Every trader in the process of trading cryptocurrencies uses important risk management tools — stop loss (Stop Loss) and take profit (Take Profit). These orders allow for automatic closing of trades with profit or loss, even if the trader is not at the terminal. In this article, we will explain what stop loss and take profit are in simple terms, how they work, and how to set them correctly on the exchange.

What is Stop Loss and Take Profit

Almost every cryptocurrency exchange offers its users the ability to create a “pending order.” Here, two aspects are important to consider:

- automatic closing or opening of a position (rather than manually);

- the actual time of the transaction.

Thus, take profit and stop loss are needed precisely so that the trade can “function” without the direct involvement of the trader, and the person may not even be in the market. How it works – we will explain further.

How Stop-Loss Works

What is a stop-loss is a question that interests many newcomers in the cryptocurrency market. Literally, stop-loss translates as “stop losses.” In practice, such orders are placed as a supplement to existing positions. Their main task is to minimize risks.

Let’s take an example. A virtual coin was purchased for a price of 1000 conditional units. The maximum loss that the trader is willing to bear is 20%. These parameters are entered into the system, and as soon as the market starts to move against this trade, for example, if the rate drops sharply, a correctly set stop loss on the exchange will automatically create a sell order for the currency when its value reaches 800 conditional units (according to the 20% loss). This will happen even if the trader is not currently in the system. In simple terms, a stop loss is a pending order that will not allow a loss greater than what was planned in advance under any circumstances.

Example:

You bought cryptocurrency for $1000. You are willing to lose no more than 20%. You set the stop loss at $800. If the rate falls to this level — the trade will automatically close. Thus, you control the risk and avoid large losses.

How take profit works

The literal translation of take profit means – ‘take profit’. Such an order, like a stop loss in a short, is set as an addition to an already opened position. Its main task will be to establish a target profit level.

Let’s return to the examples. There’s still the same coin for 1000 conditional units, only 20% is already about the level of profit that the trader wants to achieve. Consequently, the take profit is 1200 conditional units, which the crypto will be equivalent to in the market. And as soon as the rate rises and a deal can be made at the desired price, it will happen automatically. Essentially, what is a take profit? It’s a tool to secure profit. Why is this needed? The rate is so dynamic and unpredictable that a sharp upward jump can occur at any moment and for a short period of time. Again, the trader may not always be ‘online’ at that time, which means they will miss their income.

Example:

You bought a coin for $1000 and want to make a 20% profit. You set the take profit at $1200. When the price reaches this level — the order will be executed automatically, and you will receive profit without your participation.

What is the difference between them

Stop loss and take profit have only two things in common – they will always be pending orders and are used to close a trade. The main differences will be in functionality. Stop loss is a tool for minimizing losses, while take profit is needed to extract maximum profit.

Ratio of Stop Loss and Take Profit

Traders can use various ratios of stop loss and take profit, and in each case, a mathematical method should be applied. Specifically:

- 1:1 – means that upon closing the trade, the size of stop loss and take profit will be the same (as in our example – 20%);

- 1:2 – when the first figure is 10% and the second is 20%.

Popular ratios include 1 to 3, 1 to 2, 2 to 1. There is no single correct ratio or definition of what an ideal stop loss on the exchange is. Each user chooses their own strategy, and therefore their own combination of tools.

A strategy will guide you on how to properly set stop loss and take profit. And no matter what it is, it is important to clearly follow the previously outlined plan. Many traders, especially at the beginning of their career, give in to emotional stress and take impulsive actions – constantly moving orders. Without waiting for automatic operations, they manually close orders, receiving only part of the profit that was planned earlier. Therefore, professionals advise not to succumb to emotions and not to manually close trades that have not yet reached their limits, despite the market situation. Such spontaneous behavior will lead to financial losses in any case.

