Summary

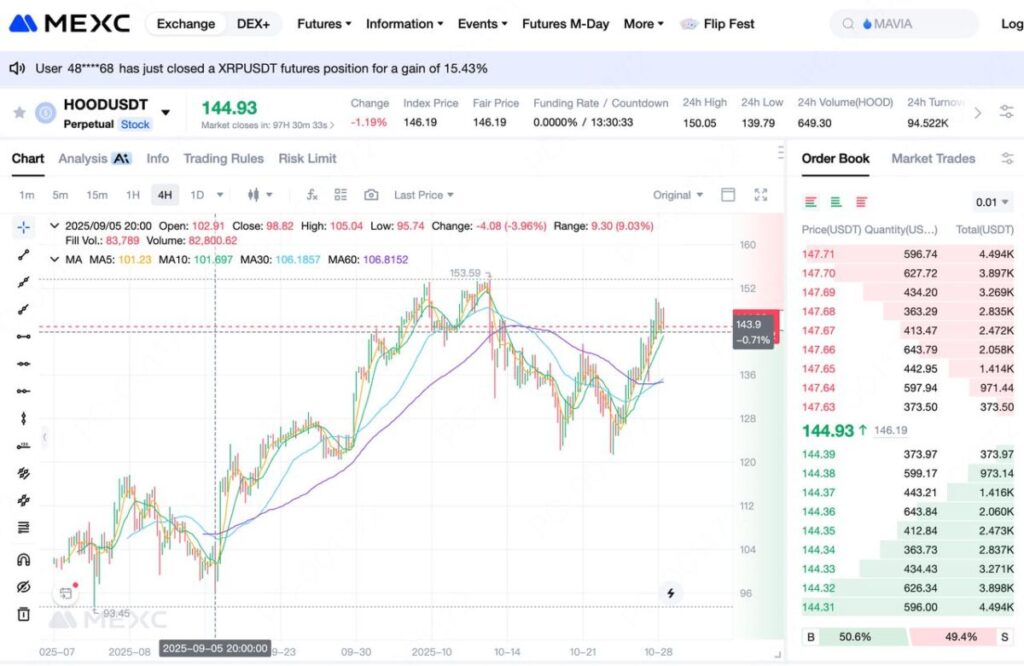

As global exchanges expand tokenized stock offerings, Robinhood (HOOD) has emerged as a high-volatility favorite among traders. With MEXC’s HOODUSDT perpetual futures, investors can now speculate on HOOD’s price movements directly in USDT — without owning any traditional shares.\

TL;DR

- Robinhood Markets, Inc. (Ticker: HOOD) has become one of the most actively traded tokenized stocks.

- The launch of “HOOD USDT” perpetual futures on MEXC enables 24/7 trading and flexible leverage with USDT settlement.

- While high potential returns exist, leveraged trading involves substantial risks — beginners should start conservatively.

1. Company Overview

1.1 About Robinhood

Robinhood Markets, Inc.(HOOD) is a leading mobile-first brokerage platform offering commission-free trading across equities, options, and cryptocurrencies. With its mission to “democratize finance for all,” the platform has built strong brand equity among millennial and Gen Z investors.

1.2 Why HOOD Became a Popular Futures Asset

- High volatility: HOOD’s stock is sensitive to market sentiment, retail flow, and regulatory updates — ideal for futures traders.

- Strong brand and liquidity: Robinhood’s mainstream recognition ensures ample market participation and trading depth.

- Competitive and narrative-driven: As zero-commission models reshape brokerage economics, Robinhood remains a key media and market topic.

- Diversified exposure: Expansion into crypto and retirement accounts strengthens its ecosystem.

- Lower entry barrier: MEXC’s HOODUSDT perpetual futures allow investors to trade HOOD movements directly with USDT — no U.S. brokerage required.

2. HOODUSDT Perpetual Futures Explained

2.1 What Is a USDT Perpetual Contract

A USDT-settled perpetual futures contract allows traders to speculate on an asset’s price direction without holding the underlying stock. There’s no expiry date — instead, funding rates keep prices anchored to the spot index.For example, MEXC has explicitly supported multiple U.S. stock futures contracts, such as AMZNUSDT and COINUSDT.

2.2 Key Differences vs. Stock Trading

- No need for a U.S. brokerage account.

- Trade both long and short positions.

- Leverage available to amplify capital efficiency.

- Higher potential returns — but equally higher risk.

2.3 MEXC Features for HOODUSDT

- Low barrier access: Only USDT required; no complex stock account setup.

- Aligned market hours: Some stock futures sync with U.S. equity sessions for stable liquidity.

- Advanced risk tools: Isolated margin, adjustable leverage, stop-loss/take-profit support.

3. How to Trade HOODUSDT on MEXC

- Sign up and verify your MEXC account and complete KYC.

- Transfer USDT to your Futures Wallet.

- Search “HOODUSDT” and open the perpetual futures pair.Choose direction (long/short), set leverage and entry type (market/limit).Define stop-loss and take-profit thresholds.

- Monitor positions and margin ratio to avoid liquidation.

4.Market Logic & Trading Insights

4.1 Why Traders Focus on HOOD

- Social trading momentum: Robinhood’s community engagement drives attention.

- High volatility: Retail sentiment and policy news create frequent swing setups.

- Tokenization expansion: HOOD USDT represents the convergence of U.S. equities and crypto markets.

4.2 Trading Guidelines

- Start with low leverage (2–3x) and small position sizing.

- Use stop-loss/take-profit rules to manage volatility.

- Evaluate funding rate and liquidity conditions before scaling exposure.

4.3 Key Risks

- Leveraged losses can exceed principal if unmanaged.

- After-hours volatility and thin liquidity may cause slippage.

- Futures provide no shareholder rights or dividends.

- This article is for educational purposes only — not financial advice.

5.FAQ

Q1: What’s the difference between HOOD stock and HOODUSDT futures? A: The stock represents ownership in Robinhood, while the HOODUSDT perpetual is a crypto-derivative contract settled in USDT with leverage up to 100×.

Q2: Do I need a U.S. stock account to trade HOODUSDT? A: No. You can access it directly through MEXC using USDT as collateral.

Q3: Is HOODUSDT suitable for beginners? A: Suitable only for users familiar with derivatives. Start small and use low leverage.

Q4: What type of investors favor HOOD stock? A: Growth-oriented, fintech-focused, and risk-tolerant investors who believe in the digital brokerage model.

Q5: Who are Robinhood’s main competitors? A: Schwab, SoFi and so on. Robinhood’s edge lies in its young user base (75% Gen Z & Millennials) and fast product iteration such as the IRA launch.

6.Conclusion

The tokenization of U.S. equities is reshaping how investors access traditional assets. Robinhood (HOODUSDT) stands at the intersection of fintech and crypto innovation — bridging Wall Street and Web3. Through MEXC’s perpetual futures, traders can now capture opportunities from one of the most dynamic narratives in modern finance.

Join MEXC and Get up to $10,000 Bonus!

Sign Up