The chain split incident on the Cardano network wasn’t just a technical mishap. It was a rare phenomenon in the blockchain world — a space that prides itself on stability and strong consensus. Yet this very incident has opened up big questions about long-lingering bugs, AI-generated code, and governance that few have dared to openly discuss.

To understand this story as more than just “drama on X,” we need to dig deeper: why this incident happened, why it’s serious, and what kind of warning it sends to the entire blockchain industry.

1. What really happened to Cardano?

The Cardano chain split incident began with a transaction that appeared extremely simple — a delegation transaction, something that happens on the network every day. But the key difference here is that this transaction wasn’t written manually by a human; it was generated by a piece of AI-produced code. While AI can create transactions that are syntactically valid, it cannot fully understand all the constraints and internal logic of a blockchain system.

When this transaction propagated across the network’s nodes, a rare phenomenon occurred: some nodes accepted it as valid, while others rejected it. This disagreement happened because nodes used different software versions or had different processing configurations, causing them to react inconsistently to a malformed transaction — one that has an unusual structure but isn’t fully invalid.

This inconsistency triggered the chain split:

- Branch A continued building blocks that included the faulty transaction.

- Branch B discarded the transaction and followed a different path.

Two parallel chains emerged, each competing to establish the network’s “truth.” In the blockchain world, this is extremely dangerous because it threatens the consensus mechanism — the core component that ensures the entire system remains unified.

What’s even more concerning is this: the incident wasn’t caused by a sophisticated attack, nor by any group of hackers, but by a single AI-generated line of code that an operator tested accidentally. This left the community unsettled: if just one transaction can destabilize a multi-billion-dollar network, is Cardano truly as resilient as it claims to be?

2. The 2022 Bug: A Time Bomb Hidden Inside the System

When developers and the technical community dug deeper into the incident, they discovered something far more concerning: the bug that caused the chain split wasn’t new at all. It was a vulnerability dating back to 2022, documented long ago but never fully resolved. This bug lived within the validation layer — the component known as the “gatekeeper,” responsible for deciding which transactions are allowed to pass and which must be rejected.

If this gatekeeper makes different decisions on different nodes, the blockchain immediately falls into an unstable state. The validation layer’s core responsibility is to ensure absolute consistency. But the 2022 bug caused this layer to evaluate unusual transactions differently depending on the circumstances.

The troubling part isn’t just the existence of the bug — it’s how long it remained in the system. It persisted across multiple versions, improvements, and audits yet continued to lurk beneath the surface. A flaw that survives three years without being eliminated completely shows that Cardano’s development and maintenance processes have serious structural issues.

Even more unsettling, this incident suggests that other “dormant bombs” may also exist within the Cardano system. A major blockchain network operates on decentralized trust, yet that trust can be undermined by a tiny flaw buried deep in the codebase. The long-term accumulation of unresolved risks — not the AI-generated transaction itself — is what makes the situation truly alarming.

3. AI-generated code: The double-edged sword the blockchain world isn’t ready for

Cardano’s incident marks a very special milestone in blockchain history: the first time a major chain split was triggered by AI-generated code. This forces us to take a more serious look at both the power — and the danger — of AI as it penetrates the blockchain development space, a domain that demands absolute precision and security.

Modern AI can produce complete code in seconds. With just a few short instructions, it can build a transaction, write a smart contract, and even generate complex systems without requiring the developer to think too much. But this convenience hides a critical weakness: AI doesn’t understand blockchain the way humans do.

AI does not grasp:

- the subtlety of consensus mechanisms,

- the sensitivity of validation logic,

- the rare edge cases that can lead to catastrophic consequences,

- how the system reacts to abnormal or malformed data.

To AI, a syntactically correct transaction is “valid.” But in blockchain, syntax alone is never enough — it must be logically correct, contextually correct, and aligned with all the implicit rules embedded deep inside the codebase.

Because of this lack of understanding, AI can generate transactions that look perfectly fine on the surface but contain unusual characteristics — like a shiny apple that is rotten inside. If such transactions make it into the system, they can trigger latent bugs and lead to large-scale incidents like a chain split.

What’s truly worrying isn’t that AI accidentally caused an issue — it’s that AI is opening a new era of risk:

- Malicious actors can use AI to mass-produce thousands of edge-case transactions to probe for vulnerabilities.

- Inexperienced operators may rely on AI without understanding the consequences.

- AI-generated code may fall outside the reach of traditional auditing processes.

In short, AI can become a powerful tool for advancing blockchain development, but without strong protective layers, it can just as easily become an unintentional engine of chaos. Cardano is the first victim — but certainly not the last.

4. Cardano Governance: Who Is Controlling Whom?

When the incident settled, the community’s biggest question wasn’t “What did the AI do?” but rather:

“Why was a stake pool operator allowed to test risky code directly on the mainnet?”

This question goes straight to the heart of Cardano’s governance model — how authority and responsibility are distributed in a decentralized network. And here, the long-overlooked cracks suddenly became impossible to ignore.

