1.What is the CFTC?

The CFTC is a U.S. federal agency whose job is to regulate derivatives markets including futures, options, and swaps , under a law called the Commodity Exchange Act (CEA).

The CEA gives the CFTC authority to oversee trading platforms for commodities and derivatives, ensure market integrity, prevent fraud and manipulation, and protect investors.

Historically, this meant regulating things like agricultural commodity futures, energy derivatives, financial futures , not necessarily cryptocurrencies.

The CFTC Is composed of several divisions (market oversight, clearing & risk, enforcement, etc.), which together monitor trading, settlements, compliance, and enforcement of rules.

With the rise of cryptocurrencies (especially those treated as commodities, like Bitcoin / BTC and Ethereum / ETH), the CFTC’s remit has increasingly overlapped with digital-asset markets.

2. Why CFTC Matters for Crypto

The regulatory landscape for crypto in the U.S. has long been fragmented and ambiguous. Some tokens are treated as securities (falling under the Securities and Exchange Commission, SEC), others as commodities (under CFTC), and regulatory clarity often lacked.

That ambiguity made institutions , big banks, hedge funds and traditional investors cautious. Without clear rules, risk of fraud, lack of oversight, or sudden shutdowns on shady exchanges made many hesitant to engage.

Over the years, CFTC did regulate crypto derivatives (futures, options) but not spot, “cash-market” crypto trades. So while you could trade crypto futures under CFTC oversight, actual buying/selling of crypto was mostly happening on private crypto exchanges, often unregulated or with uncertain legal status.

3. What Changed : CFTC’s December 2025 Decision

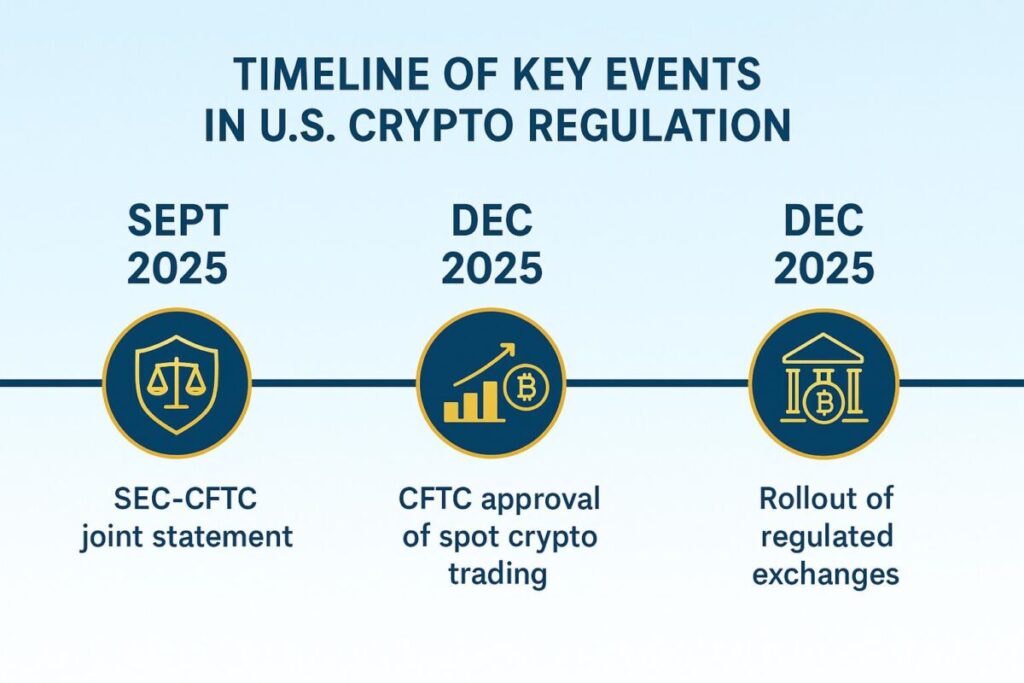

On December 4, 2025, the CFTC announced that listed spot cryptocurrency products will begin trading on CFTC-registered exchanges for the first time.

These are “spot crypto asset contracts” meaning trades where you buy/sell cryptocurrencies like Bitcoin or Ethereum directly (not futures or derivatives).

The approved markets are existing regulated exchanges (so-called “Designated Contract Markets” or DCMs) not new or unregulated crypto-only platforms.

Settlement could occur in actual digital assets e.g., you receive real BTC or ETH upon trade execution.

The move Is part of a broader push by U.S. authorities (under President Donald Trump’s administration) to integrate digital assets into mainstream finance which often referred to as the “crypto-friendly wave.”

This represents a paradigm shift: for the first time, regular , not only derivative crypto trading will be brought under full federal regulation and oversight.

4. The Broader Regulatory Shift: CFTC, SEC & Unified Framework

This December action builds on earlier coordination between the CFTC and the SEC. On September 2, 2025, both agencies issued a joint statement clarifying that registered exchanges under either regulator are not prohibited from facilitating spot crypto trading (as either commodity or security product ,depending on classification).

