After a sharp downturn earlier this year, the crypto market is showing strong recovery momentum — and so is Starknet, the once-faltering Ethereum Layer2. Capital inflows, rising TVL and trading volume, and major updates all point toward a revitalized ecosystem.

1.On-chain Metrics Overview

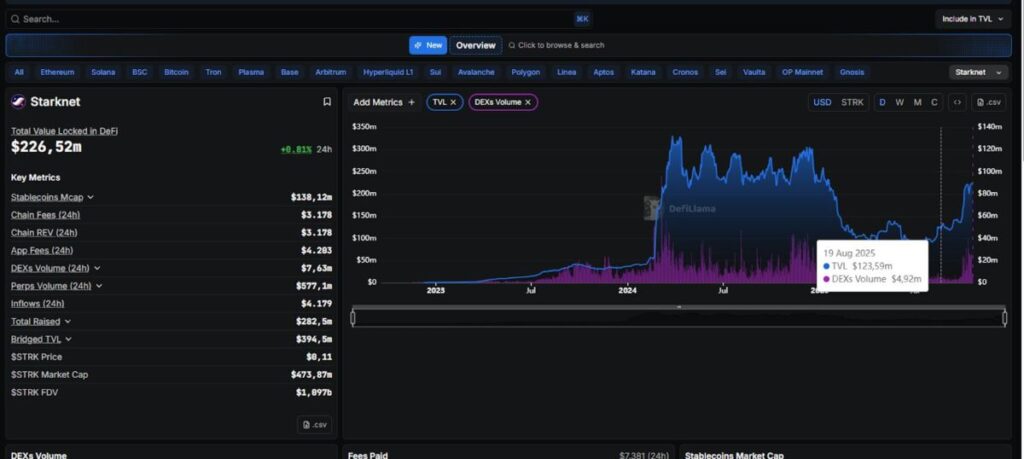

1.1 TVL and DEX Volume

Following a steep decline in early 2025, Starknet’s ecosystem is now recovering impressively. TVL has surged from $90M in early May 2025 to $220M currently, nearly doubling in the last 10 days — signaling a powerful inflow of liquidity returning to the network.

DEX trading volume has also seen significant growth, averaging over $30M/day, with peaks reaching $250M/day in recent weeks.

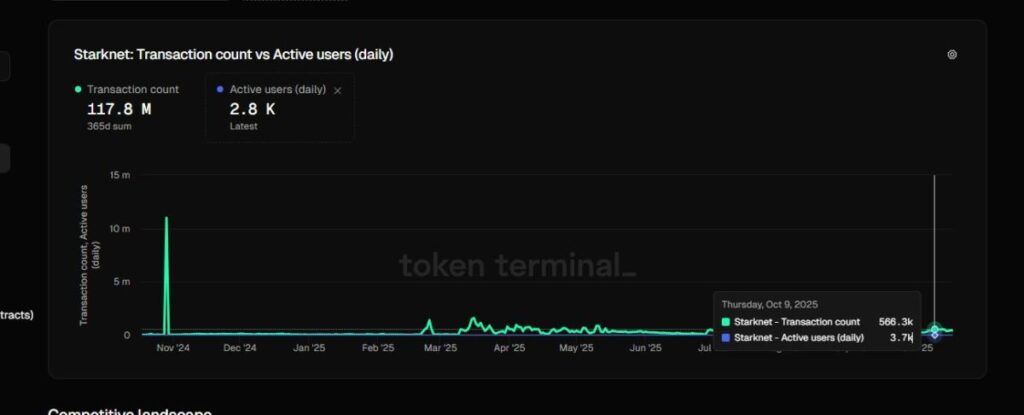

1.2 Daily Transactions and Active Users

Daily transactions on Starknet have improved, ranging between 200K–500K per day. However, the number of active users remains low, fluctuating around 3.5K–5K daily.

This indicates that the increase in TVL, transaction count, and trading volume is likely driven by a small group of active participants — not yet accompanied by meaningful user expansion.

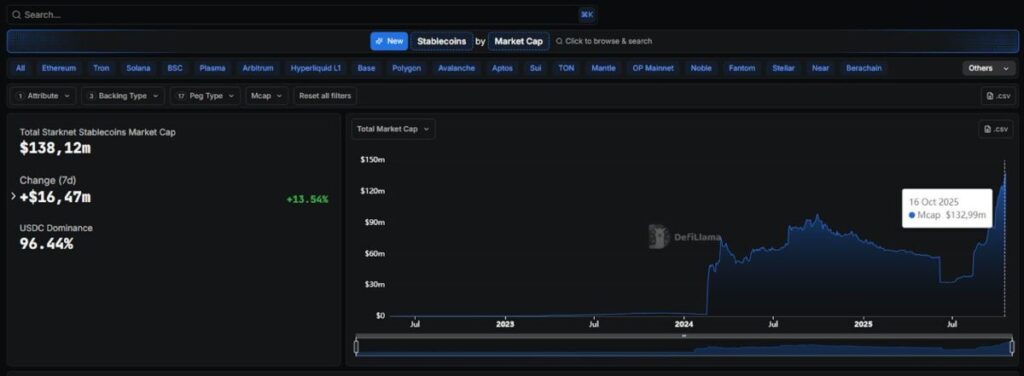

1.3 Stablecoin Growth

According to DeFiLlama, Starknet’s stablecoin market is booming, growing nearly 10x since July.

The total stablecoin market cap on Starknet has reached $138.12M, up $16.47M (+13.54%) in just 7 days.

Notably, USDC dominates with a 96.44% market share, making Starknet an increasingly important hub for on-chain stablecoin liquidity — bolstered by recent infrastructure updates.

