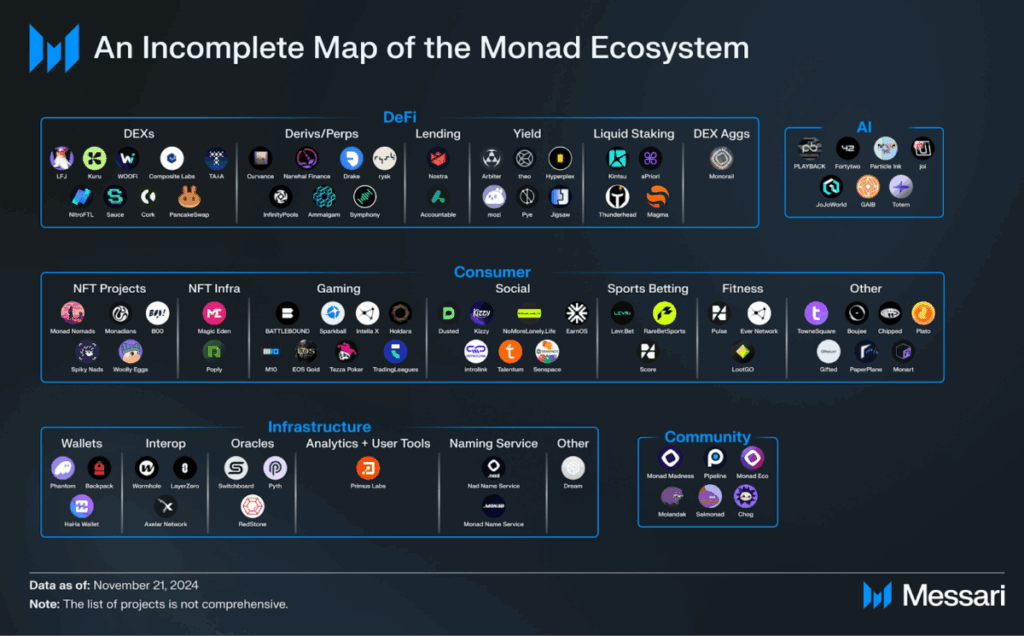

Monad, a Layer-1 blockchain that raised $250 million from major investors such as Paradigm and Coinbase Ventures, has officially announced its airdrop, with token launch and mainnet release coming soon.

As one of the most anticipated L1s, Monad is designed to scale Ethereum without compromising security or EVM compatibility. Thanks to its ultra-fast performance and parallel execution, Monad is attracting a wave of DeFi, infrastructure, and staking projects, many of which have already raised tens of millions in funding — even before mainnet launch.

Below are some of the most notable dApps building on Monad.

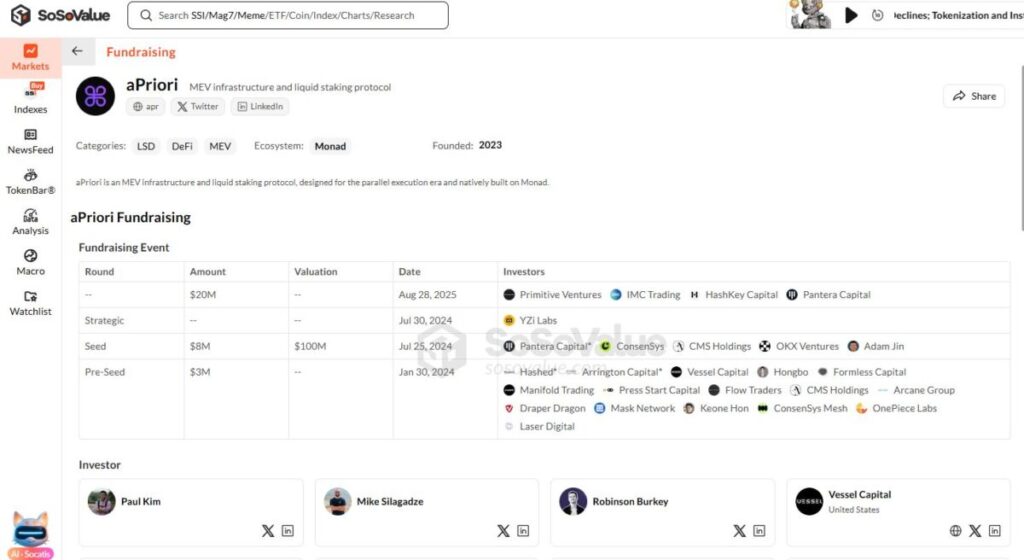

aPriori

Category: LSD, DeFi, MEV

aPriori is one of the core projects in the Monad ecosystem, focusing on staking and MEV infrastructure — two crucial layers for optimizing network efficiency and user yield.

