Digital Asset Treasuries (DATs) are a relatively new concept, but given the current market dynamics, they could become a major force shaping the crypto landscape — in the same way ETFs have impacted the industry.

1.What are DATs?

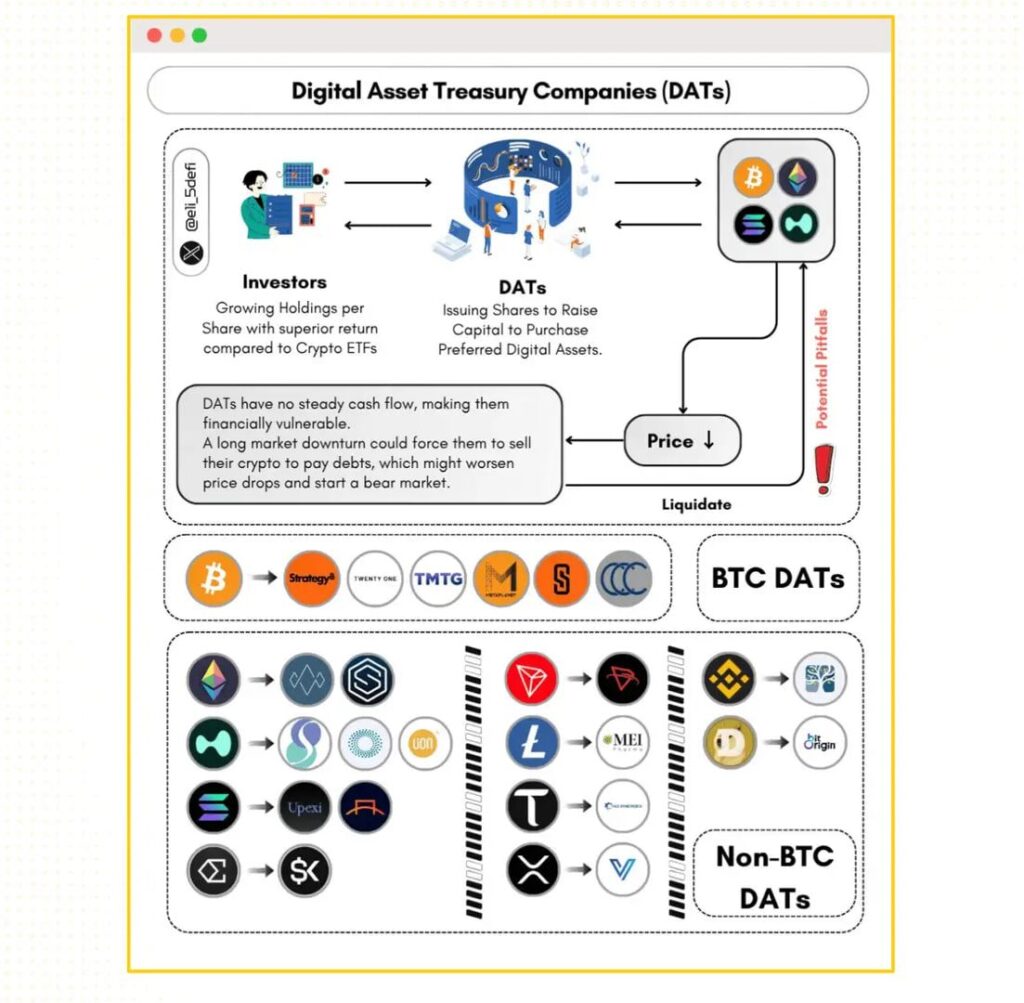

DATs are an emerging financial model in crypto, designed as a “digital asset treasury.” Instead of focusing solely on business operations, these entities issue additional shares, use the proceeds to purchase crypto (Bitcoin/Altcoins), and hold them on the balance sheet. In practice, DATs function like a “basket of digital assets,” consolidating various tokens or on-chain assets to issue their own token — or simply representing value through the company’s listed shares.

