In the most significant validation of cryptocurrency as a mainstream asset class, Vanguard Group—the world’s second-largest asset manager with $11 trillion in client assets—began allowing Bitcoin and cryptocurrency ETFs on its brokerage platform starting December 2, 2025. The policy reversal ends years of staunch resistance from a firm that blocked crypto access even after spot Bitcoin ETFs launched in January 2024, triggering the viral #BoycottVanguard campaign across social media.

The timing is remarkable. Vanguard’s pivot comes amid a brutal market correction, with Bitcoin down approximately 30% from its October peak above $126,000, currently trading around $91,000. Ethereum and Solana have fallen 22% and 24% respectively. Yet rather than waiting for market recovery, Vanguard is opening the floodgates precisely when conservative investors might find valuations attractive—a move that sent Bitcoin surging 6% at Tuesday’s U.S. market open.

For crypto markets, the implications are seismic. Vanguard’s 50 million brokerage clients managing over $11 trillion in assets now have direct access to regulated Bitcoin, Ethereum, XRP, and Solana ETFs—the same products the firm categorically refused to support just months ago. This isn’t just another institution dipping its toes into crypto; it’s the most conservative pillar of traditional finance acknowledging that digital assets have matured into legitimate portfolio components deserving mainstream access.

The Reversal: From #BoycottVanguard to Crypto-Accessible

The Old Guard’s Resistance:

When spot Bitcoin ETFs launched in January 2024 after years of SEC battles, Vanguard immediately erected barriers preventing all client access. Customers attempting to purchase products like BlackRock’s iShares Bitcoin Trust (IBIT) encountered error messages stating trades could not be completed—a technical blockade that sparked outrage across crypto communities.

Former CEO Tim Buckley repeatedly expressed doubts about including Bitcoin-based products in long-term portfolios, arguing that digital assets were too volatile and speculative for serious investors. Vanguard’s official position cited regulatory uncertainty, investor protection concerns, and philosophical disagreement with cryptocurrencies as stores of value.

The #BoycottVanguard movement gained traction throughout 2024, with crypto advocates threatening to withdraw billions in assets if the firm maintained its anti-crypto stance. Despite sustained pressure and watching competitors like Fidelity and Charles Schwab capture crypto-curious clients, Vanguard held firm, until now.

The Transformation Under New Leadership:

The reversal coincides with leadership change. Salim Ramji assumed the CEO role in July 2024 after serving as BlackRock’s Global Head of iShares and Index Investments, where he helped launch BlackRock’s spot Bitcoin ETF, the most successful ETF debut in history. Ramji became the first outsider to lead the 50-year-old investment firm, bringing a drastically different perspective on digital assets.

Andrew Kadjeski, Vanguard’s head of brokerage and investments, explained the policy shift by noting that cryptocurrency ETFs have been tested through market volatility and performed as designed while maintaining liquidity. He emphasized that administrative processes for servicing these funds have matured, and investor preferences continue to evolve.

What Changed on December 2:

Starting December 2, 2025, Vanguard brokerage customers can trade ETFs and mutual funds that primarily hold select cryptocurrencies:

- Bitcoin (BTC) – Including BlackRock IBIT, Grayscale GBTC, Fidelity FBTC

- Ethereum (ETH) – Including BlackRock ETHA, Grayscale ETHE

- XRP – Select XRP-focused ETFs

- Solana (SOL) – Including Bitwise BSOL and others

The firm treats crypto ETFs similarly to other non-core asset classes like gold, requiring products to meet established standards before listing eligibility. Critically, Vanguard emphasized it has no plans to launch its own crypto products and will exclude funds tied to memecoins as described by the SEC.

The Numbers: What $11 Trillion in Access Means

Vanguard’s Client Base:

- Brokerage Clients: 50 million investors

- Assets Under Management: $11 trillion (as of September 2025)

- Market Position: World’s second-largest asset manager after BlackRock

- Client Profile: Typically conservative, long-term investors focused on index funds and retirement accounts

Conservative Adoption Scenarios:

Even modest allocation percentages translate to massive capital inflows:

1% Allocation Scenario: If just 10% of Vanguard clients allocate 1% of their portfolios to crypto ETFs:

- 5 million clients × average $220,000 portfolio × 1% = $11 billion in new demand

2% “Satellite Position” Scenario: Standard portfolio theory suggests 1-2% allocations to alternative assets. If 20% of clients adopt 2% crypto allocations:

- 10 million clients × $220,000 × 2% = $44 billion in potential inflows

Institutional Comparison: For context, spot Bitcoin ETFs accumulated $120 billion in assets under management since January 2024 debut, while Ethereum ETFs reached $20 billion. Vanguard’s client base alone could theoretically double total crypto ETF AUM if adoption mirrors broader industry trends.

