The cryptocurrency market has once again recorded a notable downturn following the historic crash on October 10, 2025. The decline, led by Bitcoin, triggered a broad selloff across altcoins amid rising tariff tensions — particularly between the United States and China.

1.Market Overview

1.1 General Market Conditions

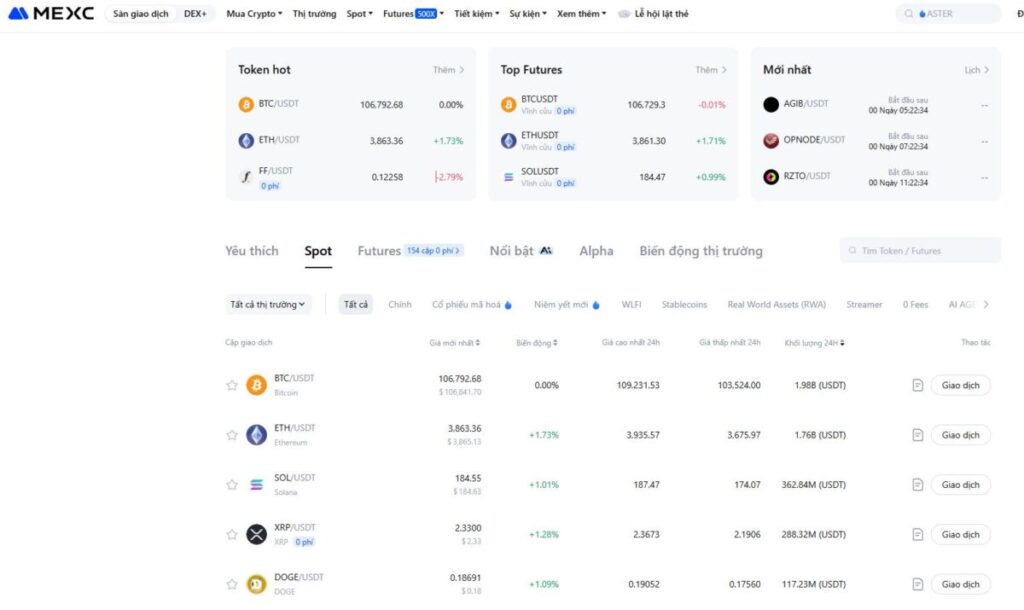

As of October 18, 2025, the global crypto market is undergoing another correction.

The total market capitalization was dropped to around $3.58 trillion, with 24-hour trading volume reaching $273 billion.Bitcoin is currently trading at $110.863, down more than 5% over the past 24 hours, while Ethereum has slipped below $3,900. (Data based on October 18)

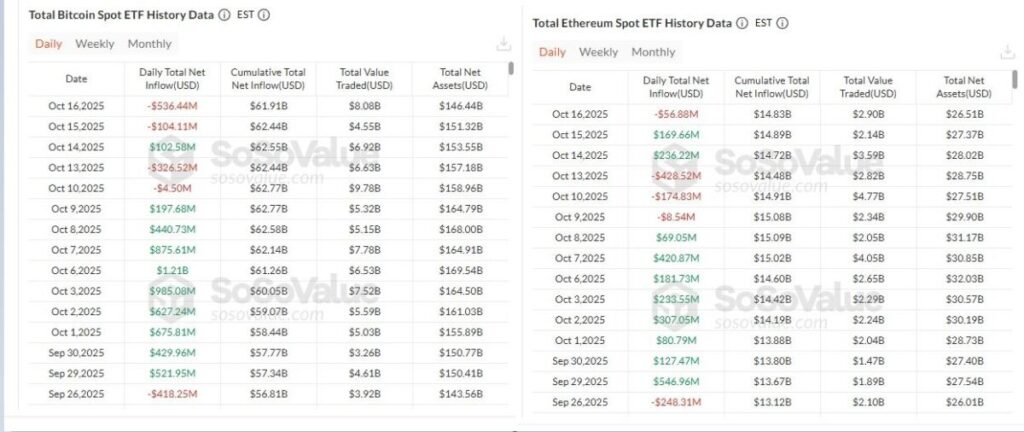

One notable trend is the outflow of funds from crypto ETFs.On October 16, Bitcoin ETFs saw net outflows totaling $536 million, the largest since August. Leading the withdrawals were ARK 21Shares Bitcoin ETF (ARKB) with $275 million and Fidelity’s FBTC with $132 million.Similarly, Ethereum ETFs recorded $57 million in outflows.

