October 2025 is shaping up to be Bitcoin’s most disappointing month in a decade. As of October 27th, BTC is down about 5% month-to-date, a stark contrast to October’s historical average gain of 19.8%. With Bitcoin trading around $116,629, the Fear & Greed Index sitting at 30 (Fear), and 74% of cryptocurrencies losing value in the last 24 hours, sentiment is unmistakably bearish.

But here’s what most traders miss: Bitcoin’s worst months often precede its best rallies. Market weakness isn’t just noise, it’s a setup. Understanding why October disappointed and what historically follows could position you ahead of the next major move.

1.The Numbers: October 2025 vs Historical Performance

Let’s start with the facts. Bitcoin entered October trading near $117,000 after a strong September. By October 26, it had declined to $111,629—a 4.6% drop. Adding intraday volatility that briefly pushed BTC below $108,000 earlier this month, October 2025 has delivered losses not seen since October 2015, when Bitcoin fell 10% in a much smaller, less mature market.

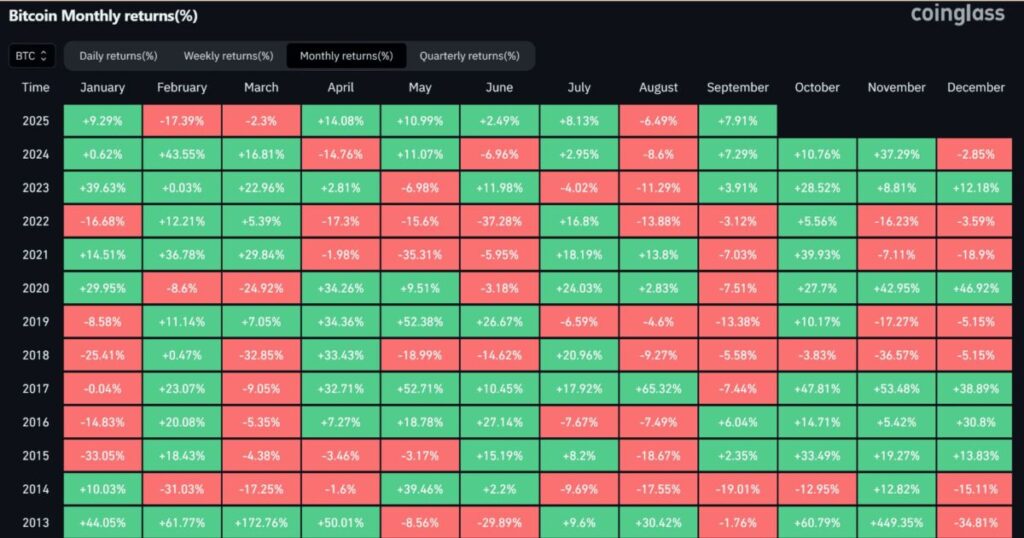

Historically, October has been one of Bitcoin’s strongest months. From 2013 to 2024, Bitcoin gained an average of 19.8% in October, with positive returns in 8 out of 12 years. The pattern earned October the nickname “Uptober” among crypto traders. So what went wrong in 2025?

2.Why October 2025 Disappointed: Three Key Factors

2.1 Macro Uncertainty: U.S.-China Trade Tensions and Fed Policy

October 2025 coincided with renewed U.S.-China tariff discussions that rattled global risk assets. While crypto markets have matured beyond simple “risk-on/risk-off” correlations, major geopolitical shocks still influence short-term sentiment. When traditional markets face uncertainty, institutional investors reduce exposure to volatile assets like Bitcoin, triggering selling pressure.

