The most anticipated DeFi collaboration of 2025 just went live. HyENA Trade—a perpetual futures exchange built on Hyperliquid‘s HIP-3 infrastructure exclusively accepting Ethena’s USDe as collateral—launched December 9, 2025, combining the $10 billion synthetic dollar protocol with the fastest-growing decentralized derivatives platform. The launch represents more than another perp DEX; it’s a strategic integration designed to cement USDe as the dominant collateral asset for on-chain leverage trading while driving massive demand for Ethena’s ecosystem.

The platform went live after months of anticipation following teases on social media in late November. Unlike Hyperliquid’s main exchange which accepts multiple stablecoins, HyENA creates closed-loop demand where every leveraged position requires holding USDe—no USDC, no USDT, no alternatives. This forced adoption strategy transforms USDe from passive dollar-pegged asset into mandatory infrastructure for accessing one of DeFi’s fastest perp DEX environments, with trades executing sub-200 milliseconds and zero gas fees.

For the $50 billion perpetual DEX market currently dominated by dYdX, GMX, and Hyperliquid itself, HyENA represents audacious bet on specialized infrastructure. Rather than competing on breadth (supporting every collateral type), HyENA bets on depth: offering the absolute best experience for USDe holders through integrated staking rewards, revenue sharing with Ethena (reportedly 50% of trading fees), and optimized liquidity. If successful, HyENA could process billions in daily volume while capturing institutional and retail traders already committed to Ethena’s ecosystem—making it the first major perp DEX to achieve product-market fit through strategic vertical integration rather than horizontal expansion.

The Launch: What Just Went Live

Mainnet Activation:

HyENA Trade officially launched on Hyperliquid mainnet December 9, 2025, after a pre-registration period that offered signup bonuses for early adopters. The platform immediately went live with trading capabilities, accepting deposits and enabling perpetual futures trading across multiple asset pairs.

Core Features at Launch:

USDe-Only Collateral: Users must deposit USDe to open leveraged positions. This creates direct utility for Ethena’s stablecoin beyond simple holding or DeFi lending, positioning USDe as required infrastructure for accessing HyENA’s markets. No other stablecoins accepted—period.

Multiple Asset Pairs: While specific markets weren’t fully disclosed pre-launch, HIP-3 infrastructure supports crypto, commodities, bonds, stocks, indices, and synthetic assets. HyENA reportedly will offer derivatives on:

- Major cryptocurrencies (BTC, ETH, SOL, others)

- RWA (Real World Assets) derivatives

- Synthetic assets and indices

- Potential expansion into traditional finance products

Revenue Sharing Model: According to Italian crypto media reports, Ethena receives approximately 50% of HyENA’s trading fee revenue—an unprecedented deal structure that directly feeds protocol income back to USDe/sUSDe holders. This transforms Ethena from pure stablecoin issuer into derivatives infrastructure partner capturing ongoing fee streams.

Hyperliquid Infrastructure: Built on Hyperliquid’s HIP-3 framework, HyENA inherits sub-200ms latency, institutional-grade order matching, and the security of Hyperliquid’s validator set. The platform processes thousands of transactions per second without gas fees typical of Ethereum-based DEXs.

Familiar UI/UX: Interface nearly identical to Hyperliquid’s main exchange, reducing learning curve for existing Hyperliquid traders while maintaining best-in-class user experience that made Hyperliquid a top-3 perp DEX processing $1B+ daily volume.

The Strategic Rationale: Why This Changes Everything

Forced USDe Adoption:

Every leveraged position on HyENA requires USDe collateral. If the platform reaches $100 million in open interest (modest for perp DEXs), that’s $100M+ in permanent USDe demand. Scaling to $1 billion OI, comparable to mid-tier centralized exchanges—would require locking $1 billion+ in USDe, dramatically expanding Ethena’s TVL and fee revenue.

This differs fundamentally from passive USDe adoption where DeFi protocols simply “add USDe support” as one of many stablecoin options. HyENA creates mandatory adoption—want to trade on this platform? Must hold USDe. No alternatives, no compromises.

