Meme coins represent perhaps the most misunderstood segment of cryptocurrency markets. Dismissed by traditional analysts as speculative gambling while simultaneously generating some of the highest returns in digital asset history, these narrative-driven tokens have evolved from internet jokes into legitimate market forces that command serious institutional attention.

The dismissive attitude that once prevailed in professional crypto circles is finally shifting. When memes like $TRUMP on Solana surged to multi-billion dollar market caps, or when coins like Pepe (PEPE) and Bonk (BONK) generate daily trading volumes in the hundreds of millions, movements rivaling or even exceeding some mid-tier DeFi protocols, there’s no longer room for shrugging off the memecoin space.

For example:

Dogecoin (DOGE) still leads with tens of billions in market cap. Pepe (PEPE) is seeing trading volumes in the ~$300 million per day range, with market caps in the several billions.The $TRUMP token exploded out of the gate. raising massive speculation and liquidity almost immediately after launch.

These aren’t fringe bets anymore. They’re headline-makers. Traders and analysts now must factor in how memecoins behave: how fast they move, how big their community is, how much of their volume comes from hype vs institutional or sustained trading. Ignoring them means missing entire sectors of risk and opportunity.

This article examines why meme coins have shifted from fringe speculation to serious trading opportunities, the structural factors driving this evolution, and the critical distinctions between sustainable meme coin projects and inevitable failures that most retail participants fail to recognize.

1.The Evolution of Meme Coin Market Structure

The memecoin sector has undergone a fundamental evolution since Dogecoin’s playful launch in 2013. What began as a tongue-in-cheek critique of crypto speculation has matured into a dynamic, self-sustaining market segment. Today’s memecoins such as $Pepe, $Bonk, and $TRUMP demonstrate that the category is no longer limited to satire; instead, it operates with its own liquidity structures, speculative cycles, and valuation metrics. Unlike traditional crypto assets, memecoins thrive on community identity, narrative virality, and cultural resonance as primary drivers of value, making them a distinct ecosystem within the broader digital asset market.

2.Historical Context and Market Development

Early meme coins existed primarily as social experiments with minimal economic infrastructure. Dogecoin’s inflationary tokenomics and absence of development roadmap reflected its origins as parody rather than serious financial instrument. However, successive market cycles revealed unexpected durability and community engagement that traditional project evaluation frameworks failed to predict.

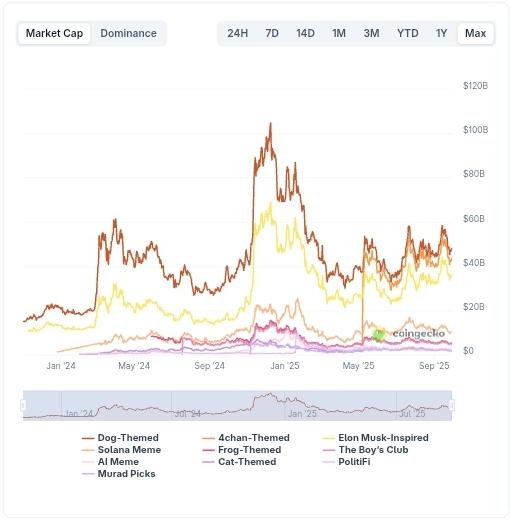

Figure 1: Meme Coin Sector Market Capitalization Growth

The 2021 bull market marked a turning point. Shiba Inu’s rise demonstrated that meme coins could implement complex ecosystems including decentralized exchanges, NFT platforms, and layer-2 scaling solutions while maintaining memetic appeal. This fusion of serious infrastructure with community-driven narrative created new valuation paradigms that professional traders initially dismissed but gradually recognized as sustainable market forces.

3.Why Professional Attention Has Shifted

Several structural factors explain increasing institutional and professional trader interest in meme coin markets, contradicting earlier dismissals of the sector as purely retail-driven speculation.