The Timing Paradox:

Vanguard’s decision becomes more intriguing given current market conditions. Bitcoin has fallen from approximately $126,000 in early October to roughly $91,000—a 28% correction that typically would prompt conservative institutions to delay crypto initiatives. Instead, Vanguard is jumping in at what many analysts view as attractive accumulation levels.

Bloomberg ETF analyst Eric Balchunas noted the price surge partially reflects unexpected demand from typically conservative Vanguard clients finally gaining crypto exposure. This suggests pent-up demand existed despite Vanguard’s previous restrictions.

Why Now? The Regulatory and Competitive Calculus

Regulatory Clarity Under New Administration:

Vanguard’s reversal follows sweeping shifts in the regulatory environment under the current U.S. administration. The SEC’s pivot toward pro-innovation policies, combined with years of court decisions, effectively eliminated the regulatory uncertainty Vanguard long cited as a barrier.

The SEC’s approvals of spot crypto ETFs were underpinned by robust frameworks establishing surveillance-sharing agreements, custody arrangements, and disclosure standards for digital assets. Additionally, the passage of the GENIUS Act introduced the first federal framework for regulating payment stablecoins, providing legal clarity that de-risked crypto exposure for conservative institutions.

Competitive Pressure:

While Vanguard hesitated, competitors captured market share:

BlackRock’s Dominance: BlackRock’s iShares Bitcoin Trust (IBIT) peaked at approximately $100 billion in assets, making it one of the most successful ETF launches ever. Although down to roughly $66-70 billion following the October correction, IBIT remains BlackRock’s top revenue source according to company executives.

Fidelity’s Success: Fidelity’s Bitcoin and Ethereum ETFs combined hold tens of billions in AUM, attracting clients specifically seeking crypto exposure through trusted brands.

Client Exodus Risk: Internal pressure mounted as clients threatened to transfer accounts to competitors offering crypto access. In a low-margin business like index fund management, losing even 5% of clients to crypto-friendly platforms would devastate Vanguard’s economics.

Generational Shift:

Vanguard’s typical client—conservative, retirement-focused, buy-and-hold investors—is aging. Younger investors overwhelmingly expect crypto access as table stakes. Without crypto ETFs, Vanguard risked becoming irrelevant to the next generation of wealth.

What Vanguard Will (and Won’t) Support

Approved Asset Classes:

- Bitcoin ETFs: IBIT (BlackRock), GBTC (Grayscale), FBTC (Fidelity), BITB (Bitwise), others meeting standards

- Ethereum ETFs: ETHA (BlackRock), ETHE (Grayscale), others

- XRP ETFs: Select products as they meet eligibility criteria

- Solana ETFs: BSOL (Bitwise) and other SOL-focused products

Explicit Exclusions:

- Memecoins: Vanguard will not support ETFs tied to memecoins or speculative tokens lacking fundamental use cases

- Unregulated Products: Only SEC-approved, regulated ETFs qualify

- Direct Crypto: No support for direct cryptocurrency purchases (e.g., buying BTC directly on Vanguard platform)

Vanguard’s Own Products: The firm emphasized it has no plans to launch its own crypto ETFs or mutual funds. Kadjeski stated: “While Vanguard has no plans to launch its own crypto products, we serve millions of investors with diverse needs and risk profiles.”

This selective approach positions Vanguard as crypto-accessible without becoming crypto-native, preserving its reputation for conservative investment strategies while acknowledging client demand.

