As regulators crack down on privacy coins, Zama is positioning FHE as the institutional-grade confidentiality layer blockchain has been missing.

While retail traders fear the regulatory crackdown on “privacy coins” like Monero and Tornado Cash, institutional investors are quietly positioning for a fundamentally different approach to blockchain confidentiality. Zama, the world’s first Fully Homomorphic Encryption (FHE) unicorn, is preparing to launch its $ZAMA token through a public auction mechanism marking a pivotal moment in the evolution from anonymity-focused protocols to enterprise-grade confidential computation.

The Announcement: Public Auction Confirmed for Jan 12, 2026

Zama has confirmed a public token auction as part of its Token Generation Event (TGE), scheduled for early Q1 2026, alongside the Ethereum mainnet launch. The company has confirmed it will conduct a sealed-bid Dutch auction for 10% of the token supply using its own FHE technology to keep participant bids confidential.

- The Auction Mechanism: A single-price sealed-bid Dutch auction on Ethereum where all successful bidders pay the same clearing price; the lowest price among winning bids. Critically, Zama will use its own FHE protocol to encrypt bid quantities while keeping price bids visible, ensuring fairness and true price discovery while preventing front-running by MEV bots.

- The Token Utility: The $ZAMA token will power the FHE network, paying for computational resources required to process encrypted data on-chain. Token holders can stake to become network operators, pay protocol fees (ZK proof verification, decryption, bridging), and participate in governance decisions.

The Context: A $1 Billion Bet on Confidential Infrastructure

Zama achieved unicorn status in June 2025 with a $57 million Series B funding round co-led by Blockchange Ventures and Pantera Capital, bringing total funding to over $150 million and valuing the company above $1 billion. This makes Zama the world’s first unicorn focused exclusively on Fully Homomorphic Encryption.

The company was founded in 2020 by Dr. Pascal Paillier (inventor of the widely-used Paillier encryption scheme) and Dr. Rand Hindi (former Citadel hedge fund manager turned deep tech entrepreneur). Zama’s mission: make FHE long considered the “holy grail” of cryptography practical for real-world blockchain applications.

The timing of the token launch coincides with Zama’s Ethereum mainnet deployment in Q4 2025, with subsequent expansion to other EVM chains in H1 2026 and Solana integration in H2 2026.

The Institutional Thesis: Three Critical Catalysts

1. The “HTTP to HTTPS” Moment for Blockchain

The analogy is deliberate and powerful. Early internet (HTTP) was transparent and fundamentally unsafe for sensitive transactions like credit card payments. E-commerce only exploded after HTTPS provided encryption for data in transit. Zama argues that blockchains are currently in their “HTTP era”; everything is visible on public ledgers.

The Problem: Banks cannot put proprietary trading strategies on a public blockchain where competitors can front-run their trades. Enterprises cannot put sensitive financial data on chains where every transaction is visible. Insurance companies cannot process claims on-chain when medical data must remain private.

The Solution: Zama’s Fully Homomorphic Encryption enables what the company calls “HTTPZ” end-to-end encryption where data remains encrypted even during computation. Smart contracts can process sensitive information without ever decrypting it, enabling institutional use cases that were previously impossible on public blockchains.

This isn’t about hiding illegal activity; it’s about enabling legitimate businesses to use public blockchain infrastructure without sacrificing confidentiality.

2. The “Computation vs. Verification” Pivot: Why FHE Differs from Zero-Knowledge

A common question: Why invest in Zama when Zero-Knowledge (ZK) projects like Aztec, StarkNet, and zkSync already exist?

The answer reveals a fundamental distinction in what these technologies accomplish:

Zero-Knowledge Proofs (ZK): Enable verification that a statement is true without revealing underlying data. Example: “I have enough money to make this payment” can be proven without showing account balances. ZK is primarily used for scaling (rollups) and selective disclosure (identity verification).

