alt:Palantir

Summary As a U.S. leader in big data analytics and artificial intelligence, Palantir Technologies is undergoing a major business transformation — changing from a traditional government contractor to an enterprise AI platform provider. In 2024, the company demonstrated remarkable momentum, with its stock price soaring over 200% year-to-date.

TL;DR

- AI transformation success: Palantir’s Artificial Intelligence Platform (AIP) has signed over 500 enterprise clients within a year, driving 27% YoY growth in commercial revenue.

- Strong government moat: Renewed multiple billion-dollar defense contracts, securing an irreplaceable position across U.S. and allied government markets.

- Solid financials: Q3 2024 revenue reached $726 million, with a 39% free cash flow margin.

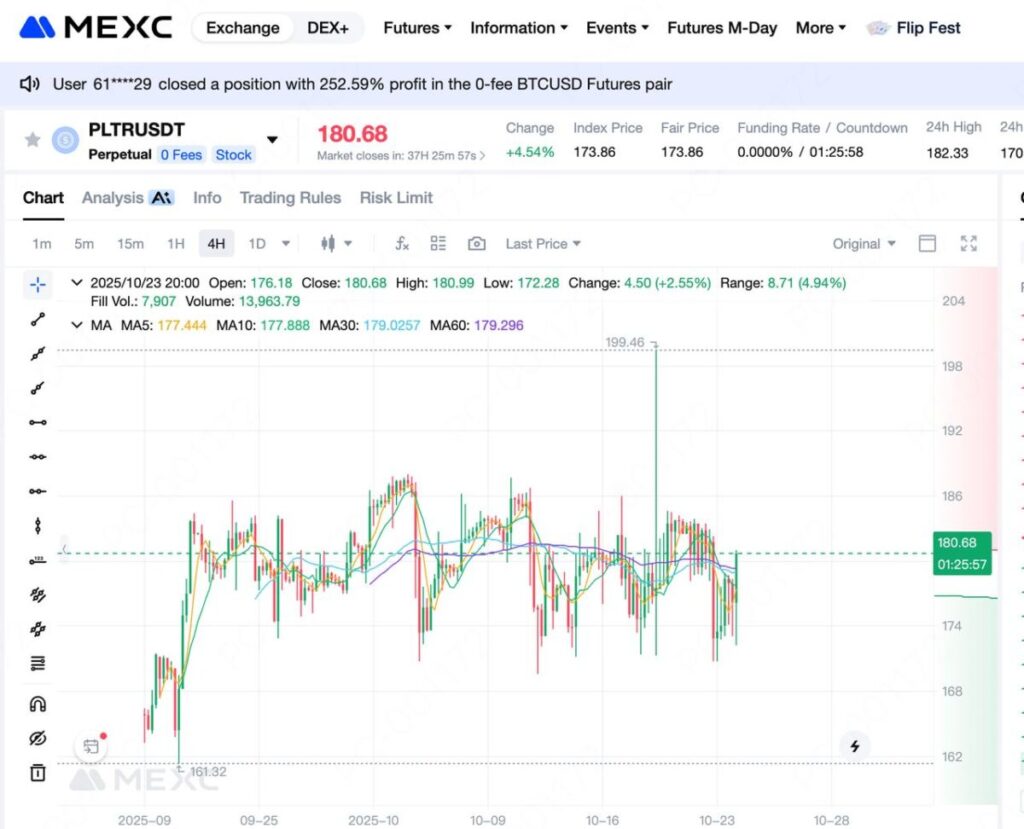

- MEXC advantage: PLTRUSDT perpetual futures support 1–25× leverage and 24/7 trading.

- Technical strength: Stock has broken all-time highs with strong institutional inflows.

1.Company Overview & Core Strengths

Palantir Technologies Inc. , founded in 2003 and headquartered in Denver, Colorado, is a software company providing data analytics, intelligence augmentation, and AI-driven solutions for government, defense, security, and enterprise sectors.

Core products and business models:

- Gotham — Intelligence and security analytics platform for government clients.

- Foundry — Enterprise platform for data integration and business optimization.

- Apollo —A continuous deployment system that enables software delivery across cloud and edge environments.

Together, these solutions empower organizations to achieve “intelligence augmentation” — a synergy between human expertise and machine-driven analytics.

2.Is Palantir Worth Investing in Now?

2.1 Riding the AI Revolution

The boom in generative AI has created unprecedented opportunities for Palantir. Unlike pure AI model developers, Palantir delivers end-to-end implementation platforms. Enterprises can deploy tools like ChatGPT or large language models into real-world workflows without building internal AI teams — a turnkey solution highly sought after by businesses today.

