On the evening of November 28, 2025, everything began like any other trading day for thousands of traders around the world. U.S. index futures were still ticking second by second, oil prices were fluctuating slightly, and the foreign exchange market was busy with large bank orders. But then, in an instant, the price boards on their screens went still. Pending orders suddenly froze, and the data that had been updating continuously simply stopped flowing.

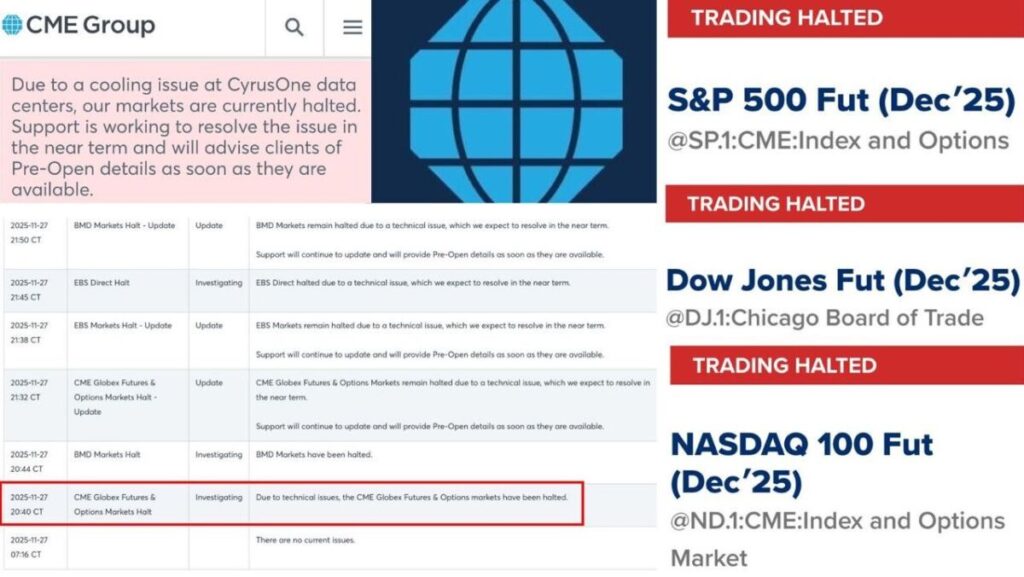

At first, many thought it was just a minor delay or an Internet glitch. But when the system showed no sign of recovery, that silence quickly turned into anxiety. Internal communication channels between exchanges, trading desks, and brokers started flashing notifications: CME was shutting down trading. Not just a few symbols. Not just certain segments. But the entire system.

1. A shocking cause: a cooling failure at the CyrusOne data center

Right after global markets began slipping into confusion, CME Group issued an official notice: its electronic trading system had to be halted due to a cooling failure at the CyrusOne data center. To outsiders, this reason might sound like a minor technical glitch, even a puzzling one—how could “overheating machines” bring trillions of dollars in trading to a standstill? But for those in technology and financial infrastructure, this explanation carries extremely serious implications.

In high-speed trade-processing systems, heat is the most dangerous enemy. The servers responsible for receiving orders, processing them, synchronizing, and broadcasting data worldwide operate at constant, intense loads, generating massive amounts of heat. The cooling system is the first and most critical line of defense. When that system malfunctions, temperatures rise within minutes, and servers are forced to shut down automatically to avoid severe damage. A single server going offline can be handled with redundancy. But when an entire cluster or part of a data center is affected, the whole system can fall into a cascading shutdown. That is exactly what happened in this incident.

What is even more shocking is that CME Group is known to maintain multiple layers of redundancy—from power supply and connectivity to secondary data centers. But the incident shows that either the backup layers failed to activate in time, or the switchover procedures to the alternate site did not function as designed. This raises a critical question: if a cooling failure alone can paralyze the entire system, what would happen in the face of larger risks—natural disasters, widespread power outages, or cyberattacks?

