Pieverse (PIEVERSE) has emerged as one of November’s strongest performers, surging 357% from its November 14 all-time low of $0.1145 to a peak of $0.6143 on November 24. Currently trading at $0.524, the token maintains a $91.7 million market cap with explosive $353 million in 24-hour trading volume—positioning it as #303 on CoinMarketCap despite launching just 12 days ago.

The token debuted on Binance Alpha on November 14 at 11:00 UTC following a successful pre-TGE that distributed 30 million PIEVERSE tokens across four phases. Unlike typical meme coin launches, Pieverse represents functional infrastructure: a Web3 payment compliance layer transforming blockchain timestamps into legally recognized business records. Backed by Animoca Brands and participants in Binance MVB 9, the project targets a $16 trillion tokenized asset market by bridging crypto transactions with real-world regulatory requirements.

What Is Pieverse? The Compliance Layer for Web3 Payments

Pieverse solves a critical problem: crypto transactions lack the legally recognized documentation businesses need for accounting, taxes, and audits. While blockchain provides transparency, it doesn’t generate jurisdiction-specific invoices, receipts, or checks that meet standards like GAAP (Generally Accepted Accounting Principles) or KYC (Know Your Customer) requirements.

Core Technology:

Timestamping Layer: Converts blockchain activity into legally binding documentation with cryptographic proofs stored on BNB Greenfield (decentralized storage).

x402b Protocol: Extension of Coinbase’s HTTP payment standard enabling gasless transactions via wrapped stablecoin (pieUSD).

AI Integration: Autonomous AI agents can conduct compliant microtransactions without human intervention using zero-knowledge proofs for privacy-preserving verification.

Real-World Use Cases:

- Freelancers: Generate verifiable invoices for crypto payments that satisfy tax authorities

- DAOs: Create audit trails for treasury spending meeting corporate governance standards

- Businesses: Accept crypto payments with automatic GAAP-compliant bookkeeping

- AI Agents: Enable autonomous financial transactions with built-in compliance

Token Metrics and Performance

Current Trading Data (Nov 26):

- Price: $0.524 USD

- 24h Change: -6.12%

- Market Cap: $91.7 million

- 24h Volume: $353.3 million (3.8x market cap—extremely high turnover)

- Circulating Supply: 175 million PIEVERSE (17.5% of 1 billion total)

- FDV: $524 million

- CMC Rank: #303

- ATH: $0.6143 (Nov 24, 2 days ago)

- ATL: $0.1145 (Nov 14, launch day)

- ATH to Current: -14.66%

- ATL to Current: +357.88%

Volume Analysis:

$353M in daily volume for a $91M market cap (3.8:1 ratio) indicates extreme speculation and trading activity. This turnover rate is unsustainable long-term but typical for newly listed tokens with locked supply—only 17.5% circulating means concentrated liquidity drives volatility.

Exchange Listings:

- Binance Alpha

- MEXC (PIEVERSE/USDT, $273M volume)

- Gate.io

- DigiFinex

- OKX Perpetual Futures (launched Nov 16, 40x leverage)