According to JPMorgan, this correction is largely driven by high-leverage traders on decentralized exchanges, leading to a wave of liquidations.

Meanwhile, institutional investors using ETFs have mostly held their positions, remaining unaffected by short-term volatility.

The Fear & Greed Index currently stands at 23, indicating extreme fear across the market.However, analysts from Bitwise believe this could represent a buying opportunity rather than a time to panic sell.

1.2 Key Drivers Behind the Market Decline

The recent drop in Bitcoin can be attributed to several factors, including geopolitical tensions and declining institutional interest.

U.S. President Donald Trump has intensified market concerns by threatening to impose higher tariffs on China, to which Beijing responded by vowing to retaliate.

This has further spooked global investors.

Although reports suggest that Trump and Chinese President Xi Jinping are planning a high-level meeting to discuss tariffs, both the financial and crypto markets continue to experience volatility and downward adjustments.

2.U.S. Economic Landscape

2.1 Slowing Economy, Persistent Inflation

The U.S. government remains in a partial shutdown, and President Trump has threatened to fire 4,000 federal employees to pressure Congress to reopen it — a move blocked by federal courts.

The latest Fed Beige Book report shows that U.S. economic growth has remained stagnant since September, with a weaker labor market and many companies are already feeling the impact of the U.S.–China tariffs.

Firms are reluctant to raise prices for fear of losing customers, leading to shrinking profit margins and ripple effects across global supply chains.

The wealth gap in the U.S. continues to widen as assets like gold, real estate, and Bitcoin remain high, benefiting the wealthy, while lower-income groups face spending pressure and minimal savings.

Surveys show that low-income Americans rate the U.S. economy 4.4/10, middle-income respondents 4.9, and high-income respondents 6.2 — all generally pessimistic about the next 12 months.

Inflation remains sticky, not spiking but also not easing significantly.

The Fed is expected to cut interest rates by 0.25% in both October and December to support growth.

Investors and the public largely want the Fed to end its tightening cycle and prioritize job creation and recovery over curbing inflation, which has failed to bring prices back down to pre-pandemic levels.

2.2 Tariff Policy

Recently, Treasury Secretary Scott Bessent announced that the Trump administration will implement minimum price floors across several key U.S. industries to counter China’s market manipulation — especially in rare earths and other strategic sectors.

At the same time, the U.S. government has begun taking equity stakes in certain companies and plans to establish a national mineral reserve, potentially in collaboration with JPMorgan Chase, to secure critical supply chains for defense and technology.

Bessent emphasized that stock market fluctuations will not alter U.S. trade policy, stressing that all decisions will prioritize long-term economic goals rather than short-term market reactions.

Meanwhile, Fed Governor Stephen Miran warned that U.S.–China trade tensions and China’s export restrictions on rare earths are raising economic risks. He urged the Fed to cut rates by another 1.25%, on top of the 0.25% reduction in September, arguing that monetary policy must quickly return to a neutral stance before the late-October FOMC meeting.

Despite tensions, Bessent expressed optimism about U.S.–China relations, saying that both sides continue to maintain active dialogue and that he remains confident in achieving a breakthrough agreement soon.