2. Immediate consequences: when brokers, banks, and investment funds are all forced into a defensive position

The most alarming part of CME’s outage was not just that prices stopped updating, but that the disruption occurred during a period of high market volatility. For brokers, halting trading became a mandatory decision. If they allowed clients to continue placing orders while CME could not execute them, the risk of slippage when the market reopened could lead to major losses or legal disputes. As a result, many brokers had to suspend their services—something clients dread.

Banks fared no better. Their trading desks rely on futures contracts to hedge risks in interest rates, bonds, and foreign exchange. But when both CME and EBS—an essential FX platform—went down, they could no longer hedge their portfolios appropriately, causing their risk exposure to spike. Hedge funds, which run algorithms designed to capture millisecond-level volatility, suddenly lost direction. Without reference prices, many systems had to switch into safe mode or shut down temporarily. Quietly, chaos spread from the bustling trading floors of New York to financial offices in London, Singapore, and Tokyo.

Beyond the interruption, the incident created serious concerns about a potential “post-recovery price jump.” When the market reopened, even a move of a few percentage points could trigger mass liquidations beyond anyone’s control. This is what traders feared most: they had no idea whether CME’s return would come with a price shock that could wipe them out.

3. Doubts and concerns: when the investment community starts asking questions

The CME incident quickly became a hot topic across all professional forums. Veteran traders noted that throughout their careers, a full-system outage at CME was extremely rare. This led to a wave of questions: was CME truly prepared for infrastructure risks? Were its backup layers tested regularly? And most importantly, why could a single cooling failure cause such a massive impact?

Some IT experts in the financial sector argued that this raises major concerns about the level of concentration in the global financial system. When too many markets depend on a single data provider and trading platform, any failure—from physical to technical—can trigger unpredictable domino effects. Others pointed to systemic risk and called for stricter technical regulations for key exchanges like CME.

The incident also prompted serious reflection on how vulnerable modern markets really are. Advanced technologies may seem capable of handling everything, yet they can be rendered powerless by something as mundane as a server overheating.

4. Lessons for the future: the fragility of a system once thought untouchable

CME Group has long been considered the “last fortress” of the derivatives market. This incident proved that even that fortress is not immune to physical risks. An overheated server room can influence global oil prices, the exchange rates of dozens of currencies, and the yields on U.S. Treasury bonds—factors on which millions depend for investing, doing business, or shaping policy.

In an era where finance runs on electronic infrastructure, people tend to worry about cyberattacks, faulty algorithms, and market volatility. Yet this serves as a reminder that physical infrastructure—cooling systems, power supply, fiber-optic connectivity—still determines the survivability of the entire system. Without it, all advanced technology built on top collapses.

CME’s outage will likely push regulators to step in, requiring major exchanges to demonstrate stronger redundancy, diversify their data centers, and be more transparent about their routine testing procedures. At the same time, it forces investors to recognize a sobering reality: the modern financial world is not as stable as it appears. A small issue in a sealed server room filled with machines can send shockwaves across every major market.

Conclusion: when a cooling fan can influence the future of the markets

The cooling failure at the CyrusOne data center—seemingly simple—became one of the most notable events in the financial markets of 2025. It exposed how deeply the entire system depends on small, physical components that are nonetheless critically important. In the moment CME went dark, the world did not just lose a trading tool; it lost the sense of security that came from believing everything was fully backed up.

This is a wake-up call: no matter how advanced technology becomes, just one physical weak link can throw the entire market into chaos. And that is why, in an increasingly digital financial system, cooling units and server rooms still quietly determine the fate of trillions of dollars every single day.

Disclaimer:The information provided here is for informational purposes only and should not be considered financial, investment, legal, or professional advice. Always conduct your own research, consider your financial situation, and, if necessary, consult with a licensed professional before making any decisions.

Join MEXC and Get up to $10,000 Bonus!

Sign Up