In a decentralized system like Cardano, stake pool operators (SPOs) play a critical role. They run nodes, validate transactions, produce blocks, and keep the network stable. However, with great power comes great responsibility — and without the right controls, that power can turn into a major source of risk.

This incident revealed that:

- Cardano lacks a strict sandbox or isolated test environment for SPOs. This makes them more likely to test directly on the mainnet — an extremely dangerous practice.

- There is no automatic validation layer capable of blocking malformed or high-risk transactions before they reach the mempool. If such a system existed, the AI-generated malformed transaction would have been stopped immediately.

- The network lacks real-time behavioral monitoring for nodes. An SPO can send multiple experimental transactions without triggering clear alerts.

- Not all operators have the deep technical expertise to fully understand the implications of unusual transactions. In a decentralized environment, operator competence varies widely. This unevenness amplifies systemic risk.

Decentralization is good — but decentralization must come with controlled decentralization.

A blockchain cannot place the safety of the entire ecosystem in the hands of individuals acting independently without adequate safeguards.

Cardano has been building an ambitious governance framework, but the chain split incident shows it is still missing several crucial layers of protection to limit mistakes from node operators — the very people running the backbone of the network. And in the blockchain world, a small mistake can trigger a massive chain reaction.

5. Drama on X: When a Technical Incident Turns Into a War of Opinions

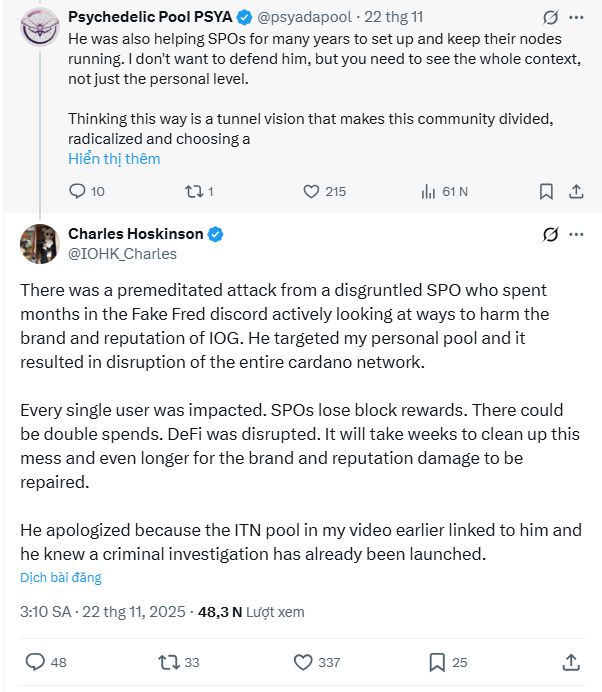

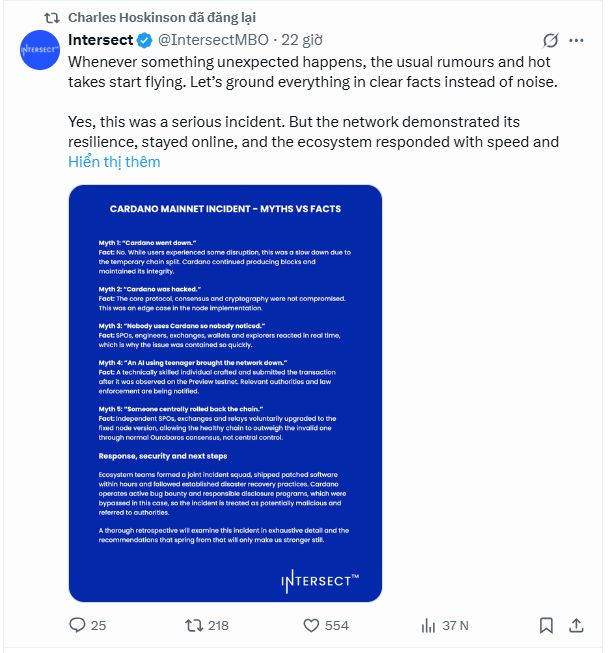

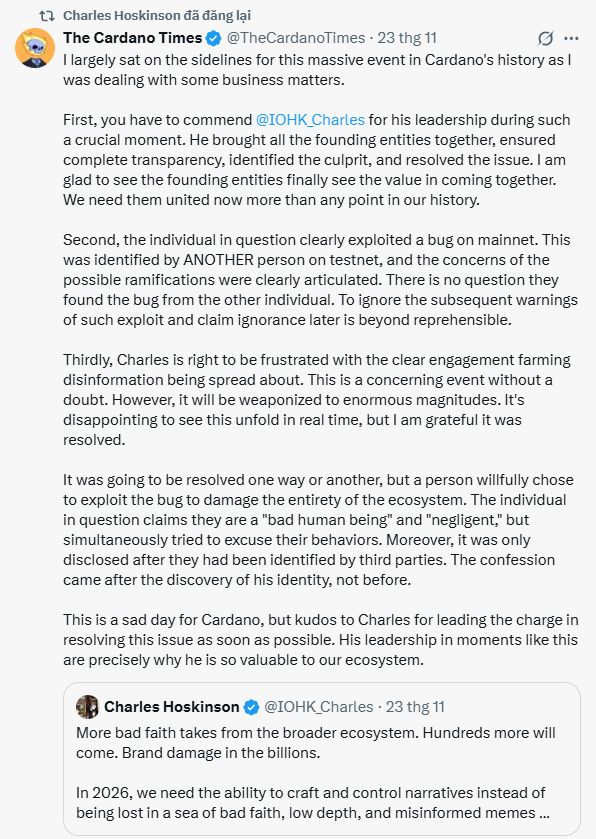

Right after news of the chain split spread, the X (Twitter) space instantly turned into a “battlefield.” What’s striking is that the incident attracted not only the Cardano community but also members of other blockchains — many of whom were waiting for any reason to criticize a competitor.

Charles Hoskinson — the founder of Cardano — quickly spoke up, calling the incident a “deliberate attack.” This strong wording surprised many, especially since the operator who caused the issue insisted he was merely testing AI-generated code with no intention of harming the network. This raised the question: did Hoskinson genuinely believe it was an attack, or was he trying to shift attention away from the long-existing 2022 bug?

The community quickly split into two camps:

- One group argued that the issue was being exaggerated, claiming every blockchain faces problems at times, and the important thing was that the incident was resolved quickly. To them, the whole situation was just more FUD.

- The other group — especially outsiders — viewed this as clear evidence that Cardano is unstable. Some even mocked: “Cardano split for hours and nobody noticed because the network is so empty.”

Memes, mocking videos, deep-dive threads, and hundreds of comment chains followed. A technical issue that should have been analyzed professionally was dragged into an emotional and biased vortex, making truth and misinformation blend into one. In the end, the ones who suffered most were regular users trying to find accurate information in a sea of conflicting opinions.

This event highlights both the power — and the dark side — of decentralized media. A small incident can be amplified into a media storm far beyond its technical scope.

6. Why This Incident Is More Dangerous Than People Think