2.3 Developments in U.S. Crypto Regulation

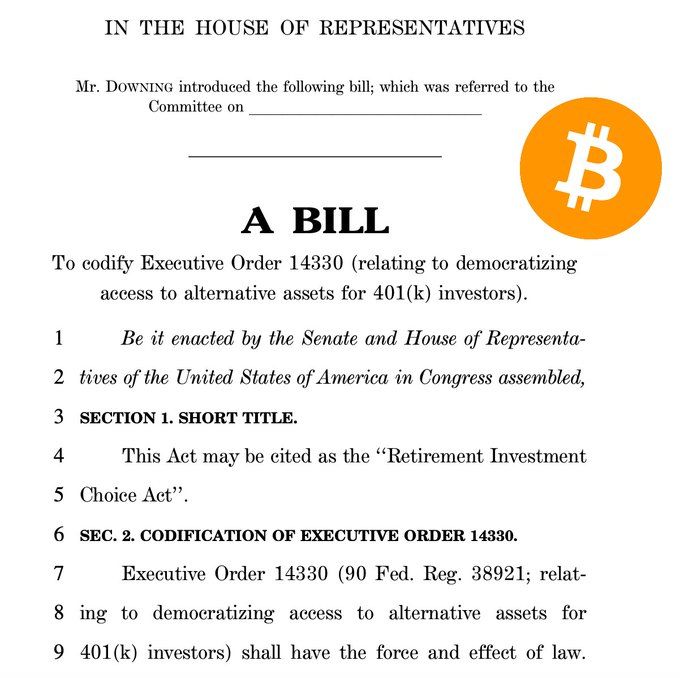

The Republican Party has proposed legalizing Trump’s executive order allowing crypto investments in 401(k) retirement plans under the Retirement Investment Choice Act, introduced by Congressman Troy Downing.If passed, Americans could allocate Bitcoin and digital assets within their retirement portfolios, at the discretion of plan providers.Analysts expect this could unlock billions of dollars in new capital from the $25 trillion U.S. retirement industry flowing into crypto.

Meanwhile, New York City officially launched the Office of Digital Assets and Blockchain, established by Mayor Eric Adams to bridge government, regulators, and the crypto industry.

The office aims to become a hub for blockchain innovation, focusing on public record management and helping crypto businesses navigate regulatory hurdles such as the state’s stringent BitLicense regime.

3.Other Crypto News

- Cloudflare has partnered with Visa, Mastercard, and American Express to develop infrastructure for “agentic commerce” — an economic model where AI agents autonomously shop and make payments. The alliance focuses on creating a Trusted Agent Protocol based on Cloudflare’s Web Bot Auth standard. Cloudflare is also building machine-to-machine payment systems, preparing to launch its NET Dollar stablecoin, and collaborating with Coinbase via the x402 Foundation. With partners including Microsoft, Shopify, Circle, and Worldpay, Cloudflare aims to become the standardized payment infrastructure for secure AI-driven transactions.

- Coinbase Ventures has invested in Indian crypto exchange CoinDCX, valuing it at $2.45 billion post-investment. CoinDCX currently serves 20 million users across India and the UAE, with $141 million in revenue, $165 billion in trading volume, and $1.2 billion in assets under custody. Coinbase views India and the Middle East as key growth markets for global crypto expansion. The deal comes shortly after CoinDCX suffered a $44 million hack, signaling Coinbase Ventures’ continued international push, following investments in Crown, Stablecore, RedotPay, and Bastion.

- A wallet linked to LuBian, the Bitcoin mining pool hacked in 2020, has just moved 9,757 BTC (~$1.1 billion) after over three years of inactivity. The transfer occurred shortly after reports that the U.S. government plans to seize 127,271 BTC (~$14.4 billion) stolen from LuBian. It remains unclear whether the move was for selling purposes or security measures, as the U.S. DOJ recently also seized $15 billion in Bitcoin tied to Prince Group, accused of running forced-labor scam operations in Cambodia — believed to be linked to the original LuBian hack.

- Ripple has partnered with Absa Bank (South Africa) to expand its digital asset custody services into Africa, marking Ripple’s first client in the region. Absa will leverage Ripple’s technology to tokenize and store assets under regulatory compliance. The move aligns with Ripple’s goal to become a global blockchain infrastructure provider, following collaborations with Chipper Cash and its plan to launch the RLUSD stablecoin, positioning South Africa as a leader in digital asset custody.

- Sam Bankman-Fried (SBF), founder of FTX, has claimed his arrest was politically motivated, alleging that the Biden administration targeted him after he secretly donated tens of millions to the Republican Party in 2022. He argues about the timing — just before a Congressional hearing and a key crypto-bill vote — was deliberate. Currently serving a 25-year sentence, SBF is appealing his case and seeking a pardon from President Trump, maintaining that his prosecution is politically driven.

Disclaimer: This content is for educational purposes only and does not constitute investment, tax, legal, financial, or accounting advice. The information provided by MEXC is for reference only. Always conduct your own research (DYOR), understand the risks, and invest responsibly. Data is based on October 18th.

Join MEXC and Get up to $10,000 Bonus!

Sign Up