In early October, open interest in Solana futures was approaching $89 billion (according to CoinGlass).

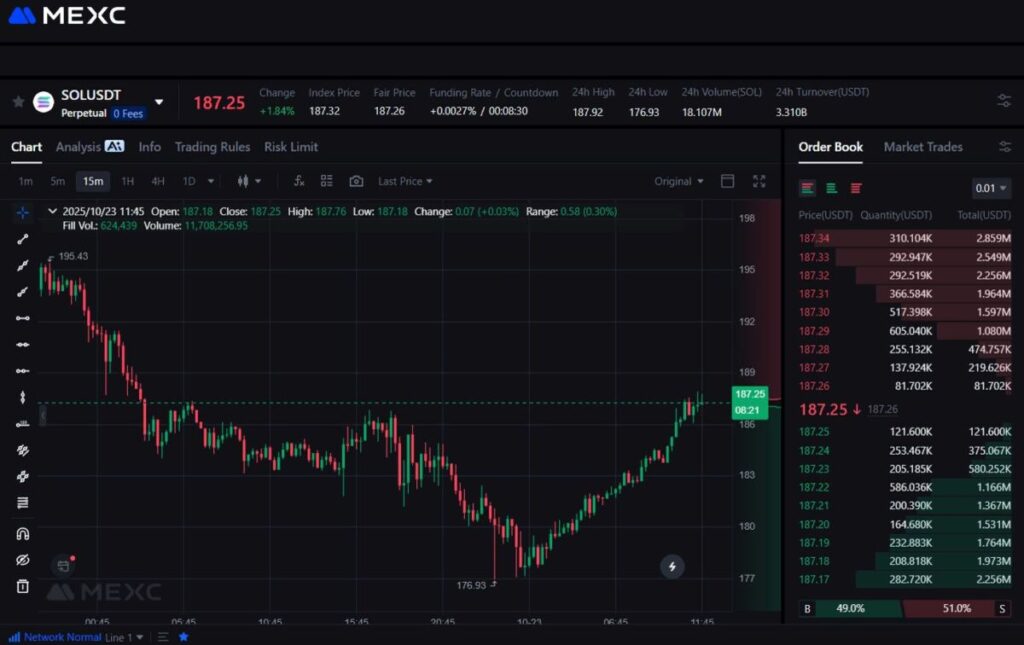

On the MEXC exchange on October 5, the amount of deployed contracts exceeded $4 billion, but in the second half of the month it fell to $3 billion.

The day before, total interest in Solana in the futures market dropped to $69.5 billion, the lowest level since June 2025.

Altcoin last Wednesday dropped to $185, coin lacks support to approach $200. Even if bulls manage to provoke a jump of SOL to this psychological mark, the resistance zone in the range from $200 to $210 is unlikely to be quickly broken.

relative strength index RSI is in a neutral zone, which indicates the lack of reserves to reach $200. At the same time, a decline in the digital currency in the coming days is unlikely, as there is weak targeted activity in the market.

- According to analysts, the risks of a large-scale reset are still low. Most likely, we are waiting for trading in a narrow range.

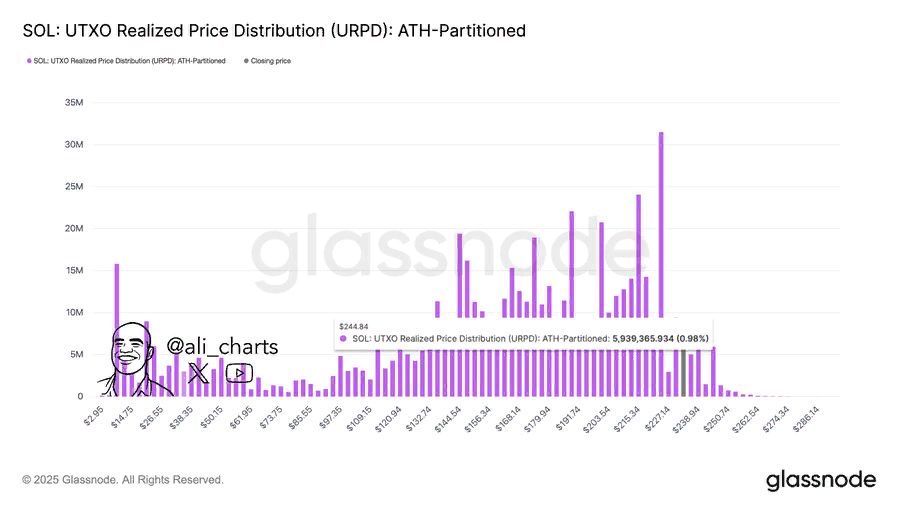

Fixing profits with the participation of a large number of traders is possible if Solana overcomes several key barriers and breaks through to $245.

Solana consolidation is delayed

This week, the value of Solana decreased by about 4%, on Thursday morning the price rose to $187. Despite the moderate growth of the crypto is still in the consolidation phase, which is delayed.

The rate on perpetual swaps on the MEXC exchange is declining, but still remains in the positive zone. The turnover of futures on the trading floor over the past 24 hours has decreased to $3.2 billion in dollar terms.

The activity of speculators weakened, which led to a narrowing of the amplitude of price fluctuations of the altcoin.