Even though no clear financial loss occurred, the chain split incident is structurally dangerous — with damage potential far greater than what appeared on the surface.

First, a chain split is one of the most serious events a blockchain can experience. It shows that consensus — the foundation of system-wide agreement — was broken by a single abnormal transaction. A network believed to be stable and secure, capable of handling thousands of independent nodes, was shaken by a single input. This raises major doubts about its resilience.

Second, the 2022 bug proved that hidden vulnerabilities can persist unnoticed. If a flaw from three years ago could remain dormant until triggered, there’s no guarantee more such bugs don’t exist. It’s like seeing a brick fall from a building — the real question isn’t “why did the brick fall?” but “is the internal structure rotting without us knowing?”

Third, the AI factor makes the incident more frightening. In the past, causing such disruption required deep knowledge of consensus mechanisms. Today, with a sufficiently capable AI, even someone without malicious intent can unintentionally cause a major failure. AI isn’t just a coding assistant — it’s also an accelerator of bug discovery, intentional or not.

Fourth, the incident shows that Cardano’s governance is not strong enough to prevent risky operator behavior. If one person can cause a split, what happens if a coordinated group tries to intentionally cause harm?

All this leads to one conclusion: Cardano didn’t fail technically — it failed systemically. And when a system fails, fixing code isn’t enough — governance, operations, and trust must also be rebuilt.

7. A Wake-Up Call for the Entire Blockchain Industry

Looking beyond Cardano’s story, this incident is a crucial warning for the whole blockchain industry — an industry racing toward the future but sometimes forgetting to check whether the ground beneath its feet is solid.

First, AI is becoming an unavoidable part of development. It makes everything faster, easier, cheaper. But the Cardano incident shows: AI does not come with responsibility. If blockchains want to survive in an AI-driven era, they need new safeguards: smarter validation layers, automated fuzzing, isolated sandboxes for AI-generated transactions, and anomaly detection systems. Without these, Cardano is merely the first of many similar incidents to come.

Second, governance must be redesigned. Decentralization is often celebrated as a symbol of freedom, but freedom without boundaries breeds chaos. A network with hundreds of independent operators needs clear constraints to prevent one operator — intentional or not — from impacting millions of users.

Third, blockchain projects must seriously revisit legacy bugs. Codebases evolve over years, through multiple developers and phases, accumulating untouched vulnerabilities. If projects don’t clean up their foundations, they will face hidden time bombs just like Cardano did.

The chain split incident is not a death knell for Cardano — but it is a wake-up call. It reminds the entire industry that:

- No blockchain is absolutely safe.

- No system is immune to AI.

- No project can afford complacency.

Cardano is simply the first to step into the danger zone that AI has created. Those who fail to prepare for this future may be the next. Disclaimer:The information provided here is for informational purposes only and should not be considered financial, investment, legal, or professional advice. Always conduct your own research, consider your financial situation, and, if necessary, consult with a licensed professional before making any decisions.

Join MEXC and Get up to $10,000 Bonus!

Sign Up