This article tells Ethereum’s story from the whitepaper to the Merge and beyond. I will focus on the features that actually matter today: the smart-contract architecture, the projects that run on top of Ethereum, the major protocol upgrades that changed token economics, and why institutions and retail users both care. I’ll show the future path, what to watch for, and how you can think about ETH as both a technology and an asset.

1.A short backflash – how Ethereum began

In late 2013, Vitalik Buterin published an essay arguing for a programmable blockchain. Bitcoin was brilliant for value transfer, but it was limited as a platform. Vitalik’s idea was simple and powerful: a general purpose, Turing-complete blockchain where developers could write small programs, called smart contracts. Those contracts would run on a global virtual machine, enforceable by code rather than lawyers.

Ethereum launched in 2015, backed by a small team of builders who wanted to make decentralized applications possible and Within two years the community created token standards, most notably ERC-20 for fungible tokens and ERC-721 for non-fungible tokens. That standardization enabled tokens, decentralized finance and NFTs to grow quickly and The network was never meant to be static. It was designed as a platform that would evolve with the demands of builders and users.

2.What makes Ethereum different?

There are many blockchains and many crypto projects, but three core differences explain Ethereum’s position

First, Ethereum was designed as a programmable platform. The Ethereum Virtual Machine, EVM, is a global runtime where smart contracts execute in the same, predictable way for every participant. This is the technical foundation that allows composability the idea that one app’s output becomes another app’s input. Composability is the secret sauce behind decentralized finance, where protocols can build on each other.

Second, Ethereum standardized token behavior early. ERC-20 made fungible tokens interoperable across wallets and exchanges. ERC-721 and later ERC-1155 allowed unique and semi-fungible assets, which fueled the NFT wave and These standards created developer network effects, which attracted more tools, dApps and liquidity.

Third, Ethereum’s culture is relentlessly iterative. The community governs technical change through Ethereum Improvement Proposals and Over time, the network has shifted from proof-of-work mining to proof-of-stake validation, introduced transaction fee mechanics that burn base fees, and adopted improvements that reduce cost and increase throughput. The result is a platform that remains broadly decentralized but steadily more practical.

2.The major technical turning points

A handful of upgrades and technical shifts matter more than others because they changed how Ethereum looks to builders and institutions

Smart contracts and token standards

ERC-20 and ERC-721 established the rules for tokens and NFTs. Without them, tokens would be isolated experiments. With them, entire ecosystems formed

The Merge, September 2022

Ethereum moved from proof-of-work to proof-of-stake. The immediate effect was a radical drop in energy consumption. More importantly, the Merge changed issuance dynamics. Block rewards to miners vanished, replaced by a model in which validators stake ETH and secure the chain. Staking encourages long-term holding and, together with fee burning, alters supply-growth expectations

Dencun (2024) and proto-danksharding (EIP-4844)

This set of upgrades focused on lowering data costs for layer-2 solutions. By introducing blob transactions and other mechanisms, Dencun made L2 rollups far cheaper. Practically, this slashed the cost of moving data on L2s and accelerated the migration of high-volume activity from mainnet to L2s

Pectra and subsequent upgrades (2025 onward)

Pectra bundled a range of further improvements. Features like batch transactions, improved validator parameters, and gasless transaction patterns make apps more user-friendly. The later roadmap items sharding, PeerDAS for data availability, stateless client improvements are engineering efforts that aim to scale Ethereum by orders of magnitude. Collectively, these upgrades moved Ethereum out of a curiosity into a viable infrastructure for daily apps.

3.The ecosystem that runs on Ethereum

Ethereum’s value is not in the base protocol alone. It’s in the vast ecosystem that uses it.

DeFi

Uniswap, Aave and Maker exemplify finance without intermediaries. Uniswap lets users swap tokens instantly, relying on automated market maker logic. Aave provides lending and borrowing markets. MakerDAO stabilizes a decentralized stablecoin. These protocols together unlock on-chain lending, borrowing, price discovery and synthetic assets

NFTs and digital culture

From collectible avatars to tokenized art and gaming assets, NFTs created a new way to own and trade digital goods. Projects that became cultural touchstones changed the public perception of what blockchain could do for creators and communities.

