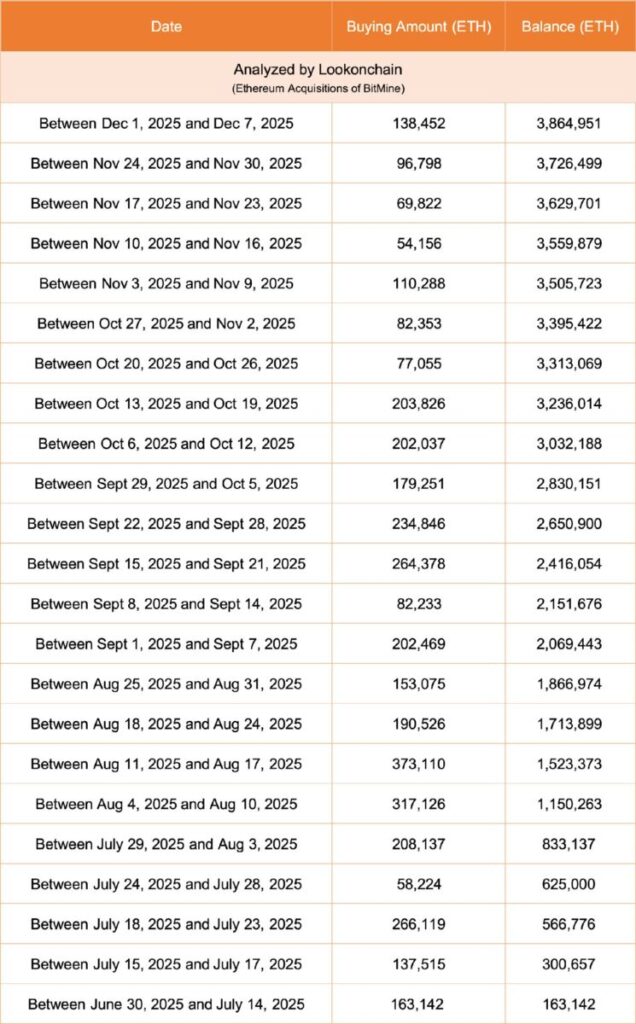

Tom Lee’s BitMine Immersion Technologies just became the most aggressive Ethereum accumulator in crypto history. On December 8, 2025, the company announced its Ethereum holdings now exceed 3.86 million ETH, worth approximately $12.1 billion at current prices, representing more than 3.2% of Ethereum’s entire circulating supply. With an additional $1 billion in cash reserves, BitMine’s total crypto and cash holdings stand at $13.2 billion, positioning it as the world’s #1 Ethereum treasury and #2 global crypto treasury behind only Strategy Inc’s $59 billion Bitcoin hoard.

The accumulation strategy has intensified dramatically. BitMine acquired 138,452 ETH in the past week alone, a 156% increase from its weekly pace four weeks ago, spending approximately $435 million at current prices. This buying spree comes as Ethereum’s Fusaka upgrade on December 3 enhanced network scalability, and as Lee released his December chairman’s message titled “The Crypto Supercycle is Intact,” forecasting Ethereum could reach $62,000 based on institutional adoption and the coming transformation of Wall Street tokenization.

For a company that traded at $4 per share in June 2025 before rocketing to a $161 high and settling around $34 today, BitMine represents one of 2025’s most volatile yet compelling investment theses. With 3.86 million ETH accumulated, a fiscal 2025 net income of $328 million, and America’s first major crypto dividend declared, BitMine is betting everything that Ethereum becomes the backbone of tokenized finance—and that Tom Lee’s $62,000 prediction isn’t hyperbole but inevitability.

The Numbers: $13.2 Billion in 8 Months

BitMine Holdings as of December 7, 2025:

– Ethereum: 3,864,951 ETH valued at $3,139 per token = $12.1 billion

– Bitcoin: 193 BTC = ~$18 million

– “Moonshots“: $36 million stake in Eightco Holdings (NASDAQ: ORBS)

– Cash: $1.0 billion unencumbered

– Total: $13.2 billion in crypto + cash + equity holdings

Supply Ownership:

BitMine now owns more than 3.2% of Ethereum’s total token supply, described by Chairman Tom Lee as “two-thirds of the way to the ‘Alchemy of 5%'”—a threshold Lee believes would create structural supply scarcity similar to MicroStrategy’s Bitcoin accumulation strategy.

