A single whale’s decision to dump 24,000 Bitcoin last weekend worth $2.7 billion sent shockwaves through cryptocurrency markets recently, triggering a flash crash that wiped $200 billion from total crypto market capitalization and liquidated over $550 million in leveraged positions. Bitcoin briefly touched below $111,000 before stabilizing near $112,800, marking one of the most dramatic single-transaction market events in cryptocurrency history.

The massive sell-off highlighted the continued influence of large holders on Bitcoin price action, despite the cryptocurrency’s growing institutional adoption and market maturity. The whale-driven crash served as a stark reminder that concentrated ownership remains a significant risk factor in cryptocurrency markets, where individual actors can still create billion-dollar market movements within minutes.

Currently down nearly 12% from its all-time high of $124,000, Bitcoin faces critical technical levels that will determine whether the recent weakness represents temporary profit-taking or the beginning of a more substantial correction. With the cryptocurrency now testing key Fibonacci support levels and breaking down from important chart patterns, traders are closely monitoring price action for signs of stabilization or further decline.

1. The $2.7 Billion Whale Dump: Anatomy of a Flash Crash

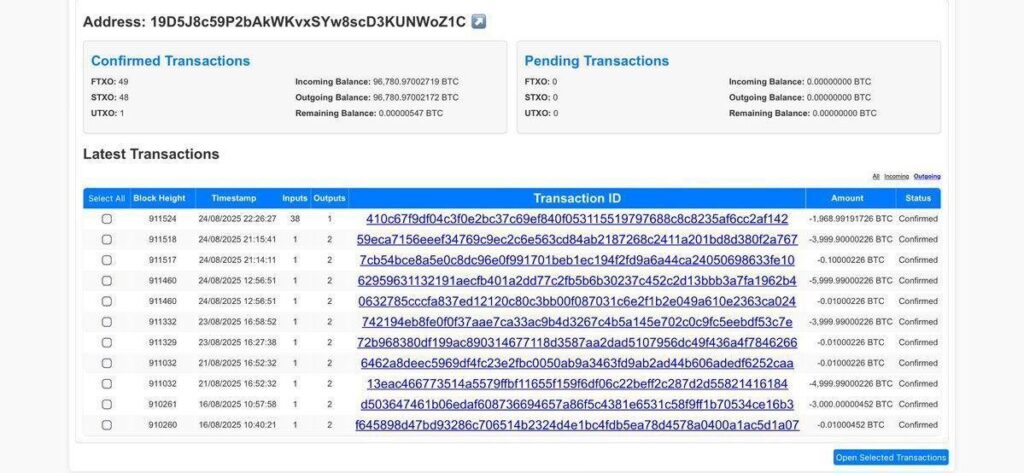

The massive Bitcoin whale transaction that triggered recent market turbulence represents one of the largest single cryptocurrency sells in history, demonstrating how concentrated ownership continues to create systemic risks in digital asset markets.

1.1 The Scale of the Whale Transaction

The whale’s decision to dump 24,000 Bitcoin in what appears to have been a coordinated sell-off created immediate market pressure that overwhelmed available liquidity across major exchanges. The $2.7 billion transaction size represents approximately 0.11% of Bitcoin’s total market capitalization, indicating the substantial market impact that large holders can create through sudden liquidation decisions.

The timing of the whale dump appears strategically planned to maximize market impact, occurring during relatively lower liquidity periods when fewer market makers and institutional buyers were actively providing support. This timing amplified the price impact compared to similar-sized transactions during high-liquidity trading sessions.

Analysis of the transaction patterns suggests the whale may have used sophisticated execution strategies to spread the sell-off across multiple exchanges and time intervals, though the overall impact was still sufficient to trigger widespread liquidations and panic selling.

1.2 Market Structure Vulnerability Exposed

The whale dump exposed fundamental vulnerabilities in cryptocurrency market structure, where liquidity concentration and algorithmic trading systems can amplify initial selling pressure into cascading market crashes that affect all major cryptocurrencies simultaneously.

The flash crash demonstrated how Bitcoin’s price discovery mechanism remains susceptible to large individual actions despite growing institutional participation and professional market making services that have improved market depth during normal trading conditions.

Exchange order books showed rapid depletion of buy-side liquidity as the whale selling pressure overwhelmed available demand, creating temporary price dislocations that triggered stop-loss orders and margin calls across leveraged trading platforms.