Layer 2 networks

Arbitrum, Optimism, zkSync, Polygon and others take the transactional load off Ethereum mainnet while keeping final settlement on Ethereum. They reduce fees, increase speed and unlock new classes of applications, notably gaming and micropayments.

Infrastructure and tooling

Wallets, oracles like Chainlink, identity systems and developer frameworks make the platform practical. Exchanges and custodians provide liquidity and institutional access. The result is a full stack that can support complex, multi-party apps.

4.Why Layer 2 matters in practice

Layer 2s are the unsung heroes of Ethereum’s scaling story and They run transactions in a way that reduces fees and increases throughput. From a user’s perspective, interactions on L2 feel like web apps fast and low-cost and From a developer’s perspective, integration with L2s means reaching mainstream users and enabling business models that were impossible under high gas fees.

Put another way, L2s turn Ethereum from a specialist network for high-stakes trades into a platform that can handle micropayments, games and everyday use. That shift is crucial and Without it, the narrative of Ethereum as “digital silver” utility plus value would not hold.

5.Tokenomics, supply and staking and why ETH matters as an asset

The economics of ETH have changed since the Merge and subsequent upgrades.

EIP-1559, fee burning Introduced in 2021, EIP-1559 changed the fee model so that a portion of every transaction fee is burned and Burning reduces circulating supply, particularly during high activity. This was an important first step in making ETH a partial scarcity asset.

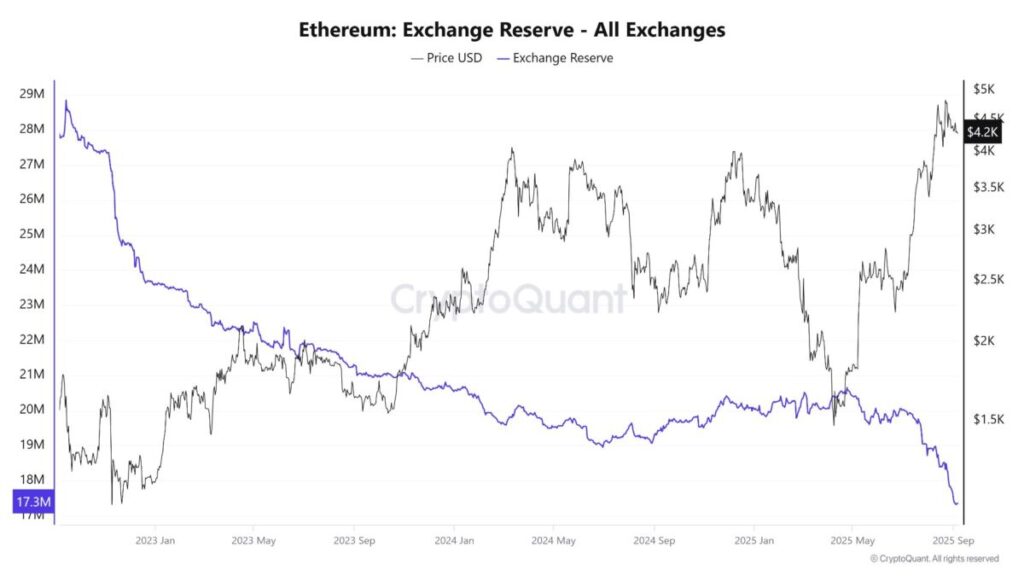

Proof-of-stake issuance After the Merge, issuance dropped dramatically compared to the proof-of-work era and Validators now receive rewards for staking. A large share of ETH is staked, which means it is locked and not trading on exchanges. This decreased sell-side liquidity and contributed to a tighter supply.

