bitcoin halving will take place in late April 2024. The actual timing of these halving occurrences can vary considerably due to small fluctuations in the Bitcoin network’s block production times, but they generally occur every four years. Because they have a direct effect on the rate at which new Bitcoins enter circulation, Bitcoin halvings are extremely important. Miners will receive half of the current 6.25 BTC reward for successfully verifying trades and creating blocks to the Bitcoin system when the next halving occurs or 3.125 BTC. To ensure that there is only ever a limited number of 21 million Bitcoins, this process is hard-coded into the cryptocurrency.

Impacts of Bitcoin Halving

Because halvings enhance the scarcity of Bitcoin, they may have an impact on its price. Existing Bitcoins grow correspondingly more rare as new ones become more difficult to obtain. The increased scarcity of Bitcoin may put upward pressure on prices if demand for it stays high or even increases. In addition, by maintaining the profitability of the mining process, halvings contribute to the longevity of the Bitcoin network. Because of this ongoing incentive, miners continue to devote their resources to preserving the security and integrity of Bitcoin.

As the upcoming Bitcoin halving event draws near, thousands of US mining systems that are older will be turned off for sale and sent abroad. Colorado-based distributor SunnySide Digital is setting up a shop to repair and ship these devices to regions with much cheaper electricity. Since energy is the main cost of living for miners, publicly traded behemoths like Riot Platforms (NASDAQ: RIOT) and Marathon Digital Holdings (NASDAQ: MARA) are under pressure to increase productivity to maintain their profitability. The pre-halving improvement cycle is underway despite obstacles and miners of Bitcoin have been getting ready for years. Since February 2023, it appears that the top 13 publicly traded mining corporations have spent more than $1 billion on new equipment.

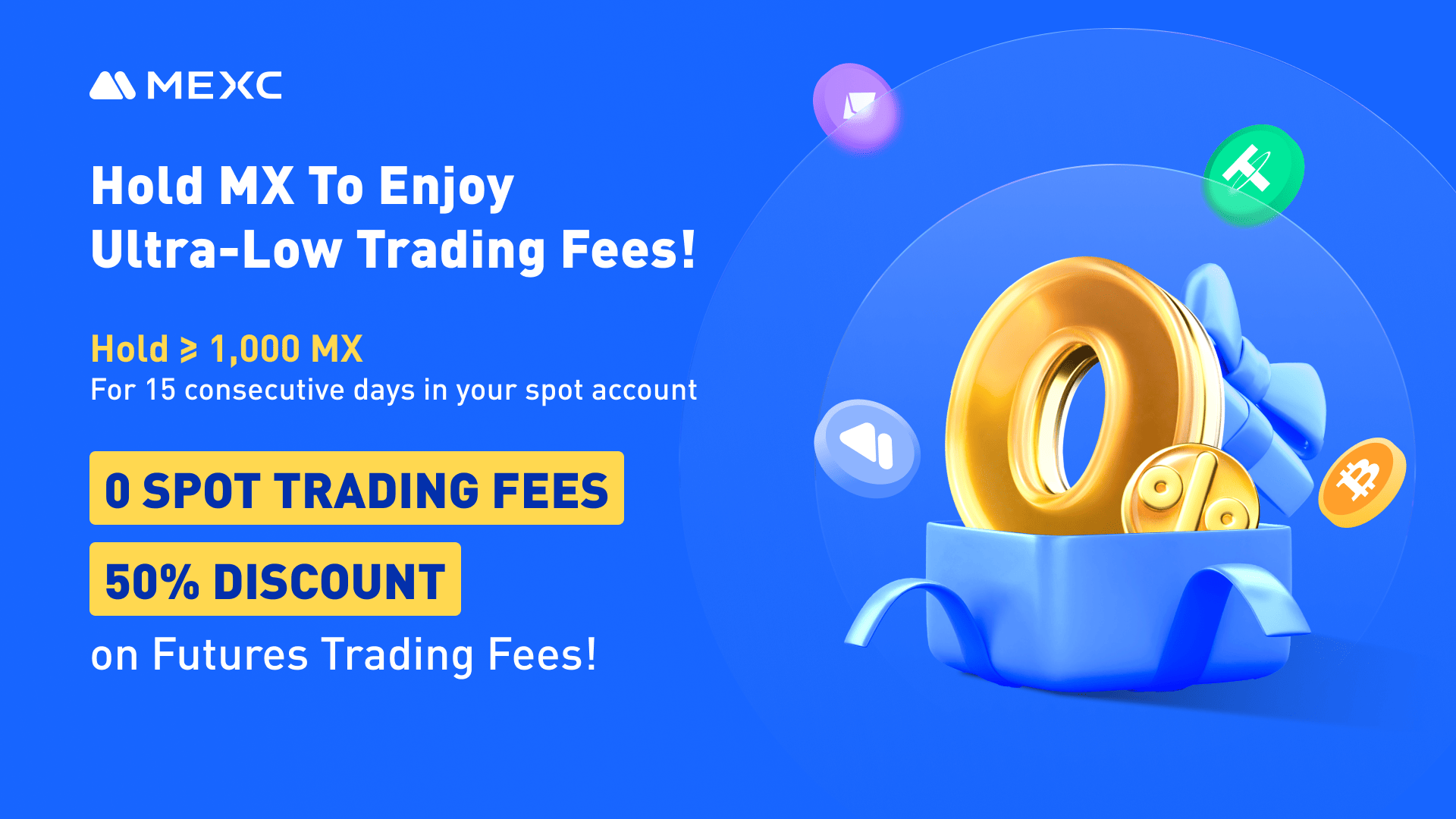

Personal Note From MEXC Team

Check out our MEXC trading page and find out what we have to offer! There are also a ton of interesting articles to get you up to speed with the crypto world. Lastly, join our MEXC Creators project and share your opinion about everything crypto! Happy trading! Learn about interoperability now!

Join MEXC and Get up to $10,000 Bonus!

Sign Up