1.3 Immediate Market Response and Contagion Effects

The Bitcoin whale dump created immediate contagion effects across all major cryptocurrencies, with Ethereum, XRP, and Solana following Bitcoin’s decline as automated trading systems and correlated risk management strategies amplified the selling pressure throughout the crypto ecosystem.

Total cryptocurrency market capitalization shrank by $200 billion within 24 hours of the whale transaction, indicating that the impact extended far beyond Bitcoin to affect investor sentiment and position management across all digital asset categories.

Alternative cryptocurrencies experienced disproportionate selling pressure compared to Bitcoin, suggesting that the whale event triggered broader risk-off sentiment where investors liquidated more speculative positions while potentially maintaining exposure to Bitcoin as the most established cryptocurrency.

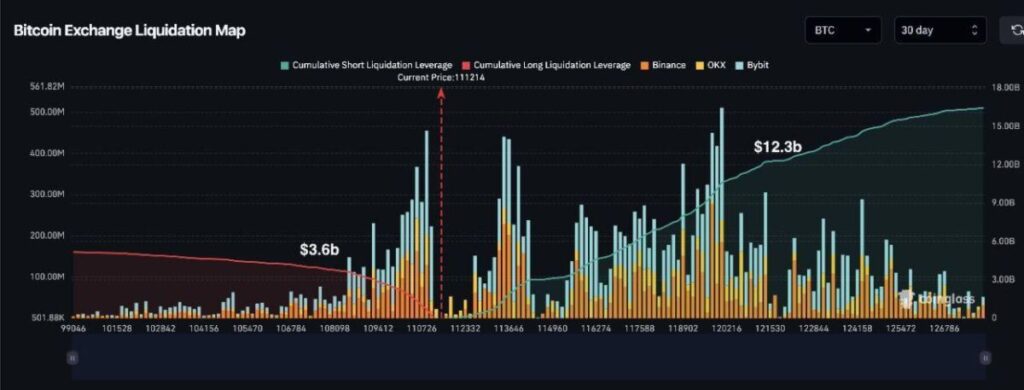

2. The $550 Million Liquidation Cascade

The whale-driven Bitcoin crash triggered a massive liquidation event that wiped out over $550 million in leveraged positions, demonstrating how sudden price movements can create cascading failures across cryptocurrency trading platforms.

2.1 Leveraged Position Destruction

The $550 million in Sunday liquidations represents one of the largest single-day liquidation events in recent cryptocurrency history, with the majority of forced closures affecting long positions that had been established during Bitcoin’s recent strength above $120,000.

The liquidation cascade began with highly leveraged positions that were closest to margin call levels, but quickly spread to more conservative leverage ratios as prices continued declining and margin requirements increased across major trading platforms.

Automated liquidation systems designed to protect exchanges from bad debt exposure accelerated the selling pressure by force-closing positions exactly when market liquidity was most constrained, amplifying the downward price momentum initiated by the whale dump.

2.2 Cross-Platform Liquidation Analysis

Major cryptocurrency exchanges experienced simultaneous liquidation events as the whale-driven crash affected price discovery across all trading venues, creating synchronized forced selling that overwhelmed available liquidity across the entire cryptocurrency trading ecosystem.

The liquidation data reveals that retail traders using high leverage ratios suffered disproportionate losses compared to institutional traders with better risk management and lower leverage utilization, highlighting the risks associated with excessive leverage during volatile market conditions.

Exchange-specific liquidation mechanisms and margin requirements created slight timing differences in forced closures, but the overall impact was remarkably synchronized across platforms as all venues faced the same fundamental liquidity constraints during the crash period.

2.3 Risk Management System Performance

The massive liquidation event tested risk management systems across major cryptocurrency exchanges, with most platforms successfully managing the crisis without creating bad debt or system failures despite the extreme market stress conditions.

Automated liquidation engines performed as designed by closing positions before they could generate negative account balances, though the forced selling contributed to market instability by adding supply pressure during the most volatile trading periods.

The event highlighted both the effectiveness and limitations of current risk management approaches, where systems successfully protected exchange solvency but contributed to market volatility through mechanical selling that amplified the initial whale dump impact.

3. Technical Analysis: Critical Support Levels Under Pressure

Bitcoin’s whale-driven decline has created a complex technical situation where the cryptocurrency faces multiple critical support levels that will determine whether recent weakness represents temporary profit-taking or the beginning of a more substantial correction.