Market Impact: The 6% Bitcoin Surge and Beyond

Immediate Price Reaction:

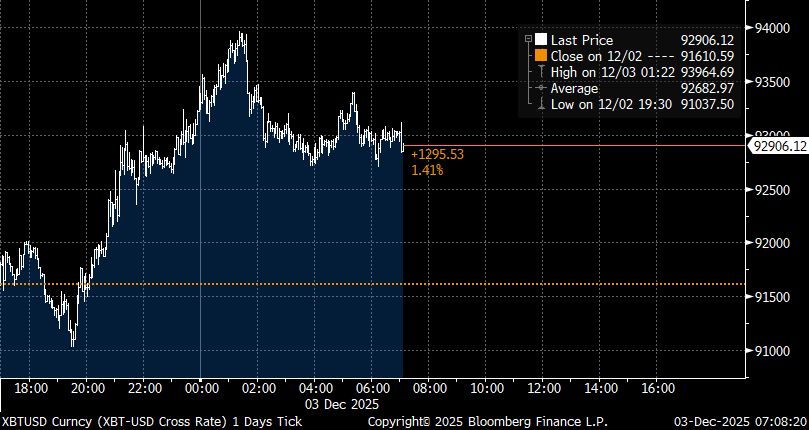

Bitcoin jumped approximately 6% at Tuesday’s U.S. market open (December 2), the first trading session after Vanguard lifted its ban. The surge broke above $93,000 briefly before settling around $91,000, representing a strong reversal from sub-$84,000 lows seen December 1.

Eric Balchunas attributed the move partially to unexpected demand from typically conservative Vanguard clients finally gaining access. Options market activity suggested significant institutional interest, with large call positions accumulating around $95,000-$100,000 strikes.

Mid-Term Implications (30-90 Days):

Analysts expect Vanguard‘s reversal to have compounding effects:

1. Legitimacy Boost: When the most conservative asset manager in finance embraces crypto ETFs, it validates digital assets as mature investment vehicles. This credibility extends beyond Vanguard clients to influence pension funds, endowments, and family offices still on the sidelines.

2. Competing Institutions: Vanguard’s move pressures remaining holdouts (if any exist) to reconsider crypto restrictions or risk obsolescence. The “safety in numbers” dynamic means institutions can now point to Vanguard as justification for crypto allocations.

3. Gradual Inflows: Unlike retail-driven pumps, institutional adoption through platforms like Vanguard creates steady, sustained demand. Conservative clients allocating 1-2% to crypto ETFs generate persistent buy pressure regardless of short-term volatility.

4. ETF Market Growth: Vanguard’s entry could accelerate demand for additional crypto ETF products. Expect applications for altcoin ETFs (Cardano, Avalanche, Polkadot) to surge as issuers seek to capture Vanguard-enabled demand.

How Vanguard Clients Can Access Crypto ETFs

Eligibility: All Vanguard brokerage account holders have immediate access as of December 2, 2025. No special applications or approvals required beyond standard brokerage account access.

How to Trade Crypto ETFs on Vanguard:

Step 1: Log Into Brokerage Account Access your Vanguard brokerage account through web or mobile app.

Step 2: Search for Crypto ETFs Use ticker symbols to locate desired products:

- IBIT (BlackRock Bitcoin)

- FBTC (Fidelity Bitcoin)

- GBTC (Grayscale Bitcoin)

- ETHA (BlackRock Ethereum)

- BSOL (Bitwise Solana)

Step 3: Review Product Details Vanguard will display standard ETF information: expense ratios, holdings, performance, and risk disclosures. Crypto ETFs carry specific risk warnings about volatility.

Step 4: Place Trade Execute trades like any other ETF through market or limit orders. Standard brokerage commissions apply (Vanguard typically charges $0 for online ETF trades).

Step 5: Monitor Holdings Crypto ETFs appear in standard portfolio views alongside traditional holdings.

Tax Considerations: Crypto ETFs held in taxable accounts generate capital gains/losses on sale. ETFs in IRAs or 401(k)s grow tax-deferred. Consult tax advisors for specific situations.

Community Reaction: Validation Meets “Too Late”

Crypto Advocates Celebrate:

For advocates who criticized Vanguard’s resistance throughout 2024, the reversal validates their view that digital assets have matured into legitimate investment vehicles deserving mainstream access through the financial industry’s most trusted platforms.

Social media erupted with “Vanguard capitulates” narratives, framing the move as final proof that crypto has won the institutional adoption battle. The fact that Vanguard—not a crypto-native firm, but the epitome of conservative investing—embraced ETFs signals to remaining skeptics that resistance is futile.

“Too Little, Too Late” Criticism:

Others argue Vanguard’s two-year delay cost clients significant opportunity. Bitcoin traded as low as $15,000 in late 2022 and reached $126,000 in October 2025—an 8x return that Vanguard clients were prevented from accessing through regulated ETF wrappers.

