With the Federal Reserve positioned to cut interest rates in September and Cardano holding key technical support levels, analysts are projecting ADA could target $3 in a bullish scenario that would deliver potential 7x returns to investors. As macroeconomic conditions align with improving technical indicators, Cardano stands at a critical inflection point that could determine whether the long-dormant altcoin finally breaks out of its extended consolidation phase.

The convergence of Fed policy accommodation with Cardano’s technical setup has created what many analysts view as the most compelling risk-reward opportunity in major altcoins since the 2021 bull market peak. With ADA trading near key support levels while institutional appetite for alternative cryptocurrencies grows, the stage appears set for what could be Cardano’s most significant price movement in over three years.

Recent analysis suggests that Fed rate cuts combined with Cardano’s strong technical foundation could propel ADA toward $3.38 in optimistic scenarios, representing a dramatic departure from the extended bear market that has suppressed altcoin valuations since early 2022. This potential breakout would mark Cardano’s return to relevance in a crypto market increasingly dominated by Bitcoin and Ethereum.

1. Federal Reserve Policy Shift: The Macro Catalyst ADA Needs

The anticipated September interest rate cuts represent a fundamental shift in monetary policy that could provide the macroeconomic tailwinds necessary for Cardano’s long-awaited breakout from multi-year consolidation levels.

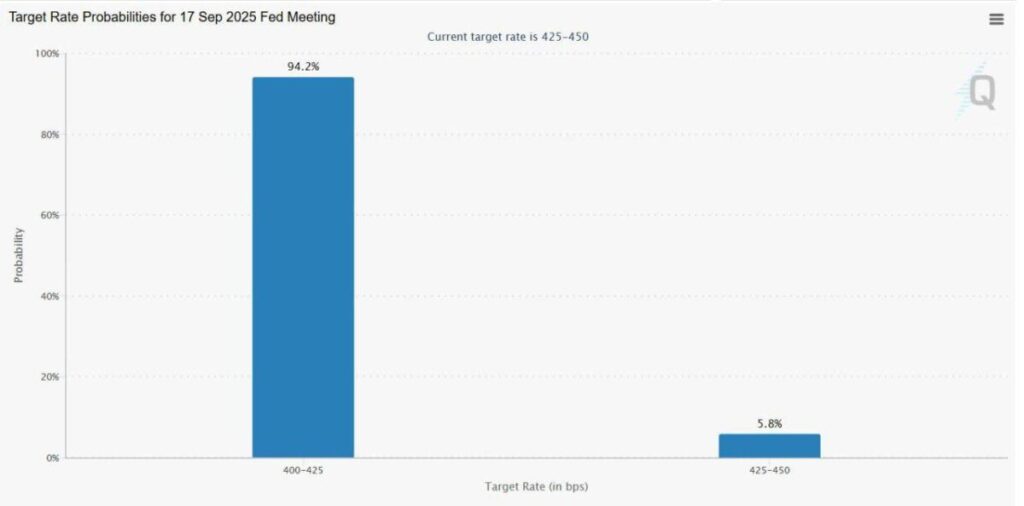

1.1 September Rate Cut Certainty Builds Altcoin Optimism

Market expectations for Federal Reserve rate cuts in September have solidified following Chair Jerome Powell’s dovish Jackson Hole speech, creating favorable conditions for risk assets including alternative cryptocurrencies that have underperformed during the extended high-rate environment.

Lower interest rates typically drive capital toward higher-risk, higher-reward investments as traditional fixed-income yields become less attractive relative to crypto’s potential returns. This dynamic has historically benefited altcoins like Cardano that offer substantial upside potential during favorable monetary policy cycles.

The timing of rate cuts coincides with Cardano’s technical positioning at key support levels, creating potential for synchronized fundamental and technical catalysts that could drive sustained price appreciation rather than temporary speculative moves.

1.2 Risk Asset Rotation and Altcoin Season Potential

Fed policy accommodation typically triggers risk asset rotation as investors seek higher yields than traditional investments can provide in lower rate environments. This rotation effect often benefits altcoins disproportionately compared to Bitcoin and Ethereum, which have become more correlated with traditional markets.

Cardano’s positioning as a major smart contract platform with unique technical characteristics makes it a likely beneficiary of institutional rotation toward alternative crypto assets during periods of monetary accommodation and increased risk appetite.

The psychological impact of Fed policy shifts often creates momentum effects where initial price movements attract additional investment, potentially amplifying Cardano’s response to rate cut announcements and implementation.

1.3 Historical Precedents and Monetary Policy Correlation

Analysis of previous Fed policy cycles reveals strong correlations between monetary accommodation and altcoin performance, with Cardano showing particular sensitivity to interest rate changes due to its positioning as a growth-oriented technology investment.

