The “Infinite Money Glitch” officially stalls as index exclusion looms and executives break five-year “never sell” doctrine for the first time.

The invincible aura surrounding Michael Saylor’s Bitcoin accumulation machine is cracking. MicroStrategy (Nasdaq: MSTR); the world’s largest corporate Bitcoin holder, is reportedly in urgent discussions with MSCI regarding potential removal from major global indices on January 15, 2026, threatening to trigger up to $8.8 billion in forced institutional outflows. More alarming: for the first time in the company’s five-year Bitcoin buying spree, executives have publicly admitted that selling Bitcoin is now “a last resort option.”

The market is pricing in catastrophe. MicroStrategy’s stock has plummeted 49% from recent highs and now trades at a negative premium to its Bitcoin holdings—a mathematical anomaly that signals deep institutional distress. What was once Wall Street’s most audacious leverage play on Bitcoin has become its most precarious.

The Crisis: Three Convergent Threats

1. The Index Exclusion Catalyst (January 15 Decision)

MSCI, the influential index provider whose benchmarks guide trillions in passive investment flows, is considering new criteria that would exclude companies where digital assets comprise more than 50% of total assets. MicroStrategy holds approximately 649,870 BTC worth $62.3 billion, representing roughly 90% of the company’s balance sheet; well above the proposed threshold.

The decision date: January 15, 2026.

The Mechanical Liquidation Risk: Unlike discretionary selling, index exclusion triggers automatic, mandatory selling by passive funds. JPMorgan estimates potential outflows of:

- $2.8 billion if excluded from MSCI indices alone

- $8.8 billion if other index providers (S&P, Russell, Nasdaq) follow suit

Of MicroStrategy’s current $59 billion market capitalization (as of late November 2025), approximately $9 billion is held in passive investments through ETFs and mutual funds tied to major benchmarks. These funds have no discretion, if MicroStrategy is removed from the index, they must sell.

MSCI’s proposal, first introduced on October 10, 2025, would reclassify Bitcoin-heavy companies as “digital asset funds” rather than operating companies, making them ineligible for equity indices. The consultation period ends December 31, 2025, with a final decision expected January 15, 2026.

Why This Matters: Index inclusion isn’t just about prestige; it’s about structural access to capital. Passive funds don’t evaluate companies; they buy whatever the index tells them to buy. Exclusion doesn’t just mean some investors might avoid MicroStrategy; it means billions in capital are mandated to exit immediately.

2. The mNAV Death Spiral (Trading Below Bitcoin Value)

MicroStrategy’s business model depends on maintaining a premium i.e trading above the value of its Bitcoin holdings. This premium allows the company to issue new shares, use those proceeds to buy more Bitcoin, which theoretically drives the stock higher, enabling more share issuance in a self-reinforcing loop.

The loop has reversed.

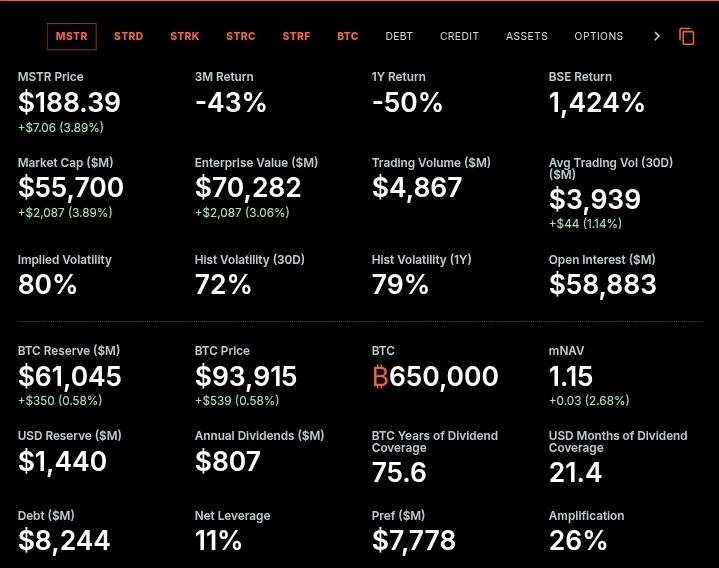

As of early December 2025, the “Infinite Money Glitch” faces a critical math problem. While the dashboard currently shows a Market-Adjusted Net Asset Value (mNAV) of 1.15x, indicating a slight premium to net equity; the headline reality is far more bearish.

