TL;DR Breakdown

- Turkey leads stablecoin adoption amid economic instability.

- DeFi growth is fueled by stablecoin integration and liquid staking.

- The tokenization of real-world assets revolutionizes finance in the blockchain era.

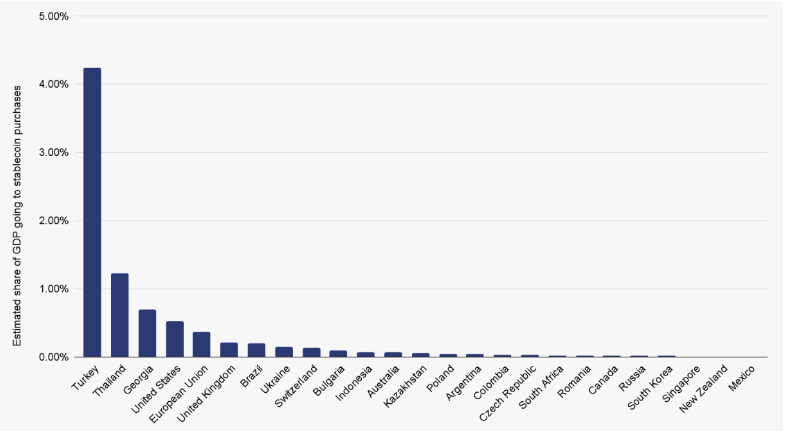

Turkey has emerged as a leading country in stablecoin adoption, outpacing the United States and other global leaders in terms of stablecoin transactions relative to its GDP.

This information comes from the “2024 Crypto Spring Report” by Chainalysis, highlighting the growing significance of stablecoins in the global market. Stablecoins, typically pegged one-to-one with the U.S. dollar, provide the benefits of cryptocurrencies without the associated volatility, making them particularly appealing in regions like Turkey.

In March 2024 alone, over $40 billion in stablecoin transactions were recorded worldwide, indicating a substantial shift towards these digital assets. Countries like Thailand and Brazil are also notable for their increasing use of stablecoins, which now account for more than half of all cryptocurrency transactions in these regions. In nations experiencing currency devaluation, such as Turkey and Georgia, residents are turning to stablecoins like USDT (Tether) to preserve savings and facilitate commerce amidst unstable economic conditions.

DeFi Sector Growth and the Impact of Stablecoins

The decentralized finance (DeFi) sector has seen considerable growth, driven by the adoption of stablecoins. Despite a period of decline where the total value locked (TVL) in DeFi platforms decreased by over 69%, the sector is experiencing a resurgence.

Innovations such as liquid staking, which allows participants to maintain liquidity while staking their assets, are contributing to this growth. This is a shift from traditional staking methods that require locking up assets, enhancing flexibility within the blockchain ecosystem.

Furthermore, the integration of real-world assets (RWAs) into DeFi is transforming asset management and investment. Platforms like TrueFi, Maple, MakerDAO, Goldfinch, Clearpool, and Centrifuge are leading the way in issuing loans collateralized by tokenized RWAs.

This sector has seen significant growth since mid-2023, with MakerDAO’s RWA program greatly enhancing its balance sheet and accounting for up to 80% of its revenue at times. The tokenization of tangible and intangible assets simplifies transactions, enhances liquidity, and promotes transparency in the market.

This trend towards incorporating RWAs underscores a broader move towards a blockchain-dominated future, where value transfers are more open and less frictional, democratizing investments and introducing innovative financial products across borders.

Personal Note From MEXC Team

Check out our MEXC trading page and find out what we have to offer! There are also a ton of interesting articles to get you up to speed with the crypto world. Lastly, join our MEXC Creators project and share your opinion about everything crypto! Happy trading! Learn about interoperability now!

Join MEXC and Get up to $10,000 Bonus!

Sign Up