2.Key Starknet Updates

2.1 Launch of V0.14.0 “Grinta”

In early September 2025, Starknet rolled out version V0.14.0, codenamed “Grinta”, marking a crucial step toward scalability and decentralization.

This update enhances throughput, fee optimization, and infrastructure stability by introducing:

- Distributed Sequencing Architecture

- A New Fee Market model

- Multiple developer and UX enhancements

Distributed Sequencing is a major milestone toward Decentralized Sequencing, eliminating single points of failure by allowing multiple nodes to verify and order transactions. This reduces censorship risk and improves reliability.

The new Fee Market works dynamically, allowing gas prices to adjust based on real-time supply and demand — similar to Ethereum’s EIP-1559, but optimized for ZK Rollups.

2.2 Bitcoin Staking & BTCFi Season — $100M STRK Incentive

On September 30, 2025, Starknet officially launched Bitcoin Staking, a major step toward bridging Bitcoin and the Starknet ecosystem. Users can now stake BTC, tBTC, WBTC, or LBTC directly on Starknet, increasing network liquidity while connecting the world’s oldest crypto asset with Starknet’s ZK infrastructure.

This move aims to make Staking the liquidity center for Bitcoin in the BTCFi sector, one of 2025’s hottest narratives. By staking BTC on Starknet, users can earn yield while participating in DeFi activities with ZK-level security.

Unstaking time has also been reduced from 21 days to 7 days, improving capital flexibility for short-term yield strategies.To encourage participation, Starknet allocated 100M STRK tokens as incentive rewards, distributed across liquidity providers and early BTC stakers — a major push to bootstrap BTCFi adoption.

2.3 Decentralization Roadmap 2025

Starknet revealed an ambitious decentralization roadmap, aiming to become a fully community-driven Layer2 on Ethereum.

This roadmap rests on three pillars:

- Staking — economic decentralization

- Network operation — validator-based consensus

- Governance — independent community decision-making

The Staking mechanism allows users and organizations to lock STRK and secure the network while earning proportional rewards. The Phase 1 mainnet staking launch marks the start of community participation in securing Starknet.

The network will gradually transition block production and validation from core developers to independent validators, ensuring transparency, censorship resistance, and long-term sustainability — similar to Ethereum’s distributed security model.

Through phased rollouts (v2–v4) across 2025, Starknet plans to expand validator participation, refine consensus, and enhance reward structures — eventually achieving near-total decentralization across validation and governance layers.

2.4 Governance Vote: Next Development Phase

In its push for decentralization, Starknet launched a community governance vote for STRK holders, covering multiple proposals impacting network performance, security, and UX.

Key highlights include:

- Sub-300ms transaction confirmation time, bringing near real-time UX

- 2-second block time, improving responsiveness for high-frequency apps like DeFi and gaming

- Timeboost mechanism, allowing users/projects to pay higher fees for transaction priority (similar to Ethereum gas auctions, optimized for ZK Rollups)

- Native Transaction Scheduling, enabling automatic or conditional transaction execution (based on time, market events, or on-chain triggers)

Long-term proposals include:

- Network fee reduction

- STRK burn mechanism to introduce deflationary pressure

- Post-Quantum Signatures to future-proof Starknet against quantum computing threats.

3.Notable Projects in the Starknet Ecosystem

3.1 Extended — The Next-Gen PerpDEX on Starknet

Formerly known as x10, Extended launched on Starknet mainnet on August 12, 2025, and quickly became the leading perpetual DEX on the network.The platform offers 50+ assets, up to 100x leverage, and fully on-chain settlement, leveraging Starknet’s security and composability.

Current stats:

- TVL: $84M

- Daily volume: ~$600M

- 30-day volume: ~$17B Extended now ranks Top 10 among all PerpDEXs globally, effectively carrying the Starknet ecosystem’s trading narrative.

3.2 Endur — Leading Liquid Staking Protocol on Starknet

Endur has become Starknet’s #1 Liquid Staking platform, with TVL surging 10x in a month to $50M.Recently, Endur launched BTC Liquid Staking, enabling users to stake WBTC, tBTC, LBTC, or SolvBTC, receiving LST tokens in return to use across Starknet DeFi protocols.

Alongside BTC staking, Endur introduced xSTRK staking, allowing STRK holders to earn yield while maintaining liquidity — strengthening Starknet’s capital efficiency and on-chain liquidity.

3.3 Vesu — Lending Growth Driven by BTCFi

Vesu, Starknet’s top lending platform, now holds over $50M TVL.

As part of the BTCFi Season, Vesu launched an incentive where borrowers using BTC as collateral receive 40% of loan interest paid back in STRK, promoting BTC as a DeFi collateral asset.

Vesu recently integrated tBTC as collateral, enabling users to borrow without relinquishing custody of their BTC. Advanced users can execute looping strategies (borrow tBTC → stake → receive xtBTC → re-collateralize → borrow again) to maximize staking yields.

4.Conclusion

Starknet’s ecosystem currently revolves around 4–5 core projects, with limited competition across verticals — meaning each sector is dominated by a single protocol.This lack of diversity restricts user choice and slows ecosystem growth.

The BTC Staking launch with 100M STRK incentives is a strong short-term liquidity booster but not a long-term fix. Starknet still faces fundamental weaknesses — limited user adoption, slow ecosystem expansion, and strong competition from other Ethereum L2s. Without structural improvements, it will be hard for Starknet to reclaim momentum in the next phase of Layer2 evolution.

Disclaimer: This content does not constitute investment, tax, legal, financial, or accounting advice.MEXC provides this information for educational purposes only. Always DYOR, understand the risks, and invest responsibly

Join MEXC and Get up to $10,000 Bonus!

Sign Up