As November 2025 unfolds, the cryptocurrency market witnesses Bitcoin and Ethereum navigating through pivotal price points. This analysis delves into the current market dynamics and future predictions for these leading cryptocurrencies.

Bitcoin’s Market Position in November 2025

Bitcoin, having reached near $110,000, exhibits a cautious sentiment following a lackluster October. Despite attempts to rebound from recent Wall Street session losses, continuous selling pressure was evident in US exchanges and spot Bitcoin exchange-traded funds (ETFs).

According to on-chain research by Glassnode, significant ETF outflows were recorded, indicating increased sell pressure from traditional finance investors and a drop in institutional demand. UK-based Farside Investors reported approximately $191 million exiting spot Bitcoin ETFs, highlighting a broader market hesitancy.

The recent interest rate cut by the US Federal Reserve did little to sway the markets, with Glassnode noting a maintained hawkish outlook for December, tempering any burgeoning optimism.

Bitcoin Price Prediction: A Cautious Market Below $120K?

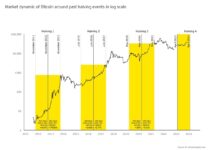

Analyzing the price action, Bitcoin continues to hover near $110,000. Market analysts, including Ali Martinez, speculate whether the current market structure supports a potential surge toward $250,000 by year-end. Historical data shows Bitcoin enduring significant drawdowns in past years but reclaiming key resistance levels in recent months. The monthly MACD indicators suggest a flattening momentum, signaling a possible consolidation phase as the market approaches the $120,000 mark.

Despite these challenges, the underlying uptrend from the 2022 bottom suggests resilience, with Bitcoin still charting higher highs and lows over the two-year period.

Ethereum’s Current Market Stance

Ethereum, on the other hand, showcases stability above the critical support zone of $3,600-$3,750. Recent price movements indicate a strong defense of this level, with potential signs of a bull-flag pattern forming below the $4,100-$4,250 resistance area.

Analysts from Bitbull highlight that Ethereum’s market structure remains positive, although the momentum needed for a breakout has not fully materialized. A decisive move above the resistance could propel Ethereum towards the $5,000-$6,000 range, aligning with bullish forecasts for the coming months.

Significant trading activity, including a notable order of over 30,000 ETH on Binance, suggests preparatory movements for a potential upward trajectory. Ethereum’s ability to maintain its uptrend after breaking a long-term downtrend earlier in the year reinforces its bullish outlook.

Looking Ahead: Ethereum’s Prospects in Late 2025

As the market progresses into the latter part of 2025, all eyes will be on Ethereum to gauge whether it can sustain the momentum and possibly lead the next major rally in the crypto market. The broader uptrend and consistent formation of higher lows provide a solid foundation for such optimism.

With both Bitcoin and Ethereum at critical junctures, the coming weeks will be crucial in determining the trajectory of these top cryptocurrencies as we approach the end of 2025. Investors and traders alike are advised to keep a close watch on market signals and potential shifts in investor sentiment that could influence price movements.

For more insights and updates on cryptocurrency trends, continue to follow our detailed market analysis and predictions.

Disclaimer: This post is a compilation of publicly available information. MEXC does not verify or guarantee the accuracy of third-party content. Readers should conduct their own research before making any investment or participation decisions.

Join MEXC and Get up to $10,000 Bonus!

Sign Up