The crypto world is witnessing a new kind of bull run, not led by retail traders or meme coins, but by institutions. At the center of this quiet financial revolution stands BlackRock’s iShares Bitcoin Trust (IBIT).

As IBIT’s assets under management (AUM) edge closer to the $100 billion mark, institutional money is no longer a fringe factor ,it’s the primary engine driving Bitcoin’s surge to new highs.

1.What Is IBIT : A Primer

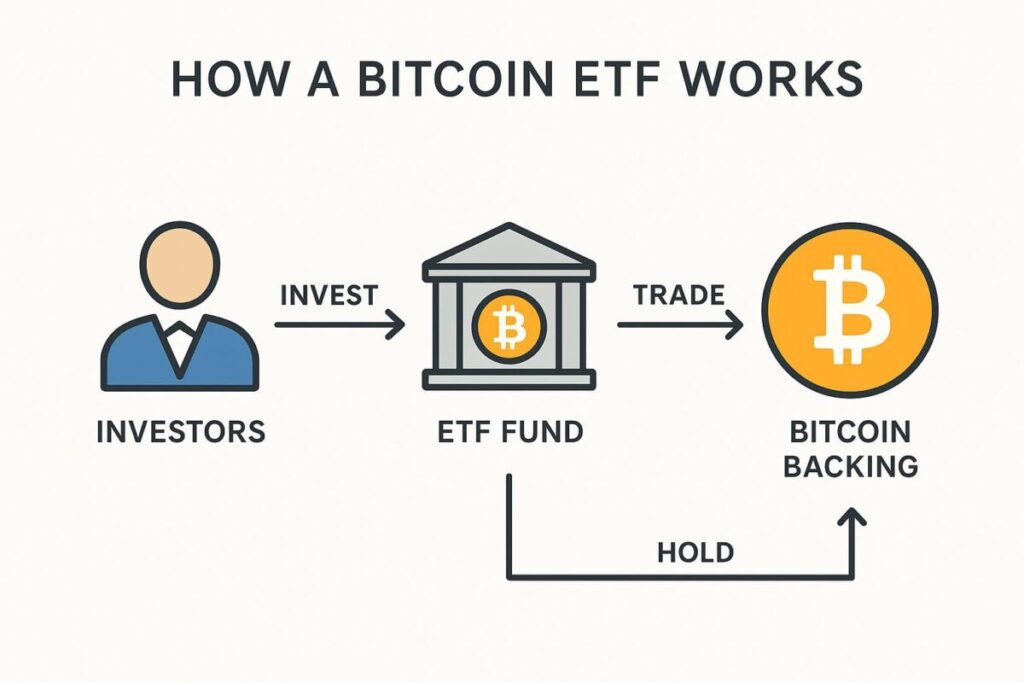

IBIT (iShares Bitcoin Trust) is BlackRock’s flagship spot Bitcoin ETF, launched in January 2024. It gives investors a regulated, exchange-traded way to gain exposure to Bitcoin , without needing to hold or secure it themselves.

2.Key Specs (as of October 2025):

- Net Assets / AUM: ≈ $96.17 billion

- Fee / Expense Ratio: 0.25%

- Shares Outstanding: 1.39 billion

- Benchmark: CME CF Bitcoin Reference Rate (New York variant)

Unlike futures ETFs or indirect crypto funds, IBIT holds real Bitcoin to back every issued share.

That means whenever IBIT grows, actual BTC supply is removed from circulation , tightening availability and driving prices higher.

- Institutional advantage: With BlackRock’s credibility, regulation, and custody infrastructure, IBIT gives large funds the confidence to join Bitcoin’s market safely.

3.The Meteoric Rise : How Fast and How Big

IBIT’s trajectory has shattered all records.

In mid-2025, IBIT crossed $80 billion AUM just 374 days after launch ,making it the fastest ETF in history to hit that milestone.

It now holds 700,000+ BTC, dominating all U.S. spot Bitcoin ETFs.

On October 6, 2025, IBIT recorded nearly $970 million in net inflows in a single day, contributing to $1.21 billion in total U.S. spot ETF inflows.

