Ethereum is the second largest asset in the cryptocurrency market after Bitcoin, and its investment value has garnered widespread attention. However, in this market cycle, Ethereum’s performance has not matched that of Bitcoin since October 2024.Bitcoin pricebroke through the previous bull market’s high point, continuously setting new highs, successfully surpassing the $100,000 mark in less than two months. Meanwhile,ETH pricehas performed mediocrely during the same period, failing to reach the historical peak of 2021 and even dipping below $2,000 at one point. According to the MEXC platformthe ETH/USDT spotprice quote at 17:00 (UTC+8) on August 7, 2025, is around 3,700 USDT, still 24% away from the highest price point.

Therefore, the question of whether ETH is worth investing in 2025 and whether its price can set new highs remains unresolved in the market. This article aims to analyze the investment worthiness of ETH, focusing on the changes in the ETH/BTC price ratio to evaluate its relative value, market trends, and potential prospects.

1.How to understandthe ETH/BTC price ratio?

The ETH/BTC price ratio indicates the price of Ethereum relative to Bitcoin, showing how much BTC is needed to purchase 1 ETH. It reflects the relative strength relationship between the two major crypto assets and is an important indicator for investors to assess changes in ETH’s value.

The significance of the ETH/BTC price:

- When the ETH/BTC ratio rises: it indicates that the price performance of ETH outperforms BTC, and the influx of market funds into ETH is growing faster than into BTC.

- When the ETH/BTC ratio drops: it indicates that the price performance of BTC is better than ETH, and the influx of market funds into ETH is growing slower than into BTC.

2.Reviewingthe historical performance of the ETH/BTC price ratio

2.1 ETH/BTC price ratioHistorical trend analysis

- 2017 Bull Market:

- The ETH/BTC price ratio soared from 0.02 (early 2017) to 0.15 (mid-2017), with ETH significantly outperforming BTC during this phase.

- Reason: The rise of the Ethereum ecosystem (such as the ICO boom) attracted a massive influx of funds.

- 2018 Bear Market:

- The ETH/BTC ratio plummeted to around 0.025, reflecting a weak performance of ETH relative to BTC.

- Reason: The burst of the ICO bubble led to a sharp decline in ETH demand.

- 2020-2021 DeFi Boom:

- The ETH/BTC ratio increased from 0.02 at the beginning of 2020 to 0.08 in May 2021.

- Reason: Explosive growth in the DeFi ecosystem and NFT market drove demand for Ethereum.

- 2022 Cryptocurrency Winter:

- The ETH/BTC ratio fluctuated between 0.05 and 0.07.

- Reason: Macroeconomic tightening and declining market confidence made BTC more appealing as a safe-haven asset.

2.2 Current trend of the ETH/BTC price ratio (2023-2025)The ETH/BTC price ratio has recently shown relatively stable performance, mainly influenced by the following factors:

Completion of the Ethereum 2.0 upgrade

- (September 2022): Ethereum successfully transitioned from proof-of-work (PoW) to proof-of-stake (PoS), reducing energy consumption and generating optimistic expectations for its long-term development potential.Macroeconomic environment

- 宏观经济环境: Bitcoin is more likely to be viewed as ‘digital gold’ amid economic uncertainty, attracting safe-haven funds, while ETH relies more on the development of its application ecosystem.

- Recovery of DeFi and NFT: As market sentiment warms, the use cases of ETH (such as smart contracts, DeFi, and NFTs) may drive its demand.

According to the MEXC platformthe ETH/BTC spotprice quote at 17:00 (UTC+8) on August 7, 2025, is around 0.032, which is a 64% difference compared to the peak rate in November 2021.

3.What notable information can be gleaned fromETH/BTC price ratiothe changes?

3.1 The core value of investing in ETH

The ETH/BTC price ratio is a key indicator for assessing the investment value of ETH and should be analyzed from the following perspectives:

- Technological development

- The Ethereum ecosystem focuses more on development and application, supporting areas such as smart contracts,DeFi、NFT、DAOand other directions.

- With the upgrades of the Ethereum network (such as Ethereum 2.0 and Layer 2 scaling solutions), its transaction costs and network efficiency are continuously optimized, promising to attract more developers and users.

- Market demand

- Bitcoin is primarily seen as a store of value asset, while ETH is driven by a greater practical demand due to its wide range of applications.