The platform allows users to stake MON and receive aprMON, a liquid staking token (LST). What makes aPriori unique is that it shares MEV rewards generated by validators within its ecosystem, resulting in higher yield than standard staking.

In addition, aPriori is developing Swapr, an AI-powered order flow management and transaction routing tool capable of classifying healthy vs. malicious MEV transactions in just milliseconds — protecting traders and liquidity from sandwich attacks and frontrunning.

In its most recent funding round on Aug 28, 2025, aPriori raised an additional $20 million, bringing its total to $30 million, with participation from Pantera Capital, ConsenSys, Hashed, HashKey, Arrington, OKX Ventures, CMS Holdings, and YZi Labs.

The founding team includes former members from Jump Crypto, Flow Traders, Pyth Network, and Coinbase.

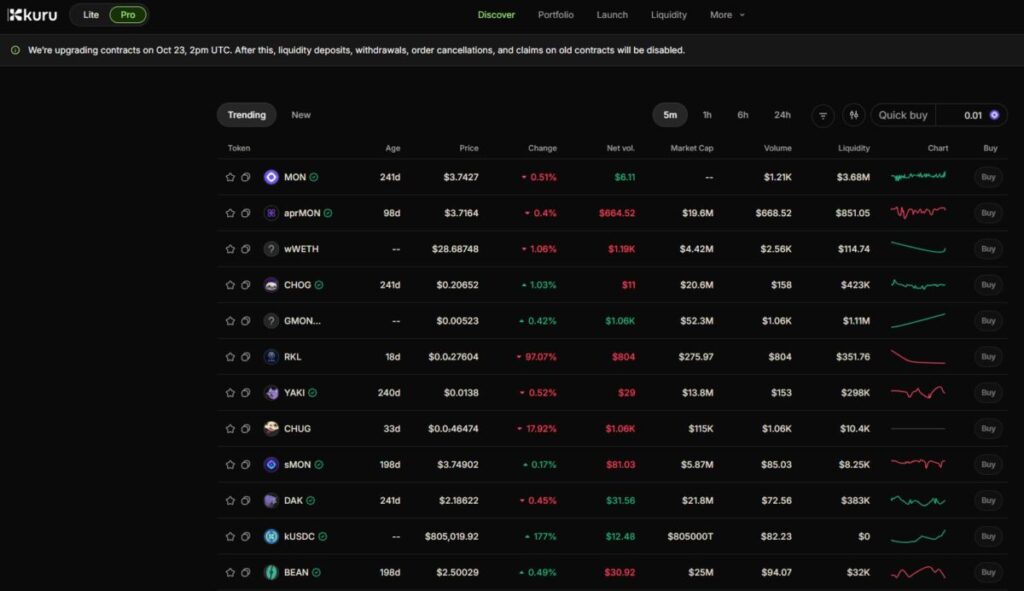

Kuru Exchange

Category: DEX, DeFi, Orderbook DEX

Kuru Exchange is a pioneer DeFi project on Monad aiming to build a CEX-like trading experience fully on-chain.

It leverages an on-chain CLOB (Central Limit Order Book) model, allowing users to place and cancel limit orders with low gas fees thanks to Monad’s optimized architecture.

What sets Kuru apart is its hybrid CLOB + AMM design — when liquidity is insufficient, the protocol automatically supplies AMM liquidity to ensure smooth trade execution and minimize slippage. This hybrid model benefits market makers while providing pro-level UX for traders.

In July 2025, Kuru closed an $11.5M Series A, bringing total funding to $13.5M. The round was led by Paradigm, with participation from Electric Capital, CMS Holdings, and Brevan Howard Digital.

The team also launched the “Kuru Monster Kurator” community program to incentivize early users to testnet, provide feedback, and participate in the liquidity network.

Block Street

Category: DeFi, Lending, Digital Securities, RWA

Block Street is an on-chain financial infrastructure project on Monad focusing on tokenized equities, lending, leverage, and yield products.

Its goal is to bring traditional equity markets onto blockchain with performance, transparency, and compliance.

In September 2025, Block Street raised $11.5 million in a strategic round led by Hack VC, with participation from DWF Labs, Generative Ventures, StudioB, and investors from major trading firms such as Jane Street, Point72, and Hudson River Trading (HRT).