Liquidity and Volume Concentration

Major meme coins now routinely generate trading volumes exceeding many “serious” cryptocurrency projects with substantially larger development teams and technical sophistication. This liquidity concentration creates trading opportunities independent of fundamental value assessments.

During the 2024 market cycle, several meme coins maintained 24-hour trading volumes representing 50-100% of their market capitalization, compared to 10-20% for typical altcoins. This extraordinary liquidity facilitates large position entries and exits that would be impossible in less liquid markets, attracting professional trading operations seeking efficiency.

Price Discovery Efficiency

Contrary to assumptions about irrational meme coin pricing, analysis reveals relatively efficient price discovery mechanisms driven by transparent on-chain activity and community sentiment metrics. While valuation doesn’t follow traditional fundamental analysis, price movements demonstrate responsiveness to measurable inputs including social media engagement, developer activity, and whale wallet behavior.

Professional traders have developed systematic frameworks for quantifying these alternative valuation inputs, creating edge opportunities unavailable in markets where information is primarily controlled by centralized entities.

Exchange Listing Dynamics

MEXC has dramatically accelerated meme coin listing timelines, often providing trading access within hours of token launch rather than the weeks or months required by more conservative exchanges. This speed creates first-mover advantages for traders capable of rapid opportunity assessment and position deployment.

The listing speed differential has created distinct market phases: early trading on fast-listing exchanges like MEXC, followed by price appreciation upon subsequent listings on larger platforms. Traders who understand this pattern can systematically capture listing arbitrage opportunities.

Market Psychology and Behavioral Dynamics

Meme coin markets exhibit distinct psychological patterns that differ from traditional cryptocurrency trading, creating both opportunities and risks that require specialized understanding.

Community-Driven Valuation Frameworks

Unlike cryptocurrencies valued on technological innovation or network utility, meme coins derive worth primarily from community strength and narrative appeal. This creates valuation dynamics more similar to attention economy assets than traditional financial instruments.

Analysis of successful meme coins reveals consistent patterns: strong community engagement across multiple platforms, organic content creation rather than paid marketing, and narrative adaptability that allows projects to remain relevant across changing market conditions.

The Role of Virality in Price Discovery

Meme coin valuations demonstrate high sensitivity to virality metrics that can be quantified and monitored systematically. Tweet impression volumes, Reddit post engagement rates, and TikTok video proliferation all show measurable correlation with subsequent price movements, typically with 12-48 hour lag periods.

Sophisticated traders have developed monitoring systems that track these engagement metrics in real-time, creating early warning systems for viral breakouts before they fully reflect in price. This systematic approach to virality tracking represents a legitimate form of fundamental analysis adapted for attention-driven assets.

4.Distinguishing Sustainable Projects from Failures

The critical skill in meme coin trading involves differentiating projects with sustainable community engagement from pump-and-dump schemes destined for collapse. Professional traders employ specific evaluation frameworks that go beyond surface-level social media presence.

Tokenomics Red Flags and Green Flags

Critical Warning Signs:

- Excessive token allocation to team or early insiders (>20% of supply)

- Vesting schedules shorter than 12 months for insider holdings

- Complex token burn mechanisms that obscure actual circulating supply

- Multi-signature wallet controls with anonymous participants

- Contract code that enables hidden minting or transfer restrictions

Positive Indicators:

-Fair launch mechanics with no pre-mine or insider allocation

– Transparent, audited smart contracts with verified source code

– Community-controlled treasury with transparent governance

– Gradual, predictable emission schedules if inflationary

– Liquidity permanently locked or burned to prevent rug pulls

Portfolio Allocation Guidelines

Professional approach to meme coin trading involves strict capital allocation limits to prevent catastrophic portfolio damage from sector-specific risks:

- Conservative Allocation: 5-10% of cryptocurrency portfolio in meme coin positions

- Moderate Allocation: 10-20% for traders with higher risk tolerance and sector expertise

- Aggressive Allocation: 20-30% maximum even for specialized meme coin traders

No individual meme coin position should exceed 2-3% of total portfolio value at entry, with scaling into positions only after initial thesis validation through price performance.

