In November 2025, the drop in the cryptocurrency market became more than a short-term correction. It has turned into a structural shift. Bitcoin has fallen more than 20% and dropped below the symbolic $100,000 level, a price floor that many believed would hold in this cycle. The move has forced investors to reconsider a bigger question: Has crypto entered a new valuation phase?

(Source: Mexc )

The total crypto market cap has declined to around $3.3 trillion. On-chain activity is slowing, the share of stablecoins is rising, and long-term holdings are being reduced. These are not random signals. They reflect a meaningful shift in market psychology—from aggressive accumulation to cautious defense. The narrative has moved from “risk-taking” to “risk assessment.”

(Source:CMC )

The message is clear: the current downturn is not panic-driven. It is a period of repricing and recalibration.

How Macro Conditions Triggered the Crypto Market Drop

The roots of this crypto market downturn are found in macroeconomic policy. In recent years, Bitcoin has been described as an inflation hedge, a digital alternative to gold, and even a future global monetary standard. But real-world price behavior tells a different story: Bitcoin currently trades like a high-beta risk asset—not a safe-haven asset.

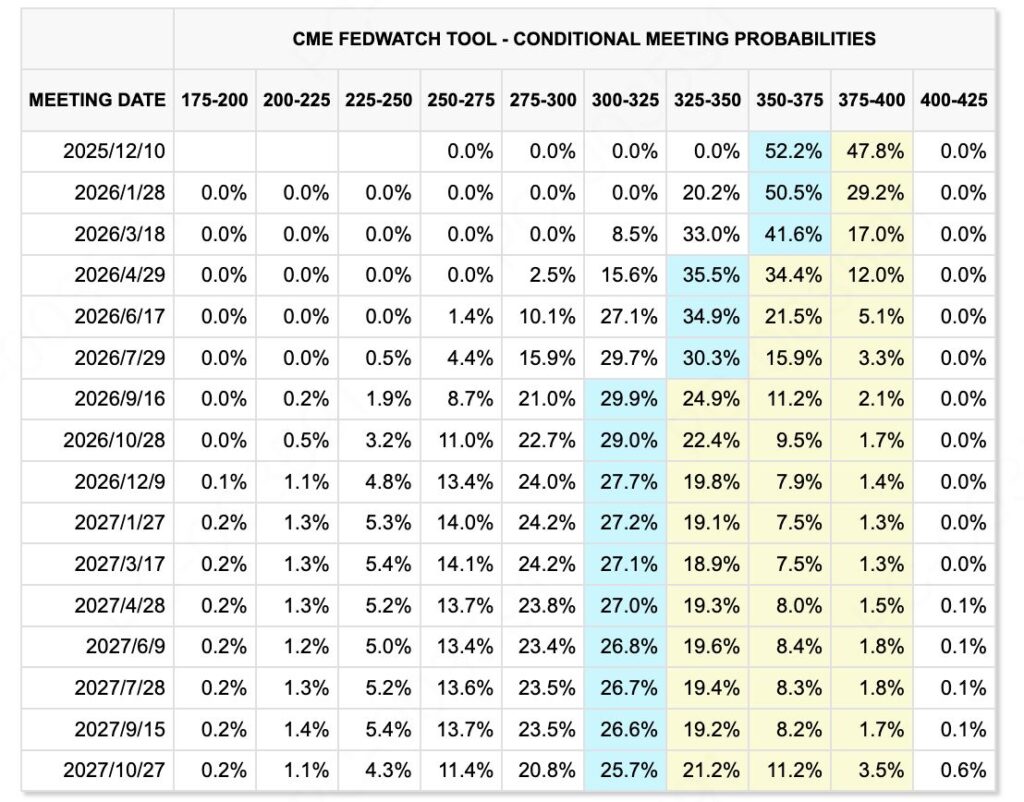

(Source:CME)

When expectations for a Federal Reserve rate cut fell sharply—from nearly 90% to just 53%—capital began adjusting. Institutional allocation models are tied closely to interest rates. When rates remain high and liquidity expectations weaken, capital naturally shifts toward safer assets such as government bonds or gold. The decline in crypto is not a surprise—it is a predictable reaction to tightening conditions.

The deeper takeaway is that Bitcoin is now moving with the global financial system, not outside it. Its value is increasingly shaped by macro indicators, policy cycles, and institutional risk models—not just market sentiment.

Why Institutional Crypto Investors Are Pulling Back

Spot Bitcoin ETFs have played an important role in bringing crypto into mainstream finance. However, institutional capital behaves differently from retail capital. Institutions do not trade based on hope—they trade based on frameworks and risk thresholds.

Over the last two months, Bitcoin ETF flows have turned negative. Ethereum ETFs have seen similar pressure. This does not mean institutions have abandoned crypto, but it shows a clear adjustment: reducing exposure rather than expanding it.

(Source:Sosovalue)

This shift is also visible in the stock performance of MicroStrategy, once seen as the corporate symbol of Bitcoin conviction. Its decline of over 18% during the pullback is more than a stock movement—it reflects a cooling narrative. Institutions are no longer accelerating the market with balance-sheet purchases. They are watching and waiting.

For the first time, the crypto market is experiencing a real institutional cooldown period.

How Leverage Turned the Drop Into a Crash

Macro changes set the direction. Leverage determined the speed.

Over the last month:

- More than $200B of leveraged positions have been liquidated

- Forced selling triggered cascading liquidation events

- Fear spread across social media faster than price data updated on-chain

The crypto market is highly reflexive. People do not simply observe price action—they react to it. Those reactions then reshape the next move in price.

This is why the cryptocurrency market downturn has not been gradual—it has accelerated. Like an avalanche, the collapse was not caused by a single event, but by accumulated weight.