50% Revenue Share Revolution:

If reports of Ethena receiving 50% of HyENA trading fees are accurate, this represents unprecedented economics for stablecoin issuers. Consider the math:

- HyENA processes $100M daily volume (conservative)

- At 0.045% average taker fees = $45,000 daily revenue

- Ethena’s 50% share = $22,500 daily = $8.2M annually

- This revenue could fund sUSDe rewards, ENA buybacks, or treasury growth

If HyENA scales to $500M-$1B daily (comparable to established perp DEXs), Ethena’s share becomes $41M-$82M annually—transforming the project’s economic model from pure stablecoin issuance to derivatives infrastructure provider.

The Network Effects Play:

By staking 500,000 $HYPE (~$16.3M) to deploy HyENA under Hyperliquid’s HIP-3 framework, Ethena gains:

- Technology: Proven infrastructure processing $1B+ daily volume

- Liquidity: Access to Hyperliquid’s order books and liquidity pools

- Distribution: Exposure to Hyperliquid’s 23,400+ traders and $6.5B cumulative volume

- Credibility: Association with Hyperliquid’s institutional-grade reputation

For Ethena, which struggled through October-November as funding rates collapsed (reducing sUSDe yields), HyENA provides diversified revenue stream independent of perpetual funding rates. This strategic hedge against cyclical funding rate volatility positions Ethena for sustained operations regardless of crypto market conditions.

Hyperliquid’s HIP-3: The Infrastructure Enabling Innovation

What HIP-3 Unlocked:

Hyperliquid’s November 2024 HIP-3 upgrade introduced permissionless deployment of customized perpetual exchanges using Hyperliquid’s technology stack. Any entity staking 500,000 $HYPE can launch a specialized derivatives platform inheriting HyperCore’s proven capabilities:

- Sub-50ms latency and sub-200ms execution

- Institutional-grade order matching

- 100,000 orders per second capacity

- Security of Hyperliquid’s validator network

- Zero gas fees for trading

Reduced Fees for New Markets:

HIP-3 Growth Mode slashes taker fees from standard 0.045% to 0.0045%-0.009%—a 90%+ reduction. For high-frequency traders, this fee compression makes HIP-3 platforms like HyENA potentially cheaper than established alternatives while maintaining identical execution quality.

Examples of HIP-3 Success:

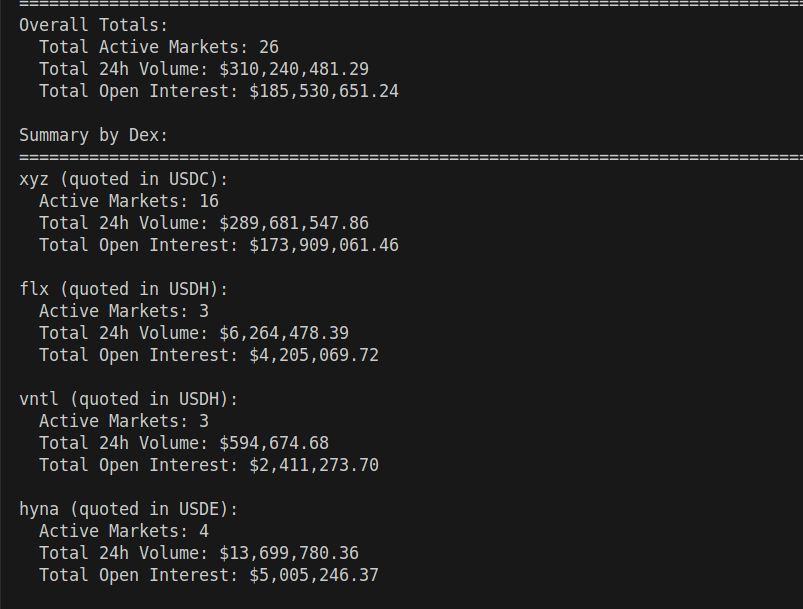

trade.xyz: U.S. stock perpetuals (NASDAQ-100, individual equities) operating 24/7, processed $6.5B volume in under 2 months Ventuals: Pre-IPO company valuation speculation (SpaceX, OpenAI, Anthropic) TROVE: Gaming collectibles, Pokémon cards, CS2 skins, connected to Kalshi prediction markets

HyENA represents the first major stablecoin issuer leveraging HIP-3 infrastructure, validating the framework’s ability to attract institutional-grade partners beyond speculation-focused applications.