During the 2020-2021 monetary accommodation period, Cardano experienced its most significant price appreciation, reaching all-time highs above $3 as investors rotated toward technology-focused cryptocurrencies with long-term development potential.

The current setup shows similarities to previous pre-rate-cut periods where Cardano consolidated at technical support before experiencing significant breakouts following Fed policy announcements and implementation.

2. Technical Analysis: ADA’s Critical Support Test

Cardano’s current technical positioning suggests the cryptocurrency is testing crucial support levels that have historically served as launching points for major price movements during favorable market conditions.

2.1 Key Support Level Analysis

Cardano is currently holding key technical support levels that have provided reliable buying opportunities during previous market cycles, with current price action suggesting potential for either decisive breakdown or explosive breakout depending on broader market catalysts.

The technical support confluence includes multiple timeframe support levels, historical price memory zones, and Fibonacci retracement levels that have provided significant buying interest during previous correction periods.

Volume analysis around current support levels shows signs of accumulation rather than distribution, suggesting that long-term holders and institutions may be adding positions at current price levels in anticipation of policy-driven rallies.

2.2 Resistance Levels and Breakout Targets

Analysis of Cardano’s resistance structure reveals clear targets for potential breakouts, with the $3 level representing a psychologically significant milestone that would confirm the end of ADA’s extended bear market phase.

The path to $3 involves breaking through several intermediate resistance levels that have capped previous recovery attempts, though Fed policy accommodation could provide the momentum necessary to overcome these technical barriers.

In bullish scenarios, technical analysis suggests Cardano could reach $3.38, representing potential 7x returns from current levels and marking a return to price levels not seen since the peak of the previous bull market cycle.

2.3 Volume and Momentum Indicators

Recent volume patterns around Cardano’s current price levels suggest accumulation by sophisticated investors who may be positioning ahead of anticipated Fed policy changes and broader altcoin market recovery.

Momentum indicators are showing signs of stabilization after extended oversold conditions, creating potential for rapid acceleration if fundamental catalysts like rate cuts provide the trigger for renewed buying interest.

The combination of oversold technical conditions with improving fundamental backdrop creates asymmetric risk-reward profiles where limited downside risk is paired with substantial upside potential during favorable policy environments.

3. The $3.38 Bullish Case: 7x Return Potential

Technical and fundamental analysis converges on a bullish scenario where Cardano could achieve $3.38 pricing, representing one of the most compelling risk-adjusted opportunities in major altcoins during the current market cycle.

3.1 Price Target Methodology and Projections

The $3.38 target derives from multiple analytical approaches including technical pattern completion, historical cycle analysis, and fundamental valuation models that account for Cardano’s development progress and market positioning.

Fibonacci extension analysis from previous market cycles suggests $3.38 represents a logical target based on historical price relationships and market structure patterns that have governed Cardano’s long-term price movements.

The target aligns with pre-2022 price levels where Cardano achieved sustained trading, suggesting market memory effects could provide support once ADA breaks above current resistance levels.

3.2 Risk-Reward Analysis and Position Sizing

The potential for 7x returns creates compelling risk-adjusted return profiles, though investors must consider position sizing carefully given the inherent volatility associated with such dramatic price appreciation scenarios.

Current price levels near technical support provide relatively defined risk management opportunities where stop-loss levels can be placed below key support with contained downside risk relative to substantial upside potential.

The asymmetric risk-reward profile becomes particularly attractive when combined with Fed policy tailwinds that could provide sustained fundamental support rather than temporary speculative momentum.

3.3 Timeline and Catalyst Dependencies

Achievement of $3.38 targets depends heavily on Fed policy implementation timing and broader crypto market recovery, with September rate cuts serving as potential catalyst for initiating the breakout sequence.

Historical analysis suggests major altcoin moves typically develop over 3-6 month periods once initiated, implying that achievement of bullish targets could extend into early 2026 if current favorable conditions persist.

The scenario requires both technical breakout confirmation and sustained fundamental support, making timing and risk management crucial factors for investors seeking to capitalize on potential 7x return opportunities.

4. Cardano’s Fundamental Strengths: Beyond Price Speculation

While technical analysis and macro conditions create compelling trading opportunities, Cardano’s fundamental development and ecosystem growth provide underlying support for sustained higher valuations.

4.1 Development Progress and Technical Milestones

Cardano’s continued development of its proof-of-stake infrastructure and smart contract capabilities has created a mature blockchain platform capable of supporting significant transaction volume and complex applications.

The platform’s focus on academic rigor and peer-reviewed development has resulted in robust technical architecture that differentiates Cardano from faster-moving but potentially less stable blockchain projects.

Recent upgrades and ongoing development milestones provide fundamental justification for higher valuations, particularly if Fed policy accommodation drives increased interest in technology-focused crypto investments.