5. Key points from that statement:

The agencies recognized that existing law (under the CEA and other statutes) already allows for listing of spot crypto asset products.

They invited exchanges and other market participants to engage e.g. file proposals, prepare custody & clearing arrangements to enable spot trading under regulatory oversight.

This joint approach aims to reduce regulatory fragmentation and create a unified, federal-level regulatory perimeter for crypto , instead of a patchwork of state-level rules or unregulated offshore exchanges.

This shift which is sometimes called as “Crypto Sprint” signals a decisive move by U.S. regulators to bring crypto markets into the same regulatory architecture as traditional commodities and securities.

6. What This Means for the Crypto Market : Potential Impact

The CFTC’s move is more than symbolic. If implemented well, it could reshape how crypto markets operate, who participates, and how safe/regulated those markets are. Here’s why It matters:

6.1 Improved Market Integrity & Investor Protection

Because trading will happen on regulated exchanges, with oversight, custody standards, clearinghouses, compliance requirements and risks like fraud, counter-party default, wash-trading or exit-scams are reduced.

6.2 Institutional Participation & Bigger Liquidity

Large financial institutions like banks, funds, asset managers have historically shied away from unregulated exchanges for legal and compliance reasons. A regulated U.S. venue can attract institutional money, increasing liquidity and stabilizing prices. Analysts expect this could shift trading volume from offshore crypto-only platforms to U.S. federal-regulated exchanges.

6.3 Better Price Transparency & Settlements in Real Crypto

Because the contracts settle in actual cryptocurrencies (not just cash-settlement), pricing and settlement will be more transparent and “on-chain,” helping align derivatives and spot markets possibly narrowing the gap between futures and spot prices.

6.4 Regulatory Clarity, Reduced Fragmentation

By bringing crypto under existing regulatory frameworks, U.S. regulators aim to reduce the uncertainty and regulatory fragmentation that have long plagued the crypto space. This could encourage innovation, attract more serious players, and reduce reliance on risky offshore exchanges.

Exchanges Poised to Gain vs. Those Facing Challenges Under U.S. Regulatory Scrutiny

Evolving U.S. regulatory clarity creates “winners” and “laggards” among crypto exchanges.

Exchanges Likely to Benefit:

Exchanges like Coinbase, Kraken, and Bitstamp benefit from established U.S. compliance efforts, deep regulatory alignment within the U.S., and institutional readiness. They gain trust and market credibility through necessary state licenses and federal regulatory alignment.

Key Points: Easier institutional partnerships, lower legal/enforcement risk, established U.S. derivatives access via regulated entities (DCMs).

Exchanges Facing Challenges:

In contrast, exchanges such as Binance, Bybit, KuCoin, Gate.io, and MEXC face significant challenges. These are predominantly international platforms with limited or no U.S. licensing, operating offshore to serve non-U.S. clients.

Key Points: Limited U.S. presence, higher ongoing regulatory scrutiny, need for significant compliance upgrades to enter the U.S. market compliantly.

7. Why This Is a Big Milestone? and Some Open Questions

The December 2025 move by the CFTC marks a historic shift: spot crypto trading , long relegated to unregulated or offshore exchanges can now be brought under the umbrella of traditional, regulated markets. That could redefine how crypto is integrated into mainstream finance, invite institutional participation, and improve safety and transparency.

7.1 But some questions and challenges remain:

Q1:Which specific exchanges will register under CFTC and list crypto spot products? The decision allows “registered futures exchanges”, but roll-out, exchange adoption, and operational readiness remain to be seen.

Q2:Which coins/assets will be supported? While BTC and ETH seem obvious, broader crypto coverage will depend on exchange listings, liquidity, and regulatory review.

Q3:How will custody and settlement be handled? Clearinghouses, custodians, and compliance infrastructure for digital assets will need to scale a non-trivial challenge.

Q:4 What will be the interplay with SEC regulation? Some tokens may be deemed “securities,” especially altcoins meaning SEC involvement; the regulatory classification of many crypto assets remains unresolved.

Global and offshore exchanges outside U.S. jurisdiction may continue to attract international traders or people seeking fewer restrictions which means regulatory fragmentation may persist in practice, even if U.S. markets get more structure.

Conclusion: A Turning Point for Crypto Markets

The CFTC’s decision to allow spot crypto trading on regulated U.S. exchanges represents more than a regulatory adjustment it’s a potential turning point for the crypto industry. For investors (retail and institutional), it means safer, clearer, regulated access to crypto. For markets, it suggests deeper liquidity, better transparency, and a bridge between traditional finance and digital assets.

For the global crypto ecosystem (including exchanges like MEXC), it signals a new standard ,one that may not automatically apply to all platforms, but defines a path toward legitimacy and long-term stability.

If implemented well, we may soon witness crypto markets that are as regulated, transparent, and trusted as traditional commodity and securities markets , which would be a huge win for mainstream adoption.

Disclaimer:This content is for educational and reference purposes only and does not constitute any investment advice. Digital asset investments carry high risk. Please evaluate carefully and assume full responsibility for your own decisions.

Join MEXC and Get up to $10,000 Bonus!

Sign Up