In 2024, stablecoins are shaking up the crypto world, as highlighted by the latest reports from CCData. These digital assets pegged to stable currencies like the US dollar, have hit a record market cap as new regulations sweep across the market.

Stablecoin Market Records Notable Growth in June

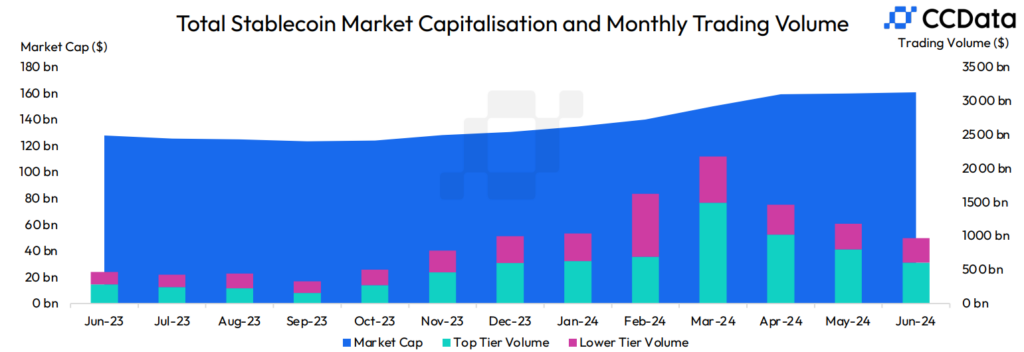

The total market value of stablecoins reached a whopping $161 billion in June 2024. This marks the ninth month in a row that the market has grown, according to CCData.

It’s now at its highest point since April 2022. However, the growth has slowed down in recent months, matching the overall cooldown in the crypto market.

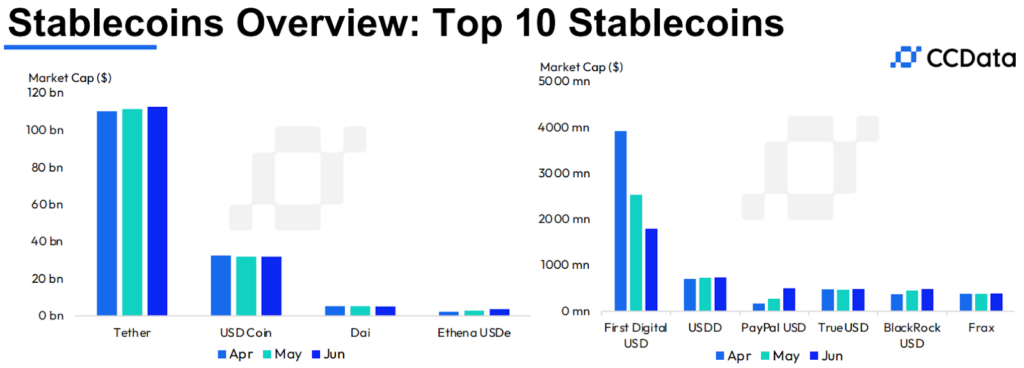

Interestingly, Tether (USDT) hit a new record high of $113 billion in market value that same month. It now makes up 70% of the entire stablecoin market. This growth shows that more people are using USDT, despite some concerns about its backing.

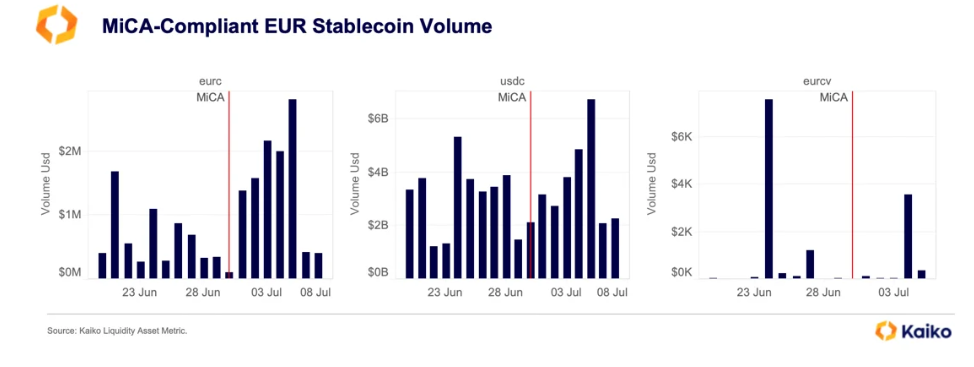

On the other hand, Circle’s USD Coin (USDC) is making waves as a regulated stablecoin. It’s now compliant with new European rules called MiCA, which has led to a big jump in USDC trading, especially on centralized exchanges.

More traders are using USDC for things like futures trading, showing a shift towards more regulated options.

