Victoria, Seychelles, 24 July 2025 — MEXC, a leading global cryptocurrency exchange, has released a new behavioral intelligence report showing a dramatic generational shift in crypto trading patterns. Based on in-platform analytics of over 780,000 Gen Z users (aged 18–27), the report finds that two-thirds of this cohort either currently rely on or are willing to adopt AI-powered tools as part of their trading strategies.

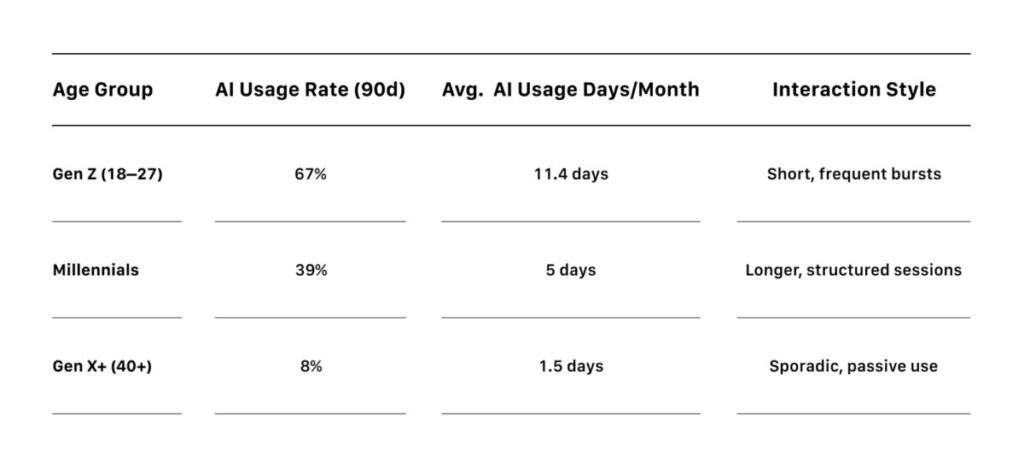

The MEXC data reveals a clear generational divide in how traders interact with technology, manage risk, and emotionally navigate volatile markets. With 67% of Gen Z users activating at least one AI bot or strategy in the last 90 days, the report underscores a shift toward automation, emotional regulation, and strategic delegation in crypto investing.

Key Takeaways:

- 67% of Gen Z users activated at least one AI-powered trading bot within Q2 2025.

- 22.1% of Gen Z traders engage regularly (4+ interactions/month) with AI tools or rule-based strategies.

- Gen Z accounts for 60% of all AI bot activations on MEXC.

- Gen Z uses AI trading tools 11.4 days/month, more than double the engagement of users over 30.

- Gen Z users are 2.4x more likely to use AI-generated signals than traditional technical indicators.

These trends intensify during periods of market uncertainty. Usage patterns reveal a deliberate strategy: 73% of Gen Z users activate bots during volatility spikes, but consciously disable them during stagnant or low-volume periods, signaling intentional, rather than passive, AI deployment.

Psychological Insights: Trust in AI, Control Through Delegation

MEXC’s data shows that Gen Z’s affinity for AI reflects more than convenience — it’s part of a broader behavioral adaptation. Bots function as emotional anchors, reducing panic sell-offs by 47% compared to manual traders during high-stress market events.

Gen Z configures automated strategies with clear parameters, then steps back. This “structured delegation” helps them manage cognitive overload and avoid impulsive decisions. The report cites parallel trends in workplace behavior: according to a May 2025 study by Resume.org, over 50% of Gen Z workers consider ChatGPT a co-worker or even a “friend.”

AI as Risk Management

The latest metrics also suggest that, beyond automation — the primary advantage of using AI tools — Gen Z traders are increasingly recognizing their value in risk management. Specifically, MEXC’s research highlights several behavioral patterns among Gen Z users who adopt AI:

- 1.9x less likely to reactively trade in the first 3 minutes of market events — the most emotionally vulnerable window.

- 2.4x more likely to implement stop-loss and take-profit rules.

- 58% of all Gen Z AI trading activity occurred during spikes in MEXC’s internal volatility index.

These observations suggest a semi-automated, discipline-enforcing approach, where AI serves as a protective layer against emotional volatility.

Gen Z vs. Millennials in AI Trading

MEXC’s cross-age analysis reveals a stark behavioral divergence. While Millennials prefer thesis-driven, chart-heavy strategies, Gen Z treats trading as an interactive, fast-paced environment — mirroring their behaviors on platforms like TikTok and Discord. This generation prefers modular, customizable tools that match their fragmented attention spans and emotional bandwidth.

The Road Ahead: AI Becomes the Interface

According to MEXC’s forecast, AI is on track to evolve from a feature into the foundation of trading platforms. By 2028, more than 80% of Gen Z traders are projected to rely on AI for full-cycle portfolio management, including dynamic asset rebalancing, cross-chain yield strategies, tax automation, and risk-tiered exposure allocation.

This evolution parallels a broader market trend: the global AI trading platform industry is projected to grow at a CAGR of over 20%, reaching $69.96 billion by 2034.

Yet, the report also warns of the risks of overreliance. AI systems are only as sound as the data and assumptions they’re built on. Black swan events, algorithmic bias, or opaque models can undermine trust and performance. MEXC emphasizes the need for transparent, auditable AI frameworks and user education to ensure safe adoption.

The full report is available at the link.

About MEXC

Founded in 2018, MEXC is committed to being “Your Easiest Way to Crypto”. Serving over 40 million users across 170+ countries, MEXC is known for its broad selection of trending tokens, frequent airdrop opportunities, and low trading fees. Our user-friendly platform is designed to support both new traders and experienced investors, offering secure and efficient access to digital assets. MEXC prioritizes simplicity and innovation, making crypto trading more accessible and rewarding.

For more information, visit: MEXC Website|X|Telegram|How to Sign Up on MEXC

For media inquiries, please contact MEXC Media Centre media@mexc.com

Join MEXC and Get up to $10,000 Bonus!

Sign Up