4.2 Ecosystem Growth and Adoption Metrics

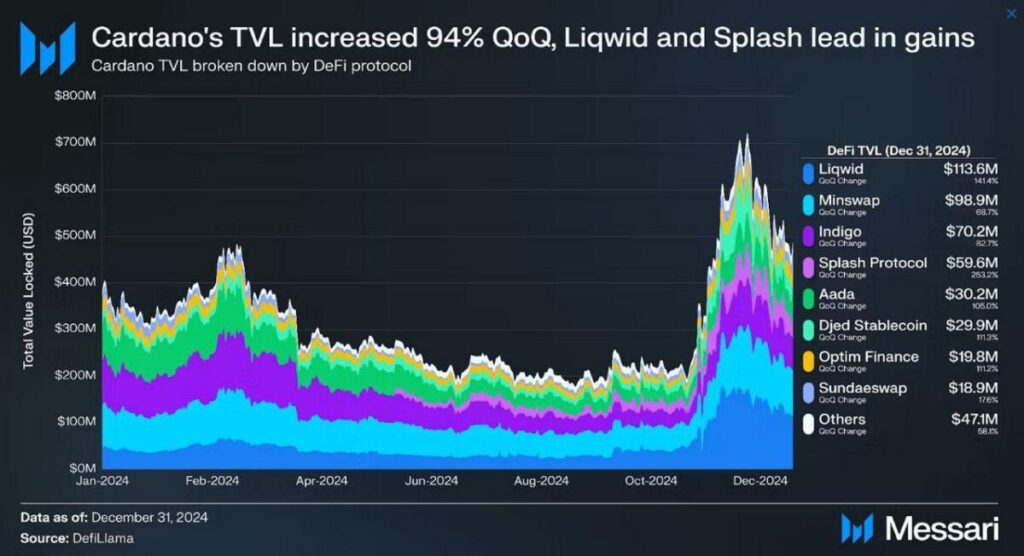

Cardano’s ecosystem has shown steady growth in developer activity, total value locked in DeFi applications, and overall network usage despite price underperformance during the extended bear market period.

Growing institutional interest in proof-of-stake networks for ESG compliance and energy efficiency considerations provides additional fundamental support for Cardano’s long-term value proposition.

The combination of technical development progress with improving macroeconomic conditions creates potential for fundamental valuation catch-up with ecosystem growth and development milestones.

4.3 Competitive Positioning and Market Share Potential

Cardano’s unique approach to blockchain development and governance positions it favorably for capturing market share in specific use cases including identity management, supply chain tracking, and institutional DeFi applications.

The platform’s regulatory-conscious development approach may provide advantages as cryptocurrency regulation evolves and institutions seek compliant blockchain infrastructure for business applications.

Sustained development progress during the bear market has positioned Cardano to capitalize on renewed institutional interest if Fed policy accommodation drives capital toward alternative crypto investments.

5. Institutional Interest and Market Dynamics

Growing institutional recognition of Cardano’s technical merits combined with improving macroeconomic conditions creates potential for renewed professional investor interest that could drive sustained price appreciation.

5.1 Institutional Adoption Trends

Recent institutional crypto allocation trends show growing interest in proof-of-stake platforms that offer yield generation opportunities while maintaining environmental sustainability credentials important for ESG-focused institutional investors.

Cardano’s staking mechanism provides institutional investors with yield opportunities that become more attractive in lower interest rate environments, potentially driving allocation increases as Fed policy becomes more accommodative.

The platform’s regulatory-conscious approach and academic development methodology appeal to conservative institutional investors who require robust risk management and compliance frameworks for crypto investments.

5.2 Staking Yield and Income Generation

Cardano’s staking rewards provide institutional investors with income generation opportunities that become more attractive as traditional fixed-income yields decline following Fed rate cuts.

The current staking yield environment offers competitive returns compared to traditional income investments, particularly in lower rate scenarios that make alternative investments more attractive on a risk-adjusted basis.

Institutional staking participation could create natural supply constraints that support higher prices if demand increases following Fed policy accommodation and renewed altcoin interest.

5.3 ESG Considerations and Sustainability Focus

Growing institutional focus on environmental sustainability and ESG investing criteria favors proof-of-stake platforms like Cardano over energy-intensive proof-of-work alternatives.

Corporate treasury diversification trends may increasingly favor environmentally sustainable cryptocurrencies as companies seek to balance investment returns with sustainability goals and public relations considerations.

The alignment of Cardano’s technical architecture with institutional ESG requirements creates potential for sustained allocation increases that could support higher valuations independent of speculative trading activity.

6. Risk Assessment and Alternative Scenarios

While bullish scenarios for Cardano appear compelling, investors must consider potential risks and alternative outcomes that could prevent achievement of $3+ price targets.

