Kalshi just pulled off one of 2025’s most explosive fundraises. The U.S.-regulated prediction market announced a $1 billion Series E funding round on December 2, valuing the seven-year-old startup at $11 billion—more than double its $5 billion valuation from just two months earlier in October. Led by crypto-focused Paradigm with participation from Sequoia Capital, Andreessen Horowitz, and Alphabet’s CapitalG, the round validates prediction markets as a legitimate financial asset class worthy of Wall Street-tier valuations.

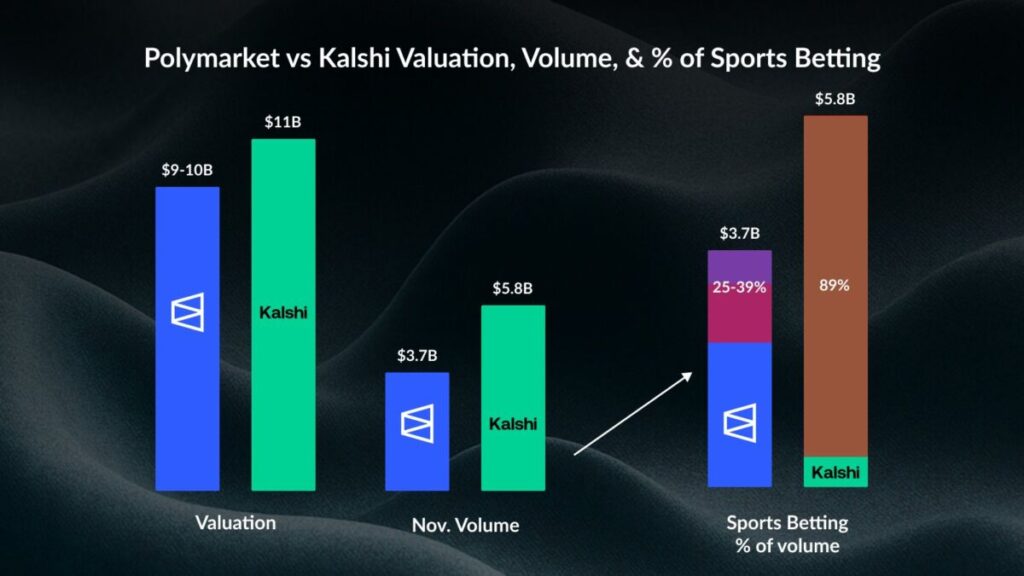

The math is staggering. Kalshi raised $300 million at $5 billion in October, then $1 billion at $11 billion in December—a 120% valuation increase in under 60 days. Trading volumes tell the story: Kalshi logged $4.47 billion in Q3 2025, surpassing rival Polymarket’s $3.5 billion and cementing its position as the world’s largest regulated prediction market. Weekly volumes now exceed $1 billion, up over 1,000% year-over-year, with no signs of slowing.

For traders accustomed to crypto’s boom-bust cycles, Kalshi represents something different: a real-money trading platform regulated by the CFTC, growing faster than most crypto projects, yet focused on predicting real-world events rather than speculating on tokens. Whether Bitcoin hits $150K or Congress passes legislation, Kalshi lets users bet with actual dollars through yes/no contracts—and VCs are betting billions that prediction markets become as ubiquitous as stocks and bonds.

The Numbers: $11B Valuation in Context

Funding Timeline:

- June 2025: $2 billion valuation (Series C)

- October 2025: $5 billion valuation, $300M Series D

- December 2025: $11 billion valuation, $1B Series E

That’s a 5.5x valuation increase in six months. For context, most startups that achieve $1B+ valuations (“unicorns”) take 7-10 years to reach that milestone. Kalshi went from $2B to $11B in half a year.

Who’s Investing:

Lead Investor – Paradigm: The crypto-focused VC firm that backed Coinbase, Uniswap, and FTX (pre-collapse) is betting prediction markets represent a similar category-defining opportunity. Co-founder Matt Huang compared Kalshi’s potential to crypto a decade ago, stating the firm sees “uncapped cultural and economic phenomenon.”