The project positions itself as an infrastructure layer, not just a DeFi app — building risk management tools, performance analytics systems, and market protection mechanisms like oracle caps, timelocks, and circuit breakers.

Perpl

Category: DEX, DeFi

Perpl is a native perpetual DEX built on Monad that uses a Central Limit Order Book (CLOB) model instead of AMM, aiming to deliver a professional derivatives trading experience similar to dYdX or Hyperliquid, but entirely on-chain.

Unlike other perp DEXs, Perpl integrates its matching engine and risk engine directly into Monad’s parallel execution architecture, enabling multi-order processing within the same block — ensuring fairness and near-instant execution.

Its goal is to fully eliminate off-chain dependencies in order matching and risk management, making every trade transparent and verifiable.

In May 2025, Perpl raised $9.25M in a round led by Dragonfly Capital, joined by CMS Holdings, HashKey Capital, Mirana Ventures, Brevan Howard Digital, and L1D Capital.

The two founders, originally from the U.S., have relocated to London to navigate regulatory challenges and expand their international dev team.

Perpl hasn’t launched a testnet yet, but the team confirmed it will release one before Monad mainnet for community testing and feedback on order matching, funding rates, and UI/UX.

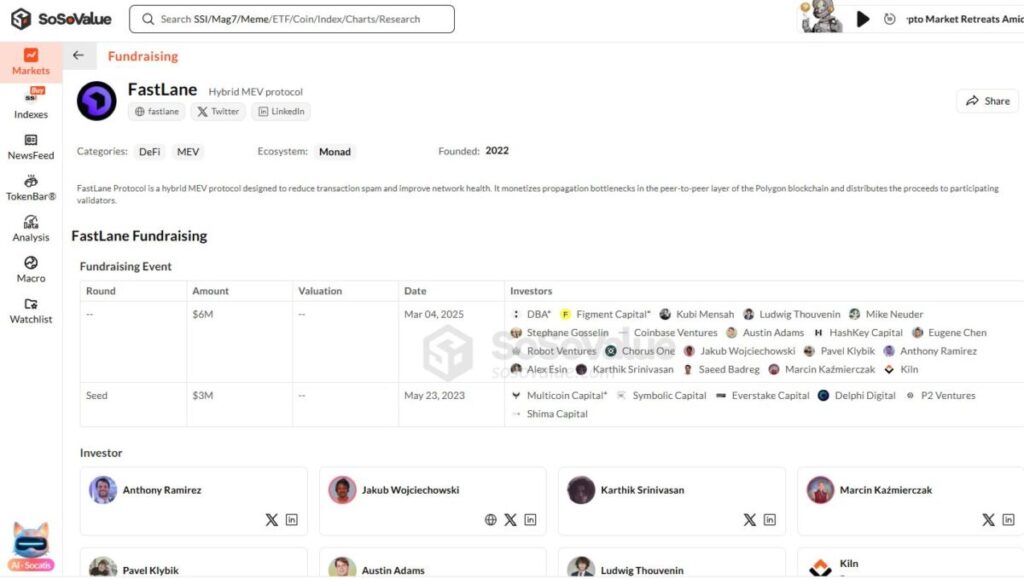

FastLane

Category: DeFi, MEV

FastLane Labs is a MEV infrastructure project focused on validator performance optimization and staking yield on Monad.

It’s building a MEV marketplace combined with a liquid staking protocol, with its main product being $shMON — the token representing staked MON.

At its core, FastLane aims to create a “fair MEV layer” for Monad, where validators, builders, and traders share MEV value transparently.

Instead of allowing a small group of validators to capture MEV profits (as in other networks), FastLane implements an auction-based block slot mechanism, redistributing MEV revenue to the community via $shMON — boosting APY while reducing validator centralization risk.

It also features FastFlow, a smart routing layer that optimizes transaction paths and mitigates sandwich attacks and front-running, similar to Flashbots’ MEV-Share but tailored for Monad.

So far, FastLane has raised nearly $9 million across two rounds, backed by Multicoin Capital, Delphi Ventures, Coinbase Ventures, HashKey Capital, Shima Capital, Robot Ventures, and P2 Ventures.

The team includes engineers from Flashbots, Lido, Coinbase, and Jump Crypto, with deep expertise in staking and MEV optimization.