Fully Homomorphic Encryption (FHE): Enables computation on encrypted data while it remains encrypted. Example: A smart contract can calculate loan interest on encrypted balance data, perform encrypted token swaps, or process encrypted bids in an auction; all without ever decrypting the underlying information.

The Strategic Implication: ZK is for verification and scaling. FHE is for state and computation. As sophisticated financial applications, AI agents, and complex business logic move on-chain, the demand for confidential computation (FHE) may significantly outpace demand for simple verification.

Zama’s FHE enables use cases ZK cannot address:

– Confidential DeFi where balances and trading strategies remain private

– Sealed-bid auctions where bids remain encrypted until auction close

– Private AI inference where model inputs and outputs stay confidential

– Encrypted governance where vote weights and choices are hidden but results are verifiable

3. The “Fair Launch” Signal: Why Sealed-Bid Dutch Auctions Matter

The choice of auction mechanism sends a specific signal to institutional allocators and sophisticated investors.

The Problem with Traditional Crypto Launches: Most token launches are manipulated by MEV bots, insider whale accumulation, and immediate “pump and dump” cycles that leave retail underwater. This creates toxic distribution where early insiders dump on public market participants.

Zama’s Solution: A sealed-bid Dutch auction where:

– Bids remain encrypted using Zama’s own FHE technology until auction conclusion

– All successful bidders pay the same clearing price (lowest winning bid)

– Tokens unlock immediately after purchase; no immediate unlock cliffs that create sell pressure

– No gas wars or front-running possible due to encrypted bids

This structure attracts long-term holders rather than “airdrop farmers” seeking quick flips. It prioritizes fair distribution and price discovery over hype and manipulation.

The mechanism also serves as a powerful product demonstration; Zama is using its own FHE technology to conduct the auction, proving the technology works in a high-stakes real-world scenario.

The Market Structure Shift: From Privacy Coins to Confidential Layers

Understanding Zama’s positioning requires understanding how it differs from previous “privacy” approaches in crypto:

Privacy Coins (Generation 1): Anonymity-Focused

Examples: Monero, Zcash, Tornado Cash

Approach: Hide the user, transaction amounts, and transaction graph through cryptographic techniques like ring signatures, confidential transactions, and zero-knowledge proofs.

Regulatory Status: Under severe regulatory pressure. Exchanges are delisting privacy coins, mixers are being sanctioned, and developers face prosecution. The narrative has shifted to “these tools primarily facilitate money laundering.”

Limitation: Focused on payments and anonymity rather than programmable computation. Cannot support complex smart contracts or DeFi applications while maintaining privacy.

Confidential Computation Layers (Generation 2): Business-Focused

Example: Zama’s FHE Protocol

Approach: Protect the data, not the user. Enable confidential smart contracts where transaction participants are visible but transaction amounts, contract state, and computational logic remain encrypted.

Regulatory Positioning: Emphasizes compliance and selective disclosure. Users and applications can choose to reveal data to regulators, auditors, or specific parties while keeping information private from the public and competitors.

Capability: Full smart contract functionality with confidentiality. Enables complex DeFi, RWA tokenization, enterprise applications, and AI integration; all while maintaining data privacy.

The Critical Distinction: Privacy coins aim to hide users. Confidential computation layers aim to protect business-sensitive data while maintaining transparency where needed for compliance.

This distinction matters immensely for institutional adoption. Banks need confidentiality, not anonymity. Enterprises need to protect proprietary data, not hide their identity. Zama’s framing positions FHE as essential business infrastructure rather than a tool for regulatory evasion.

Real-World Adoption: Beyond Speculation

Zama’s ecosystem is demonstrating actual utility before token launch:

- Zaiffer Joint Venture (November 2025): Zama and PyratzLabs launched Zaiffer with €2M investment, creating confidential tokens (cTokens) that hide on-chain amounts while preserving audit trails. Any ERC-20 token can be “shielded” into confidential versions (USDC → cUSDC, ETH → cETH). Mainnet launch scheduled December November 2025.

