In the exciting world of cryptocurrency, Bitcoin is gearing up for a significant event known as “halving.” If you’re new to the scene, understanding what this means and its potential impact is crucial. Let’s dive into the details.

What is Bitcoin Halving?

Bitcoin halving is a pre-programmed event built into the Bitcoin protocol, designed to occur approximately every four years or after every 210,000 blocks mined. During this event, the reward that Bitcoin miners receive for successfully mining a block is cut in half. This reduction in reward is what gives the event its name – halving.

The Importance of Bitcoin Halving

Historically, Bitcoin halving events have been viewed as bullish signals for the cryptocurrency. This perception stems from the idea of reduced supply entering the market, which can potentially drive up demand and, consequently, the price of Bitcoin.

The Upcoming Halving Event

The next Bitcoin halving is scheduled for mid-April 2024. As we approach this event, anticipation and speculation are running high within the cryptocurrency community. Many investors and enthusiasts are closely watching for potential price movements.

Factors Affecting Post-Halving Price Movements

While past halving events have often been followed by price increases, it’s essential to understand that various factors can influence Bitcoin’s price dynamics. Analysts at Grayscale, a prominent cryptocurrency investment firm, caution against relying solely on historical patterns for predicting future price movements.

Beyond Supply and Demand

Grayscale analysts emphasize that while the scarcity created by halving can impact price, other factors also come into play. These include broader macroeconomic conditions, market sentiment, regulatory developments, and technological advancements within the cryptocurrency space.

Learning from Litecoin

To illustrate this point, Grayscale analysts reference Litecoin (LTC), a cryptocurrency that shares a similar halving mechanism with Bitcoin. Despite its halving events, Litecoin’s price has not consistently experienced significant appreciation. This discrepancy highlights the complexity of cryptocurrency markets and the importance of considering multiple variables.

Conclusion: A Comprehensive Approach

As we approach the upcoming Bitcoin halving, newbies and seasoned investors alike need to adopt a comprehensive approach to analyzing market dynamics. While halving events may spark optimism, it’s crucial to consider the broader context and understand that price movements can be influenced by a multitude of factors.

In summary, Bitcoin halving is a significant event that can impact the cryptocurrency’s price, but it’s essential to approach it with a nuanced understanding of the market and its complexities. By staying informed and considering various factors, investors can navigate the cryptocurrency landscape more effectively.

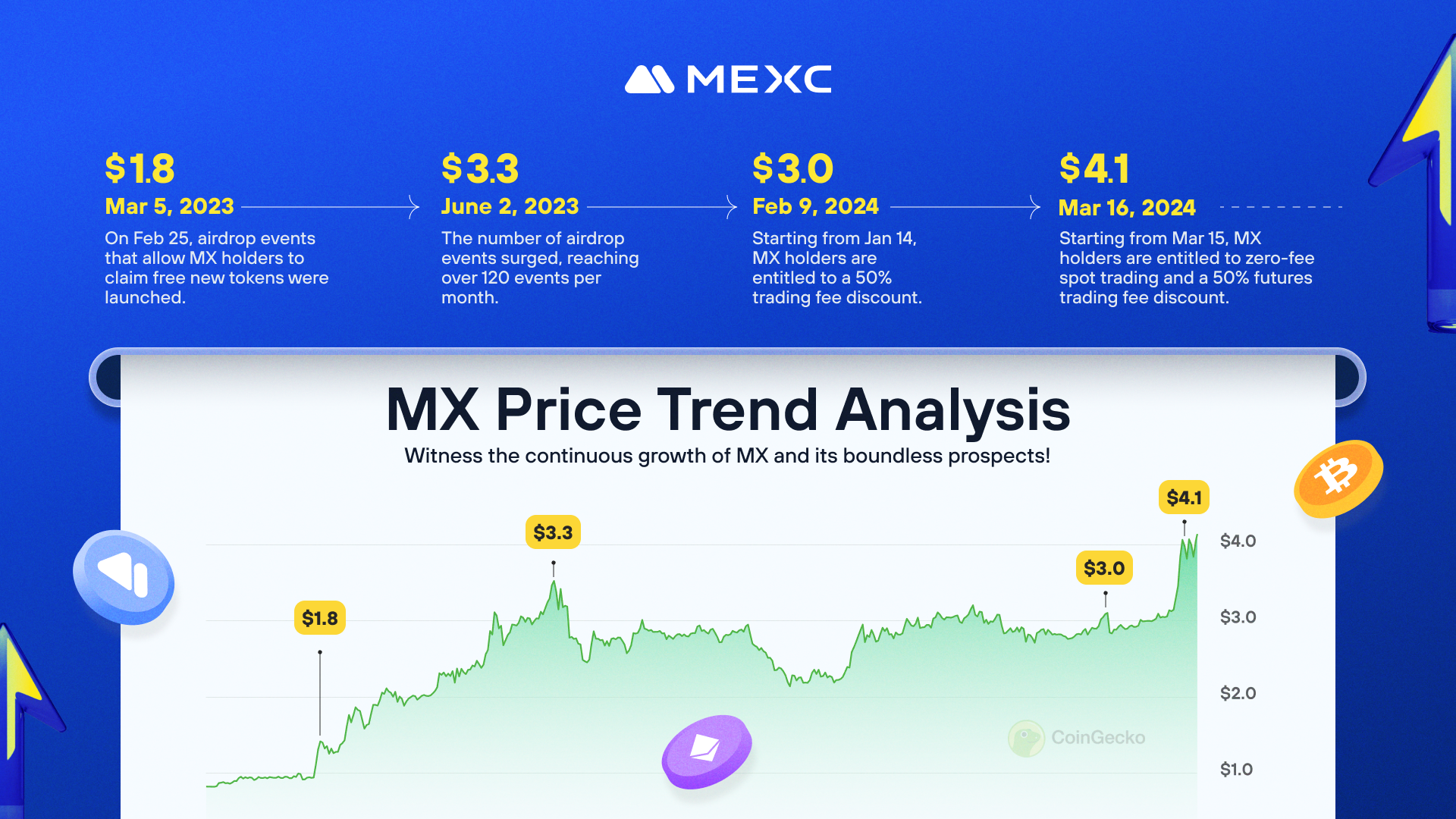

Personal Note From MEXC Team

Check out our MEXC trading page and find out what we have to offer! There are also a ton of interesting articles to get you up to speed with the crypto world. Lastly, join our MEXC Creators project and share your opinion about everything crypto! Happy trading! Learn about interoperability now!

Join MEXC and Get up to $10,000 Bonus!

Sign Up