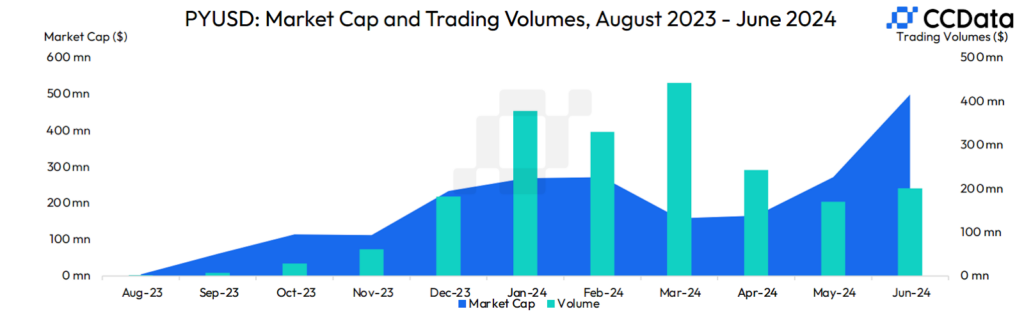

Meanwhile, PayPal’s stablecoin, PYUSD, also saw a huge 83.6% increase in market value, reaching $499 million.

According to CCData, this growth is partly due to its recent addition to the Solana network. Many users are lending out their PYUSD on Solana, earning high interest rates.

New Rules Shake Up the European Market

The European Union’s new MiCA regulations for crypto assets took effect on June 30, 2024. These rules set strict standards for stablecoin issuers.

So far, only a few stablecoins, including USDC and some euro-pegged coins, have met these requirements. This has led to some exchanges delisting non-compliant stablecoins for European users.

Apart from that, some stablecoins have already recorded the after-effects of this regulatory shake-up in terms of trading volumes. Some of the stablecoins in this category include USDC, EURC, and EURCV.

Stablecoin Trading Volumes Take a Hit

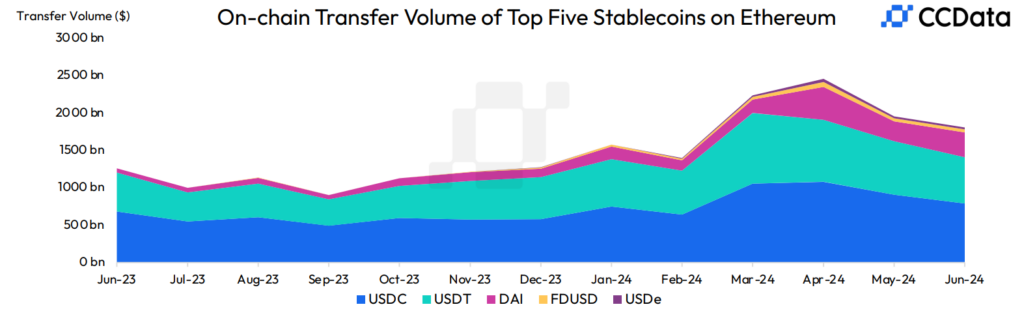

Moving on, despite the growth in market value, stablecoin trading volumes have dropped. In June, trading on centralized exchanges fell by 18% to $970 billion. CCData notes that this is the lowest level in seven months.

Of course, the decrease might be due to a general slowdown in crypto trading activity.

Likewise, the number of stablecoins moving on blockchain networks has also decreased. On Ethereum, the largest network for stablecoins, transfer volume fell by 7.5% to $1.80 trillion in June.

Looking Ahead: Stablecoins in the Spotlight

As regulations tighten and market conditions evolve, stablecoins are likely to remain a hot topic. The push for more regulated options could reshape the market, potentially boosting coins like USDC. At the same time, established players like Tether continue to dominate.

As the crypto market matures, stablecoins are set to play an even bigger role. Whether you’re a seasoned trader or just curious about crypto, understanding stablecoins is key to navigating this exciting and ever-changing landscape.

Stablecoin Statistics Data

Current Stablecoin Market Cap: $164 Billion

24-Hour Trading Volume: $57.4 Billion

Top 10 Stablecoins:

- Tether (USDT)

- USD Coin (USDC)

- Dai (DAI)

- First Digital USD (FDUSD)

- USDD (USDD)

- TrueUSD (TUSD)

- PayPal USD (PYUSD)

- Ethena USDe (USDe)

- Frax (FRAX)

- USDB (USDB)

Get accurate, winning trading signals: https://learn2.trade/

Best crypto trading bot: https://learn2.trade/crypto-trading-bot

Personal Note From MEXC Team

Check out our MEXC trading page and find out what we have to offer! There are also a ton of interesting articles to get you up to speed with the crypto world. Lastly, join our MEXC Creators project and share your opinion about everything crypto! Happy trading! Learn about interoperability now!

Join MEXC and Get up to $10,000 Bonus!

Sign Up