3.1 Fibonacci Support Test at $112,562

Bitcoin’s current trading near $112,800 places the cryptocurrency directly at a critical 78.6% Fibonacci support level that has historically provided significant buying interest during correction periods. The defense of this $112,562 level represents a crucial test of Bitcoin’s technical foundation and investor confidence.

Historical analysis of Bitcoin’s response to 78.6% Fibonacci tests reveals that successful defense of these levels often leads to sustained rebounds, while breakdown below these critical supports typically triggers extended correction periods toward lower Fibonacci targets.

The current test occurs with volume characteristics and momentum indicators that will provide important confirmation signals for whether the support level can hold under continued selling pressure from remaining whale inventory or profit-taking by other large holders.

3.2 Channel Breakdown and Momentum Indicators

Technical analysis indicates that Bitcoin has broken down from key ascending channels that had provided structural support during its recent advance toward all-time highs, suggesting that the whale dump may have triggered a more significant technical deterioration than initially apparent.

Momentum indicators including RSI and MACD have turned decisively bearish across multiple timeframes, creating conditions where technical selling could continue even without additional whale activity or fundamental negative catalysts.

The channel breakdown has opened potential downside targets toward $105,000 if current support levels fail to hold, representing a more substantial correction than the immediate flash crash impact initially suggested.

3.3 Volume Analysis and Market Structure

Trading volume during the whale dump and subsequent recovery attempts provides important insights into market structure and the likelihood of successful support defense versus continued weakness toward lower technical targets.

High volume during the initial crash followed by lower volume during recovery attempts suggests that selling interest remains elevated while buying demand has not yet returned with sufficient conviction to establish sustainable price floors.

The volume profile indicates that significant resistance now exists at levels that previously provided support, suggesting that the whale dump may have altered Bitcoin’s technical structure in ways that could persist beyond the immediate crash recovery period.

4. Market Impact Beyond Bitcoin: Altcoin Carnage

The whale-driven Bitcoin crash created widespread selling pressure across alternative cryptocurrencies, with most major altcoins experiencing disproportionate declines that highlighted their continued correlation with Bitcoin during stress periods.

4.1 Ethereum’s Response and ETF Impact

Ethereum followed Bitcoin’s decline but showed relative strength during certain phases of the crash, potentially reflecting growing institutional interest and the recent success of Ethereum ETF products that have attracted substantial investment flows.

The ETH response to the Bitcoin whale dump provided insights into how growing institutional infrastructure and product availability may be creating some decoupling effects during market stress, though overall correlation remained high throughout the crash period.

Ethereum’s recovery patterns following the initial crash suggest that institutional buying interest may provide support during Bitcoin-driven market corrections, creating opportunities for relative outperformance during recovery phases.

4.2 Altcoin Leverage and Liquidation Amplification

Alternative cryptocurrencies experienced amplified selling pressure compared to Bitcoin as leveraged traders faced margin calls on altcoin positions that typically carry higher risk premiums and leverage ratios than Bitcoin trading.

The altcoin liquidation cascade was particularly severe for smaller market capitalization cryptocurrencies where leverage trading has grown substantially but liquidity remains limited compared to Bitcoin and Ethereum markets.

Recovery patterns across different altcoin categories revealed significant dispersion in how various cryptocurrency sectors responded to the Bitcoin whale event, with some showing resilient demand while others continued declining even after Bitcoin stabilized.

4.3 Market Structure Evolution and Correlation Analysis

The whale-driven crash provided real-time data about how cryptocurrency market structure has evolved, with correlation patterns revealing both increased integration and emerging differentiation across different digital asset categories.

The event demonstrated that while Bitcoin remains the dominant driver of cryptocurrency market sentiment, growing institutional infrastructure and product differentiation are beginning to create more nuanced market responses during stress periods.

5. Institutional Response and Market Maturity Questions

The whale-driven crash and its market impact raised important questions about cryptocurrency market maturity and whether institutional participation has created sufficient stability to absorb large individual transactions without systemic disruption.

5.1 Institutional Buyer Response

The recovery following the initial whale dump revealed patterns of institutional buying interest that helped stabilize prices after the initial shock, though the response was insufficient to prevent substantial short-term volatility and liquidations.

