Yesterday, S&P Global Ratings delivered a devastating blow to Tether, downgrading the world’s largest stablecoin to “5 (weak)”—the lowest grade on its five-point stablecoin risk scale. The rating agency cited “persistent gaps in disclosure” and a rising share of “high-risk assets” in USDT’s reserves, including Bitcoin, gold, corporate bonds, and secured loans that carry “credit, market, interest-rate, and foreign-exchange risks.”

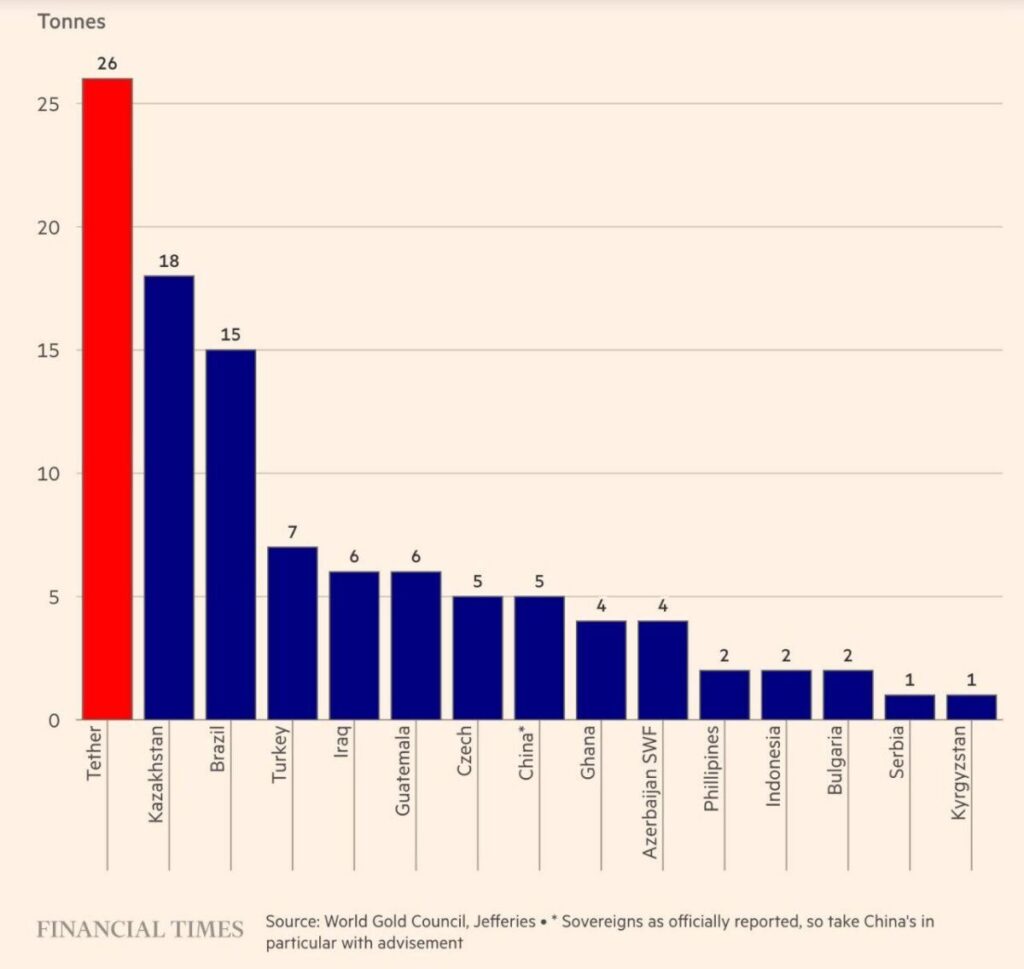

The downgrade comes just one day after reports revealed Tether has become the largest independent holder of gold in the world, acquiring 26 tonnes in Q3 2025 alone—more than any central bank during the same period. With 116 tonnes now in reserve ($12.9 billion), Tether’s gold holdings rival mid-sized sovereign nations, ranking ahead of Greece, Qatar, and Australia.

CEO Paolo Ardoino fired back aggressively, calling S&P’s methodology “broken” and accusing traditional rating agencies of being “uncomfortable with companies that decouple from a broken financial system.” The clash marks one of the most public confrontations between a major credit-rating agency and a leading crypto issuer, raising critical questions: Is Tether’s diversification into gold a strategic hedge—or a warning sign that USDT’s $184 billion in circulation is insufficiently backed?

S&P’s Downgrade: What “Weak” Really Means

S&P Global Ratings introduced its stablecoin stability assessment framework in 2023, rating coins on a scale from 1 (strong) to 5 (weak). Tether’s downgrade from “4 (constrained)” to “5 (weak)” reflects S&P’s view that USDT faces elevated risks to maintaining its $1 peg.

