In the evolving landscape of decentralized data storage, a new contender is emerging to challenge Arweave’s dominance: Irys Network. Founded by Josh Benaron, the creator of Bundlr Network (which previously handled 95% of Arweave’s transactions), Irys introduces a radical rethinking of how blockchains handle data, not as static archives, but as programmable, executable assets that can trigger smart contracts, automate workflows, and power AI applications.

With 100,000 TPS throughput, storage costs claimed to be 20x cheaper than Arweave, and native EVM compatibility through IrysVM, Irys is positioning itself as the infrastructure backbone for AI, DePIN (Decentralized Physical Infrastructure Networks), and next-generation Web3 applications. Following successful fundraising of $18.9 million from top-tier VCs including Coinfund, Framework Ventures, and Hypersphere Ventures, Irys is preparing for its Token Generation Event (TGE) and mainnet launch—a milestone that could reshape the $12 billion decentralized storage market.

The Programmable Data Revolution: What Makes Irys Different

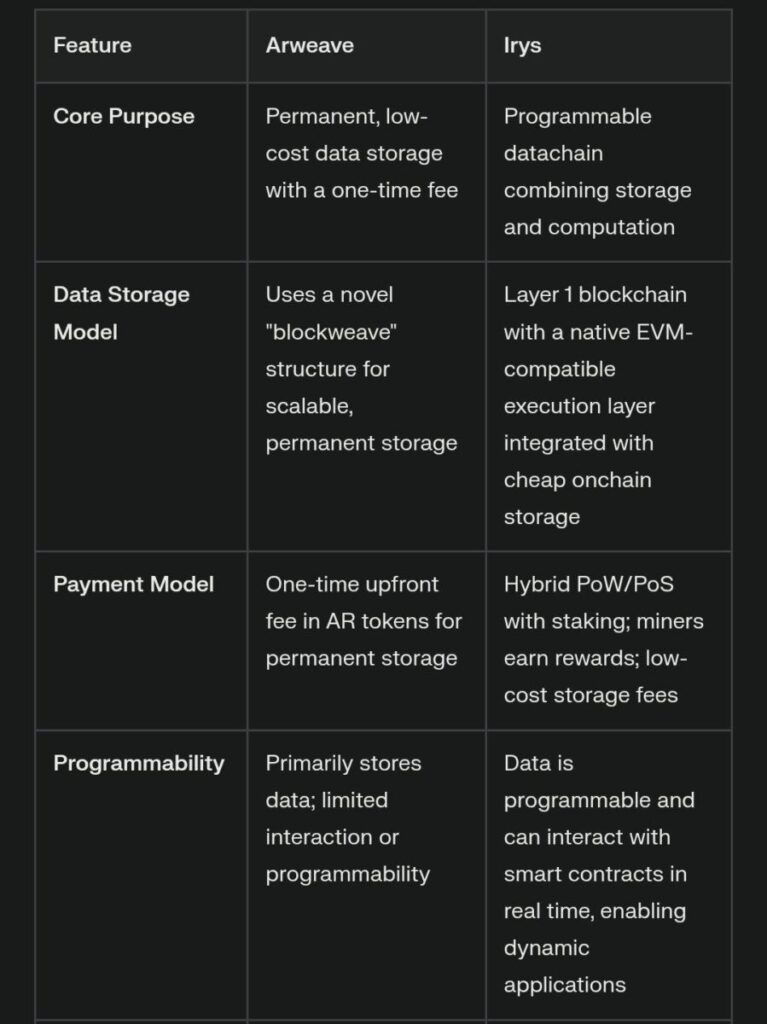

Traditional blockchains treat data as passive information—you store it, retrieve it, but it doesn’t do anything. Smart contract platforms like Ethereum execute code but struggle with data at scale. Decentralized storage networks like Arweave and Filecoin archive information permanently but lack native computation.