Acquisition Velocity:

The company’s buying pace has accelerated dramatically:

– Week of December 1: 138,452 ETH acquired ($435M at current prices)

– Previous 4 weeks: Average 54,156 ETH per week

– Increase: 156% week-over-week acceleration

BitMine spent $130.78 million to acquire 41,946 ETH in a single purchase earlier this week, with the transaction executed as Ethereum broke above $3,200 following positive momentum from the Fusaka upgrade.

Market Performance:

Despite holding $12+ billion in ETH, BitMine trades at approximately $13 billion market cap—implying the market values the company’s cash, Bitcoin, equity stakes, and future staking operations at roughly $1 billion combined. This creates interesting valuation dynamics where BMNR stock essentially trades at a slight premium to net asset value.

Tom Lee’s $62,000 Ethereum Prediction

Fundstrat Global Advisors co-founder and BitMine Chairman Tom Lee released his December message forecasting a crypto “supercycle” that could drive Ethereum to $62,000—a 1,850% increase from current levels around $3,200.

The Bull Thesis:

Institutional Tokenization:

Lee argues that “Wall Street tokenizing everything onto the blockchain” represents a multi-trillion dollar shift comparable to the 1971 end of Bretton Woods and the gold standard. He stated: “The best years are ahead for crypto given the substantial upside to current adoption rates for crypto and given the coming transformation as Wall Street tokenizes everything onto the blockchain.”

This isn’t speculative—major institutions are moving. Nasdaq-listed companies Synaptogenix and Oblong have acquired $17.5 million in TAO (Bittensor) tokens since June 2025, mirroring MicroStrategy’s Bitcoin strategy. If corporate treasuries begin diversifying into Ethereum at scale, demand could overwhelm available supply.

The GENIUS Act and SEC Project Crypto:

Lee describes the GENIUS Act (establishing federal stablecoin framework) and SEC’s Project Crypto initiative as “as transformational to financial services in 2025 as US action on August 15, 1971 ending Bretton Woods.” These regulatory clarifications remove barriers preventing institutional participation, potentially unleashing pension funds, endowments, and sovereign wealth funds into crypto markets.

Fusaka Upgrade Impact:

Ethereum’s December 3 Fusaka upgrade dramatically improved scalability through PeerDAS (Peer Data Availability Sampling), increased gas limits from 45M to 60M, and stabilized blob fees. Lower transaction costs make Ethereum more competitive with Solana and other high-throughput chains, potentially reclaiming market share lost during 2024-2025’s fee crisis.

Federal Reserve Policy:

Lee expects the Federal Reserve to cut interest rates December 10 and end quantitative tightening, creating macro tailwinds for risk assets. Lower rates reduce opportunity cost of holding non-yielding assets like crypto, while increased liquidity flows into speculative investments.

The $62K Path:

If Ethereum captures even 10% of global financial asset tokenization (derivatives, bonds, equities, real estate), the total value locked could exceed $10+ trillion. With Ethereum as settlement layer capturing fees and requiring ETH for gas, sustained demand coupled with fixed supply creates conditions for exponential price appreciation.

The MicroStrategy Playbook: Bitcoin’s Precedent

BitMine’s strategy mirrors Michael Saylor’s MicroStrategy, which transformed from struggling software company into Bitcoin treasury behemoth.

MicroStrategy Comparison:

– Strategy (MSTR): 650,000 BTC valued at $59 billion (#1 global crypto treasury)

– BitMine (BMNR): 3.86 million ETH valued at $12 billion (#2 global crypto treasury, #1 Ethereum treasury)

The Mechanics:

Both companies issue debt and equity to purchase crypto, betting that token appreciation will outpace dilution costs. MicroStrategy pioneered “Bitcoin yield”, measuring how much BTC accumulation per share increases despite stock issuance. BitMine applies the same framework to Ethereum.

Stock Performance Parallels:

MicroStrategy’s stock has dramatically outperformed Bitcoin itself due to leverage and institutional access. Investors who couldn’t (or wouldn’t) buy Bitcoin directly purchased MSTR stock, creating premium valuations above net asset value.

BitMine appears to be following similar trajectory. After June-July rally from $4 to $161, the stock crashed 79% to current $34 levels, but remains 770% above its 52-week low. This volatility mirrors early MicroStrategy, where stock price swung wildly as markets digested the unconventional treasury strategy.

The Liquidity Advantage:

BitMine trades $1.8 billion average daily volume, ranking #37 among all U.S. stocks—ahead of Goldman Sachs (#38) and behind CrowdStrike (#36). This liquidity makes BMNR accessible to institutional investors who face restrictions on direct crypto purchases, creating structural buying pressure independent of ETH price movements.