Put simply, DATs resemble an “on-chain investment fund,” but with several key differences:

- No regulatory approval required.

- Built natively on blockchain, transparent and automated via smart contracts.

- Broader exposure for investors, who gain access to multiple crypto assets at once rather than buying them individually.

The defining feature of DATs lies in two dynamics:

- Network effects – value compounds as more assets, investors, and projects participate.

- Trust premium – investors are often willing to pay above NAV thanks to transparency and on-chain backing mechanisms.

2. How DATs Work?

DATs can be visualized as a “stock-printing machine to acquire digital assets.”

- On-chain Treasury – DATs hold a basket of assets ($BTC, $ETH, stablecoins, blue-chip altcoins, etc.), which form the foundation of their balance sheet.

- Listed Equity – Many DAT companies are already publicly traded. For instance, a small-cap firm with $10M market cap issues 10M shares at $1 each, with the founder holding 60% and the rest free-floating.

- Raising Capital to Buy Crypto – The company issues new shares to investors (via PIPE or secondary offerings), raising significant capital (e.g., $100M) which is then used to purchase BTC or other crypto. Treasury grows in size.

- Premium → Print More – Once the stock trades above NAV (premium vs. mNAV), the company issues more shares, raises more capital, and buys more crypto. This cycle — raise → buy crypto → premium → raise again — becomes a reinforcing loop.

- Optional Tokenization – Some DATs issue an on-chain token representing treasury or equity, allowing investors to trade it directly within the crypto ecosystem.

The result:

- Diversified risk (treasury isn’t all-in on one coin).

- Dual liquidity channels (public shares + on-chain token).

- A potential infinite flywheel if the premium cycle sustains.

3. Evolution of DATs

The rise of DATs is aligned with clearer regulations (SEC, Bitcoin Spot ETFs, GAAP standards). Instead of directly holding crypto on their balance sheet, companies create separate legal entities (DATs) — optimizing for regulatory, tax, and reporting clarity.

DATs emerged from three key drivers:

- DeFi 2020–21 – proved demand for decentralized finance infrastructure.

- Crypto ETFs 2024 – brought institutional capital but confined within TradFi frameworks.

- Crypto-native funds – demanded ETF-like products that are on-chain, permissionless, and DeFi-compatible.

Implementation models include:

- DATs via RWA tokenization (bonds, gold, stablecoins).

- Specialized DATs (BTC-only, ETH-only, altcoin-focused).

- DAT DAOs – community-managed treasuries.

4. DATs vs. ETFs vs. Crypto

To understand DATs’ role, it’s essential to compare them against two existing models: ETFs and spot crypto.

4.1 Crypto ETFs

- How it works: ETFs are traditional financial products listed on stock exchanges. Institutions like BlackRock or Fidelity manage them, giving investors indirect exposure to BTC/ETH.

- Target investors: TradFi institutions, funds, and risk-averse individuals.

- Risks: Lower than raw crypto (regulated by SEC/government), but lacks freedom and is dependent on third parties.

- Returns: Tracks BTC/ETH closely, but misses “alpha” from altcoins, DeFi, or emerging narratives.

- Impact: Huge. Spot Bitcoin ETFs injected tens of billions into crypto, pushing BTC to new ATHs. ETFs are the bridge that institutionalized crypto.

4.2 DATs (Digital Asset Treasuries)

- How it works: DATs are “digital treasuries,” holding crypto (BTC, ETH, altcoins) with native on-chain mechanics. They can leverage DeFi for yield — e.g., staking ETH, farming stablecoins, or using BTC as collateral to mint synthetic assets.

- Target investors: Crypto-native institutions, hedge funds, DAOs, and retail seeking on-chain exposure.

- Risks: Medium–high. DATs rely on DeFi infrastructure (staking, yield farming), so they face smart contract risks, hacks, and altcoin volatility. But they are more transparent than ETFs, with real-time on-chain audits.

