Kuartal terakhir 2025 kembali mengguncang dunia kripto ketika Base, jaringan Layer-2 besutan Coinbase, secara resmi mengonfirmasi rencana untuk meluncurkan token native mereka. Pengumuman ini datang langsung dari Jesse Pollak di ajang BaseCamp 2025, menandai transisi dari rumor menjadi kenyataan.

Sejak saat itu, aktivitas on-chain di ekosistem Base melonjak tajam. Ribuan pengguna bergegas melakukan transaksi, menjembatani aset, dan berinteraksi dengan protokol DeFi yang semua demi satu tujuan: mendapatkan posisi terbaik untuk airdrop yang bisa menjadi salah satu terbesar tahun ini.

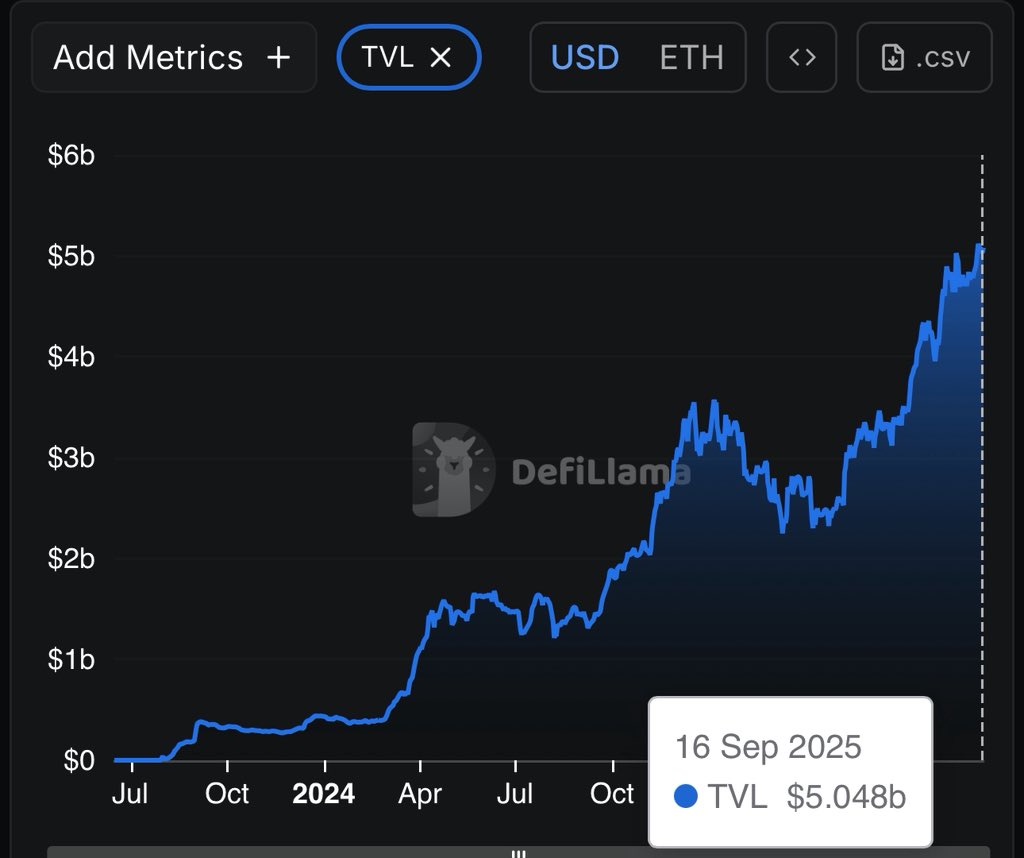

Brian Armstrong, CEO Coinbase, menegaskan bahwa tahapnya masih dalam “eksplorasi awal,” namun pengakuan resmi ini cukup untuk memvalidasi ekspektasi komunitas. Dengan nilai TVL yang sudah mencapai miliaran dolar dan pertumbuhan volume transaksi yang memecahkan rekor, potensi airdrop Base kini menjadi pembicaraan utama di pasar Layer-2.

Langkah Awal Menuju Airdrop Base

Bagi pengguna yang ingin memanfaatkan peluang ini, memahami pola distribusi dari proyek-proyek Layer-2 sebelumnya menjadi kunci. Berdasarkan data historis, partisipasi dini dalam ekosistem sering kali berujung pada reward yang signifikan.

