TL;DR Breakdown

- SSS adopts USDT for payments; Tether partners with Uquid for contributions.

- Philippines embraces stablecoins; SSS modernizes with USDT disbursements.

- SSS goes crypto: USDT for payouts, Uquid for contributions, challenges ahead.

The Philippine Social Security System (SSS) has announced a groundbreaking move to incorporate USDT stablecoin for its disbursements. This decision marks a significant shift in the country’s approach to social security payments and represents a major step towards embracing digital currencies in government operations.

Tether’s Partnership with Uquid

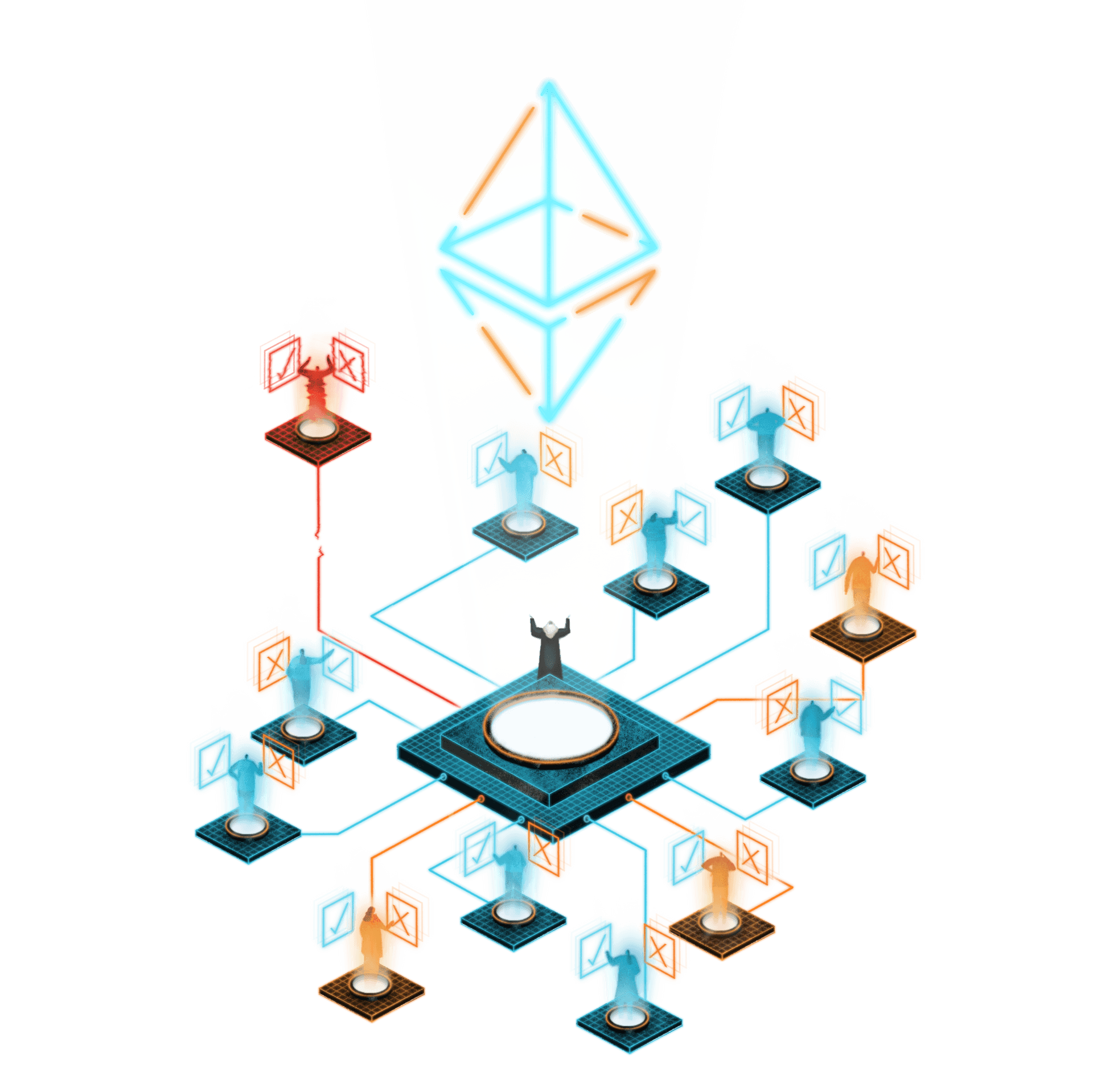

In a parallel development, Tether has partnered with Uquid, a Web 3.0 program, to enable Philippine citizens to pay their SSS contributions using USDT. This collaboration represents a significant step towards integrating cryptocurrencies into everyday financial transactions.

Through the Uquid platform, SSS members can now seamlessly convert their USDT into Philippine Pesos and make their social security contributions. This system not only provides greater flexibility for contributors but also aligns with the government’s broader initiatives to promote financial inclusion and digital innovation.

USDT and the SSS: A New Partnership

USDT, also known as Tether, is a popular stablecoin pegged to the US dollar. The SSS’s decision to use this cryptocurrency for disbursements aims to streamline payment processes and reduce transaction costs. This partnership between a traditional government institution and a digital currency platform signals a progressive approach to financial technology adoption in the Philippines.

Stablecoin Demand on the Rise

The adoption of USDT by the SSS comes at a time when demand for stablecoins is surging globally. Stablecoins, which are designed to maintain a stable value relative to a specific asset or basket of assets, have gained popularity due to their potential to bridge the gap between traditional finance and the cryptocurrency world.

The increased interest in stablecoins has been driven by their utility in cross-border transactions, remittances, and as a hedge against the volatility often associated with other cryptocurrencies.

Global Implications

The SSS’s adoption of USDT for disbursements could have far-reaching implications beyond the Philippines. This move may encourage other countries to explore similar initiatives, potentially accelerating the integration of cryptocurrencies into government operations worldwide.

As the Philippine Social Security System embarks on this innovative journey, the eyes of the global financial community will be watching closely. The success of this initiative could shape the future of government-backed cryptocurrency adoption and influence social security systems around the world.

Join MEXC and Get up to $10,000 Bonus!

Sign Up