Market Positioning: Competing in the $50B Perp DEX Landscape

The Competition:

dYdX: $500M+ daily volume, established leader, cross-margined perpetuals Hyperliquid Main: $1B+ daily volume, fastest-growing, best UI/UX GMX: $100M+ daily, concentrated on Arbitrum, real yield narrative Gains Network: Crypto and forex perps, strong retail following

HyENA’s Differentiation:

Vertical Integration: Instead of competing on breadth (more markets, more collateral types), HyENA owns USDe holders completely. If you’re committed to Ethena’s ecosystem, HyENA offers objectively superior experience versus depositing USDe on generic platforms that treat all stablecoins equally.

Revenue Sharing: Ethena’s 50% fee share creates alignment no competitor can match. dYdX users earn DYDX governance tokens; GMX users earn esGMX; HyENA indirectly benefits USDe/sUSDe holders through protocol revenue that funds yields, making it “trade to earn” model without inflationary token emissions.

sUSDe Integration Speculation: While not confirmed at launch, market expects HyENA to enable automatic sUSDe rewards for traders holding USDe collateral—effectively staking while trading. This “double dipping” (staking yield + trading returns) represents innovation competitors cannot easily replicate.

Fee Competitiveness: HIP-3’s reduced fee structure makes HyENA potentially cheapest option for high-frequency strategies, particularly when combined with any sUSDe rewards offsetting trading costs.

Institutional Appeal: Large traders managing hundreds of millions appreciate single-collateral systems simplifying accounting and risk management. HyENA’s USDe-only model, while limiting for retail, may attract institutional desks already using USDe for treasury operations.

The Risk: Single-Collateral Dependency

Limited Accessibility:

Requiring USDe creates friction competitors don’t impose. Traders holding USDC or USDT must convert to USDe before accessing HyENA—an extra step that may deter users seeking immediate market access.

For comparison:

- Hyperliquid Main: Accepts USDC, USDT, multiple collateral types

- dYdX: Accepts USDC

- GMX: Accepts USDC, ETH, BTC, other assets

HyENA’s exclusive USDe requirement trades accessibility for ecosystem lock-in, betting that USDe’s advantages (potential yields, revenue sharing) outweigh conversion friction.

Concentration Risk:

If USDe depegs or Ethena faces operational failures (hedging losses during extreme volatility), HyENA’s single-collateral dependency becomes existential risk. Users cannot pivot to alternative stablecoins—their capital is stuck in potentially failing system.

Historical precedent exists: UST’s collapse took down entire Terra ecosystem built on single stablecoin assumption. While USDe’s delta-neutral backing differs fundamentally from UST’s algorithmic model, concentration risk remains.

Regulatory Uncertainty:

Ethena operates in regulatory gray area—synthetic dollars backed by derivatives positions may face classification challenges. If regulators determine USDe constitutes unregistered security or if perpetual futures hedging violates securities laws, HyENA built exclusively on USDe faces shutdown risk competitors using regulated stablecoins (USDC) avoid.

Early Market Reception: Cautious Optimism

Crypto Twitter Reaction:

DeFi analysts immediately recognized strategic brilliance. Comments like “Two of DeFi’s biggest innovations this cycle coming together” and “This is how you create sustained USDe demand” dominated initial reactions following the December 9 launch announcement.

Bulls argue HyENA solves Ethena’s scaling problem. USDe adoption has been strong but passive—protocols add it as option alongside USDC/USDT. HyENA makes USDe mandatory, converting optional support into required infrastructure.

Community Concerns:

Collateral Lock-In: Critics note requiring single collateral type creates vendor lock-in. If Ethena faces regulatory crackdowns or operational failures, HyENA users have no recourse—their collateral is stuck in potentially failing system.

Limited TAM: Total addressable market shrinks when excluding users unwilling to convert to USDe. dYdX and Hyperliquid accept any collateral; HyENA only accepts USDe holders. This self-imposed constraint may limit growth ceiling relative to more permissive competitors.

Timing Risk: Launching during market correction (Bitcoin down 28% from October ATH) creates headwinds. New platforms typically launch during bull markets when risk appetite is high; HyENA enters during caution and deleveraging.