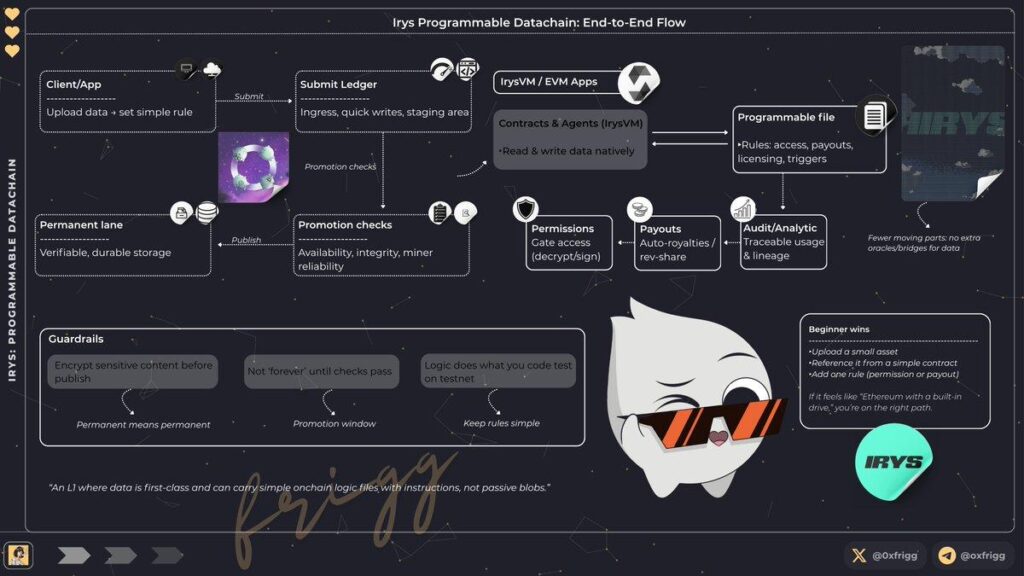

Irys bridges this gap through Programmable Data—a paradigm where stored information carries embedded instructions that execute automatically on-chain.

Real-World Applications:

AI Training Data: Store datasets with embedded licensing terms that automatically distribute royalties when AI models access the data for training.

Dynamic NFTs: NFT metadata that updates based on on-chain events—imagine artwork that evolves as market conditions change, with transformation logic embedded in the data itself.

Automated Compliance: Legal documents that trigger smart contract actions when conditions are met, such as releasing escrow funds after contractual milestones are verified.

Supply Chain Provenance: Product data that automatically updates authenticity certificates and triggers inventory reorders when threshold conditions are met.

This isn’t theoretical—Irys’s IrysVM (Ethereum Virtual Machine compatible execution layer) enables these use cases today through Solidity smart contracts that read, transform, and execute instructions directly on stored data.

Technical Architecture: How Irys Achieves 100K TPS

Irys’s performance advantage stems from architectural innovations that treat data as a first-class citizen rather than an afterthought:

Hybrid Proof of Work and Stake (uPoW/S) Consensus:

Unlike pure PoW (wasteful) or pure PoS (potentially centralized), Irys uses “Useful Proof of Work” where validators prove they’re maintaining assigned data partitions. This ties validator economics directly to data reliability—earn rewards for uptime and integrity, face slashing for data loss or misbehavior.

Horizontal Scaling:

As demand increases, new validators join the network and take responsibility for specific data partitions. This differs from monolithic chains where every validator must process every transaction. Irys achieves theoretically infinite capacity by adding validators rather than upgrading core infrastructure.

Flexible Storage Model:

Irys offers two storage options:

- Term storage: Duration-based (temporary), priced competitively for applications needing data for weeks/months

- Permanent storage: One-time payment for perpetual retention, backed by the Irys Storage Endowment that funds long-term maintenance

Both operate at at-cost pricing, with Irys’s multi-revenue model (storage fees + execution fees + programmable data transactions) maintaining economic sustainability without the fee volatility that plagues competitors.

Instant Retrieval:

Unlike traditional decentralized storage where file retrieval can take seconds to minutes, Irys delivers instant access matching centralized cloud performance—critical for AI applications and real-time dApps.

The Arweave Controversy: From Collaboration to Competition

Irys’s relationship with Arweave is complicated. As Bundlr Network, the project was Arweave’s largest Layer-2 solution, processing over 98% of Arweave’s daily transactions and handling over 1 billion transactions before rebranding to Irys in October 2023.

What Went Wrong:

In December 2023, Arweave founder Sam Williams publicly accused Irys of planning to fork Arweave “out of greed,” alleging plans to “drop the dataset and reset token supply.” Williams responded by removing Irys bundlers from Arweave’s trusted gateway set, causing “significant delays” for Irys users—a move critics called “active censorship” against supposedly permissionless infrastructure.

Irys countered that they were “developing new provenance tech” and accused Arweave of attempting to “deplatform” them despite Arweave’s open-source ethos. The public feud caused Arweave’s AR token to drop 20% within days.