Key Concerns Cited:

“High-Risk Assets” Concentration: Tether’s reserves now include approximately 7% gold, plus Bitcoin, corporate bonds, secured loans, and “other investments.” S&P argues these assets introduce “market, interest-rate, and foreign-exchange risks” that traditional cash-and-Treasury-backed stablecoins avoid. A sharp Bitcoin crash or gold price collapse could theoretically leave USDT undercollateralized.

Disclosure Gaps: Despite quarterly attestations from BDO, Tether provides “limited insight into the creditworthiness of its custodians and counterparties.” S&P noted that while USDT has maintained “notable price stability” during volatility, opacity around collateral quality creates systemic risk.

Liquidity Mismatch: S&P warned that if Bitcoin drops significantly, Tether’s reserves could fall below 1:1 backing. The report specifically highlighted this vulnerability: “A drop in Bitcoin’s value could leave the stablecoin undercollateralized.”

Context Matters: S&P acknowledged that despite concerns, USDT has never lost its peg during banking crises, exchange failures, or liquidity shocks—maintaining full redemptions even during extreme stress events like FTX’s collapse and Terra’s implosion

Tether’s Aggressive Response: “Overcapitalized” vs. “Broken Legacy System”

CEO Paolo Ardoino issued a blistering rebuttal, framing Tether as a revolutionary financial institution that legacy rating agencies fail to understand:

“Overcapitalization” Argument: Ardoino claims Tether is “the first overcapitalized company in the financial industry, with no toxic reserves.” Unlike traditional banks that operate with fractional reserves (lending out 90% of deposits), Tether maintains 1:1+ backing with diversified assets generating yield to fund operations.

Attack on Legacy Finance: “The classical rating models built for legacy financial institutions… collapsed, pushing worldwide regulators to challenge such models,” Ardoino wrote. He argues that S&P’s framework—designed for assessing traditional banks—doesn’t apply to a crypto-native company that operates outside fractional banking.

Resilience Record: Tether pointed to its survival through multiple existential crises: the 2018 banking crisis, FTX collapse, Terra/Luna implosion, and Silicon Valley Bank failure. “USDT has withstood banking crises, exchange failures, liquidity shocks, and extreme market swings—while maintaining full stability and allowing redeemability,” the company stated.

Philosophical Divide: Ardoino framed the dispute as ideological: Tether represents “decoupling from a broken financial system,” while S&P represents the entrenched interests threatened by that decoupling. Whether this narrative resonates depends on whether one views Tether as an innovator or a regulatory arbitrageur hiding risks.

The Gold Strategy: Hedge or Red Flag?

Tether’s aggressive gold accumulation—26 tonnes in Q3 alone, over 1 ton per week—represents one of the most dramatic shifts in stablecoin reserve management ever undertaken.

The Numbers:

- Q4 2024: $5.3 billion in gold

- Q3 2025: $12.9 billion in gold

- Net increase: $7.6 billion in 9 months

- Total holdings: 116 tonnes (ranks #30 globally if compared to central banks)

- Market share: 7% of Tether’s total reserves

- XAU₮ backing: ~12 tonnes support Tether Gold token

- USDT backing: ~104 tonnes bolster stablecoin reserves

Strategic Rationale:

Inflation Hedge: Gold prices surged 50%+ year-to-date in 2025, reaching $4,151/oz on November 26. Tether’s gold strategy has generated billions in unrealized gains, strengthening its reserve cushion.

Diversification: By spreading reserves across U.S. Treasuries, Bitcoin, gold, and other assets, Tether reduces single-point-of-failure risk. If Treasuries crash or Bitcoin collapses, gold may hold value.

Competitive Positioning: Tether Gold (XAU₮) reached $2.1B market cap by October 2025, competing with PAX Gold and other tokenized commodities. Tether’s vertical integration—from vaults to tokenization—creates a moat.

CEO’s Philosophy: “While the world continues to get darker, Tether will continue to invest part of its profits into safe assets like Bitcoin, Gold, and Land,” Ardoino stated in September.

Institutional Infrastructure: In November, Tether hired two senior metals trading executives from HSBC, signaling serious institutional-grade gold operations. The company also invested $100M in Elemental Altus Royalties (mining royalties), acquiring up to 51.8% equity stake.