- Last night, the SOL rate dropped to $177, and a quick rebound at $10 indicates an improvement in sentiment in the camp of retail traders. However, so far the coin lacks sufficient support to overcome the powerful resistance at $200.

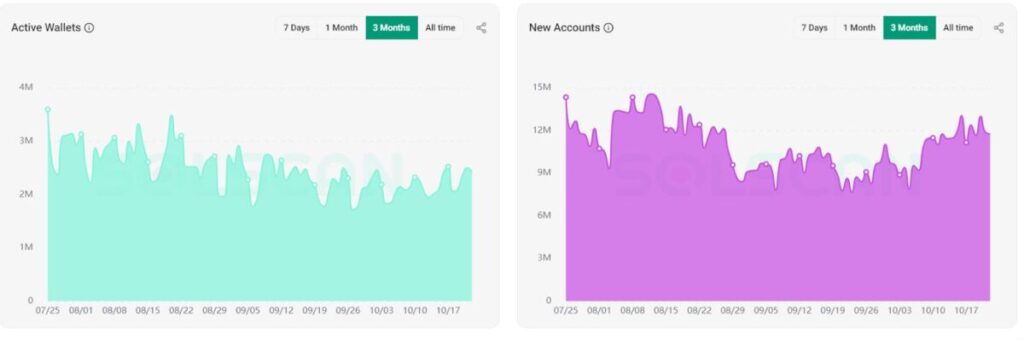

This mark remains unattainable in conditions of weak targeted activity. According to the SolScan service, the number of active wallets has been declining since the beginning of this week.

Weakening of network activity is one of the main factors preventing the return of volatility, reminds the team of MEXC Research.

The pace of registering new wallets on the blockchain has also slowed in recent days.

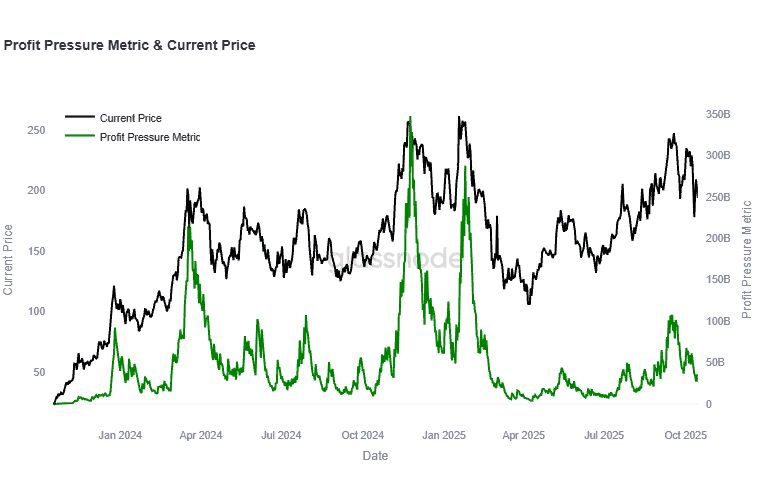

The fall in the Solana rate below $200 negatively affected the investment attractiveness of this digital currency. Last week, it fell by more than 15%.

The coin suffered the biggest losses on October 10. On this day, its price fell from $220.93 to $168.79 (-23.6%). Only last weekend, the situation stabilized, and the SOL rate rose.

Altcoin is still in the consolidation phase, which can stretch for a long time. Fixing profits in the first half of the month led to a strong drawdown of Solana, and aggressively sold retail investors.

However, in mid-October, sales began to gradually decline.

- According to analysts, the cryptocurrency has found the bottom after reaching a local peak at $250 and the subsequent fall in value.

- Traders now need to focus on the behavior of bitcoin. If the largest digital currency falls below $105,000, then Solana will also face pressure and may go below $170.

Solana-ETF launch could improve altcoin attractiveness

The Securities and Futures Commission of Hong Kong (SFC) recently approved the launch of a spot crypto fund ETF on Solana. The issuer of the instrument instrument is ChinaAMC.

product will be available investors on October 27 on the Hong Kong Stock Exchange.

- Thus, the first tool will appear on the local market to track the spot performance of the underlying digital asset of the Solana ecosystem, which is considered by many analysts as the main competitor to Ethereum.

The commission for managing crypto will be 0.99% per year. BOCI-Prudential Trustee Limited and OSL Digital Securities are responsible for storing coins.

ChinaAMC stressed that OSL will also provide a platform for trading virtual assets.

Investors will be able to fund the spot Solana-ETF with Hong Kong dollars, Chinese yuan and US dollars. On the Hong Kong Exchange, each lot will include 100 shares in any of the above currencies.

Experts predict that other spot ETFs on Solana will soon become available in Hong Kong.

- According to JPMorgan Bank, within a year after the appearance of tools focused on SOL, the net inflow of capital into the asset will be about $1.5 billion. In addition, analysts believe that in addition to the stock market, Solana in the future will become one of the main competitors of Ethereum in the DeFi market.

Launching an ETF on Solana will create conditions for a more active institutional entry into the altcoin.

Its capitalization is now approaching $103 billion. At the historical maximum crypto was traded June 19, 2025 – $294.33.

Disclaimer: This information does not constitute investment, tax, legal, financial, accounting, advisory or any other related services advice, nor does it constitute advice on buying, selling or holding any assets. MEXC Training provides information for reference purposes only and does not

Join MEXC and Get up to $10,000 Bonus!