- The Disconnect: MicroStrategy’s market cap stands at $55.7 billion, significantly below the raw value of its Bitcoin holdings, which are valued at $61.0 billion.

- The Reality: Despite the technical 1.15 mNAV reading, the stock is effectively trading at a $5.3 billion discount to its liquid treasury. The market is assigning a negative value to the operating business, signaling that the premium leverage loop has reversed.

The Reflexivity Trap:

- Upward Spiral (2020-2024): Stock trades at 2.0x+ Premium = Issue Equity = Buy BTC = NAV per share rises.

- Downward Spiral (2025): Market Cap drops below BTC Value ($55.7B < $61.0B) = Issuing equity becomes less attractive = Cash Crunch = Forced Selling fears ignite.

3. The Liquidity Crunch (Dividend Obligations Due)

MicroStrategy faces approximately $807 million in annual dividend obligations on its preferred shares, with roughly $200 million due by December 31, 2025. Unlike common stock, preferred shares create binding financial obligations; the company *must* pay dividends or face severe consequences for future capital raising.

On December 1, 2025, MicroStrategy announced the creation of a $1.44 billion “USD Reserve” specifically to cover dividend obligations for the next 21 months. While Saylor framed this as proactive risk management, critics view it differently.

- The Bear Case: The reserve represents capital that cannot be deployed to buy Bitcoin, contradicting the entire premise of the business model. More troubling, the need to explicitly announce this reserve signals that investors and creditors were questioning whether Strategy could meet its obligations.

- The Debt Load: MicroStrategy carries $8.2 billion in convertible bonds, with the first maturity not until 2028. While this provides breathing room, the company’s ability to refinance or issue new debt depends entirely on maintaining investor confidence. If the stock continues falling and Bitcoin selling becomes necessary, that confidence evaporates.

The CEO’s Admission: “Selling Bitcoin Is Now an Option”

For five years, Michael Saylor has been crypto’s most unwavering maximalist. His mantra: “There is no second best.” His strategy: buy Bitcoin, never sell, leverage the position, buy more. The company has never recorded a single Bitcoin sale, only orange dots on Saylor’s Twitter tracker indicating purchases.

Until now.

In a recent appearance on the “What Bitcoin Did” podcast, MicroStrategy CEO Phong Le made a stunning admission:

“If the stock trades below the value of our Bitcoin and we can’t raise any other capital to pay the preferred dividends, then mathematically we would have to sell some Bitcoin. It would be the last resort. We will do that because that’s in the best interest of shareholders.”

This represents a complete reversal of MicroStrategy’s foundational philosophy. While Le emphasized this would only occur in crisis scenarios, the mere acknowledgment that Bitcoin sales are “on the table” marks a psychological turning point.

Adding fuel to speculation, Saylor cryptically tweeted on November 30 about potentially adding “green dots” to his Bitcoin tracker; traditionally, only orange dots (purchases) appeared. The crypto community interpreted green dots as indicating potential sales, though Saylor has not explicitly confirmed this.

The Institutional Exodus: Smart Money Left Months Ago

While retail investors are discovering these risks now, institutional holders began exiting months ago.

Q3 2025 SEC Filings Reveal:

– BlackRock reduced its MicroStrategy position

– Vanguard decreased holdings substantially

– JPMorgan and other major institutions liquidated over $5.38 billion in aggregate MicroStrategy shares

The Smart Money Thesis: These institutions saw the MSCI rule proposal, evaluated the debt structure, and recognized the reflexivity trap. Rather than hold a leveraged, potentially illiquid proxy to Bitcoin, they rotated capital into:

– Spot Bitcoin ETFs (direct exposure without corporate risk)

– Bitcoin mining companies (diversified crypto exposure)

– Cash positions (waiting for clarity)

The exodus left MicroStrategy’s shareholder base increasingly concentrated among retail investors and momentum traders—precisely the cohort most vulnerable to forced selling during volatility.

The Market Structure Shift: Bitcoin Has Outgrown MicroStrategy

A broader narrative is unfolding beneath MicroStrategy’s crisis: Bitcoin no longer needs Michael Saylor.