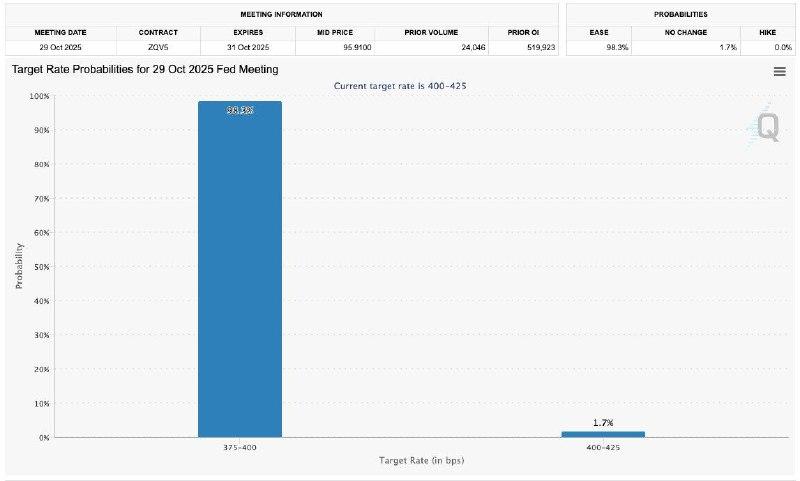

Additionally, Federal Reserve policy remains in flux. Markets had priced in a 25 basis point rate cut at the October 28-29 FOMC meeting with 95% certainty, but mixed economic data created uncertainty about the pace of future cuts. This uncertainty kept institutional capital on the sidelines, limiting the buying pressure needed to sustain a rally.

2.2 Weakening ETF Inflows

Bitcoin spot ETF inflows—a key driver of 2024’s rally—have declined sharply in October 2025. Weekly inflows dropped from over $2.5 billion in early summer to under $500 million by mid-October. While cumulative ETF holdings remain strong at $143.93 billion (6.75% of Bitcoin’s market cap), the slowing pace of new capital suggests institutional conviction has cooled.

Without consistent institutional buying, Bitcoin lacks the structural demand needed to push through resistance levels. ETF investors aren’t selling aggressively, but they’re not adding new positions either—creating a supply/demand stalemate that keeps price range-bound.

2.3 Profit-Taking After Strong 2024-2025 Rally

It’s easy to forget how far Bitcoin has come. From lows near $16,000 in late 2022 to a peak above $126,000 in October 2025, Bitcoin has delivered over 687% returns in less than three years. Approximately 95% of circulating BTC is currently in profit, creating massive potential for profit-taking.

On-chain data shows realized profit (the aggregate gains locked in when holders sell) spiked to $1.9 billion in late October—the second-highest reading of 2025. This indicates long-term holders are taking chips off the table, reducing the available supply of “strong hands” willing to hold through volatility.

3.The Contrarian Case: Why November Could Deliver Big Returns

While October’s weakness is frustrating for bulls, history suggests disappointing October performance often sets up explosive November rallies. Here’s why:

3.1 Pattern 1: Weak October, Strong November

Historical data shows an inverse relationship between October and November performance. When October underperforms (returns below +5%), November tends to overperform (returns above +15%). This pattern held in 2018, 2019, and 2022. The logic is simple: sellers exhaust themselves in October, clearing overhead resistance and setting up a clean chart for November buyers.

In October 2022, Bitcoin fell 0.5% while markets fretted over Fed tightening. November 2022 saw Bitcoin drop another 16% due to FTX’s collapse—an exception to the pattern driven by a black swan event. But in 2023, weak October performance (flat to slightly down) preceded a 9% November rally that kicked off the 2024 bull market.

3.2 Pattern 2: Fear Readings Signal Capitulation

The Fear & Greed Index currently sits at 30 (Fear). Historically, readings below 35 mark periods of maximum pessimism and maximum opportunity. When retail sentiment turns fearful, it often signals that selling pressure is near exhaustion. Smart money accumulates when fear is high and sentiment is bearish, then profits when greed returns.

Current sentiment aligns with previous market bottoms: bearish positioning, low conviction, and pervasive doubt about Bitcoin’s ability to break higher. These are the conditions from which rallies emerge.

3.3 Pattern 3: Technical Setup: Compressed Coil Waiting to Spring

Bitcoin has traded in a relatively tight range between $107,500 and $118,000 for most of October. This consolidation creates a “compressed coil” pattern—price coiling tighter as buyers and sellers reach equilibrium. When consolidation breaks, the resulting move is often sharp and sustained in the breakout direction.

Current technical indicators suggest this breakout is approaching:

- RSI (Relative Strength Index) has reset from overbought levels above 70 to neutral territory near 54

- Open interest in Bitcoin futures has declined, reducing leverage and liquidation risk

- Support at $107,500-$108,000 has held through multiple tests, suggesting strong accumulation at these levels

If Bitcoin breaks above $115,000-$117,000 on strong volume, it could trigger a rapid move toward $120,000-$125,000 as shorts cover and momentum buyers re-engage.