Returning Investors:

- Sequoia Capital (legendary early backers of Google, Apple, YouTube)

- Andreessen Horowitz (a16z, dominant crypto/tech VC)

- CapitalG (Alphabet’s growth equity arm)

- IVP, ARK Invest, Anthos Capital, Meritech Capital

Strategic Validators:

- Y Combinator (Kalshi’s original accelerator)

- Coinbase Ventures (connecting prediction markets to crypto infrastructure)

The investor roster reads like a “who’s who” of venture capital. These aren’t crypto-native funds making speculative altcoin bets—they’re firms that backed Amazon, Facebook, and Airbnb writing nine-figure checks for prediction markets.

What Kalshi Actually Does

For those unfamiliar with prediction markets, Kalshi offers a fundamentally different trading product than crypto exchanges or stock brokerages.

The Model:

Users trade binary event contracts—yes/no questions about future events. Examples:

- “Will Bitcoin exceed $100,000 by December 31, 2025?” (Yes: $0.65, No: $0.35)

- “Will Congress pass infrastructure bill before February 2026?” (Yes: $0.42, No: $0.58)

- “Will Lakers win NBA Championship?” (Yes: $0.18, No: $0.82)

Contracts settle at $1 if the event occurs, $0 if it doesn’t. Prices represent market probability—a contract trading at $0.65 implies 65% chance the event happens. Users profit by correctly predicting outcomes.

Why This Matters:

Traditional markets (stocks, bonds, commodities) move based on events, but you can’t directly trade the events themselves. Prediction markets let you bet on the actual thing driving asset prices: Congressional legislation, Federal Reserve decisions, weather patterns, sports outcomes, even social trends.

The company, founded in 2018 and the first U.S.-regulated prediction market, also raised $300 million at a $5 billion valuation in October amid plans to expand globally. The founding team’s insight was regulatory arbitrage—prediction markets existed (Intrade, PredictIt) but operated in legal gray areas. Kalshi obtained CFTC registration as a derivatives exchange, making it the first fully legal U.S. prediction market for real-money trading.

The Volume Explosion: From Niche to Mainstream

Kalshi’s valuation isn’t speculative—it’s backed by explosive volume growth that VCs interpret as product-market fit.

Q3 2025 Performance:

- Kalshi: $4.47 billion trading volume

- Polymarket: $3.5 billion trading volume

- Market Share: Kalshi overtook its main rival despite Polymarket’s crypto-native advantage

Weekly Volumes: Kalshi reports weekly volumes exceeding $1 billion as of December 2025, representing 1,000%+ year-over-year growth. To contextualize: many established crypto exchanges would kill for $1B weekly volume. Kalshi is processing those numbers trading on Congressional votes and sports outcomes.

What Drives Volume:

Political Events: The 2024 U.S. presidential election drove massive volume as users traded election outcomes in real-time. Although Kalshi gained attention for election markets, CEO Tarek Mansour notes that sports actually represents the largest category by volume—counterintuitive but important for understanding sustainable business model.

Sports Betting Pivot: A large portion of Kalshi’s trades are actually tied to sports, according to The New York Times. This diversification away from purely political markets suggests durability beyond election cycles.

Institutional Hedging: Future growth is expected to come from various companies using Kalshi to hedge against business-specific risks, such as government shutdowns or adverse weather changes. Imagine airlines hedging fuel costs by trading weather prediction contracts, or agricultural firms hedging crop yields.

CNN Partnership: Kalshi is reportedly planning to announce a partnership with CNN, potentially displaying Kalshi odds during news coverage—legitimizing prediction markets as information source rather than gambling curiosity.

Regulatory Breakthrough: The CFTC Battle

Kalshi’s explosive growth follows a hard-fought legal victory that opened the floodgates for political prediction markets in the U.S.

The Backstory:

The CFTC historically blocked prediction markets on political events, viewing them as gambling rather than legitimate derivatives. Platforms like PredictIt operated under academic no-action letters with strict volume caps. Intrade, once the dominant prediction market, was shut down by CFTC enforcement in 2013.

Kalshi challenged this restriction, arguing that contracts on Congressional control, election outcomes, and policy decisions represent hedgeable risks for businesses and investors—meeting the legal definition of derivatives.