Current Status:

The “fork drama” appears to have resolved with Irys pivoting to become an independent Layer-1 rather than an Arweave Layer-2. This strategic shift positions Irys as a direct competitor offering:

- 16-20x cheaper storage than Arweave (per analyst @KingKens4 with 31.2K followers)

- 100K TPS vs. Arweave’s ~5K TPS through parallel processing

- Native programmability via IrysVM vs. Arweave’s limited SmartWeave

The controversy highlighted a key philosophical divide: Arweave prioritizes permanent archival storage, while Irys targets dynamic, executable data for AI and real-time applications—two distinct use cases that may coexist rather than compete directly.

Tokenomics: Deflationary Model Built on Usage

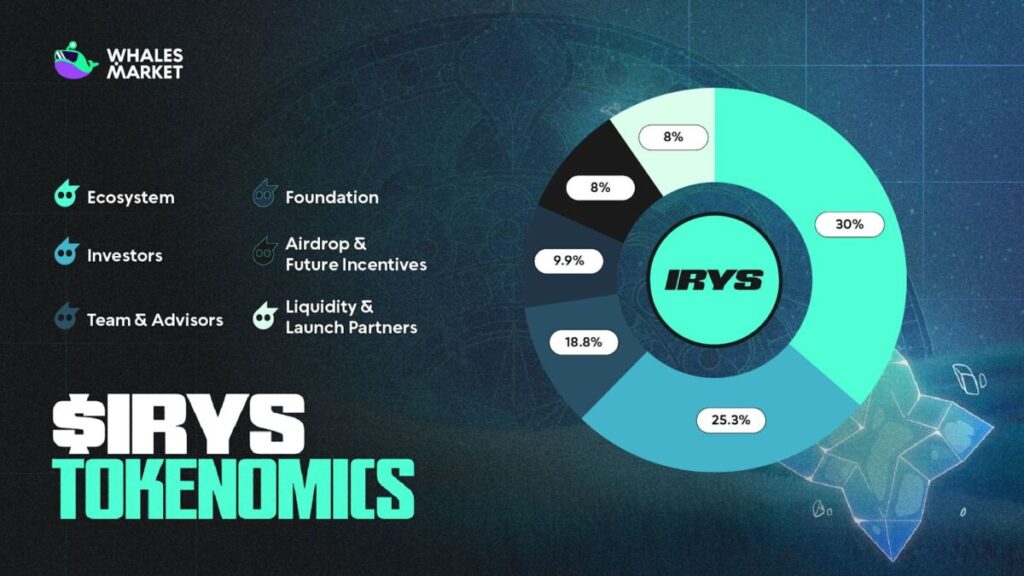

Irys’s economic model demonstrates sophisticated thinking about long-term sustainability:

Token Supply and Emission:

- Initial emission: 2% annually to validators/miners

- Halving schedule: Rewards cut in half every 4 years (Bitcoin-style)

- Long-term goal: Transition from inflation to deflationary as usage scales

Fee Burning Mechanism:

- 50% of execution fees: Burned permanently

- 95% of term-storage fees: Burned permanently

- Permanent storage fees: Flow to non-circulating Irys Storage Endowment (funds perpetual data maintenance)

Deflationary Thesis:

As network activity increases, token burns eventually outpace emissions, creating supply shock. This is similar to Ethereum’s EIP-1559 model but more aggressive—potentially burning 50-95% of revenue depending on storage type.

Staking Requirements:

Validators must stake $IRYS tokens to participate in consensus. Combined with slashing for misbehavior, this ensures only reliable participants secure the network while creating natural demand for the token.

Target Markets: AI, DePIN, and Enterprise Adoption

Irys’s value proposition resonates strongest in three sectors:

1. AI Infrastructure

Training large language models requires massive datasets with clear provenance and licensing. Irys’s programmable data enables:

- Automated royalty distribution when datasets are accessed

- Usage tracking embedded in data for compliance

- Versioning and lineage to trace model training sources

With AI companies facing lawsuits over training data usage, provable, programmable licensing could become table-stakes for the industry.