Berikut adalah beberapa langkah penting untuk memaksimalkan peluang airdrop:

- Bridge Aset ke Base

Aktivitas bridging dari Ethereum ke Base kemungkinan besar menjadi syarat utama kelayakan. Volume dan frekuensi transaksi juga penting dan bukan sekadar satu kali transfer besar, tapi aktivitas rutin yang menunjukkan komitmen terhadap jaringan. - Berpartisipasi di DeFi Base

Gunakan protokol-protokol utama seperti Aerodrome Finance, Uniswap V3, atau Compound on Base untuk menyediakan likuiditas dan melakukan pinjaman. Aktivitas ini memperlihatkan keterlibatan nyata dalam ekosistem. - Ikut dalam Ekosistem NFT dan Komunitas

Mint dan perdagangkan NFT di platform native Base, ikuti forum resmi, dan berkontribusi dalam event komunitas. Banyak proyek menilai kontribusi sosial sebagai faktor tambahan dalam alokasi token. - Aktivitas Cross-Chain

Dengan adanya bridge Solana di Base, partisipasi lintas rantai juga bisa menjadi poin bonus. Menghubungkan wallet aktif di Ethereum, Base, dan Solana dapat menunjukkan keterlibatan multi-ekosistem yang lebih luas.

Strategi Lanjutan untuk Optimasi Aktivitas

Bagi pengguna yang serius, ada beberapa strategi lanjutan yang dapat meningkatkan peluang mendapatkan alokasi lebih besar:

- Transaksi Konsisten: Hindari pola aktivitas yang terlihat seperti farming massal. Aktivitas yang alami dan berkelanjutan menunjukkan penggunaan yang autentik.

- Kontribusi Teknis: Developer dapat ikut dalam open-source Base atau membangun dApp kecil sebagai bukti kontribusi ekosistem.

- Likuiditas Produktif: Menyediakan likuiditas saat volatilitas tinggi atau ketika proyek baru diluncurkan dapat memperlihatkan nilai tambah bagi jaringan.

- Gunakan Analitik: Lacak aktivitas wallet dan performa protokol menggunakan DeFi portfolio trackers untuk memantau perkembangan dan bukti partisipasi.

Langkah-langkah ini tidak hanya meningkatkan kemungkinan mendapatkan token, tetapi juga membantu membangun rekam jejak positif di jaringan Base yang sedang berkembang pesat.

Eksposur Awal Melalui Perdagangan di MEXC

Sambil menunggu peluncuran token resmi, trader dapat memanfaatkan peluang melalui perdagangan token ekosistem Layer-2 terkait di MEXC, seperti ARB/USDT atau proyek-proyek Base-native yang baru muncul.

MEXC, sebagai salah satu bursa yang selalu cepat dalam listing aset potensial, menjadi tempat ideal untuk mendapatkan eksposur awal terhadap token yang berhubungan dengan ekosistem Base. Trader dapat memanfaatkan strategi grid trading atau futures trading untuk mengelola volatilitas sambil memperkuat posisi terhadap tren Layer-2 yang tengah menguat.

Kesimpulan

Rencana tokenisasi Base menjadi sinyal kuat bahwa ekosistem Layer-2 memasuki fase matang. Dengan dukungan langsung dari Coinbase, proyek ini berpotensi menjadi airdrop paling signifikan tahun 2025.

Namun, peluang besar datang bersama risiko, belum ada jaminan distribusi, dan syarat akhir bisa berubah. Karena itu, strategi terbaik bagi peserta adalah konsistensi, partisipasi nyata, dan kontribusi bernilai di ekosistem Base.

Bagi pengguna MEXC, ini adalah kesempatan untuk tidak hanya mengikuti hype, tetapi memahami arah baru integrasi antara AI, DeFi, dan Real World Asset (RWA) karena di pasar kripto, mereka yang lebih dulu memahami pergerakan, adalah mereka yang memimpin revolusi berikutnya.

Disclaimer:

Partisipasi dalam airdrop mengandung risiko, termasuk kemungkinan kehilangan dana, tidak adanya jaminan distribusi token, serta potensi kewajiban pajak. Konten ini tidak dimaksudkan sebagai saran investasi. Pengguna disarankan untuk melakukan riset secara mandiri dan memahami seluruh risiko sebelum berpartisipasi dalam aktivitas airdrop. MEXC tidak bertanggung jawab atas hasil airdrop maupun proses kualifikasi pengguna.

Join MEXC and Get up to $10,000 Bonus!

Sign Up