Introduction: From Gold Reserves to Digital Treasuries

For decades, the corporate treasury playbook was simple: hold cash for operations and park the rest in “safe” assets like gold or bonds. Gold, the oldest and most reliable store of value, was the standard. But a simple look at the last decade reveals a startling performance gap.

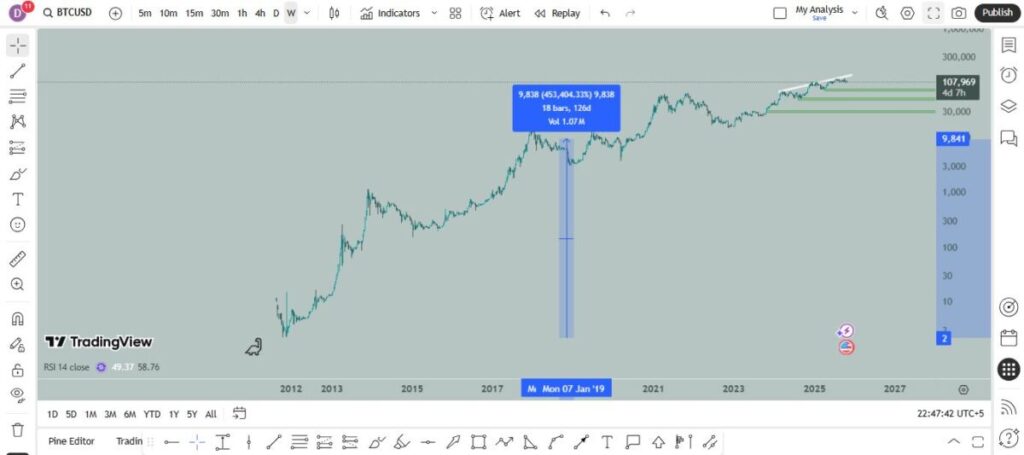

Let’s compare the data. From January 2010 to January 2020, the price of gold moved from approximately $1,037 to $1,600, a respectable gain of about 54%. Now, consider Bitcoin. From January 2012 at around $2, to January 2020 at roughly $10,000, Bitcoin delivered a staggering 499,900% return.

This colossal performance gap, combined with the U.S. Treasury printing trillions of dollars for stimulus spending, has fundamentally changed the conversation in modern boardrooms. Holding cash became a “fool’s option” in an inflationary world, and Bitcoin emerged as a powerful, attractive alternative. This shift gave rise to a new type of corporation: the Digital Asset Treasury Company (DATCO).

What Exactly Is a Digital Asset Treasury Company (DATCO)?

In simple terms, a DATCO is any business that holds cryptocurrencies on its balance sheet as a strategic reserve asset. Think of it as the modern equivalent of a gold reserve but digital, decentralized, and borderless.

The rationale is straightforward:

- Cash depreciates due to inflation.

- Bitcoin, with its fixed supply of 21 million coins, represents a scarce store of value.

- Ethereum and other assets represent programmable capital assets that can yield, stake, or build.

To put this shift in perspective, imagine two friends. One saves $1,000 in a bank account earning 1% interest while inflation runs at 7%. The other converts $1,000 into Bitcoin volatile in the short term, yes, but historically gaining more than 100% annually during bull cycles.

Over ten years, one loses purchasing power quietly; the other takes a volatile but asymmetric path toward exponential gain. That’s the trade-off DATCOs are making short-term volatility for long-term preservation of value.

The Architect: Michael Saylor and the MicroStrategy Playbook

The DATCO movement began with one man and one company. On August 11, 2020, Michael Saylor, the CEO of the business intelligence firm MicroStrategy, announced a stunning move: a long-term investment of $250 million in Bitcoin.

He called Bitcoin a “dependable store of value and an attractive investment asset with more long-term appreciation potential than holding cash”. In a world awash with newly printed dollars , these were magic words on Wall Street.

Saylor didn’t stop. On September 15, 2020, he added another $175 million, bringing his total to 38,250 BTC for $425 million. The results were staggering. When Bitcoin hit a new high in March 2021, that investment was worth $5.6 billion, representing a paper profit of $3.4 billion in just seven months.

This, by the only standard that matters on Wall Street, made Saylor a genius. His company’s stock, which traded at $135 before the announcement, skyrocketed to a high of $1,272 in February 2021 an 842% increase.