Opinion Labs (O.LAB)

Category: Prediction Market, Social

Opinion Labs is a cross-chain prediction market built on Monad and BNB Chain, enabling users to create, trade, and bet on outcomes of future events — from crypto prices and sports to social and political trends.

Its vision is to turn public opinion into a tradable asset, similar to Polymarket on Ethereum.

O.LAB stands out with its custom oracle and data layer, called O.Data, which combines AI validation, oracle feeds, and on-chain human verifiers to ensure event results are accurate and tamper-resistant.

Thanks to Monad’s high-performance design, O.LAB can settle and price markets within seconds, compared to minutes on other chains.

In Q2 2025, the project raised $5 million in a Seed round led by YZi Labs and Amber Group, with participation from angel investors specializing in data oracles and prediction analytics.

O.LAB also won Binance MVP Season 7, earning technical support from Binance Labs and advisors from the decentralized data space.

The project has already launched its testnet on Monad, inviting users to explore prediction markets and join the Mainnet waitlist ahead of its early 2026 launch.

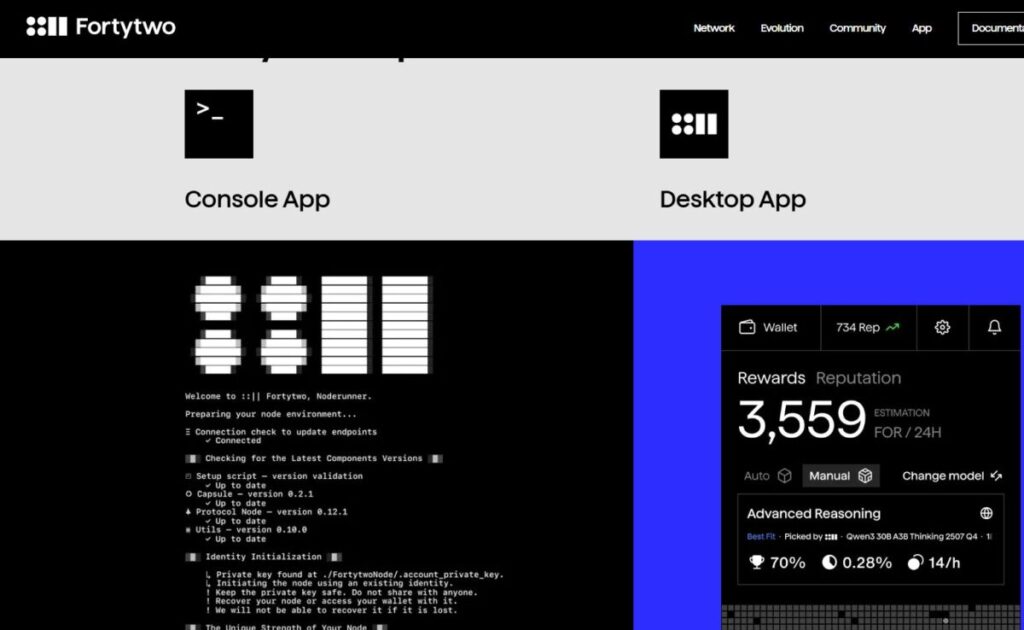

FortyTwo

Category: AI, Infrastructure, AI Agent

FortyTwo is a decentralized AI infrastructure project addressing the scalability and cost challenges of centralized AI systems.

It’s building a distributed AI network that allows users and developers to run AI tasks on Monad without relying on centralized servers.

The project’s core vision is to create a “fair AI layer” where anyone can contribute computing power and earn rewards via its governance token $42AI.

FortyTwo uses an incentivized compute node mechanism to efficiently allocate resources, maximize throughput, and reduce operational costs.

It also implements an intelligent scheduling system that automatically assigns workloads to the most efficient nodes — similar to distributed AI networks but custom-built for Monad, ensuring transparency and decentralization.

So far, FortyTwo has raised $2.3 million in a Pre-Seed round, backed by top AI and crypto investors such as Big Brain Holdings, EV3, Chorus One, Comfy Capital, CMT Digital, and angels like Paul Taylor and Keone Hon.

The team includes engineers and researchers with strong backgrounds in multi-agent systems, distributed AI, and blockchain infrastructure, working toward building a scalable, decentralized AI protocol for global adoption.

Disclaimer: This content does not constitute investment, tax, legal, financial, or accounting advice. MEXC provides this information for educational purposes only. Always DYOR, understand the risks, and invest responsibly

Join MEXC and Get up to $10,000 Bonus!

Sign Up