The Victory:

After a closely watched legal battle, Kalshi gained approval in 2024 to list markets tied to the U.S. presidential election, clearing a major hurdle for its strategy in one of the most sensitive areas of event-based trading. The ruling effectively recognized prediction markets as a legitimate financial asset class deserving regulatory oversight rather than prohibition.

This clearance matters enormously. With CFTC approval, Kalshi can:

- Integrate with traditional brokerages (more distribution)

- Accept institutional capital (funds, family offices can participate)

- Scale without shutdown risk (operating legally vs. regulatory gray area)

Rival Polymarket operates in legal gray area (offshore, crypto-based, U.S. users technically prohibited). Kalshi’s regulatory clarity provides sustainable competitive advantage as markets mature.

The Polymarket Competition: Two Models, Same Market

Kalshi’s $11B valuation comes as its main rival Polymarket was reportedly in talks for funding at $12-15 billion valuation in October. The competition between regulated (Kalshi) and decentralized (Polymarket) models represents fascinating experiment in market structure.

Kalshi Advantages:

- CFTC-regulated, eliminating legal risk

- Fiat onramps (bank transfers, no crypto required)

- Integration potential with traditional brokerages

- Institutional accessibility (compliance teams approve regulated platforms)

Polymarket Advantages:

- Decentralized (censorship-resistant, no single point of failure)

- Crypto-native (USDC deposits, blockchain settlement)

- Global accessibility (no geographic restrictions)

- Lower regulatory overhead (offshore structure)

Market Dynamics:

Interestingly, Kalshi surpassed Polymarket in Q3 volume despite Polymarket’s first-mover advantage and explosive 2024 election volume. This suggests that regulated, fiat-based prediction markets appeal to broader audience than crypto-native alternatives—critical insight for understanding long-term winner.

However, Polymarket’s potential $12-15B valuation (higher than Kalshi’s $11B) indicates investors remain split on which model dominates. The next 12-24 months will determine whether regulation or decentralization wins the prediction market race.

What $1 Billion Buys: Kalshi’s Expansion Plans

Kalshi didn’t raise $1B to sit on cash. The company outlined specific deployment strategies that signal aggressive expansion.

Growth Initiatives:

Consumer Adoption: Accelerate user acquisition to “next hundred million customers.” Kalshi currently serves hundreds of thousands of users—scaling 100x requires massive marketing, product development, and customer support infrastructure.

Brokerage Integrations: Partner with traditional brokerages (Robinhood, E*TRADE, Schwab) to offer prediction market contracts alongside stocks and ETFs. This distribution strategy could expose tens of millions of retail traders to prediction markets without requiring separate platform signup.

News Partnerships: The reported CNN partnership represents first of many potential deals. Imagine Bloomberg, CNBC, Fox News displaying Kalshi odds during coverage—instantly legitimizing prediction markets as information sources rather than gambling oddities.

Product Expansion: Broaden contract offerings beyond politics and sports into weather, economics, business events, and custom corporate hedging products. Every hedgeable risk represents potential market.

Global Expansion: Although CFTC-regulated and U.S.-focused, Kalshi launched international expansion in October, creating unified global liquidity pool spanning 140+ countries. This positions Kalshi as true global exchange rather than U.S.-only platform.

The Bear Case: Why Prediction Markets Could Fail

Despite $11B valuation and explosive growth, skeptics point to real risks:

Regulatory Reversal: CFTC allowed political contracts after legal battle, but future administrations or policy changes could reverse this. If political markets get banned again, Kalshi loses its most visible (if not highest volume) category.

Market Manipulation: Prediction markets with low liquidity can be moved by wealthy participants placing large bets to influence perceived probabilities. If markets become tools for propaganda rather than price discovery, credibility collapses.

Competition from Traditional Finance: Once Wall Street sees prediction markets generating $1B+ weekly volume, established players (CME Group, Nasdaq) could launch competing products with more capital and distribution than startups.

Limited TAM: Total addressable market may be smaller than bulls expect. Not every event is tradeable, and user willingness to bet on mundane outcomes (weather, corporate earnings) remains unproven at scale.

Ethical Concerns: Some view betting on elections, disasters, or tragic events as distasteful. Public backlash could limit growth in certain categories or trigger regulatory crackdowns.