6.1 Fed Policy Risk and Rate Cut Delays

Delays or reversals in anticipated Fed rate cuts could undermine the macroeconomic foundation supporting bullish altcoin scenarios, potentially extending Cardano’s consolidation phase or triggering breakdown below current support levels.

Unexpected inflation resurgence or economic strength could cause Fed policy to remain restrictive longer than currently anticipated, creating headwinds for risk assets including alternative cryptocurrencies.

Market expectations for rate cuts are substantial, creating potential for disappointment if Fed communications or economic data suggest less accommodation than currently priced into altcoin valuations.

6.2 Technical Breakdown Scenarios

Failure to hold current support levels could trigger technical breakdown scenarios where Cardano tests significantly lower price levels before finding sustainable support for recovery attempts.

Extended consolidation or breakdown scenarios would delay achievement of bullish targets and could require fundamental reassessment of Cardano’s competitive positioning and development progress.

6.3 Competition and Market Share Risks

Increasing competition from other smart contract platforms and layer-2 scaling solutions could limit Cardano’s ability to capture market share growth necessary to justify higher valuations.

Rapid development and adoption by competing platforms could overshadow Cardano’s methodical development approach, potentially limiting investor interest even in favorable macroeconomic environments.

The success of bullish scenarios depends partly on Cardano maintaining competitive relevance and development momentum relative to faster-moving blockchain platforms with different technical approaches.

7. Trading Strategy and Risk Management

Successfully capitalizing on Cardano’s potential breakout requires careful attention to position sizing, risk management, and timing considerations that account for both upside potential and downside risks.

7.1 Position Entry and Risk Management

Current price levels near technical support provide relatively favorable entry opportunities for investors seeking exposure to Cardano’s bullish scenario potential while maintaining defined risk through stop-loss placement below key support.

Position sizing should account for the volatile nature of altcoin price movements and the potential for significant drawdowns even during ultimately successful breakout scenarios.

Dollar-cost averaging approaches may be appropriate given uncertainty around timing of Fed policy implementation and market response, allowing investors to build positions gradually while managing timing risk.

7.2 MEXC Trading Tools for ADA Opportunities

MEXC’s comprehensive trading infrastructure provides essential tools for capitalizing on Cardano’s potential breakout while managing the risks associated with volatile altcoin trading.

The platform’s advanced order types including stop-losses, take-profits, and trailing stops enable sophisticated risk management strategies that can protect capital during adverse moves while capturing gains during favorable price action.

Futures markets provide additional positioning options and hedging capabilities that allow traders to implement complex strategies around Cardano’s breakout potential while managing downside risk through derivatives positions.

7.3 Timeline Considerations and Catalyst Monitoring

Successful Cardano trading requires attention to Fed policy developments, technical level breaks, and ecosystem development milestones that could serve as catalysts for major price movements.

The September Fed meeting represents a critical catalyst that could initiate the breakout sequence, though sustained follow-through will depend on broader market conditions and Cardano-specific development progress.

Investors should prepare for extended consolidation periods even in bullish scenarios, as major altcoin moves typically develop over several months rather than occurring immediately following catalyst events.

8. Conclusion: Cardano at a Critical Crossroads

Cardano stands at one of the most compelling risk-reward inflection points in its trading history, with Fed policy accommodation potentially providing the catalyst for breaking out of multi-year consolidation toward $3+ targets that would deliver substantial returns to patient investors.

The convergence of improving macroeconomic conditions, technical support holding, and continued fundamental development creates a scenario where Cardano could achieve its most significant price appreciation since the 2021 bull market peak. However, success depends on execution of multiple factors including Fed policy follow-through, technical level maintenance, and sustained ecosystem growth.

For investors willing to accept the inherent volatility and timing uncertainty associated with altcoin investments, current conditions present asymmetric risk-reward opportunities where limited downside risk is paired with potential for 7x returns in bullish scenarios.

MEXC’s comprehensive trading infrastructure provides the tools necessary for implementing sophisticated strategies around Cardano’s breakout potential while maintaining appropriate risk management protocols for volatile altcoin trading.

Whether Cardano achieves its bullish targets or faces extended consolidation will likely be determined by events over the next few months, making careful position management and catalyst monitoring essential for investors seeking to capitalize on this potential inflection point.

The September Fed meeting and subsequent months will reveal whether current optimistic scenarios translate into sustained price appreciation or whether Cardano requires additional time for fundamental development to drive eventual valuation recognition.

Disclaimer:This content is for educational and reference purposes only and does not constitute any investment advice. Digital asset investments carry high risk. Please evaluate carefully and assume full responsibility for your own decisions.

Join MEXC and Get up to $10,000 Bonus!

Sign Up