Kadena, a proof-of-work blockchain founded by former JPMorgan executives, declared the immediate cessation of all operations.

The market response was swift and severe. KDA dropped 32% within the first hour, falling from $0.22 to $0.15 as selling pressure overwhelmed order books across major exchanges. Trading volume surged 1,292% as holders rushed to exit positions. By day’s end, the token had declined approximately 50-60% to trade around $0.09-$0.10, eliminating roughly $90 million in market capitalization in a single session.

The magnitude of Kadena’s collapse becomes clear when measured against its history. At its November 2021 peak, KDA traded at $27.64 with a market capitalization approaching $4 billion. The project had raised $15 million in funding, launched $150 million in grant programs, and positioned itself as “the blockchain for business.” Yet despite these advantages, the company cited “unfavorable market conditions” as it shuttered operations permanently.

1. Operational Cessation and Network Continuity

Kadena’s announcement detailed the immediate cessation of all business activity and active blockchain maintenance. A small internal transition team will remain temporarily to manage the wind-down process, while all commercial operations, development work, marketing initiatives, and technical support have been discontinued.

The company emphasized that “the Kadena blockchain is not owned or operated by the company” and that “the network is operated by independent miners, while on-chain smart contracts and protocols are governed independently.” This statement positions the blockchain as capable of continuing operations without corporate oversight.

However, market participants immediately questioned the viability of this arrangement. Without active development, ecosystem support, or user acquisition efforts, the blockchain faces significant challenges to sustained operation. Kadena plans to release a final binary update to facilitate network stability in the absence of corporate involvement, urging node operators to implement this upgrade for continued security.

2. Market Dynamics and Trading Activity

Trading data reveals the intensity of market reaction to Kadena’s announcement. Volume across major exchanges including MEXC increased 1,292%, reaching approximately $99 million—a dramatic spike from typical daily volumes. This represented almost entirely sell-side pressure as holders sought to exit positions before further price deterioration.

Order book depth decreased significantly as market makers withdrew liquidity, resulting in wider bid-ask spreads and increased slippage on larger transactions. Some traders reported difficulty executing orders at expected prices as the market adjusted to the news.

The selloff continued throughout the trading session, with brief recovery attempts quickly overwhelmed by renewed selling pressure. By market close, KDA had stabilized in the $0.09-$0.10 range, representing a market capitalization of approximately $28-31 million down from roughly $120 million at the start of the day.

3. Fundamental Metrics and Ecosystem Analysis

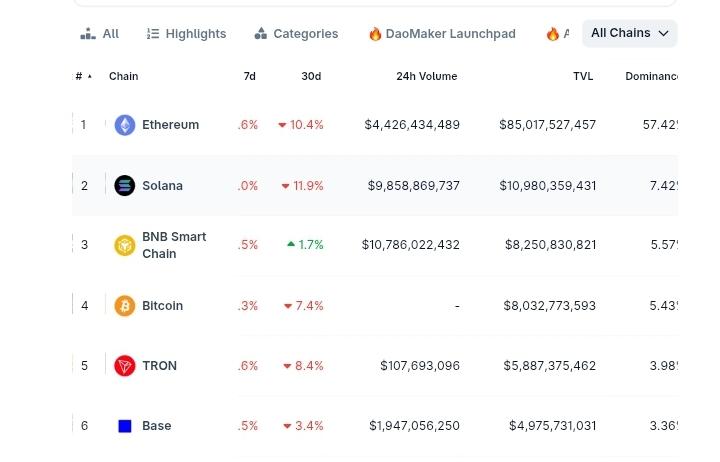

On-chain data provides context for understanding why Kadena ultimately proved unsustainable. According to DeFiLlama, the blockchain’s total value locked (TVL) peaked at $9 million in March 2022; a figure that pales in comparison to established networks:

– Ethereum: $85+ billion TVL

– Solana: $6+ billion TVL

– Arbitrum: $3+ billion TVL

– Avalanche: $1.2+ billion TVL

– Kadena: $9 million peak, declining to $170,000 by October 2025

This 98% decline in TVL from an already modest peak indicates minimal adoption of decentralized applications built on Kadena. Transaction activity remained low throughout the network’s operational history, with most volume concentrated in speculative token trading rather than DApp usage.

Developer activity similarly remained limited despite substantial grant programs designed to incentivize ecosystem growth. The $100 million grant initiative announced in 2022, followed by an additional $50 million Leap Grant Program in July 2024, failed to generate sustainable development momentum or user adoption.

4. Implications for Token Holders

For KDA holders on MEXC, the practical implications are significant. The token continues trading, but fundamental value drivers have been eliminated. Without development, marketing, or ecosystem support, no catalyst exists for price recovery.