Institutional trading desks and professional market makers provided liquidity during the crash recovery, demonstrating that growing professional participation does create some market stability benefits even when unable to prevent initial price dislocations.

The timing and scale of institutional response suggested that professional investors viewed the whale-driven decline as a buying opportunity rather than a signal of fundamental deterioration, providing support for eventual price recovery.

5.2 Market Infrastructure Performance

Cryptocurrency exchange infrastructure generally performed well during the extreme stress conditions, processing massive volume increases and liquidation events without major technical failures or trading halts that have affected traditional markets during similar stress periods.

The distributed nature of cryptocurrency trading across multiple exchanges provided some resilience benefits compared to centralized market structures, though coordination failures and liquidity fragmentation also contributed to price volatility amplification.

Professional market making services and automated trading systems adapted reasonably well to rapidly changing conditions, though the speed and scale of the whale dump still overwhelmed available liquidity buffers.

5.3 Regulatory and Systemic Risk Implications

The whale dump event highlighted ongoing concerns about concentrated ownership and systemic risks in cryptocurrency markets, potentially attracting regulatory attention regarding market manipulation and investor protection.

The ability of a single actor to create $200 billion in market cap destruction raises questions about market maturity and whether current regulatory frameworks adequately address cryptocurrency market stability risks.

The event may accelerate discussions about position disclosure requirements, market making obligations, or other regulatory measures designed to reduce systemic risks associated with concentrated cryptocurrency ownership.

6. Recovery Scenarios and Technical Outlook

Following the whale-driven crash, Bitcoin faces several potential recovery scenarios that depend on technical level defense, institutional buying interest, and the absence of additional large-scale selling pressure.

6.1 Bull Case: Support Defense and Institutional Buying

The optimistic recovery scenario involves successful defense of current Fibonacci support levels combined with institutional buying interest that absorbs any remaining whale inventory and restores confidence in Bitcoin’s long-term upward trajectory.

This scenario requires volume confirmation of support level defense and momentum indicator improvement that would signal the end of whale-driven selling pressure and return of net buying demand from institutional and retail investors.

Successful support defense could lead to rapid recovery toward previous highs as short-term sellers are forced to cover positions and institutional buyers increase allocation to take advantage of the whale-induced price weakness.

6.2 Bear Case: Support Failure and Extended Correction

The pessimistic scenario involves breakdown below current support levels that triggers additional technical selling and potentially uncovers more whale inventory or institutional profit-taking that extends the correction toward $105,000 or lower levels.

This outcome would likely result from insufficient buying demand to absorb remaining selling pressure combined with additional negative catalysts that erode investor confidence and trigger broader risk-off behavior across cryptocurrency markets.

Extended correction scenarios could persist for weeks or months depending on the scale of remaining selling pressure and broader market conditions that affect cryptocurrency risk appetite and institutional allocation decisions.

6.3 Consolidation Case: Range-Bound Recovery

A middle-ground scenario involves extended consolidation near current levels as markets digest the whale selling while institutional buying gradually absorbs remaining supply without creating immediate breakout momentum.

This consolidation phase could last several weeks while market participants assess whether additional whale inventory remains to be liquidated and institutional buyers evaluate appropriate allocation levels following the demonstrated volatility risks.

Range-bound trading would likely persist until clear technical breakout signals emerge or fundamental catalysts provide directional momentum that overwhelms the current supply-demand balance.

7. Risk Management Lessons and Trading Implications

The whale-driven Bitcoin crash provides important lessons about risk management, leverage utilization, and position sizing that apply to both institutional and retail cryptocurrency investors.

7.1 Leverage Risks and Position Sizing

The $550 million liquidation cascade demonstrates the extreme risks associated with high leverage ratios during volatile market conditions, where even brief price movements can eliminate entire trading accounts within minutes.

Successful navigation of whale-driven volatility requires conservative leverage utilization and position sizing that can withstand temporary price dislocations without forcing premature liquidation during the most unfavorable market conditions.

The event highlighted the importance of maintaining adequate margin buffers and avoiding concentration in single positions or correlated assets that can amplify losses during market stress periods.

7.2 MEXC Risk Management Tools

MEXC‘s comprehensive risk management infrastructure provides essential tools for navigating whale-driven volatility, including stop-loss orders, position limits, and margin monitoring systems that help protect against extreme market movements.

