Solana, a rapidly growing blockchain platform supporting decentralized applications (dApps) and smart contracts, has experienced a week of contrasting signals.

While its decentralized finance (DeFi) sector has achieved record-breaking trading volumes, its open interest has declined by 20% in the wake of Bitcoin’s new all-time high.

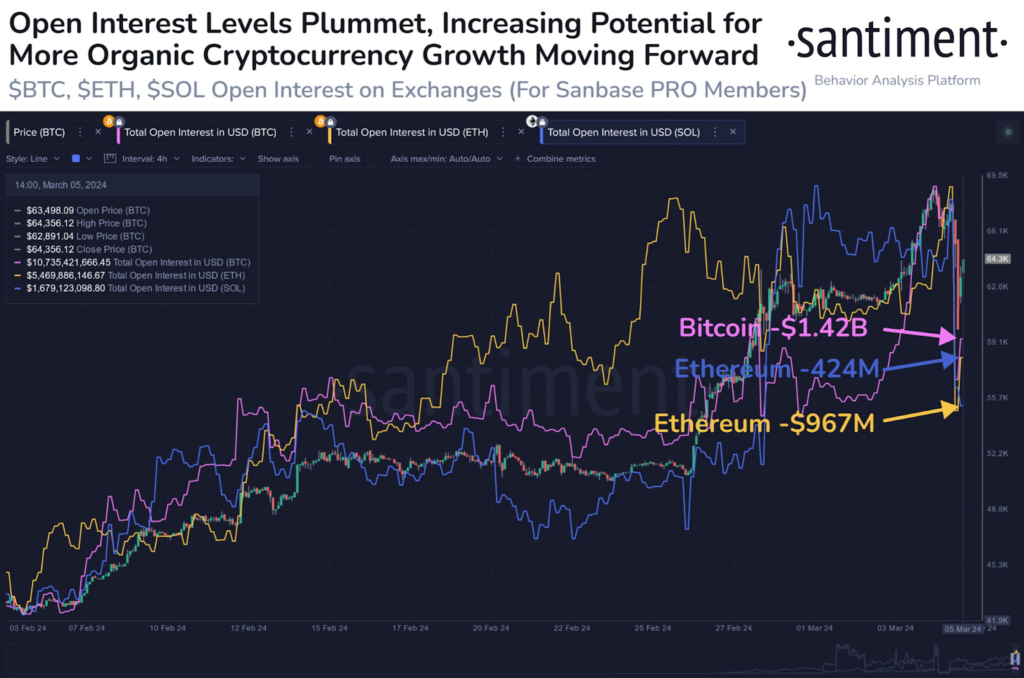

Open interest is a measure of the total value of derivative contracts, such as futures and options, that are currently open on all exchanges. It indicates the level of interest and activity in a given cryptocurrency.

A high level of open interest means that many traders are opening new positions, which could lead to more volatility and price movements. A low open interest means that traders are closing or liquidating their positions, which could result in more stability and less leverage.

According to Santiment, a crypto analytics firm, Solana’s open interest dropped by $424 million, or 20%, on March 6, mirroring trends seen in Bitcoin and Ethereum. This suggests that many traders have exited or been forced out of their positions due to sharp market fluctuations.

Solana DeFi Ecosystem Remains in a Frenzy

Despite the decline in open interest, not all is gloomy for Solana, as its DeFi sector has shown remarkable growth and resilience.

Solana’s DeFi ecosystem offers high scalability, low fees, and interoperability with other blockchains, making it an attractive alternative to Ethereum, the dominant platform for DeFi.

Data from DeFiLlama, a website tracking DeFi activity, reveals that Solana-based decentralized exchanges (DEXes) processed a record $11.24 billion in cumulative trading volume between February 25 and March 2, marking a 177% increase from the previous week and surpassing volumes on major blockchains like Ethereum.

Jupiter, the largest DEX on Solana, has played a pivotal role in this surge. Jupiter is a fully decentralized and non-custodial exchange that offers low latency and high liquidity for trading any token on Solana.

According to CoinGecko, Jupiter executed $1.5 billion in trading volumes within the last day, briefly surpassing Uniswap V3, the leading DEX on Ethereum.

SOL Is Yet to Go Parabolic

All the roller coaster activity on the Solana network comes at a time when the SOL token is gearing up for notable price action, amid the resurgence seen in Bitcoin and many meme coins and alts.

On March 5, Bitcoin printed a fresh all-time high above $69,000, which was immediately followed by a sharp slump, triggering over $1 billion in liquidations across the crypto market. Solana suffered the backlash from the dip as it fell sharply towards the $105 base before recovering to stable conditions.

SOLUSD Daily Chart

With that out of the way, the path might be opening up for SOL to make a fresh attempt towards the $150 mark as traders patiently await parabolic price action from SOL. In the meantime, the $105 base is the key level to keep in focus, though we’re not likely to see the price approach that level anytime soon, at least organically.

SOL Statistics Data

SOL Current Price: $131

Market Cap: $57.9B

SOL Circulating Supply: 442.4M

SOL Total Supply: 571.2M

Market Ranking: #5

Get accurate, winning trading signals: https://learn2.trade/

Best crypto trading bot: https://learn2.trade/crypto-trading-bot

Personal Note From MEXC Team

Check out our MEXC trading page and find out what we have to offer! There are also a ton of interesting articles to get you up to speed with the crypto world. Lastly, join our MEXC Creators project and share your opinion about everything crypto! Happy trading! Learn about interoperability now!

Join MEXC and Start Trading Today!