Staking and yields Staking provides yields, which attract capital that would otherwise trade hands and Staked ETH is not as liquid, although liquid staking derivatives add partial liquidity with tradeoffs. For investors, staking offers a competing use case to holding ETH as speculative inventory.

Putting this together, the combination of burns, staking and lower net issuance gives ETH economic characteristics that appeal to both builders and investors. It is used as gas to power apps, it is held for yields, and it functions as collateral and reserve through DeFi applications.

6.Institutional adoption and ETFs a structural shift

Institutional flows have been transformative for perception and liquidity.

Asset managers, including some big names, launched products that made ETH accessible to institutional investors who cannot custody spot crypto directly and ETF listings, staking programs and prime custody links turned ETH into a standard component of treasury and asset allocation conversations and When large funds allocate to ETH, market dynamics change not only price, but liquidity, derivatives activity, and the speed of maturation for regulated trading infrastructure.

At the same time, retail remains a powerful force. NFTs, gaming and social applications continue to attract day-to-day users who interact with apps on L2 and through custodial services. Retail behavior drives volume, while institutions drive stability and new use cases like tokenized securities.

7.Notable projects and examples that show Ethereum’s utility

To show how Ethereum becomes useful, here are short profiles of representative projects.

Uniswap : A decentralized exchange with automated liquidity. People use Uniswap to swap tokens instantly, provide liquidity and earn fees, all without approval from a central authority.

Aave : A leading lending protocol. Users supply assets to earn interest and borrow against collateral. Aave is a good example of how crypto-native lending replicates and extends traditional financial services.

OpenSea : A marketplace for NFTs. OpenSea helped mainstream the idea that digital items art, collectibles, game assets can be bought, sold and verified on-chain.

Arbitrum and Optimism : Optimistic rollups that host many of the high-volume apps, making user interactions practical and cheap. Their UX improvements and integrations demonstrate how apps reach mainstream users

Each of these shows different dimensions of Ethereum’s utility. Combined, they make the platform attractive to stakeholders across industries.

What to watch next milestones and signals?

If you want to track Ethereum’s progress, watch for these signals.

- L2 adoption metrics : Transactions per day on L2s, TVL transferred to L2s and the number of active users on rollups. These show real usage.

- Exchange supply : Large withdrawals from exchanges into staking or custody reduce readily available supply.

- Regulatory moves : Clear, supportive regulation for tokenized assets and staking products unlocks institutional flows.

- Protocol upgrades : Successful launches of sharding, PeerDAS, and stateless client improvements will materially raise throughput and lower costs.

- Real-world tokenization : Growth in RWAs and tokenized bonds will show institutional use of the chain.

These are the metrics that turn engineering progress into economic reality.

8.Practical suggestions for builders and traders

For builders: design for L2-first UX, assume users will not hold gas tokens, build guardrails for security, and leverage cross-chain composability where appropriate.

For traders: follow the on-chain flows, monitor ETF activity and staking rates, use dollar-cost averaging, and do due diligence on projects rather than hype.

For content creators and educators: focus on clear how-to content that demystifies wallets, gas, and staking. Real adoption depends on people understanding how to use the tools safely.

9.Conclusion Ethereum as the silver of Web3

Ethereum’s path is not finished, but the narrative is clear. The network has matured from a clever experiment into a practical, evolving infrastructure that powers a diverse economy of apps. The Merge and subsequent upgrades changed its economic profile and Layer 2s changed its usability and Institutional products and tokenization are changing how capital flows and how assets are represented.

Calling Ethereum “Digital Silver” captures its role: useful, versatile, and widely applied and It may not replace Bitcoin as a store of value, but it may become as indispensable to Web3 as silver is to industry a material used across applications that matter in daily life.

If you work with Ethereum as a developer, investor or user, your decision should be practical and Learn how L2s work. Understand staking and token economics. Keep an eye on protocol changes and regulatory signals And remember, this is still early. The infrastructure is being built and The companies, apps and tokenized instruments that matter in a decade are only now being designed.

Join MEXC and Get up to $10,000 Bonus!

Sign Up