- Bybit

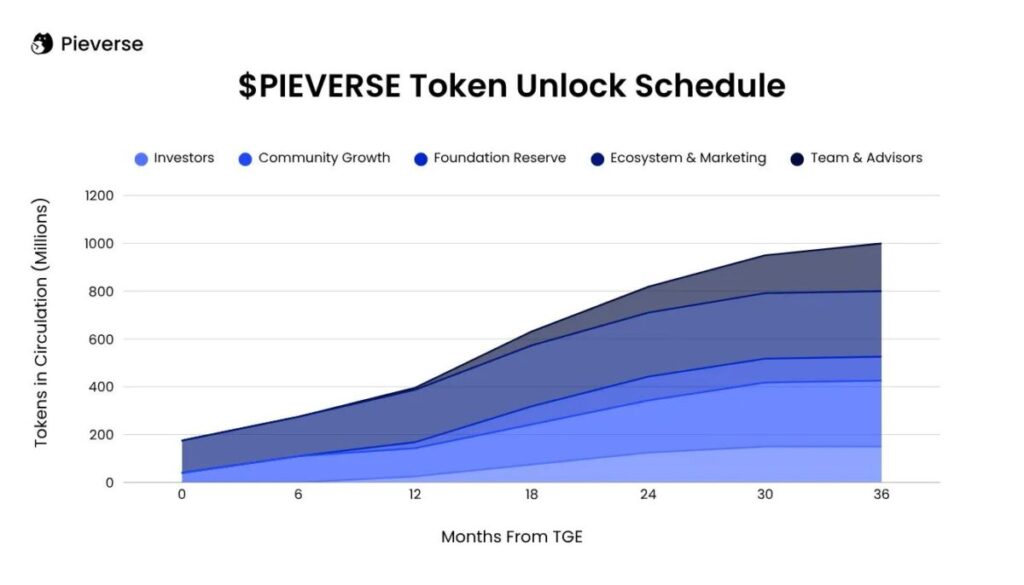

Tokenomics: 82.5% Still Locked

Total Supply: 1 billion PIEVERSE Circulating: 175 million (17.5%) Locked: 825 million (82.5%)

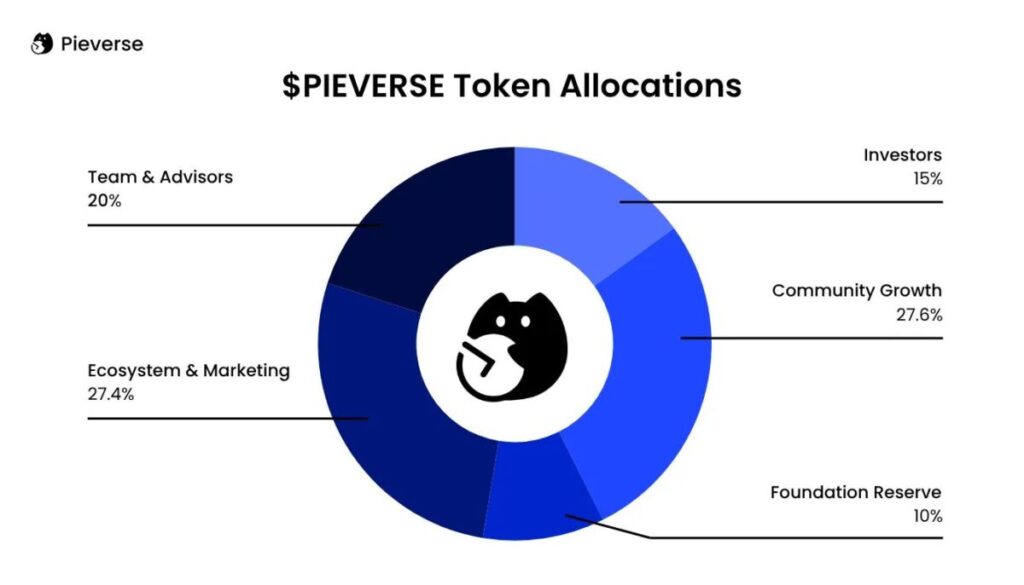

Distribution Breakdown:

- Community Growth: 27.6% (276M tokens)

- Ecosystem Development: 27.4% (274M tokens)

- Team & Advisors: 20% (200M tokens) – 12-month lockup + linear vesting

- Pre-TGE & Booster: 30M tokens distributed across 4 phases

- Airdrops: 1M tokens (“Pie Me a Coffee” campaign)

Vesting Schedule:

Team, advisors, and core contributors face 12-month lockup followed by linear vesting through 2026 Q3. Community Growth (27.6%) and Ecosystem (27.4%) allocations begin vesting Q1 2026, potentially adding ~500 million tokens (5x current circulating) by 2026 Q3.