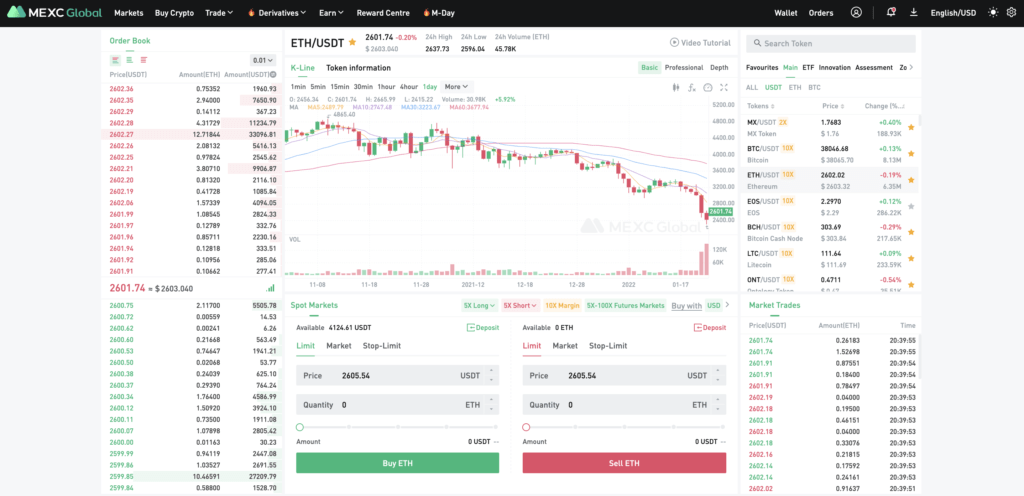

How to set Stop Loss and Take Profit on the MEXC platform

It is important to consider that both tools are used during an open trade to secure profit or loss. Therefore, the first thing to do is to open a basic trade. The sequence of actions is as follows:

- choose a trading pair;

- determine the amount of desired crypto and the total purchase price;

- set stop loss and take profit according to the strategy (for example, -5% and +10%).

At the same time, you can choose which tools will be active – only stop loss, only take profit, or both simultaneously.

How to set take profit

Now we offer a closer look at how to set a take profit. For this, a stop-limit order will be required. Therefore, in the terminal, the order type ‘limit’ for sale is selected. Two fields need to be filled: price (in our example, this will be 1100 conventional units) and quantity (in this case, 1). Next, you will need to click the ‘sell’ button. So, when the cost of the crypto reaches 1100 u.e., 1 coin will be ‘sold’ at this rate automatically.

How to Properly Set a Stop Loss

Let’s move on to how to set a stop loss. Here, a ‘stop-limit’ order for sale will be required. You will need to fill in three fields immediately:

- ‘stop’ – the price at which the order is placed for sale (in the example, 950 u.e.);

- limit – the price at which the sale will be made (which is again 950 conventional units);

- quantity of crypto – one unit.

And here it is worth noting that the first two lines turn out to be identical. Specialists do not recommend doing this, as there is a risk of slippage, which means that the order may not be executed. How should you properly set a stop loss in this case? At a small distance from each other.

Automatic Stop Loss and Take Profit

Both parameters are triggered automatically, even when the user is not logged into their account. Trades are conducted at pre-approved amounts and percentage ratios defined by the strategy.

Stop Loss and Take Profit Simultaneously – How to Set

Knowing how to properly set a stop loss and take profit, it is important to understand whether they can be set simultaneously and how to do this from a technical standpoint. To do this, you will need to select the order type “OCO”. Next, fill in four fields. You will need to specify:

- the price;

- “stop”;

- “limit”;

- amount of crypto

Это базовые настройки, которые помогут продать монету по параметрам, указанным в стратегии. Только после этого стоит нажимать на кнопку “продать”. На бирже будет выставлено сразу два ордера – тейк профит по максимальной цене и стоп лосс по минимальной.