Phase 1 (2020-2023): Saylor Legitimizes Bitcoin

When MicroStrategy began buying Bitcoin in August 2020, institutional adoption was minimal. Saylor’s public evangelism and corporate treasury strategy provided legitimacy—if a Nasdaq-listed software company could justify Bitcoin as a treasury asset, perhaps others could too.

Phase 2 (2024-2025): Bitcoin Outgrows MicroStrategy

With regulated spot Bitcoin ETFs from BlackRock, Fidelity, and other giants; tokenized yields through RWA protocols like ONDO; and direct institutional custody solutions from Coinbase and Fidelity, the market no longer accepts the risk of a leveraged software company as its primary access point.

The Decoupling: MicroStrategy’s stock has fallen 49% while Bitcoin has declined approximately 32% from recent highs—MicroStrategy is underperforming the asset it holds. This decoupling reveals that the market is now pricing in corporate risk, leverage risk, and execution risk separately from Bitcoin itself.

The dozens of “digital asset treasury” companies launched in 2024-2025 to imitate MicroStrategy’s model now face the same existential question: if investors can buy Bitcoin directly through ETFs without leverage, counterparty risk, or premium valuations, why hold the wrapper?

The Bull Case: Why MicroStrategy Might Survive

Despite the apocalyptic headlines, several analysts argue the crisis is overblown:

- Debt Structure Is Conservative: MicroStrategy’s convertible bonds don’t mature until 2028 at the earliest. Unlike traditional secured debt, no lender can force Bitcoin liquidation. The company has specifically structured its financing to avoid margin calls or forced selling triggers.

- Bitcoin Collateralization Remains Strong: MicroStrategy has emphasized that even if Bitcoin falls to $25,000; roughly 66% below current prices, its assets-to-debt ratio would remain at 2.0x. At Bitcoin’s $74,000 average purchase price, the ratio stands at 5.9x. The company is nowhere near insolvency.

- Cash Reserves Cover Operations: The $1.44 billion USD Reserve can fund dividend obligations for 21 months without raising additional capital or selling Bitcoin. The company’s software business, while declining, still generates some revenue.

- MSCI Might Grant Exemption: MicroStrategy is actively negotiating with MSCI. The index provider has discretion in how it applies new rules and could potentially “grandfather” existing holdings or create exemptions. MSCI recognizes that forced exclusion could trigger market disruption and litigation.

- Short Squeeze Potential: If MicroStrategy successfully navigates the MSCI decision or Bitcoin rebounds sharply, the record short interest in MSTR stock could trigger a violent short squeeze, sending shares vertical in a relief rally.

The Broader Implication: Testing the Digital Asset Treasury Model

MicroStrategy’s crisis extends beyond one company; it’s a test of an entire category.

Digital Asset Treasury Companies (DATs) emerged as a trend in 2024-2025:

– MARA Holdings (mining company turned Bitcoin treasury)

– Metaplanet Inc. (Japan’s “MicroStrategy copycat”)

– Bitcoin Standard Treasury Company

– Dozens of smaller imitators

MSCI’s proposed rule would affect all of them. MicroStrategy, as the largest and most prominent, serves as the test case. If excluded, it sets precedent for how global finance treats public companies using Bitcoin as primary reserves.

The Existential Question: Can a public company justify holding 90%+ of its balance sheet in a single volatile asset? Traditional corporate finance says no; diversification, revenue generation, and shareholder protection require balanced portfolios. Crypto maximalism says yes; Bitcoin is the balance sheet strategy because fiat will inevitably depreciate.

MSCI’s January 15 decision will provide the market’s answer.

The Scenarios: What Happens Next?

Scenario 1: MSCI Exclusion (Bear Case)

Probability: 60-70% (analyst consensus)

Immediate Impact:

– $2.8 billion in mandated passive selling begins January 15-17

– Stock plunges 30-50% as forced liquidation overwhelms buyers

– mNAV collapses below 0.9x threshold

– MicroStrategy must sell 20,000-50,000 BTC to meet dividend obligations and stabilize stock

– Bitcoin experiences “capitulation wick” to $70,000-75,000 range

– Other DATs face similar selling pressure, creating contagion

Medium-Term: MicroStrategy survives but permanently loses premium valuation. The company becomes a value trap, trading below Bitcoin holdings with no mechanism to close the gap.