- OpenZeppelin Partnership: Integration of Confidential Token interfaces, making privacy the default in DeFi applications.

- Developer Adoption: Over 5,000 developers are using Zama’s FHE libraries across blockchain and AI applications.

- Partnership Ecosystem: Strategic relationships with Pantera Capital, Blockchange Ventures, Multicoin Capital, Protocol Labs, and enterprise partners exploring confidential blockchain applications.

- Performance Milestones: Zama’s FHE technology is 100x faster than when the company was founded five years ago, with current throughput of 20+ transactions per second per chain. Plans include scaling to 100+ TPS using GPUs, 500-1000 TPS with FPGAs, and ultimately 10,000+ TPS using dedicated ASIC hardware.

The Technology: How FHE Actually Works

Fully Homomorphic Encryption represents a breakthrough in cryptography that allows computation on encrypted data:

- Traditional Encryption: Data must be decrypted before processing, creating a vulnerability window where sensitive information is exposed.

- Fully Homomorphic Encryption: Data remains encrypted throughout the entire computational process. Smart contracts can perform addition, subtraction, multiplication, comparison operations, and complex logic on encrypted values without ever accessing the underlying data.

The Zama Protocol Architecture:

– FHEVM (FHE Virtual Machine): A drop-in EVM variant where variables can be encrypted and computed without decryption

– Coprocessors: Offload FHE computation from the base chain to keep gas fees low while enabling horizontal scalability

– Key Management System (KMS): Uses multi-party computation (MPC) with 13 nodes to decentralize key management; no single party can access encryption keys

– ZK Proofs: Lightweight zero-knowledge proofs verify that user inputs are well-formed encrypted data

– Programmable Confidentiality: Smart contracts define exactly who can decrypt what data and under what conditions

This architecture provides confidentiality without sacrificing the verifiability and decentralization that make public blockchains valuable.

Use Cases: What FHE Enables

The technology unlocks previously impossible blockchain applications:

Confidential DeFi: Trade, lend, borrow, and provide liquidity without exposing balances, positions, or strategies to competitors or front-runners. Dark pools and institutional-grade trading on public infrastructure.

Sealed-Bid Auctions: True fair price discovery for token launches, NFT sales, carbon credit trading, and government spectrum auctions where bids remain encrypted until auction close.

Private Identity Verification: Prove specific attributes (age over 18, accredited investor status, citizenship) without revealing underlying personal data. Financial institutions can perform KYC/AML checks on encrypted customer data.

Confidential Governance: DAOs can implement voting systems where vote weights and individual choices remain private while results are publicly verifiable, preventing voter coercion and whale manipulation.

Enterprise Applications: Payroll processing, supply chain management, medical record handling, and defense applications on blockchain with full confidentiality.

Real World Assets (RWA): Tokenized securities, private credit, and institutional assets where transaction confidentiality is required for regulatory compliance and competitive protection.

Tokenomics: Structured for Long-Term Alignment

While full tokenomics details await official disclosure, available information suggests:

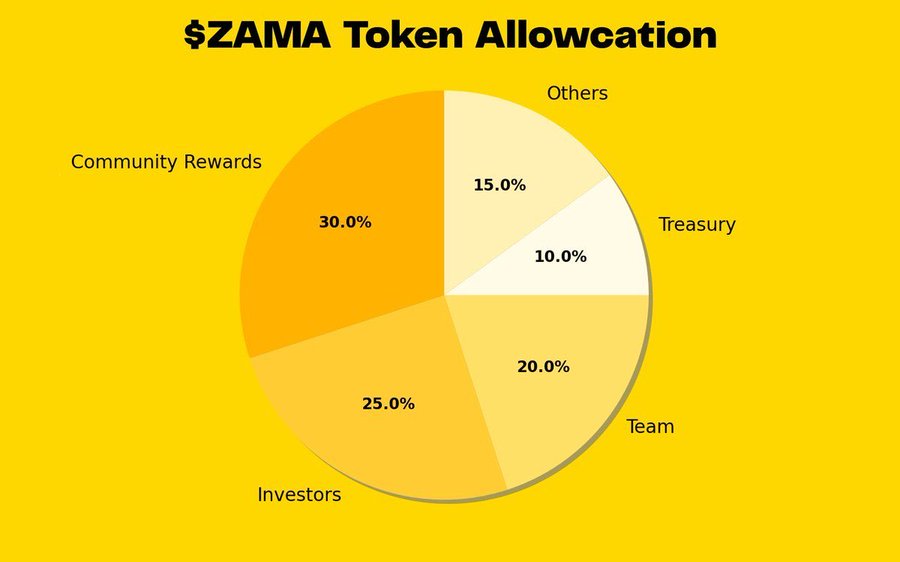

Allocation Structure:

– 20% to core team (4-year vesting)

– 25% to investors (2-3 year vesting with 1-year cliff)

– 10% to treasury/reserves

– 30% to ecosystem and community initiatives

– 15% to Auction + advisors

Economic Model: Burn-and-mint mechanism launching with mainnet. The model creates deflationary pressure by burning tokens for certain activities while minting rewards for network operators, balancing supply dynamics.

Fee Structure: Protocol fees (ZK proof verification, decryption, bridging) are priced in USD but paid in $ZAMA. Volume-based discounts up to 99% for high-usage applications. Example transaction costs: $0.01–$1.30.

Staking and Governance: Token holders can stake to become network operators (coprocessors or KMS nodes), earning monthly compensation plus token rewards. Governance participation allows community input on protocol parameters and upgrades.

Risks and Realities: The Balanced Assessment

Technical Challenges

Computational Overhead: FHE is computationally intensive; 100x to 1000x heavier than standard computation. While Zama has achieved significant optimization, user experience could remain sluggish and expensive compared to non-confidential applications until dedicated hardware accelerators (ASICs) are deployed.

Hardware Dependency: Achieving thousands of TPS requires specialized hardware (FPGAs, ASICs) that doesn’t yet exist at scale. Zama is partnering with hardware companies to develop dedicated chips, but this multi-year timeline introduces execution risk.

Developer Adoption Curve: While Zama abstracts complexity, building confidential applications requires new mental models and patterns. Developer education and tooling maturation will take time.

Market and Competition Risks

- Auction Valuation Risk: Dutch auctions efficiently discover market price, but they can be ruthless. If early participants set the clearing price too high through over-eager bidding, the token could trade below auction price for months as the market seeks equilibrium—a pattern seen in previous Dutch auction token launches.

- Competitive Landscape: Secret Network has an operational mainnet with an established ecosystem. Aztec is developing ZK-based privacy with significant traction. Oasis Network and other competitors are pursuing similar confidentiality goals. First-mover advantage in research doesn’t guarantee market dominance.

Mainnet Delay Risk: Zama’s mainnet launches Q4 2025, meaning it trails competitors in operational maturity. Delays in mainnet deployment would further extend the gap between promise and delivery.

Regulatory Uncertainty

- Regulatory Scrutiny: While Zama emphasizes compliance and business use cases rather than anonymity, regulators may not distinguish between “privacy coins” and “confidential computation” in practice. Success could attract unwanted attention from regulators concerned about financial surveillance capabilities.

- Selective Disclosure Challenges: The promise that users can reveal data to regulators when needed sounds good in theory, but implementation details matter enormously. If disclosure mechanisms are too easy to compel, privacy protections weaken. If too difficult to access, regulators may ban the technology entirely.

Strategic Implications: Rotation Into Infrastructure

For sophisticated investors, Zama’s auction represents a distinct opportunity profile:

- Aggressive Positioning: Participate in the Dutch auction to secure allocation at fair market price discovery without secondary market premium. The Q4 2025 timeframe provides a narrow window before mainnet launch and potential exchange listings.