- If ecosystems like DeFi and NFTs continue to grow, ETH may gain a larger advantage in the ETH/BTC ratio.

- Capital flow

- The fluctuations in the ETH/BTC exchange rate are often related to changes in market sentiment.

- In a bull market, investors tend to choose high-growth assets like ETH, driving up the ETH/BTC ratio; whereas in a bear market, funds flow back to safe-haven assets like BTC.

3.2 Key Observations for the ETH/BTC Exchange Rate

Investors can assess whether ETH is worth investing in by the following indicators:

- The long-term trend of the ETH/BTC exchange rate

- If the exchange rate is in a long-term upward trend, it indicates that ETH’s position in the market is gradually strengthening.

- If the exchange rate continues to decline, it may indicate that ETH is losing its competitive edge.

- Progress in technological upgrades

- Pay attention to Ethereum network upgrade plans (such as scalability improvements, fee optimizations), as these directly impact ETH demand and price.

- 宏观经济环境

- If the market enters a risk-averse mode, BTC may perform better, leading to a decline in ETH/BTC.

- When risk appetite recovers, ETH may outperform BTC.

- On-chain data analysis

- The number of active addresses, transaction volume, and total value locked (TVL) on ETH can reflect the ecosystem’s activity.

- Compare BTC’s on-chain metrics to assess capital flow.

4.2025Is ETH worth investing in?

Combining the several data points mentioned above, we can conduct further analysis.

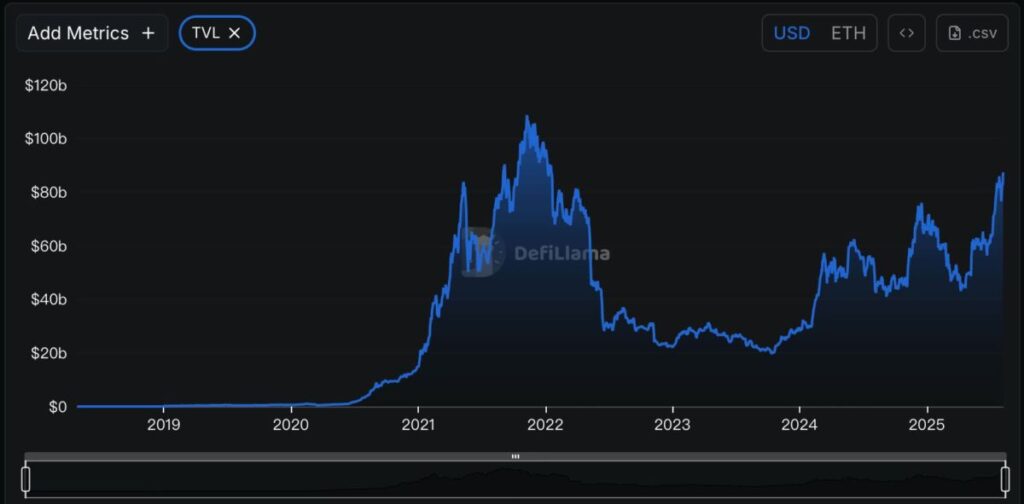

4.1 TVL Analysis: What is TVL? What does the change in TVL mean?TVL (Total Value Locked) is a core metric for DeFi protocols in the Ethereum ecosystem, referring to the total value of assets locked on the Ethereum network. TVL reflects user trust in the Ethereum network and its applications (such as lending, DEX, liquidity mining).

TVL(Total Value Locked)是以太坊生态中DeFi协议的核心指标,指锁定在以太坊网络上的资产总价值。TVL反映了用户对以太坊网络及其应用(如借贷、DEX、流动性挖矿)的信任度。

- Historical trend:

- Bull market of 2020-2021: The rise of DeFi drove ETH’s TVL from under $5 billion to over $100 billion.

- Bear market of 2022-2023: The crypto market has been sluggish, yet Ethereum maintained its dominant TVL position, accounting for about 50%-60%.

- Potential trend in 2025:

- Impact of Layer 2 solutions: The rise of Ethereum scaling solutions like Arbitrum and Optimism will further attract capital into the Ethereum ecosystem, driving TVL growth.

- DeFi 2.0 and emerging applications: New DeFi protocols (such as yield optimizers, decentralized derivatives) and new fields like GameFi and SocialFi may bring more locking demands.

As of August 8, 2025, according todefillama data, Ethereum’s TVL reached $87.3 billion, an increase of over 300% from $20 billion in October 2023.