Важно! Как только один из ордеров сработает (курс возрастет или, наоборот, понизится), то второй ордер отменяется автоматически. То есть, если удалось продать крипту по максимально заявленной цене, то стоп лосс уже “выходит из игры”. Как правильно выставить стоп лосс уже понятно, однако существует понятие “передвижного stop loss”. Им нередко пользуются профи для наибольшей выгоды от каждой сделки. Тут потребуется не только знание инструментов, но и чуточку технической работы. В чем суть метода?

Вы видите, что после открытия ордера движение рынка осуществляется в выгодном направлении (например, рынок растет, когда вы продаете крипту). Есть возможность заработать больше, если вовремя “подвинуть” тейк профит, а следом за ним и стоп лосс. Итак, вы видите, что цена приближается к вашему максимуму, например, 1200 условных единиц. В ручном режиме параметр изменяется на 1500, а стоп лосс с предполагаемых 800 на 1000. Таким манипуляции можно проводить несколько раз и даже автоматизировать такой процесс. Но тут важно внимательно следить за ценой и быть уверенным в том, что она движется в нужном для вас направлении.

Common mistakes when setting stop loss and take profit

Despite the simplicity of using these tools, not everyone knows how to set a stop loss correctly, and not always understand how take profit works in practice. By using such functionality, beginners often make “classic” mistakes. Therefore, it is better to learn from others’ wrong actions than to make your own and lose money.

The first and most common mistake is not setting a stop loss. The reasons for such actions vary. For example, a person is completely confident that they will be in front of the computer screen and will closely monitor market movements. Or they are so overconfident that they consider financial losses impossible – they have calculated everything. However, circumstances can be different, including force majeure, so the best solution would be to set a stop loss to avoid losing the principal amount.

The second, but no less significant mistake is the fear of setting a ‘large’ stop loss. A person is so unwilling to lose even the slightest portion of their money that they set parameters contrary to the principles of money management. It is important to remember that the deposit is working capital. And it should operate with maximum efficiency. Such trades usually close very quickly, resulting in a stable loss. After all, the market is dynamic and can fluctuate, sometimes falling a little and sometimes rising sharply.

The third aspect is emotionality. We have partially described the situation where a trader, seeing price fluctuations, constantly changes indicators. Therefore, it bears repeating that beginners and professionals should rely on common sense and strategy, not on fears.

How is take profit useful for beginners?

Beginners, who are more susceptible to the influence of emotions over cold reasoning, must obligatorily use take-profit. Here, the opposite situation applies. Unlike those who are afraid of going into the negative, other traders believe that they should not limit themselves in profit. Therefore, they strive to obtain as much as possible in a short time by any means. Often, such a strategy ends in losses, as prices cannot continuously rise. A change in strategy may be perceived as a temporary disorder, and the hope for constant profit growth will lead to even more reckless actions.

And here the take-profit comes into play as a restraining factor that facilitates closing a deal in any case. When one order closes, you can create the next one, having made a profit on the previous one.

Advantages and Disadvantages of Stop Losses and Take Profits

We have already dealt with how stop loss works. Now we suggest highlighting its pros and cons. Among the advantages is the ability to decide in advance at what price the trader is willing to sell the asset, thus avoiding losses. Additionally, a benefit is that the tool allows one to step away from the computer and automate the transaction process. But there is also a downside. By limiting the budget’s drawbacks, you cannot fix the maximum profit. Therefore, it will require working in conjunction with take profit, which also has its own peculiarities. Its usefulness lies in the fact that it prevents emotions from taking control over the person. And, of course, it frees one from “manual” labor. The downside is the price rise after the deal closes, but here one can intervene and timely increase the indicator.

Conclusion

Stop Loss and Take Profit are indispensable tools for any trader on the MEXC cryptocurrency exchange. They allow for the automation of trading processes, minimizing losses and securing profits. To maximize benefits, it is important not only to know what stop loss and take profit are, but also to apply them correctly in practice, avoiding common mistakes.

Join MEXC and Get up to $10,000 Bonus!

Sign Up