ENA and HYPE Token Implications

HyENA’s success directly impacts ENA token value through multiple mechanisms:

Increased USDe Utility: More use cases for USDe translate to higher demand, which benefits ENA holders through:

- Revenue-sharing from HyENA trading fees (50% split)

- Governance rights over expanding ecosystem

- Reflexive demand (successful products drive token speculation)

Staking APY Sustainability: If HyENA drives billions in USDe circulation, the expanded TVL generates more funding rate revenue plus direct trading fee income, sustaining sUSDe yields even as market funding rates compress. The 50% revenue share provides diversified income stream independent of perpetual funding dynamics.

Competitive Moat: Successful HyENA proves Ethena can build ecosystem-specific infrastructure competitors cannot replicate, positioning USDe as more than commodity stablecoin—it’s gateway to unique DeFi products.

Validator Revenue: HyENA transactions generate fees captured by Hyperliquid validators, boosting HYPE token value through revenue accrual.

Ecosystem Validation: Each successful HIP-3 project validates Hyperliquid’s platform strategy. HyENA represents first major external partner (versus internal experiments), proving the model attracts institutional-quality builders.

Strategic Partnerships: Ethena’s decision to build on Hyperliquid (rather than Arbitrum, Base, Solana) signals institutional confidence in the L1’s technology and staying power. This endorsement attracts additional builders considering HIP-3 deployments.

What’s Next: 48-Hour Metrics and Beyond

Immediate Focus (First 48 Hours):

- TVL Tracking: How much USDe flows into HyENA?

- Volume Metrics: Daily trading volume targets ($10M+ would be strong start)

- Active Users: Trader count and retention rates

- Market Pairs: Which assets see most activity?

- Price Action: ENA and HYPE response to launch

Near-Term (First 30 Days):

- $100M+ TVL target (critical validation threshold)

- $50M+ daily volume benchmark

- Integration with Ethena’s broader ecosystem

- Potential sUSDe rewards clarification

- Expansion of supported markets beyond launch pairs

Mid-Term (60-90 Days):

- $500M+ TVL goal (positioning among top-10 perp DEXs)

- Institutional onboarding announcements

- Advanced features (portfolio margining, options, structured products)

- Cross-chain expansion (if USDe scales to other networks)

- Potential $HYENA governance token launch (speculation)

Key Success Metrics:

- USDe Supply Growth: Does HyENA reverse October-November decline?

- ENA Price Recovery: Can HyENA narrative support ENA’s 70% drawdown recovery?

- HYPE Ecosystem Value: Does HyENA cement HYPE as premier derivatives infrastructure?

- Retention: Do traders stay or churn after trying platform?

Conclusion: The Vertical Integration Bet

HyENA Trade’s December 9 launch represents bold experiment in DeFi specialization. While competitors chase horizontal expansion (more markets, more collateral types, more chains), Ethena is betting on vertical integration—owning the complete trading experience for USDe holders through infrastructure that forces adoption.

The strategy’s brilliance lies in mandatory collateral. By making USDe required rather than optional, HyENA converts Ethena from stablecoin issuer into critical infrastructure. Traders who’ve committed to USDe for treasury management, yield farming, or lending now have perp trading venue optimized specifically for their collateral—creating switching costs that cement long-term ecosystem lock-in.

Success isn’t guaranteed. The platform must attract genuine trading volume (not just mercenary farmers chasing rewards), maintain USDe’s peg during volatility, and execute technically without the bugs and exploits that have plagued DEX launches. The single-collateral dependency creates concentration risk that could prove fatal if Ethena faces operational or regulatory challenges.

But if HyENA delivers, it could redefine how stablecoin issuers think about ecosystem development—not as passive infrastructure providers, but as active builders creating products that drive mandatory demand for their assets. The 50% revenue share model is unprecedented, the USDe-only requirement is audacious, and the Hyperliquid partnership is strategically brilliant.

The platform is live. The infrastructure is proven. The first trades are executing. Now comes the hard part: converting launch hype into sustained adoption that justifies the strategic risk of building entire derivatives platform on single stablecoin. For Ethena and Hyperliquid, the next 90 days will determine whether HyENA becomes case study in successful vertical integration—or cautionary tale about over-specialization in markets that reward flexibility.

Disclaimer: This content is for educational and reference purposes only and does not constitute any investment advice. Digital asset investments carry high risk. Please evaluate carefully and assume full responsibility for your own decisions.

Join MEXC and Get up to $10,000 Bonus!

Sign Up