Critics note that Fidelity, Charles Schwab, and even traditional banks like Goldman Sachs moved faster, capturing crypto-curious clients while Vanguard clung to outdated ideology. The #BoycottVanguard movement claims credit for forcing the reversal, suggesting Vanguard acted from necessity rather than conviction.

Pragmatic Perspective:

The timing, while late for early adopters, may prove opportune for conservative investors. Entering during a 30% correction from all-time highs provides better risk/reward than buying at October peaks. Vanguard’s slow-but-steady approach aligns with its client base—investors who prioritize capital preservation over chasing parabolic gains.

Additionally, the two-year delay allowed crypto ETF infrastructure to mature. Early 2024 products faced operational challenges, pricing issues, and liquidity concerns. By December 2025, these products have proven reliability through multiple market cycles.

What This Means for Bitcoin’s Next Move

Supply and Demand Dynamics:

Bitcoin’s fixed supply of 21 million coins creates inherent scarcity. With approximately 19.6 million already mined and significant portions lost forever, available supply is constrained.

Vanguard’s entry adds tens of millions of potential buyers to the demand side. Even if only 10% of Vanguard clients allocate 1% to Bitcoin ETFs, that represents approximately $11 billion in buying pressure—more than the total market cap of many large-cap cryptocurrencies.

ETF Structural Demand:

Unlike retail traders who might sell during corrections, ETF holders tend toward buy-and-hold behavior. Retirement accounts and long-term portfolios create sticky demand that doesn’t fluctuate with daily price movements.

As Vanguard clients gradually allocate to crypto ETFs over months and years, this creates persistent bid support. Combined with Bitcoin’s halving cycle reducing new supply, the supply/demand imbalance favors higher prices over multi-year timeframes.

Institutional Domino Effect:

Vanguard’s reversal gives cover to remaining institutional holdouts. Pension funds, endowments, and sovereign wealth funds can now justify crypto allocations by citing Vanguard’s embrace. This “social proof” unlocks trillions in sidelined capital.

Bear Case Considerations:

However, significant headwinds remain. Macroeconomic conditions—particularly Federal Reserve policy and potential recession risks—could suppress risk asset demand regardless of institutional access. Additionally, regulatory clarity could reverse if political winds shift.

The 30% correction from October highs reminds that Bitcoin remains volatile. Even with Vanguard access, conservative clients may allocate minimally or wait for further price stability before committing capital.

Conclusion: The Conservative Revolution

Vanguard’s decision to allow crypto ETFs represents more than a policy reversal—it’s a milestone signaling digital assets’ transition from speculative fringe to mainstream portfolio component. When the firm synonymous with conservative, long-term investing embraces Bitcoin and Ethereum ETFs, it tells the world that crypto has crossed the legitimacy threshold.

The timing amid a 30% market correction demonstrates conviction rather than FOMO. Vanguard isn’t chasing peaks; it’s providing access at valuations that may prove attractive for the patient, methodical accumulators who comprise its client base.

For Bitcoin and crypto markets, the implications compound over years rather than days. Fifty million new potential investors with $11 trillion in assets don’t create overnight pumps—they create steady, persistent demand that supports multi-year bull markets. As conservative clients allocate 1-2% to crypto ETFs, tens of billions in capital flow into digital assets without fanfare or volatility.

The transformation of Salim Ramji from BlackRock’s Bitcoin ETF architect to Vanguard’s crypto-enabling CEO represents poetic symmetry. The executive who helped launch the most successful crypto product in history now opens the gates for the most conservative institution in finance.

For the crypto industry, December 2, 2025 marks the day the last major holdout capitulated. From here, the question isn’t whether institutions will adopt crypto—it’s how quickly the remaining $100+ trillion in traditional finance allocates to digital assets now that every major platform provides access.

The revolution won’t be televised. It will happen gradually, portfolio by portfolio, as millions of conservative investors discover that the same institution they trusted with their retirement savings now offers Bitcoin ETFs. And that, more than any price pump, represents crypto’s ultimate validation.

Disclaimer:This content is for educational and reference purposes only and does not constitute any investment advice. Digital asset investments carry high risk. Please evaluate carefully and assume full responsibility for your own decisions.

Join MEXC and Get up to $10,000 Bonus!

Sign Up