- Returns: More flexible than ETFs. Besides BTC/ETH appreciation, DATs can generate yield via treasury strategies (staking ETH → 3–5% APY, providing liquidity with BTC, etc.).

- Impact: Growing rapidly. DATs reinforce on-chain liquidity, LSD, and RWAs. If ETFs channel TradFi capital into crypto, DATs optimize crypto-native capital already in the system, improving velocity and efficiency.

4.3 Crypto

- How it works: Direct purchase of BTC, ETH, SOL, etc. via CEX/DEX, self-custodied by investors.

- Target investors: Retail, traders, high-risk investors, Gen Z, crypto-natives.

- Risks: Highest. Extreme volatility, custody risk (lose keys = lose funds), scams, exchange hacks.

- Returns: Potentially massive (catching narratives like AI or meme coins), but also high chance of total loss.

- Impact: The “raw blood” of the market. Spot crypto creates narratives and original liquidity, but flows remain fragmented compared to ETFs or DATs.

Summary

- ETF = TradFi capital → Crypto (safe, regulated, BTC/ETH-focused).

- DAT = Crypto-native capital → DeFi & on-chain (flexible, capital-efficient, higher risks).

- Crypto = Market’s lifeblood (high volatility, high reward, narrative creation).

5. Why DATs Matter?

DATs may become one of the core catalysts shaping crypto in the coming years.

Unlike ETFs (passive TradFi inflows), DATs create direct on-chain network effects. Each new DAT buys and locks large amounts of BTC/ETH/altcoins, removing liquidity from circulation and tightening supply. This is comparable to Protocol-Owned Liquidity (PoL), but on an institutional scale.

Impacts of DATs:

- On price: Genuine spot demand, shrinking supply, creating more sustainable upward pressure vs. paper-based ETFs.

- On DeFi ecosystems: DATs can supply liquidity to lending protocols, AMMs, or staking pools, amplifying yield generation and capital rotation.

- On trust: DATs signal institutional on-chain participation — institutions no longer only enter via ETFs but directly interact with decentralized infrastructure.

In short: ETFs are the gateway, DATs are the engine. Once this trend scales, DATs could have deeper and longer-lasting effects on crypto markets than ETFs.

6.Risks of DATs

6.1 The “Machine Stops” – Premium → Discount

- Premium compresses → no new issuance → capital inflows stall.

- Deep discounts (e.g., mNAV $230M vs. mcap $170M, –27%) → companies must buy back shares → forced to sell crypto → spot sell pressure.

- Negative reflexivity: selling crypto → NAV falls → wider discount → more selling. Traders frontrun, accelerating declines.

6.2 Contagion Effects

- Multiple DATs hit discount simultaneously → mass treasury selling.

- DAT A selling BTC/ETH → DAT B’s NAV drops → B sells too → domino effect.

- Prop desks detect signals (shrinking premium, halted ATMs, custody outflows) → short aggressively → cascade.

6.3 Capital & Debt Risks

- Convertible debt: drawdowns → higher cost of capital → refinancing stress.

- Dilution risk: issuance without premium → BPS drops → investor confidence erodes.

6.4 Accounting & Regulatory Risks

- Impairments: deep price drops force write-downs → no reversals allowed → weak earnings.

- Index exclusion: passive funds withdraw → harder for premiums to recover.

- Tokenized DATs: smart contract risks, oracle issues, depeg, potential securities classification.

6.5 Liquidity & Technical Risks

- High premiums → vulnerable to pair trades (long BTC/ETH, short DAT). When premium compresses → arbitrage increases volatility.

- Trading hours mismatch (24/7 crypto vs. stock market hours) → gaps, forced liquidations, sudden premium/discount swings.

Disclaimer: This content is for informational purposes only and does not constitute investment, tax, legal, financial, or accounting advice. It should not be taken as a recommendation to buy, sell, or hold any asset. MEXC provides information solely for reference and is not responsible for any investment decisions made by users. Please ensure you fully understand the risks before investing.

Join MEXC and Get up to $10,000 Bonus!

Sign Up