The Unlock Risk:

Historical precedent from similar projects (AltLayer) shows 30-40% price dips post-unlock as early backers take profits. With 82.5% supply locked, PIEVERSE’s current price reflects extreme scarcity. When vesting accelerates in Q1-Q2 2026, selling pressure could overwhelm demand unless adoption scales proportionally.

Market Catalysts and Risks

Bullish Catalysts:

AI Agent Economy Growth: Partnerships with DeAgentAI and Kite AI could drive demand. If DeAgentAI’s $15M daily transaction volume migrates to Pieverse, the 0.1% burn fee creates $15K daily buy pressure—meaningful for a $92M market cap token.

Institutional Backing: Animoca Brands involvement and Binance MVB 9 alumni status provide credibility and network effects.

Binance Futures Leverage: 40x leverage on OKX/Binance perpetuals attracts degenerate traders, amplifying volatility and liquidity.

Compliance Narrative: As governments worldwide tighten crypto regulations (EU MiCA, U.S. stablecoin bills), compliance infrastructure gains strategic importance.

Bearish Risks:

Extreme Volatility: 6.12% daily swings and 3.8x volume-to-mcap ratio signal unsustainable speculation. Liquidation cascades from 40x leverage could trigger flash crashes.

Token Unlocks: 500M+ tokens unlocking in 2026 could crush prices if adoption doesn’t justify valuations. Current price assumes extreme scarcity that won’t persist.

Unproven Product-Market Fit: While technology is promising, actual business/DAO adoption remains unproven. If enterprises don’t adopt pieUSD and x402b protocol, utility thesis collapses.

Macro Correlation: With Bitcoin at $98K (recovering from $80K low), a broader crypto crash would drag PIEVERSE down regardless of fundamentals.

Price Prediction: Cautious Optimism with Major Caveats

Short-Term (1-3 Months): Expect consolidation between $0.40-$0.60 as initial hype fades and traders rotate to newer narratives. Support at $0.45 (previous resistance), risk of retest to $0.30 if Bitcoin corrects further.

Medium-Term (Q1-Q2 2026): Token unlocks will test demand. If AI agent partnerships deliver material transaction volume, PIEVERSE could hold $0.50+ and potentially push toward $0.80-$1.00. If adoption disappoints, unlocks could drive prices to $0.20-$0.30 range.

Long-Term (2026+): Success depends on becoming the standard for Web3 payment compliance. If enterprises adopt x402b protocol and pieUSD sees meaningful volume, $1-$2 becomes plausible. If not, PIEVERSE joins graveyard of infrastructure tokens that solved problems nobody cared about.

Conclusion: High-Risk Compliance Play in Explosive Growth Phase

Pieverse represents a speculative bet on Web3 payment compliance becoming critical infrastructure as crypto enters mainstream commerce. The technology is legitimate, the team has institutional backing, and the timing aligns with global regulatory tightening—but 82.5% locked supply, extreme volatility, and unproven adoption create substantial downside risk.

For traders, PIEVERSE offers momentum-play opportunities but demands tight risk management given 40x leverage availability and daily 5-10% swings. For long-term investors, waiting for post-unlock clarity (Q2 2026) may provide better entry points with less supply overhang risk.

The next 3-6 months will determine whether Pieverse becomes the Chainlink of payment compliance or another overhyped infrastructure token that failed to find product-market fit. With $353M daily volume on a $92M market cap, the market is betting big—but also hedging with extreme caution.

Trade PIEVERSE on MEXC: Access PIEVERSE spot trading with comprehensive tools including limit/market orders, grid trading for volatility, and advanced charting. Navigate high-beta compliance tokens with MEXC’s risk management features and 0-Fee Fest promotion for reduced costs.

Disclaimer:This content is for educational and reference purposes only and does not constitute any investment advice. Digital asset investments carry high risk. Please evaluate carefully and assume full responsibility for your own decisions.

Join MEXC and Get up to $10,000 Bonus!

Sign Up