Observing the market recently, I’ve noticed something interesting: after Bitcoin reached a new all-time high, capital didn’t stop there but continued to rotate into major altcoins like ETH and BNB. Both have already made impressive breakouts.

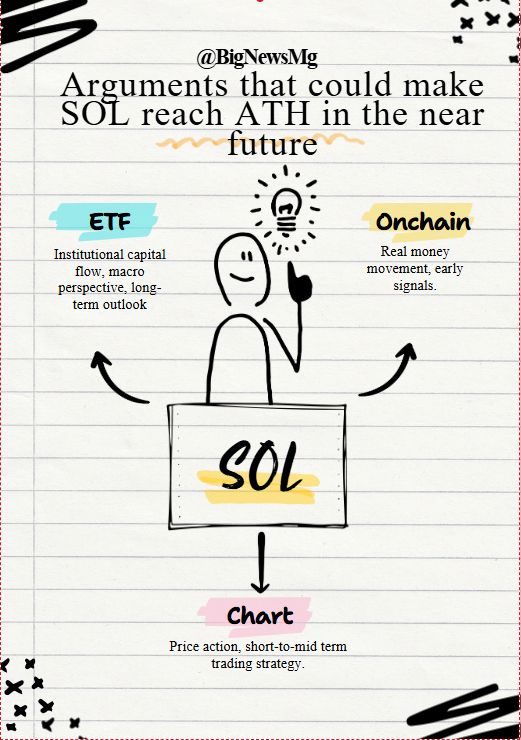

So the question is, which name will be the next to set a new milestone? Personally, I believe Solana (SOL) is gathering all the right elements to become a strong candidate for reclaiming its ATH. Let’s take a closer look at three key factors to get a clearer view of the big picture

1. ETF – Institutional Money Flows into Solana

- Data from the Solana ETF Flow paints a striking picture for September 2025.

- In less than a month, the SolanaETF has attracted a total of $308.7 million in institutional inflows, a figure that underscores the growing appeal of $SOL in traditional financial markets.

- Notably, there were several days of exceptionally strong inflows.

- On September 18, the ETF saw an additional $19.1 million pour in

- On September 22, inflows surged to $27 million – the largest single-day figure since launch.

- On September 25, with another $16.2 million flowing into the fund.

While there were days with no new inflows, such as September 17 and September 19, the overall trend remains clear: institutional money is steadily pouring into Solana.

- This reflects a growing conviction among large investors in the long-term potential of the Solana ecosystem.

2. On-chain Data – Whales and Large Capital Flows on Solana

– If ETFs reflect institutional investors’ confidence through traditional financial products, then on-chain data shows us the real picture of how capital flows are moving on the blockchain – where every transaction is recorded publicly. In the past few weeks, on-chain data has shown that a mysterious whale has been consistently withdrawing $SOL from institutional custody platforms such as Coinbase Prime and Fireblocks Custody.

- One notable transaction recorded this whale withdrawing as much as 427,000 SOL (≈ $101 million) in a single move.

- Other transactions ranged between 4,000 – 18,000 SOL (≈ $1 – 8 million) each.

As of now, this address holds a total of over 1.57 million SOL (≈ $329 million).

We can see the whale’s actions more clearly in this chart.

Withdrawing SOL from centralized exchanges to private wallets is generally understood as a signal of long-term accumulation, since those tokens are no longer immediately available for sale on the market.

- This is a strong bullish signal, indicating that whales and institutions still have high conviction in Solana’s outlook.

3. Chart – A View from Technical Analysis

– If ETFs demonstrate institutional capital inflows, on-chain data reveals whales quietly accumulating, while the chart clearly illustrates the uptrend as $SOL continues to form higher lows and approaches a key resistance level.

Let’s take a look at this chart.

– Currently, Solana (SOL) is trading around $202, while the most recent peak was at $296. This means the price is still about 46% below its previous high. – After a sharp decline, SOL has formed a V-shaped recovery pattern, maintaining a series of higher highs and higher lows.

– The medium-term trend remains bullish, as the price continues to bounce strongly from key support zones.

– The $190 level now acts as a critical support: if it holds above this threshold, the uptrend could continue toward the $296 resistance area.

=> Solana still has significant room for growth before retesting its previous high, with nearly 46% upside potential from the current price. The technical structure suggests the uptrend remains dominant, and the $296 level will be the key area to watch in the coming weeks.

4.Conclusion

– The convergence of institutional inflows through ETFs, massive whale accumulation on-chain, and a resilient bullish structure on the charts all point to growing confidence in Solana’s future. While short-term volatility is inevitable, these three pillars suggest that SOL is increasingly positioned as one of the strongest contenders in the altcoin market.

=> The big question remains: will these factors be enough for Solana to break past resistance and set a new all-time high?

Disclaimer:The information provided here is for informational purposes only and should not be considered financial, investment, legal, or professional advice. Always conduct your own research, consider your financial situation, and, if necessary, consult with a licensed professional before making any decisions.

Join MEXC and Get up to $10,000 Bonus!

Sign Up