The emotional tone has shifted from:

“It dropped — I’ll buy more.” to “It dropped — so it may keep falling.”

When confidence turns into questioning, a trend becomes a cycle.

What the Bitcoin Price Drop Really Means

Looking back across crypto history, every deep correction—from 2013 to 2018 to 2022—has been framed as the end of the market. Yet each time, the downturn served as a restructuring phase before the next evolution.

This time, however, the dynamics are different:

- The participant base is broader (retail, institutions, countries)

- Market transparency is higher (on-chain visibility)

- Investment thinking is more mature (from speculation to allocation logic)

The current correction is not a collapse—it is a valuation reset.

Bitcoin’s fall is not a rejection of its role. It is a process of redefining how it fits into a global financial system.

In the short term, price drives sentiment.

In the long term, structure drives outcomes.

Investors new to this environment are asking:

“Is this a chance to buy—or a warning to exit?”

But the real long-term questions are:

“Do I understand the asset I hold?”

“Do the original reasons for owning Bitcoin still apply?”

Bear markets do not eliminate strong assets.

They eliminate weak assumptions.

This Crypto Market Downturn Is Not the End — It Is a Shift Toward Maturity

This drop in Bitcoin sends an important signal: crypto is no longer purely emotion-driven. It is being integrated into global finance. That means future bull cycles may be steadier, slower, and more grounded in fundamentals—not driven only by momentum.

No emerging asset class in history has matured without volatility. Gold went through it. Tech equities experienced it. The internet survived it.

Crypto is now facing its version of that transition.

The difference today is that:

- More eyes are watching

- More institutions are participating

- More governments are shaping the framework around it

So this downturn is not the end.

It is the beginning of maturity.

What Should Investors Do Now? Medium- and Long-Term Strategy Considerations

Periods like this require patience, clarity, and discipline. The current downturn does not automatically mean the cycle is over—but it does mean the approach must evolve.

Some long-term investors may find that position management matters more than timing. Instead of chasing an exact bottom, strategies like dollar-cost averaging (DCA) can help distribute risk and avoid emotional decision-making.

Maintaining liquidity, whether in cash or stablecoins, provides the flexibility to act when the market offers real opportunity rather than reacting under pressure.

Risk control should come first. Avoiding high leverage and overly concentrated bets helps protect capital during volatile periods. Spreading exposure across sectors, asset types, and risk levels can also support longer-term resilience.

Most importantly, investors should focus on macro trends, regulation developments, and institutional activity—not short-term noise. Markets rarely reflect the present—they reflect expectations.

Put simply:

Survive first. The upside only matters if you remain in the game.

Frequently Asked Questions (FAQ)

Q1: Why did Bitcoin fall below $100,000?

Bitcoin fell for three main reasons. First, the economy changed. The Federal Reserve became less likely to cut interest rates. Since Bitcoin behaves like a risky asset, it suffered. Second, big institutional investors reduced their crypto holdings. Money flowed out of Bitcoin ETFs. Third, too much leverage made the drop worse. When prices fell, over $200 billion in leveraged trades were forced to sell, creating a chain reaction. This isn’t just panic. It’s the market adjusting to new conditions.

Q2: How is this different from the 2018 or 2022 crashes?

This time, the market is more mature. There are more types of investors, including large institutions and even countries. We have better blockchain data, so the market is more transparent. People are also thinking more about long-term investment instead of quick speculation. Past crashes were driven by emotion. This one is more like a normal pause and reset in a financial market.

Q3: Are institutional investors leaving crypto for good?

No. They are pulling back temporarily, not quitting. The money leaving ETFs shows they are being careful because of economic uncertainty. This is a risk management move. Crypto is already part of their world, but they change how much they hold based on the economy. They are waiting and watching for now.

Q4: How did leverage make the crash so severe?

Leverage means using borrowed money to trade. It can increase gains, but it also increases losses. When prices dropped, many leveraged traders were forced to sell to cover their loans. This pushed prices down even more, which forced more selling. It’s a snowball effect. That’s why the fall was so fast and steep.

Q5: Should I buy more now or sell everything?

Don’t try to time the market. Ask yourself if you still believe in Bitcoin’s long-term value. If you do, consider a simple strategy called dollar-cost averaging (DCA). This means buying small amounts regularly instead of making one big bet. This spreads your risk. Most importantly, don’t invest money you can’t afford to lose, avoid borrowing to invest, and keep some cash ready. Surviving this period is more important than catching the exact bottom.

Q6: Is the crypto market becoming more mature?

Yes, but it’s a slow process. The fact that crypto now moves with the global economy shows it’s growing up. However, it’s still volatile and emotional trading still happens. Like gold or tech stocks before it, crypto is going through growing pains. More rules and more big investors will help it mature further.

Q7: What should I do as a regular investor right now?

Focus on three things:

- Survive first: Don’t use high leverage. Make sure you won’t be forced to sell at a loss.

- Stay flexible: Keep some cash or stablecoins. This lets you buy when good opportunities come, not when you’re panicking.

- Watch the big picture: Follow what the Fed and regulators are doing. Watch where institutional money is flowing. Ignore the noise on social media.

Bottom line: You have to stay in the game to win it.

Read More:

- Monad Public Chain Deep Dive: MON Token, EVM Compatibility and High-Performance Design

- FIL Price Jumps 45%: A Simple Guide to the Filecoin Project

- UNI Jumps 40%: What Is Uniswap’s UNIfication Proposal?

- ZEC(Zcash)Hits New Highs:What’s Driving the Rally?

- Walrus Protocol Deep Dive: WAL Token, Programmable Storage, and Data Sovereignty

Join MEXC and Get up to $10,000 Bonus!

Sign Up