Platform Advantages for Meme Coin Trading

Exchange selection significantly impacts meme coin trading success due to varying listing speeds, liquidity provision, and trading infrastructure quality.

5.MEXC’s Competitive Positioning

MEXC has established a dominant position in early-stage meme coin trading through systematic rapid listing approach. The platform’s ability to provide trading access within hours of token launch creates substantial first-mover advantages for traders monitoring new project launches.

The speed advantage translates directly to trading opportunities. Meme coins listed first on MEXC often experience 2-5x price appreciation before appearing on larger exchanges, creating predictable arbitrage opportunities for traders positioned early.

Liquidity Considerations

Despite rapid listings, MEXC maintains professional-grade liquidity for major meme coins through active market making relationships. This combination of speed and liquidity provides an optimal environment for meme coin trading compared to platforms offering either fast listings with poor liquidity or good liquidity with slow listing processes.

Future Outlook and Market Evolution

The meme coin sector continues evolving in ways that suggest increasing rather than decreasing professional relevance despite periodic skepticism from traditional cryptocurrency analysts.

Infrastructure Maturation

Development of meme coin-specific infrastructure including specialized wallets, analytics platforms, and community management tools indicates sector maturation beyond speculative trading. This infrastructure investment suggests sustainable market presence rather than a temporary trend.

Regulatory Clarity Development

Increasing regulatory attention to meme coins may paradoxically benefit the sector by establishing clearer operational frameworks. Projects adapting to regulatory requirements while maintaining community appeal will likely capture market share from less compliant competitors.

Integration with Broader DeFi Ecosystem

Major meme coins increasingly function as collateral in DeFi protocols, bridge assets for cross-chain transactions, and liquidity provision pairs. This integration with broader cryptocurrency infrastructure suggests evolution beyond pure speculation toward genuine utility within the crypto ecosystem.

6.Conclusion: The New Reality of Meme Coin Markets

The evolution of meme coins from internet jokes to legitimate trading vehicles represents broader transformation in how digital assets accrue value. While traditional fundamental analysis remains relevant for technology-focused cryptocurrencies, meme coins demonstrate that community strength and narrative appeal constitute viable alternative valuation frameworks.

Professional traders who dismiss the sector miss substantial opportunities generated by liquidity concentration, predictable listing patterns, and systematic relationships between social engagement metrics and price performance. Conversely, retail participants who treat meme coins as lottery tickets rather than tradeable assets with quantifiable risk factors typically experience poor outcomes.

The key to successful meme coin trading involves neither dismissal nor uncritical enthusiasm, but rather systematic evaluation of community dynamics, tokenomics structures, and risk-adjusted position sizing appropriate for sector-specific volatility profiles. MEXC provides early access combined with professional-grade trading infrastructure enabling implementation of these sophisticated approaches.

As the sector continues maturing, the distinction between professional meme coin traders and speculative gamblers will likely widen. Those who develop systematic frameworks for evaluating narrative strength, community health, and technical patterns adapted for high-volatility environments will continue capturing opportunities that more traditional approaches miss entirely.

The truth about meme coins is neither the complete dismissal traditional analysts preferred nor the uncritical enthusiasm retail participants often demonstrate. Instead, it’s recognition that attention-driven assets represent legitimate market segments requiring specialized analytical frameworks and disciplined risk management, but offering genuine trading opportunities for those willing to develop appropriate expertise.

Disclaimer: This content is for educational and reference purposes only and does not constitute investment advice. Digital asset investments carry high risk, particularly in high-volatility sectors like meme coins. Please evaluate carefully and assume full responsibility for your own decisions.

Join MEXC and Get up to $10,000 Bonus!

Sign Up