- Specific data estimates:

- If the crypto market enters a new bull market in 2025, Ethereum’s TVL could reclaim the previous bull market highs and even surpass $150 billion;

- even if the market remains volatile, Ethereum’s dominant position in DeFi will likely remain secure, with TVL accounting for over 50%.

4.2 What is the number of on-chain active addresses?

The number of active addresses refers to the number of addresses participating in transactions via the Ethereum network within a certain timeframe. This metric can reflect user activity on the network and overall ecosystem usage.

- Historical performance:

- The number of active addresses on Ethereum has shown a significant upward trend from the 2017 ICO boom, through the 2020 rise of DeFi, to the NFT explosion in 2021.

- During the bear market of 2022-2023, the number of active addresses declined, but still maintained daily active levels in the hundreds of thousands.

- Potential trend in 2025:

- Layer 2 scalability improvements: Layer 2 technology has reduced transaction costs, which may attract more users to participate actively.

- Diverse ecology: In addition to DeFi, the growth of users in new fields like NFTs, GameFi, and SocialFi will enhance on-chain activity.

- Global adoption rate: As the application of Ethereum increases in various countries (such as payment, identity verification, etc.), the number of active addresses may continue to grow.

- 2025 data estimates:

- The number of daily active addresses may gradually increase from about 400,000 to 600,000-800,000;

- The number of monthly active addresses may exceed 30 million.

By observing the changes in the number of active addresses on the ETH chain, it can provide some assistance in making final investment decisions. For example, an increase in the number of active addresses on the ETH chain indicates an expanded user base, a more prosperous ecosystem, and increased user participation which may raise the demand for ETH, supporting price increases.

4.3 What is the ETH Spot ETF?

The ETH Spot ETF is an investment tool that allows traditional institutions and retail investors to invest directly in ETH through the financial markets without having to hold or manage the actual cryptocurrency assets. It could bring a significant influx of funds into the Ethereum market. On May 24, 2024,the SEC approved the first eight Ethereum Spot ETFs to be listed in the United States,including BlackRock, Fidelity, Grayscale, Bitwise, VanEck, Ark Invest, Invesco Galaxy, and Franklin Templeton.

- Historical Background:

- The introduction of the Bitcoin Spot ETF in 2021 injected a substantial amount of funds into the crypto market and drove up the BTC price.

- In 2023, the applications and approvals for ETH Spot ETFs gradually became the focus of the market.

- Potential trend in 2025:

- Institutional Fund Inflow: Traditional institutions (such as pensions and hedge funds) may use ETH Spot ETFs to allocate Ethereum assets, leading to large-scale fund inflows.

- Increased Retail Participation: ETFs lower the investment threshold for retail investors, further broadening the potential investor base for ETH.

According to well-known media,Cointelegraph reported, since mid-July 2025, the Spot Ethereum ETF has seen a net inflow of funds for 20 consecutive days, setting a record of $5.4 billion in monthly inflows. The inflow of funds may lead to a reduction in ETH supply (due to locking demand), thus pushing prices upward.

5. Investment Risks in 2025for ETHTips

5.1 Market Competition:

The rise of emerging blockchains (such as Solana, Avalanche, Polygon) poses challenges to Ethereum.

If Ethereum fails to maintain technological and ecological leadership, its market share may decline.

5.2 Macroeconomic Pressures:

In times of economic tightening or market panic, Bitcoin may be more attractive as a safe-haven asset, leading to a capital outflow from Ethereum.

5.3 Exchange Rate Fluctuations:

The ETH/BTC exchange rate may be affected by extreme fluctuations in market sentiment, making it unsuitable for risk-averse investors.

Recommended Reading:

- Why Choose MEXC for Contract Trading?Gain insights into the advantages and features of MEXC contract trading, helping you seize opportunities in the contract space.

- Contract Trading Operation Guide (App)Learn about the operating procedures for contract trading on the App to make it easy for you to get started and master contract trading.

Currently, the MEXC platform has launched a major 0 trading fee promotion.By participating in this promotion, users can significantly reduce trading costs, truly achieving the goal of ‘saving more, trading more, and earning more.’ On the MEXC platform, you can not only enjoy low-cost trading through this promotion, but also stay updated with market dynamics and seize every fleeting investment opportunity, starting your wealth accumulation journey.

Join MEXC and Get up to $10,000 Bonus!

Sign Up