Some community members have discussed potential community-led revival efforts or protocol forks. Historical precedents for such initiatives show limited success absent existing organic adoption and engaged developer communities—neither of which Kadena demonstrated prior to shutdown.

The rational strategy for existing holders involves assessing risk tolerance and liquidity needs. The token’s 99.6% decline from all-time highs reflects market assessment that recovery probability is minimal. Holding positions in anticipation of community revival requires accepting near-certain loss against low-probability upside.

5. Industry Context and Market Consolidation

Kadena’s closure represents part of a broader market consolidation trend. The 2020-2021 bull market generated numerous blockchain projects backed by venture capital and promising technological innovation. As market conditions deteriorated during 2022-2023 and remained challenging through 2025, projects without genuine adoption faced increasingly difficult sustainability questions.

Corporate-backed blockchains operate under different constraints than truly decentralized networks. They maintain burn rates, face shareholder pressures, and must eventually demonstrate viable business models. When unable to achieve these objectives, shutdown becomes the rational business decision—regardless of technology quality or team credentials.

This consolidation serves a market function, eliminating projects that failed to achieve product-market fit and reallocating capital toward networks demonstrating actual utility and adoption. The process is necessary but painful for investors in discontinued projects.

6. Risk Assessment for Altcoin Investors

Kadena’s collapse offers several analytical lessons for cryptocurrency investors evaluating altcoin exposure:

- Fundamental Metrics Over Marketing: On-chain data including TVL, daily active users, transaction volume, and developer activity provide objective measures of adoption. Kadena’s consistently low metrics were publicly available but frequently overlooked by investors focused on price movements and marketing narratives.

- Corporate Structure Risk: Projects dependent on corporate entities for core functions face business risks that decentralized networks avoid. When evaluating investments, assess whether the blockchain could continue thriving if the company ceased operations. If the answer is no, corporate shutdown risk must be incorporated into position sizing.

- Liquidity Considerations: Kadena holders discovered that exit liquidity can evaporate rapidly during crisis events. Even tokens with apparently adequate daily volume can become difficult to trade in size when all participants simultaneously attempt to exit. Position sizing should account for the possibility that orderly liquidation may not be possible during stress events.

- Bull Market Valuations: Kadena achieved a $4 billion market capitalization during peak bull market conditions—a valuation that bore no relationship to actual usage or adoption. Bull market prices do not validate long-term viability. Sustainable valuation requires sustainable fundamentals.

- Ecosystem Activity: TVL of $170,000 represents virtually no meaningful economic activity. A thriving blockchain ecosystem should show billions in TVL, thousands of daily active users, and robust application development. Absence of these indicators suggests speculation rather than sustainable value creation.

7. Broader Market Implications

While Kadena’s shutdown will not significantly impact broader cryptocurrency markets due to its relatively small market capitalization, it serves as a case study in project sustainability during challenging market conditions.

Other corporate-backed blockchains with similar characteristics like low TVL, minimal adoption, dependence on corporate support may face comparable decisions as market conditions remain difficult and funding sources become scarcer. Investors should evaluate portfolio holdings for similar risk factors.

The market is becoming increasingly efficient at distinguishing projects with genuine utility from those sustained primarily by speculation and grant programs. Capital is consolidating around networks demonstrating actual product-market fit Ethereum’s extensive DeFi ecosystem, Solana’s growing transaction volumes, layer-2 solutions addressing real scalability challenges.

This represents healthy market evolution, though individual investors in discontinued projects bear the costs of this selection process.

8. Conclusion

Kadena’s shutdown marks the end of a project that once aimed to redefine enterprise blockchain. Despite strong funding, experienced founders, and technical depth, it failed to secure meaningful adoption.

The collapse from a market cap near $4 billion to roughly $30 million, and TVL from $9 million to under $200,000 highlights the gap between promise and market reality. When corporate operations became unsustainable, decentralization alone couldn’t sustain viability.

For the broader crypto industry, Kadena’s fall underscores an ongoing shift toward networks with genuine use cases and sound economics. For investors, it’s a reminder to prioritize fundamentals over hype and to distinguish speculation from lasting value.

Though the blockchain may technically persist through independent miners, the project’s functional life has ended; its story now serving as one of 2025’s clearest lessons in adoption-driven survival.

Disclaimer: This content is for educational and reference purposes only and does not constitute investment advice. Digital asset investments carry high risk. Please evaluate carefully and assume full responsibility for your own decisions.

Join MEXC and Get up to $10,000 Bonus!

Sign Up