The Made in America Validator Network (MAVAN)

Beyond accumulation, BitMine is building staking infrastructure that could generate sustained yield on its massive ETH holdings.

MAVAN Overview:

The Made in America Validator Network represents BitMine’s “best-in-class” Ethereum staking solution launching Q1 2026. Rather than delegating to third-party staking services, BitMine will operate its own validator infrastructure, capturing 100% of staking rewards.

Economic Impact:

With 3.86 million ETH, even conservative 3-4% staking yields generate:

– 115,800 – 154,400 ETH annually (~$363M – $485M at current prices)

– Daily rewards: 317 – 423 ETH (~$1.0M – $1.3M)

These rewards compound over time. Unlike Bitcoin (which doesn’t stake), Ethereum holdings generate perpetual income streams that partially offset dilution from future equity raises to purchase more ETH.

Competitive Moat:

Operating proprietary validators provides several advantages:

– No counterparty risk: Avoiding Coinbase, Lido, or other staking providers

– Maximum rewards: No third-party fees reducing yields

– Governance control: BitMine can participate in Ethereum governance with full voting power

– Strategic flexibility: Ability to optimize validator operations for maximum efficiency

Pilot Testing:

BitMine announced it’s conducting pilot tests with three partners ahead of the Q1 2026 full launch. While specifics remain undisclosed, the testing phase suggests the company is taking validator security seriousl, —a critical concern given the billions at stake.

The First Crypto Dividend: $0.01 Per Share

In a move unprecedented among large-cap crypto companies, BitMine declared an annual dividend of $0.01 per share on November 21, 2025.

Dividend Details:

– Amount: $0.01 per share

– Ex-Dividend Date: December 5, 2025

– Record Date: December 8, 2025

– Payment Date: December 29, 2025

– Forward Yield: ~0.03% at $34 stock price

Why This Matters:

The dividend amount is negligible, roughly $0.30 million total payout based on ~300 million fully diluted shares. But the symbolism is significant. BitMine becomes the first large-cap crypto treasury company to declare a cash dividend, signaling confidence in sustained operations and profitability.

For comparison, MicroStrategy has never paid dividends, preferring to reinvest all capital into Bitcoin accumulation. BitMine’s dividend, however small, suggests management believes the company can both accumulate ETH aggressively AND return capital to shareholders.

Tax Implications:

The dividend creates taxable events for shareholders, which could complicate holdings in tax-advantaged accounts. However, for institutions seeking income-generating crypto exposure, even small dividends provide justification for positions that pure accumulation strategies cannot offer.

Conclusion: All-In on Ethereum’s Future

BitMine Immersion Technologies represents one of the purest bets on Ethereum available to traditional investors. With 3.86 million ETH representing 3.2% of total supply, the company has created a self-fulfilling dynamic: if Ethereum succeeds, BitMine succeeds massively; if Ethereum fails, BitMine becomes worthless.

Tom Lee’s $62,000 ETH prediction isn’t guaranteed, it requires institutional adoption at unprecedented scale, regulatory clarity materializing, and Ethereum maintaining technological superiority over competitors. But the infrastructure is being built. The GENIUS Act passed. SEC’s Project Crypto is real. And BitMine is betting $13.2 billion that Lee’s thesis proves correct.

For investors, BMNR offers leveraged Ethereum exposure with added complexity. The stock trades at significant volatility (770% range from 52-week low to high), faces dilution from continuous equity raises, and carries execution risk on staking infrastructure. But it also provides:

– Access to ETH through traditional brokerage accounts

– Potential staking yields unavailable to direct ETH holders

– Management team with decades of Wall Street experience

– First-mover advantage as crypto treasury pioneer (after MicroStrategy)

The next 6-12 months will determine whether BitMine becomes a case study in visionary accumulation—or a cautionary tale of overleveraged speculation. With MAVAN launching Q1 2026, the January 15 shareholder meeting providing strategic updates, and Ethereum potentially benefiting from macro tailwinds, the stage is set for 2026 to be BitMine’s defining year.

If Tom Lee is right about $62,000 ETH, BitMine’s 3.86 million tokens would be worth $239 billion—making it one of the most valuable companies in America. If he’s wrong, shareholders may discover that betting the farm on a single volatile asset has consequences. The only certainty: it won’t be boring.

Disclaimer: This content is for educational and reference purposes only and does not constitute any investment advice. Digital asset investments carry high risk. Please evaluate carefully and assume full responsibility for your own decisions

Join MEXC and Get up to $10,000 Bonus!

Sign Up