Polymarket’s Decentralization: If censorship resistance matters more than regulation, Polymarket’s model could dominate among crypto-native users who distrust centralized platforms.

Paradigm’s Bet: “Similar to Crypto a Decade Ago”

Paradigm’s decision to lead the $1B round with bullish commentary deserves analysis. The firm doesn’t chase fads—it backed Coinbase pre-IPO and Uniswap when DeFi was nascent.

Matt Huang, Paradigm’s co-founder, stated: “Kalshi’s exponential growth shows the scale of latent demand for prediction markets as a new asset class, from institutions to everyday people. People come for one type of market and stay for the breadth. We see this as an uncapped cultural and economic phenomenon, similar to how we felt about crypto a decade ago.”

Decoding the Comparison:

Ten years ago (2015), crypto was Bitcoin at $250 and Ethereum hadn’t launched. Paradigm sees prediction markets at similar inflection point—technology proven, regulatory clarity emerging, early adopters converting to power users, mainstream awareness building.

If correct, prediction markets could grow from $5-10B annual volume today to trillions within a decade, mirroring crypto’s trajectory. Kalshi would capture significant percentage of that flow, justifying $11B+ valuations even at early stage.

Huang’s emphasis on “institutions to everyday people” signals Paradigm expects both retail adoption (Robinhood traders betting on sports/politics) and institutional usage (corporations hedging business risks). Dual-sided adoption often produces strongest network effects.

What This Means for Crypto and Finance

Kalshi’s success has implications beyond prediction markets:

1. Validation of Event-Based Finance: If prediction markets gain mainstream traction, it validates premise that users want to trade real-world events directly rather than only through stock/bond/commodity proxies.

2. Competition for Crypto Attention: Dollar-based, CFTC-regulated prediction markets compete with crypto for trader attention and capital. If users can bet on outcomes using dollars without crypto complexity, does that reduce altcoin speculation?

3. Institutional On-Ramp: Kalshi provides regulated entry point for institutions curious about prediction markets but unable to use Polymarket (unregulated, crypto-based). Success here could normalize event trading for conservative capital.

4. Brokerage Integration: If Robinhood, Schwab, and others integrate prediction market contracts, it exposes tens of millions of retail traders to new asset class—potentially fragmenting attention away from meme stocks and shitcoins.

5. Decentralization Debate: Kalshi (centralized, regulated) beating Polymarket (decentralized, unregulated) in volume would suggest consumers prefer regulatory clarity over censorship resistance—important signal for broader crypto versus TradFi debate.

Conclusion: Prediction Markets Join the Mainstream

Kalshi’s $1 billion raise at $11 billion valuation marks the moment prediction markets graduated from curiosity to credible financial asset class. When Paradigm, Sequoia, a16z, and Alphabet’s CapitalG write nine-figure checks, it’s not speculation—it’s conviction based on $4.47B quarterly volume and 1,000%+ growth.

The thesis is straightforward: every event that drives financial markets is now tradeable. Congressional votes. Federal Reserve decisions. Corporate earnings. Weather patterns. Sports outcomes. Cultural trends. If it impacts prices, you can bet on it directly through Kalshi rather than trading stocks/bonds as indirect proxies.

Whether prediction markets reach trillions in volume and become as ubiquitous as equities depends on regulatory stability, product execution, and network effects. Kalshi faces formidable competition from Polymarket’s decentralized model and potential Wall Street entrants. But with CFTC approval, explosive growth, and $1B in fresh capital, it’s positioned as well as any startup could be.

For crypto traders watching from sidelines, the story offers two lessons. First, regulated finance innovation can scale faster than decentralized alternatives when mainstream adoption matters. Second, when VCs compare your market to “crypto a decade ago,” buckle up—you’re either heading to the moon or crater, and there’s little middle ground.

Kalshi is betting on moon. With $11B valuation and Paradigm’s backing, the prediction market experiment just got very real.

Disclaimer:This content is for educational and reference purposes only and does not constitute any investment advice. Digital asset investments carry high risk. Please evaluate carefully and assume full responsibility for your own decisions.

Join MEXC and Get up to $10,000 Bonus!

Sign Up