In less than two years, IBIT has absorbed institutional capital that once flowed through hedge funds and private equity , reshaping how Bitcoin is bought, stored, and traded.

4.Why Institutions Are Betting Big on IBIT

4.1Several powerful factors are converging to pull capital into IBIT:

- Regulatory Clarity

Traditional funds face compliance, audit, and custody issues with direct crypto holdings.

IBIT provides a clean, regulated pathway for exposure.

- Inflation & Monetary Pressures

Persistently high inflation and uncertain fiscal policy make Bitcoin a digital hedge, attractive to portfolio managers.

- Network Effects & FOMO

As IBIT’s numbers surge, fear of missing out drives more capital inflows , reinforcing the trend.

- Supply Squeeze

Every BTC acquired by IBIT reduces circulating supply. Less supply + constant demand = higher prices.

- Profitability

With a modest fee structure and high inflows, IBIT generates steady revenue for BlackRock, incentivizing further growth.

5.Impact on Bitcoin, Altcoins, and Market Structure

IBIT’s rise is transforming the crypto ecosystem in multiple ways.

5.1 Bitcoin Price Leverage

Massive inflows have pushed Bitcoin past $125,000, even surpassing Amazon’s market cap. Institutional demand now sets the tone for global price action.

5.2 Altcoin Rotation

Capital often flows from BTC to altcoins as traders chase higher returns ,creating synchronized rallies across MEXC trading pairs.

5.3 Centralization vs. Decentralization

With large funds controlling significant BTC reserves, Bitcoin’s decentralized ethos faces new scrutiny. ETFs like IBIT now hold collective power once spread across millions of wallets.

5.4 Liquidity Shifts

IBIT consistently ranks among the most traded ETFs by volume, influencing global liquidity and price discovery mechanisms.

5.5 Retail vs. Institutional Behavior

Institutions accumulate silently through ETFs, while retail traders react to price signals. This divergence creates volatility and opportunity for smart traders.

6.Risks You Can’t Ignore

Even with IBIT’s dominance, several caveats remain:

- Regulatory Shocks: Any U.S. policy change or SEC ruling can trigger sharp ETF outflows.

- Concentration Risk: Overreliance on a single product amplifies systemic risk.

- Premium/Discount Volatility: ETF shares can temporarily diverge from BTC’s actual price.

- Overheating: Rapid inflows can precede steep corrections.

- Competition: New entrants may dilute IBIT’s lead, changing market sentiment.

Stay informed , what fuels one bull run can also accelerate the next correction.

7.What You Should Do Now?

7.1 This institutional phase presents actionable opportunities for MEXC users:

Ride Bitcoin Momentum

BTC remains the anchor asset. Pair trading (BTC/USDT, BTC/ETH) benefits from directional trends.

Watch Altcoin Rotations

Monitor post-Bitcoin rally rotations , early entries in quality altcoins can outperform.

Avoid FOMO Leverage

Use risk-adjusted entries. Smart scaling beats overleveraged chases.

Track ETF Flows

Follow IBIT’s daily inflow data a strong indicator of institutional sentiment.

Stay Regulatory-Aware

ETF rule changes or taxation news can shift market direction instantly.

8.Final Thoughts

BlackRock’s IBIT nearing $100 billion is more than a milestone, it marks a new era of Bitcoin adoption.

Institutions are now active participants, shaping the crypto narrative.

For traders on MEXC, understanding these capital flows means staying ahead of the market ,not behind it.

- Join the Institutional Wave

Ready to trade like the pros?

Experience Bitcoin and altcoin markets on MEXC Exchange featuring the lowest futures & spot trading fees, deep liquidity, and futures leverage up to 200x.

Start your journey today and ride the wave of institutional adoption with MEXC.

Disclaimer: This content is for educational and reference purposes only and does not constitute any investment advice. Digital asset investments carry high risk. Please evaluate carefully and assume full responsibility for your own decisions

Join MEXC and Get up to $10,000 Bonus!