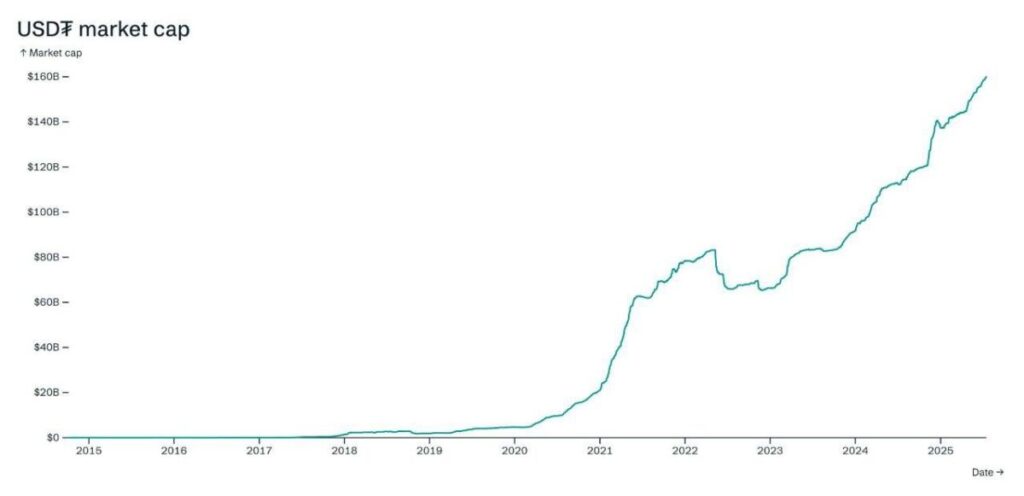

Market Impact: USDT Holds Peg Despite Downgrade

Despite S&P’s “weak” rating, USDT has shown zero signs of instability:

Price Stability: USDT trades at $1.0002 as of November 26, maintaining its peg with typical 0.01-0.02% variance. No depegging event occurred following the downgrade announcement.

Trading Volume: 24-hour USDT volume sits at $88 billion, unchanged from pre-downgrade levels. Market participants appear unfazed, continuing to use USDT as the primary trading pair across exchanges.

Redemptions: No surge in redemption requests has been reported. Tether’s ability to maintain instant withdrawals during the announcement reinforces Ardoino’s “overcapitalized” claim.

Competitive Dynamics: USDC (Circle) trades at $0.9998, showing no competitive advantage despite its superior S&P rating. This suggests the market prioritizes liquidity and network effects over rating agency opinions.

Why Markets Don’t Care: Crypto traders value speed, liquidity, and cross-exchange availability over regulatory approval or rating agency endorsements. USDT’s $184B circulation and ubiquity create a “too-big-to-fail” dynamic—even skeptics use it because everyone else does.

What This Means for Crypto Traders

Short-Term (Next 30 Days): Zero impact expected. USDT has survived far worse than a rating downgrade (DOJ investigations, banking partner losses, founder indictments). Unless redemptions surge or the peg breaks, traders will continue using USDT as usual.

Medium-Term (3-6 Months): Regulatory scrutiny may intensify. The S&P downgrade provides ammunition for lawmakers pushing stablecoin legislation (GENIUS Act). Tether could face pressure to improve transparency or reduce high-risk asset exposure.

Long-Term (1+ Year): If gold prices crash or Bitcoin collapses 80%+, Tether’s reserve cushion could compress. However, the company claims $6+ billion in retained earnings provides a buffer against such scenarios.

Diversification Considerations: Risk-averse traders may shift toward USDC for large holdings, while keeping USDT for active trading due to superior liquidity. Dollar-cost averaging across multiple stablecoins reduces single-issuer risk.

Conclusion: “Too Big to Fail” Meets “Too Risky to Trust”

Tether exists in a paradox: simultaneously the most systemically important stablecoin in crypto and the most distrusted by regulators and rating agencies. S&P’s “weak” rating reflects genuine concerns about reserve opacity and high-risk asset concentration, yet USDT’s $184 billion circulation and flawless redemption history suggest those concerns may be overblown.

The gold accumulation strategy cuts both ways: on one hand, it demonstrates Tether’s profitability and ability to diversify beyond Treasuries; on the other, it raises questions about why a “stablecoin” needs 116 tonnes of a volatile commodity to maintain stability.

Paolo Ardoino’s defiant response—framing Tether as a revolutionary alternative to “broken” legacy finance—will resonate with crypto purists but alarm traditionalists who view transparency as non-negotiable. The truth likely lies somewhere in between: Tether is neither the fraud critics claim nor the overcapitalized savior Ardoino describes.

For traders, the message is clear: USDT works until it doesn’t. Its network effects make it indispensable for now, but diversifying stable coin exposure across USDC, DAI, and fiat remains prudent risk management. The day Tether’s peg breaks will come without warning—the question is whether that day ever arrives, or if Tether’s “too-big-to-fail” status becomes self-fulfilling prophecy.

Trade with Diversified Stablecoin Options on MEXC: MEXC supports multiple stablecoins including USDT, USDC, and USDD, allowing traders to diversify counterparty risk while maintaining liquidity across 2,800+ trading pairs. Access MEXC’s comprehensive risk management tools and 0-Fee Fest promotion for cost-efficient trading.

Disclaimer:This content is for educational and reference purposes only and does not constitute any investment advice. Digital asset investments carry high risk. Please evaluate carefully and assume full responsibility for your own decisions.

Join MEXC and Get up to $10,000 Bonus!

Sign Up