- Conservative Approach: Wait for post-auction “unlock dip.” Historically, auction participants take quick profits after tokens become claimable. A price decline in weeks following token distribution offers secondary entry point for long-term infrastructure positioning without auction price risk.

- Sector Rotation Trade: Rather than buying speculative altcoins at capitulation prices hoping for recovery, rotate capital into proven infrastructure with institutional backing, real technology, and clear use cases. FHE represents enabling technology for the next generation of blockchain applications.

- Portfolio Diversification: Exposure to confidential computation infrastructure provides non-correlated returns to speculative tokens. As RWA tokenization and institutional DeFi adoption accelerate, demand for confidentiality layers grows regardless of retail speculation cycles.

The Convergence: Multiple Narratives Aligning

Several powerful trends are converging around Zama’s launch timing:

- Regulatory Tightening: Increased scrutiny of DeFi and privacy tools creates demand for compliant confidentiality solutions that balance privacy with regulatory requirements.

- Institutional Adoption: Traditional finance exploring blockchain needs confidentiality to protect proprietary strategies and sensitive data. FHE provides this without compromising on decentralization.

- RWA Tokenization Growth: As real-world assets move on-chain (approaching $4.2 billion in tokenized Treasuries alone), confidentiality becomes essential for institutional participation at scale.

- AI Integration: As AI agents begin operating autonomously on-chain, confidential computation enables private AI inference and decision-making without exposing model inputs or outputs.

- Market Capitulation Context: Launching during altcoin weakness (Altcoin Season Index at 27-31, only 5% of supply in profit) positions Zama to capture capital rotation out of speculation into infrastructure.

Final Analysis: The Evolution of Blockchain Privacy

Zama’s approach represents a fundamental evolution in how the cryptocurrency industry thinks about privacy:

Generation 1 focused on anonymity; hiding who is transacting. This approach faced insurmountable regulatory opposition and struggled to support complex applications beyond payments.

Generation 2 focuses on confidentiality—protecting what is being transacted while maintaining accountability. This approach aligns with institutional needs and regulatory frameworks while enabling sophisticated smart contract functionality.

The shift from “privacy coins” to “confidential computation layers” isn’t just semantic; it represents a recognition that blockchain’s institutional future requires confidentiality without sacrificing compliance, verifiability, or programmability.

Whether Zama becomes the dominant confidential computation platform remains to be seen. Competition is fierce, technical challenges are real, and execution risk is high. But the company’s positioning; FHE unicorn status, $150M+ funding, partnerships with major blockchain investors, and a technology approach that addresses institutional requirements suggests this is infrastructure worth watching.

The auction mechanism itself sends a signal: Zama is prioritizing fair distribution and long-term community building over short-term hype. The use of its own FHE technology to conduct the auction demonstrates confidence in practical applicability.

For investors paying attention to market structure rather than short-term price action, Zama’s token launch represents more than another speculative opportunity. It marks the arrival of institutional-grade confidential infrastructure; the missing piece that could enable traditional finance to actually use public blockchains at scale.

Key Dates and Metrics:

– Auction Date: January 12 – 15, 2026

– Ethereum Mainnet Launch: Q4 2025

– Token Utility: Protocol fees, staking, governance

– Auction Structure: Sealed-bid Dutch auction for 10% of supply

– Total Funding: $150M+ (valuation over $1 billion)

– Current Performance: 20+ TPS, with roadmap to 10,000+ TPS via ASICs

– Developer Adoption: 5,000+ developers using Zama libraries

– Founders: Dr. Pascal Paillier (Paillier encryption inventor) and Dr. Rand Hindi

– Major Backers: Pantera Capital, Blockchange Ventures, Multicoin Capital, Protocol Labs

Disclaimer:This content is for educational and reference purposes only and does not constitute investment advice. Digital asset investments carry high risk. Please evaluate carefully and assume full responsibility for your own decisions.

Join MEXC and Get up to $10,000 Bonus!

Sign Up