4.Catalysts That Could Ignite November’s Rally

Several macro and crypto-specific catalysts could flip sentiment from fear to greed in coming weeks:

4.1 Catalyst 1: Federal Reserve Rate Cut (October 28-29)

The FOMC meeting on October 28-29 is widely expected to deliver a 25 basis point rate cut. If Chair Jerome Powell signals additional cuts ahead or adopts a dovish tone, it could trigger a risk-on rally across stocks, bonds, and crypto. Lower rates reduce the opportunity cost of holding Bitcoin and increase investor appetite for alternative assets.

4.2 Catalyst 2: End-of-Year Institutional Positioning

As Q4 progresses, institutional investors begin positioning for year-end reporting. Firms that missed Bitcoin’s rally earlier in the year may decide to add exposure before 2025 closes, not wanting to explain to clients why they sat out a 600%+ asset appreciation. This “performance chasing” dynamic can create significant buying pressure in November-December.

4.3 Catalyst 3: Corporate Treasury Announcements

Recent corporate Bitcoin purchases (like Metaplanet’s 5,268 BTC addition) demonstrate continued institutional interest. If another major public company announces a Bitcoin treasury allocation in November, particularly a U.S.-based firm—it could reignite the “corporate FOMO” narrative and drive retail participation.

4.4 Catalyst 4: Election Cycle Dynamics

With the 2026 U.S. midterm elections approaching, political rhetoric around crypto regulation is intensifying. Recent policy developments like the CLARITY Act and GENIUS Act provide regulatory clarity that reduces uncertainty. If additional pro-crypto legislation advances in November, it removes a key barrier to institutional adoption.

5.How Traders Should Position Now

Given October’s weakness and November’s potential, here’s a strategic framework:

For Conservative Traders:

- Wait for a confirmed break above $115,000-$117,000 before adding new positions

- Use tight stop-losses below $107,500 to limit downside

- Target initial profits at $120,000, letting runners extend toward $125,000+

For Aggressive Traders:

- Accumulate near support zones ($108,000-$111,000) with scaled entries

- Use MEXC Futures with moderate leverage (5-10x) and strict risk management

- Set take-profit levels at $117,000, $120,000, and $125,000

For Long-Term Investors:

- October weakness represents a potential accumulation opportunity

- Dollar-cost average into positions over the next 2-3 weeks

- Focus on Bitcoin’s long-term trajectory (institutional adoption, ETF inflows, corporate treasuries) rather than short-term noise

Risk Management Is Critical:

- Never allocate more than 2-5% of your portfolio to any single position

- Use stop-loss orders to define maximum acceptable loss before entering trades

- If Bitcoin breaks below $107,000 decisively, the bullish thesis is damaged and caution is warranted

6.The Bottom Line: Opportunity in Disguise

Bitcoin’s worst October in 10 years feels disappointing in real-time, especially after expectations for “Uptober” were high. But experienced traders know that markets don’t move in straight lines. Periods of consolidation, profit-taking, and weak sentiment are normal, and often necessary, for sustainable rallies to develop.

The key insight: October’s weakness has cleared the market of weak hands, reset technical indicators, and created a setup where positive catalysts can have maximum impact. If the Fed delivers dovish guidance, if institutional buying resumes, or if a major corporate treasury announcement hits, Bitcoin could move fast.

November 2025 may not replicate the 40-50% gains of previous bull market Novembers, but a 10-15% rally from current levels ($111K to $125K+) is entirely plausible given the technical and fundamental setup. The traders who position now, when sentiment is fearful and most investors are sitting on the sidelines—are the ones who’ll profit when conviction returns.

As Warren Buffett famously said: “Be fearful when others are greedy, and greedy when others are fearful.” With the Fear & Greed Index at 30 and Bitcoin consolidating near support, the market is offering an opportunity. The question is whether you’ll take it.

READY TO POSITION FOR NOVEMBER’S POTENTIAL RALLY?

Trade Bitcoin on MEXC with zero maker fees, tight spreads, and advanced risk management tools. Don’t miss the next breakout.

Disclaimer: This content is for educational and reference purposes only and does not constitute any investment advice. Digital asset investments carry high risk. Please evaluate carefully and assume full responsibility for your own decisions.

Join MEXC and Get up to $10,000 Bonus!

Sign Up