2. DePIN (Decentralized Physical Infrastructure)

Projects like Helium (wireless), Filecoin (storage), and Render (compute) generate massive amounts of operational data. Irys provides:

- High-throughput storage for sensor data, IoT readings, network logs

- Smart contract integration for automated billing and quality-of-service enforcement

- Cost-effective archival for compliance and auditing

3. Enterprise Web3

Corporations exploring blockchain need performance matching Web2 expectations. Irys offers:

- Instant retrieval times (no 10-second wait for data)

- Predictable pricing (no gas fee volatility)

- EVM compatibility (use existing Solidity developers)

- Hybrid storage options (temporary for working data, permanent for legal records)

Competitive Landscape: Where Irys Fits

vs. Arweave:

- Irys advantage: 20x cheaper, 100K TPS, programmable data

- Arweave advantage: 5+ years proven permanence, larger ecosystem, $9+ billion in stored data

- Verdict: Different use cases—Arweave for archival, Irys for dynamic applications

vs. Filecoin:

- Irys advantage: Simpler pricing, instant retrieval, EVM compatibility

- Filecoin advantage: Larger network ($10B+ market cap), enterprise adoption (Protocol Labs backing)

- Verdict: Filecoin targets general storage; Irys targets programmable data niche

vs. Centralized Cloud (AWS S3):

- Irys advantage: Censorship resistance, no platform risk, programmable data primitives

- AWS advantage: Mature tooling, global presence, enterprise support

- Verdict: Irys for Web3-native apps; AWS for traditional cloud workloads

Market Opportunity:

The decentralized storage market is projected to grow from $12 billion (2025) to $50+ billion by 2030. If Irys captures even 5% of this market, it would process ~$2.5 billion annually—significant revenue supporting its deflationary token model.

Risks and Considerations

Mainnet Unproven: Irys mainnet is said to launch on November 25th 2025 on MEXC

Arweave Ecosystem Backlash: The December 2023 controversy burned bridges with Arweave’s community. If Irys relies on former Arweave developers/users, residual hostility could slow adoption.

Competitive Moat: What prevents Arweave from adding programmability? Or Filecoin from improving performance? First-mover advantage in “programmable data” may not last if incumbents adapt.

Token Launch Timing: TGE is approaching with Listing expected to occur on MEXC exchange where the tokens will be tradeable on the 25th of November 13:00 (UTC)

Centralization Concerns: As a young network, validator count and geographic distribution will be limited at launch. True decentralization takes years to achieve.

Investment Thesis: High Risk, High Reward

Bull Case:

- Proven team: Benaron built Bundlr to 98% market share on Arweave—demonstrates execution ability

- $18.9M raised: Top-tier VCs (Coinfund, Framework, Hypersphere) provide validation and network effects

- Technical superiority: 100K TPS + 20x cost advantage vs. Arweave is quantifiable

- Market timing: AI data needs exploding; Irys positioned at intersection of AI + Web3

- Deflationary tokenomics: If usage scales, token supply shrinks while demand grows

Bear Case:

- Unproven at scale: Testnet ≠ mainnet; many projects fail during production launch

- Market saturation: Arweave, Filecoin, Storj, Sia, and centralized competitors crowd the space

- Controversy baggage: Arweave drama may limit ecosystem partnerships

- Token launch risk: Early dumps, low liquidity, or poor market timing could crater price

For Speculators:

Irys represents a high-risk, high-reward bet on the thesis that “programmable data” becomes a critical Web3 primitive. If correct, early positioning could yield 10-50x returns. If wrong, capital could be permanently impaired.

For Long-Term Investors:

Wait for mainnet launch, monitor actual usage metrics (storage volume, execution transactions, validator growth), and assess whether “programmable data” gains traction before committing significant capital.

Conclusion: Watch This Space

Irys Network sits at the frontier of decentralized infrastructure, attempting to solve a problem most projects haven’t recognized: that data and computation have been artificially separated in blockchain architecture. By unifying storage and execution through IrysVM, Irys creates programmable data—a primitive that could unlock AI licensing, DePIN automation, and enterprise Web3 adoption.

The team’s track record (Bundlr’s dominance on Arweave), technical specs (100K TPS, 20x cost advantage), and VC backing ($18.9M from top firms) provide credibility. However, mainnet hasn’t launched yet, and the Arweave controversy highlights execution risks beyond pure technology.

For traders and investors, Irys warrants close monitoring. When TGE and mainnet arrive, this could be one of 2025-2026’s most significant infrastructure launches—or another overhyped project that fails to deliver. The next 6-12 months will tell the story.

Disclaimer:This content is for educational and reference purposes only and does not constitute any investment advice. Digital asset investments carry high risk. Please evaluate carefully and assume full responsibility for your own decisions.

Join MEXC and Get up to $10,000 Bonus!

Sign Up