According to McKinsey, AI could add $13 trillion to the global economy by 2030. As a key AI infrastructure provider, Palantir is positioned to capture a meaningful share of this growth. The company expects its total addressable market (TAM) to expand from $119 billion in 2024 to over $200 billion by 2027.

2.2 Benefiting from Geopolitical Tailwinds

Ongoing geopolitical tension has boosted demand for Palantir’s government platforms. From the Ukraine conflict to the Indo-Pacific strategy, global defense spending continues to rise. Palantir’s Gotham platform has become a core tool for Western intelligence and military coordination.

In 2024 alone, Palantir secured major contracts including:

- The U.S. Army’s $950 million TITAN program

- The UK NHS’s £330 million healthcare data platform

- NATO’s joint intelligence system

These long-term deals not only secure predictable revenue for years ahead but also reinforce Palantir’s near-monopoly in defense tech.

3.MEXC PLTRUSDT Perpetual Futures Explained

3.1 What Is PLTRUSDT Perpetual Futures?

The PLTRUSDT perpetual contract on MEXC tracks Palantir’s stock performance through a USDT-margined derivative. Each contract represents the notional value of PLTR × current index price. MEXC’s PLTRUSDT contract supports 1–25× leverage, allowing traders to adjust exposure flexibly according to their risk tolerance.

Advantages vs. Traditional stock trading:

- 24/7 market access — trade any time, including pre-market and after-hours.

- Capital efficiency — 1,000 USDT of margin at 10× leverage controls 10,000 USDT in exposure.

- Bidirectional trading — profit from both bullish and bearish moves.

3.2 How to Trade PLTRUSDT on MEXC

3.2.1 Account Setup & Funding

Visit MEXC or download the MEXC App, register by email or phone, and enable 2FA for security. Complete KYC to unlock higher withdrawal limits and access more features, then deposit USDT into your futures account.

3.2.2 Executing a Trade

Search for “PLTR” in the trading dashboard, select the PLTRUSDT perpetual contract, input quantity and price, and choose between limit or market order types to execute your trade.

4.MEXC PLTRUSDT Trading Strategies

4.1 Trend-Following Strategy

Palantir exhibits clear trending patterns suitable for momentum trading. A golden cross (20-day MA crossing above 50-day MA) often signals strong long entry points. Breakout strategies also work well — build positions when volume confirms a breakout above prior resistance.

4.2 Event-Driven Trading

Palantir’s price reacts sharply to key catalysts.

- Earnings releases: Historically, the stock jumps 8–12% when results beat estimates.

- Government or enterprise deals: Large defense or corporate contracts typically drive 5–8% price moves. Track implied volatility in the options market to gauge sentiment ahead of announcements.

4.3 Swing Trading Tactics

Palantir’s average daily volatility (~3.5% ATR) provides ample swing-trading opportunities. Bollinger Bands and support/resistance zones are effective for timing short-term reversals.

5.Frequently Asked Questions (FAQ)

Q1: What’s the difference between PLTRUSDT and buying Palantir stock?

PLTRUSDT is a perpetual futures contract, enabling 24/7 leveraged trading in both directions. Stock ownership grants dividends and voting rights, suitable for long-term investors. Active traders often combine both approaches for flexibility.

Q2: Is high-leverage PLTRUSDT trading safe?

Leverage amplifies both profits and losses. Beginners should avoid using more than 5× leverage. Even experienced traders rarely exceed 20× without robust risk control.

Q3: Is Palantir’s government dependence a strength or a risk?

Both. Government contracts are stable, high-margin, and sticky — but growth can be constrained by budget cycles and politics. Palantir aims to offset this by expanding its commercial business, targeting over 60% revenue contribution from enterprise clients.

Q4: Will employee stock unlocks create selling pressure?

Palantir does have substantial stock-based compensation (~$100–200 million per quarter). However, most options vest gradually, and insider selling remains limited due to a strong internal ownership culture.

6.Conclusion

Palantir is at a pivotal inflection point — evolving from a niche defense contractor into a mainstream AI platform powerhouse. The success of AIP, resilience of government contracts, and improving financial health all point toward a new era of sustainable growth.Through MEXC’s PLTRUSDT perpetual futures, investors can flexibly participate in this AI-driven opportunity — whether by long-term conviction trades or short-term tactical positions.

Success in trading Palantir lies in research, patience, and disciplined execution. Stay focused, manage risk, and remember: protecting capital is the foundation of longevity in any market.

Join MEXC and Get up to $10,000 Bonus!

Sign Up