The x402 protocol, a standards-based extension of HTTP 402 enabling seamless micropayments for AI and web services, continues its ascent in the decentralized economy. Following October’s explosive 361% ecosystem market cap surge to $800 million, the protocol’s flagship token, PING, has rebounded strongly, achieving a $31.43 million market capitalization as of November 1, with a 36.22% price increase in 24 hours. This recovery underscores growing institutional confidence in x402’s role as the payment infrastructure for autonomous AI agents, amid integrations with major networks like Chainbase and Cardano.

MEXC remains the premier trading venue for x402 exposure, leveraging its zero maker fee structure and the concluding $200,000 USDT “x402 Pulse” campaign (through November 10). With over 40 million users and real-time Proof of Reserves, MEXC facilitates efficient access to high-volatility assets like PING, which processed nearly 500,000 payments in a recent week—a 10,000% surge attributed to Coinbase’s x402 implementation.

1.Protocol Fundamentals and Recent Metrics

x402 operates by embedding payment requirements directly into HTTP API responses, allowing for instant, low-friction settlements in stablecoins or tokens. Its architecture supports:

- Sub-Second Execution: Transactions complete in under 200 milliseconds, bypassing traditional blockchain latency.

- Fractional Precision: Ideal for AI use cases, such as per-token billing for model inferences or per-byte data access.

- Interoperability: Compatible with Ethereum, Solana, Base, and emerging chains like Cardano.

Key performance indicators as of November 2, 2025:

| Metric | Value | Change (7-Day) |

| Ecosystem Market Cap | $800M+ | +15% (post-October surge) |

| PING Token Cap | $31.43M | +36.22% (24h) |

| Weekly Transactions | 500,000+ | +492% |

| Transaction Volume | $140,000 (recent week) | +8,218.5% |

These figures reflect x402’s maturation, with transaction volume up 701.7% in the past seven days alone, driven by developer adoption in AI data services.

2.November Institutional Catalysts

- Chainbase Closed Beta Chainbase has launched a developer-exclusive beta for x402-enabled Data Sync APIs, allowing AI agents to query multi-chain data with micropayments. Public access is slated for late Q4, potentially accelerating adoption in DeAI platforms.

- Cardano Integration Progress The Masumi initiative on Cardano is advancing x402 testing, enabling smart contracts to autonomously handle oracle feeds and staking distributions via micropayments.

- AKEDO and x4Pay Expansions AKEDO’s public USDC endpoints on Base are live, while x4Pay’s IoT framework introduces burn-to-register mechanics for physical devices, bridging digital micropayments to hardware.

These developments align with PwC’s projection of $15.7 trillion in AI-driven economic value by 2030, positioning x402 as a critical enabler for scalable, decentralized agent interactions.

3.MEXC: Optimized Trading and Incentive Framework

MEXC’s infrastructure supports professional-grade execution for x402 assets:

Fee Model: 0% maker fees on spot and select futures; 0.05% spot taker, 0.01% futures taker.

Security and Reliability: $559 million Futures Insurance Fund; distributed servers ensuring 99.99% uptime.

Incentives via x402 Pulse:

- $20,000 USDT for new deposits (≥$100 eligible for coupons).

- $30,000 USDT for spot trading volume.

- $150,000 USDT for futures performance.

- 100% rebates on DEX+ x402 pairs.

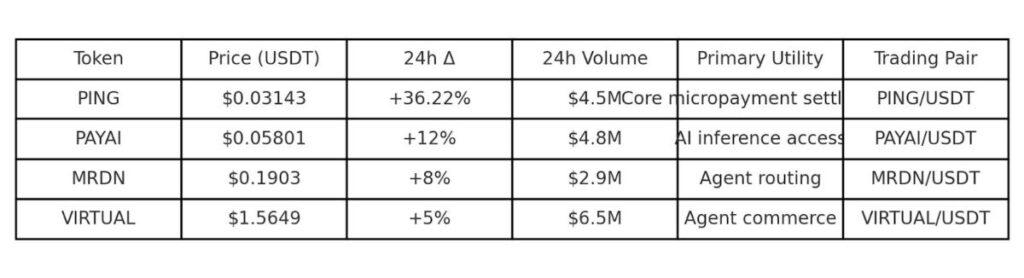

x402 Token Portfolio on MEXC (November 2, 2025):

MX Token Enhancement: Holding 500+ MX qualifies for up to 50% additional fee discounts and exclusive Launchpool allocations for x402 projects.

4.Risk Assessment and Strategic Recommendations

- Volatility Exposure: PING‘s 36% daily move highlights sector sensitivity; diversify across utility tokens.

- Regulatory Horizon: Evolving frameworks like EU MiCA may require enhanced KYC for high-frequency micropayments.

- Technical Dependencies: Beta-stage integrations (e.g., Chainbase) carry execution risks.

Recommended Allocation (Balanced Portfolio): 40% in settlement tokens (PING), 30% in infrastructure (PAYAI/MRDN), 30% in applications (VIRTUAL). Employ stop-loss orders at 10-15% below entry.

5.Forward Outlook

x402’s trajectory bolstered by Chainbase’s beta and Cardano’s testing suggests a pathway to 10x transaction volume growth by mid-2026. MEXC’s zero-fee ecosystem and promotional incentives provide a low-barrier entry for institutional and retail participants.

Disclaimer: Investing in cryptocurrencies involves substantial risk, including the possibility of total capital loss. Historical performance, such as PING’s 36.22% rebound, does not predict future outcomes. x402 and its ecosystem are nascent technologies exposed to technical failures, regulatory changes, and market downturns. This material is provided for informational purposes and does not constitute financial advice, investment recommendations, or endorsements. Investors should perform exhaustive due diligence and seek guidance from qualified financial professionals.

Join MEXC and Get up to $10,000 Bonus!

Sign Up