The platform’s advanced order types and automated risk management features enable traders to implement sophisticated strategies that can protect capital during unpredictable whale-driven market events while maintaining exposure to potential recovery opportunities.

Professional-grade risk monitoring and portfolio analytics help traders assess their exposure to concentrated ownership risks and implement appropriate hedging strategies for volatile cryptocurrency markets.

7.3 Market Timing and Opportunity Recognition

The whale-driven crash created both risks and opportunities that required rapid assessment and decisive action to avoid losses while potentially capitalizing on temporary price dislocations.

Successful traders during the event demonstrated the importance of maintaining liquidity reserves and risk management discipline that enables opportunistic positioning during market stress without compromising overall portfolio stability.

The recovery following the crash rewarded investors who could distinguish between temporary whale-driven volatility and fundamental deterioration, highlighting the value of technical analysis and market structure understanding.

8. Long-Term Implications for Bitcoin Market Structure

The whale dump event has important implications for Bitcoin’s long-term market development and the evolution of cryptocurrency market structure as institutional participation continues growing.

8.1 Concentration Risk and Market Maturity

The ability of a single whale to create such substantial market impact raises ongoing questions about Bitcoin’s market maturity and whether concentrated ownership will remain a persistent source of systemic risk as the cryptocurrency scales.

Potential solutions include increased institutional participation that provides natural distribution of holdings, development of better market making infrastructure, and possible regulatory frameworks that address concentration risks without stifling innovation.

The event may accelerate institutional adoption of risk management strategies specifically designed to handle concentrated ownership risks in cryptocurrency markets, potentially improving overall market stability over time.

8.2 Institutional Infrastructure Development

The whale crash highlighted both the progress and limitations of institutional cryptocurrency infrastructure, suggesting areas where continued development could improve market resilience and reduce volatility during stress periods.

Enhanced market making services, improved liquidity distribution mechanisms, and better coordination between exchanges could help absorb future whale transactions without creating such dramatic market disruption.

Professional risk management systems and institutional trading protocols may evolve to better handle the unique characteristics of cryptocurrency markets where concentrated ownership and 24/7 trading create different risk profiles than traditional assets.

8.3 Market Evolution and Stability Outlook

The successful recovery following the whale dump demonstrates that Bitcoin markets have developed some resilience mechanisms that enable price discovery and stability restoration even after major disruption events.

Continued institutional adoption and infrastructure development suggest that future whale transactions may have diminishing marginal impact as market depth and professional participation continue growing over time.

However, the persistence of concentrated ownership means that whale-driven volatility will likely remain a characteristic feature of Bitcoin markets for the foreseeable future, requiring ongoing adaptation of risk management and trading strategies.

9. Conclusion: Lessons from the $2.7 Billion Whale Crash

The recent whale-driven Bitcoin crash serves as a powerful reminder that despite growing institutional adoption and market maturity, cryptocurrency markets remain vulnerable to the actions of large individual holders who can create billion-dollar market movements within minutes.

The $2.7 billion whale dump that triggered over $550 million in liquidations demonstrates both the risks and opportunities inherent in cryptocurrency markets where concentrated ownership intersects with leveraged trading and algorithmic market making systems.

While Bitcoin’s recovery from the initial crash shows market resilience and institutional buying interest, the event highlights ongoing challenges around market structure, risk management, and the potential for individual actors to create systemic market disruption.

For traders and investors, the whale crash reinforces the critical importance of appropriate risk management, conservative leverage utilization, and maintaining liquidity reserves that enable opportunistic positioning during market stress periods.

MEXC’s comprehensive trading infrastructure and risk management tools provide the capabilities necessary for navigating whale-driven volatility while protecting capital and capitalizing on opportunities created by temporary market dislocations.

The long-term implications of the whale dump extend beyond immediate price impact to questions about cryptocurrency market evolution, regulatory development, and the ongoing tension between decentralized ownership and market stability concerns.

As Bitcoin continues maturing and institutional participation grows, events like the recent whale crash provide valuable data about market structure resilience and areas where continued development could improve stability without compromising the fundamental characteristics that make cryptocurrencies attractive to investors and users worldwide.

Disclaimer: This content is for educational and reference purposes only and does not constitute any investment advice. Digital asset investments carry high risk. Please evaluate carefully and assume full responsibility for your own decisions

Join MEXC and Get up to $10,000 Bonus!

Sign Up