Scenario 2: MSCI Grants Exemption (Bull Case)

Probability: 20-30%

Immediate Impact:

– Stock rallies 50-100% on relief

– Massive short squeeze as record short interest covers positions

– mNAV premium returns, enabling equity issuance

– Bitcoin buying resumes, potentially accelerating

– Other DATs receive similar exemptions, validating the model

Medium-Term: MicroStrategy returns to accumulation mode, but at a slower pace. Premium remains compressed by competing ETFs and copycat companies.

Scenario 3: Partial Compromise (Mixed)

Probability: 10-20%

Immediate Impact:

– MSCI creates special “Digital Asset Treasury” category within indices

– MicroStrategy reclassified but not excluded entirely

– Some passive outflows ($500M-$1B) but not catastrophic

– Stock volatile but stabilizes near current levels

Medium-Term: Uncertainty lingers as the market adjusts to the new classification system.

Strategic Implications for Investors

For MicroStrategy Shareholders:

- Aggressive Hold: If you believe Bitcoin returns to $120,000+ in 2026, MicroStrategy’s leverage amplifies gains. The 0.95x mNAV means you’re buying Bitcoin at a 5% discount with embedded leverage.

- Defensive Exit: If you believe the January 15 decision triggers forced selling, exit before the event. Don’t try to time the bottom—structured liquidation can persist for weeks.

- Synthetic Exposure: Short MSTR / Long BTC via Bitcoin ETFs. Profit from continued mNAV compression while maintaining Bitcoin exposure.

For Bitcoin Holders:

- Short-Term Volatility: If Strategy must liquidate 20,000-50,000 BTC, expect severe downward wicks. However, liquidation at known prices creates buying opportunities for long-term holders.

- Structural Positive: Strategy’s crisis accelerates migration from “wrapped” Bitcoin exposure (corporate proxies) to direct Bitcoin exposure (ETFs, custody). This maturation strengthens Bitcoin’s market structure.

For the Broader Market:

- DAT Contagion Risk: If MicroStrategy falls, other digital asset treasury companies face similar pressure. This could temporarily suppress Bitcoin prices across multiple forced liquidation events.

- ETF Beneficiaries: Capital exiting MicroStrategy likely flows to BlackRock’s IBIT, Fidelity’s FBTC, and other spot Bitcoin ETFs; increasing their assets and market influence.

Final Analysis: The Reckoning of Leverage

MicroStrategy’s crisis represents the inevitable collision of two incompatible systems: traditional corporate finance and Bitcoin maximalism.

Traditional finance demands:

– Diversified balance sheets

– Predictable cash flows

– Conservative leverage

– Shareholder protection through prudent risk management

Bitcoin maximalism demands:

– All-in conviction

– Never sell

– Aggressive leverage to maximize exposure

– Long-term vision over short-term stability

For five years, Michael Saylor’s charisma and Bitcoin’s bull market allowed these contradictions to coexist. MicroStrategy could maintain leverage “because” Bitcoin kept rising. The stock could trade at a premium “because” investors believed the upward spiral was infinite.

The “Infinite Money Glitch” was never infinite; it was cyclical. And cycles turn.

Whether MicroStrategy navigates this crisis successfully depends on factors largely outside its control: Bitcoin’s price trajectory, MSCI’s final decision, and institutional investor sentiment. What’s certain is that the era of treating MicroStrategy as a pure Bitcoin proxy is over. The market now sees leverage, obligations, the reflexivity trap, and liquidity risk.

Bitcoin has matured beyond needing a single corporate champion. Spot ETFs hold over $100 billion in assets. Institutions have direct custody solutions. Retail has multiple access points. MicroStrategy was essential when it began in 2020. It’s no longer indispensable in 2025.

January 15, 2026 will reveal whether the first and largest digital asset treasury company can adapt to a world where Bitcoin succeeded beyond its wildest dreams; but no longer needs leveraged corporate wrappers to thrive.

Critical Dates:

– December 31, 2025: MSCI consultation period ends; ~$200M in dividends due

– January 15, 2026: MSCI final decision on index exclusion

– 2028: First convertible bond maturities

Estimated Outflows if Excluded:

– MSCI indices alone: $2.8 billion

– All indices (if others follow): $8.8 billion

Disclaimer: This content is for educational and reference purposes only and does not constitute investment advice. Digital asset investments carry high risk. Please evaluate carefully and assume full responsibility for your own decisions.

Join MEXC and Get up to $10,000 Bonus!

Sign Up