The world’s largest cryptocurrency plunged over 10% within hours, slipping below $119,000, after renewed U.S–China tariff tensions sent shockwaves across global markets.

This sudden selloff, triggered by President Donald Trump’s threat to reimpose sweeping trade tariffs on Chinese goods, highlights a familiar truth about Bitcoin’s behavior in times of macro stress, it still trades like a high-beta macro asset tied to global liquidity and risk sentiment.

1. What Triggered the Selloff

The catalyst was geopolitical, not crypto-native. On October 10, 2025, President Donald Trump announced that the U.S. will impose a 100% tariff on Chinese goods and enforce export controls on critical software, dramatically escalating trade tensions between the world’s two largest economies.

The announcement sent prices of major cryptocurrencies down across the board, with Bitcoin falling by about 2% initially before accelerating to steeper losses. The comments rattled global markets. Asian equities tumbled overnight, traditional safe-haven assets rallied, and Bitcoin followed risk assets lower as investors fled to safety.

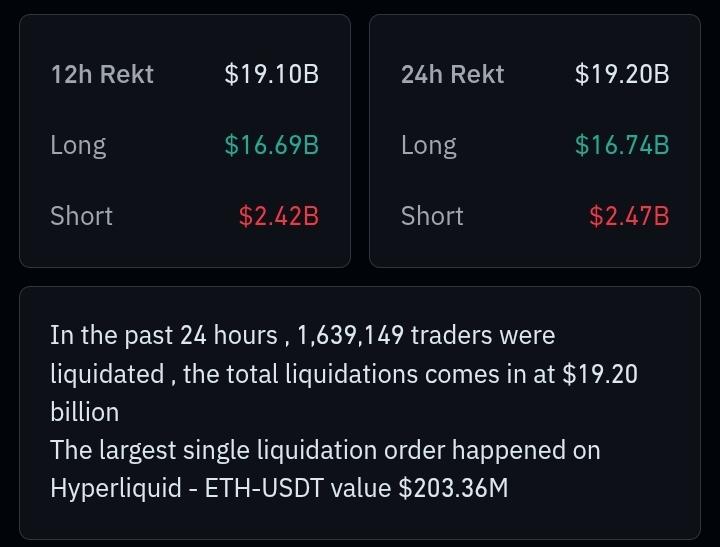

Data from CoinGlass shows that over $16.74B in BTC long positions were liquidated in the last 24 hours, marking the largest single-day liquidation event in history. Futures open interest dropped sharply, indicating widespread deleveraging across exchanges as traders rushed to reduce exposure amid escalating uncertainty.

2. A Familiar Pattern: Bitcoin Reacts to Macro Shock

Bitcoin’s move wasn’t isolated. Equity futures also fell, with the Nasdaq 100 sliding 2.5% and the S&P 500 down over 1%. This pattern has repeated throughout 2025: whenever macro uncertainty spikes, Bitcoin tends to behave more like a risk asset than a hedge against economic turmoil.

The reason is structural. While Bitcoin’s long-term narrative emphasizes monetary independence and fixed supply, its short-term trading dynamics are still dominated by leverage, derivatives, and liquidity sensitivity. When funding rates flip negative and traders de-risk, BTC tends to fall faster and harder than less leveraged assets.

The crypto market’s 24/7 nature also amplifies these moves. While traditional markets have circuit breakers and trading halts, cryptocurrency exchanges operate continuously, allowing selling pressure to cascade without interruption. This creates more violent short-term volatility during crisis moments.

3. Liquidity, Rates, and Tariff Shock

The selloff arrives at a fragile macro moment.

U.S. Treasury yields have climbed back above 4.3%, tightening liquidity conditions.

The Federal Reserve has signaled it won’t rush into rate cuts despite slowing growth, maintaining real yields that weigh on non-yielding assets like Bitcoin.

ETF inflows into Bitcoin products have cooled, down roughly 30% month-over-month, according to Bloomberg Intelligence.

Now, the sudden tariff escalation risk adds another layer threatening global trade stability, reviving inflation fears, and pushing capital toward defensive assets like gold, bonds, and the dollar.

4. Historical Parallels: When Bitcoin “Breaks Correlation”

We’ve seen similar episodes before:

March 2020: Bitcoin crashed 50% during the COVID liquidity panic, only to later lead the post-stimulus bull run.

Mid-2022: As the Fed hiked aggressively, BTC dropped alongside stocks but outperformed both in 2023’s recovery.

October 2024: When bond yields spiked, BTC corrected sharply before rebounding once rate expectations softened.

Each time, Bitcoin initially behaved like a risk asset, then reclaimed its store-of-value narrative once the dust settled.

This time may follow the same pattern, especially with ETFs, Layer 2 scaling, and institutional custody infrastructure more mature than ever before.

5. Market Mechanics: Leverage, Liquidations, and Whales

According to CoinGlass and CryptoQuant data:

Over $820M in BTC longs were liquidated.

Open interest dropped 15% in a single day.

Funding rates turned deeply negative across major exchanges.

Whale wallets particularly those holding 1,000 BTC or more showed minor accumulation near the $118K level, suggesting some large players view this dip as opportunistic rather than structural.

Retail sentiment, on the other hand, remains fragile. Social data from Santiment indicates a sharp uptick in “fear” and “liquidation” mentions, often signaling emotional-driven exits that precede mid-term reversals.

6. Investor Outlook: Macro Narratives Still Rule

For traders and investors, the message remains consistent, Bitcoin’s macro sensitivity isn’t gone; it’s just evolving.

In liquidity-driven markets, Bitcoin thrives. In liquidity-constrained environments like this one, it corrects fast. But the post-stress phase has historically been where BTC outperforms traditional assets.

Key factors to watch now include:

6.1 Fed policy path — a dovish turn could reawaken BTC demand.

6.2 ETF inflows — a pickup in institutional allocations post-volatility could reignite upside.

6.3 Volatility compression — historically, consolidation after major liquidations precedes trend continuation.

7. MEXC Traders’ Perspective

For MEXC users, volatility means opportunity both for disciplined entries and tactical short-term trades.

As long liquidations subside, range trading and small allocation scaling can offer structured exposure during consolidation periods.

BTC/USDT remains among the most actively traded pairs on MEXC, giving investors access to deep liquidity and derivatives instruments to manage both upside and downside exposure.

8. Conclusion: Bitcoin in a Real-World Storm

Bitcoin’s sudden 10% crash serves as a sharp reminder digital assets don’t exist in isolation. Global politics, interest rates, and liquidity still dictate short-term flows, even as Bitcoin’s long-term fundamentals remain sound.

As geopolitical uncertainty intensifies, Bitcoin’s role as a resilient macro asset will once again be tested and as history suggests, it tends to emerge stronger after the storm.

Disclaimer: This article is for educational purposes only and does not constitute investment advice. Digital asset trading carries significant risk. Please evaluate carefully before investing.

Join MEXC and Get up to $10,000 Bonus!

Sign Up