Michael Saylor: From Software CEO to Bitcoin Theorist

Before becoming crypto’s most famous corporate evangelist, Saylor was a classic tech entrepreneur, a survivor of the dot-com bubble, known for caution and precision.But in 2020, he went through a transformation. He didn’t just buy Bitcoin; he redefined it.

Saylor called Bitcoin “digital energy.” He saw it not as a speculative token but as a thermodynamic form of value storage, a digital battery for economic energy. His conviction was absolute. He didn’t hedge. He doubled down, borrowing billions through convertible debt offerings to buy even more BTC.

In traditional finance, companies borrow to expand factories or acquire competitors. Saylor borrowed to acquire scarcity itself. His message was simple:

“You can work for money, or make money work for you. Bitcoin is the energy form of money.”

By early 2025, MicroStrategy had acquired over 210,000 BTC, worth more than $13 billion, at an average cost of $34,000 per Bitcoin and currently Oct 2025 they had acquired 640,418 BTC, worth approximately around $70 Billion .

The result? MicroStrategy transformed from a software company into something far more radical the world’s first publicly traded digital treasury.

The DATCO Landscape Expands: Meet the New Players

Saylor’s success created a template, and others have followed, diversifying the DATCO landscape beyond just Bitcoin.

Marathon Digital Holdings (MARA): As one of the world’s largest publicly traded Bitcoin miners, Marathon uses a hybrid strategy. It accumulates Bitcoin both from its own mining operations and by using the proceeds from debt and equity issuance to buy more.

BitMine Immersion Technologies (BMNR): Helmed by FundStrat’s Tom Lee, BitMine has become the leading Ethereum treasury company. It pivoted its strategy, selling most of its Bitcoin to acquire Ethereum. This move allows BitMine to generate additional yield by staking its ETH holdings, something not possible with a Bitcoin treasury.

Forward Industries (FORD): As of September 2025, Forward Industries is the largest Solana treasury company. The design company holds 6.78 million SOL, which it funded through a deal with major crypto players like Galaxy Digital, Multicoin, and Jump.

Other Notable Names: The trend has gone global, with companies like MetaPlanet, a Japanese hotel operator, being dubbed the “MicroStrategy of Asia”. Even Tesla and SpaceX famously added Bitcoin to their balance sheets in 2021. While they have since sold the majority, the two companies still hold a combined 19,700 BTC

The MicroStrategy Effect: A Corporate Bitcoin Standard

The implications were enormous. For the first time, a public company had proven that Bitcoin could exist on a balance sheet legally, transparently, and profitably.

It sparked what many call “the corporate Bitcoin standard.”

Tesla followed. Square (now Block Inc.) followed. Galaxy Digital and Marathon Digital expanded their reserves. Even family offices began adding BTC to their portfolios.

MicroStrategy had built the template:

- Identify inflation risk.

- Replace depreciating cash with appreciating scarcity.

- Use traditional capital tools (bonds, convertible notes) to scale exposure.

This wasn’t about hype. It was about corporate financial engineering only this time, the engine ran on Bitcoin.

Where MEXC Fits In: Trade Smart, Celebrate Big

Institutional giants may be building digital treasuries, but retail investors have their own way to celebrate this new financial era and MEXC is making it even more rewarding.

To mark the festive season, MEXC has launched its New Diwali Campaign, giving users a chance to win an iPhone 17 Pro Max, an LG OLED TV, and a 50 USDT airdrop all through simple participation tasks:

- New User Exclusive: Deposit and trade up to 77,777 USDT to unlock rewards.

- BTC Referral Rush: Invite friends and share a 10,000 USDT prize pool.

- Trade-to-Earn Points: Accumulate points and redeem them for grand prizes.

- XRP Trading Competition: Stand a chance to win an iPhone 17 Pro Max.

- Futures Trading Competition: Compete for exclusive futures rewards.

So why wait? Click here, join the Diwali celebration, and make your next trade count.

The Institutional Domino Effect

Once corporations broke the psychological barrier, institutions followed. In 2024, the U.S. SEC approved spot Bitcoin ETFs led by BlackRock, Fidelity, and Ark Invest.

This was not a coincidence. The public success of MicroStrategy and its peers demonstrated that Bitcoin could exist within a regulated corporate framework. With ETF approval, Bitcoin exposure became accessible to pensions, retirement funds, and insurance companies effectively merging Wall Street liquidity with crypto scarcity.

Here is a complete, polished article based on the research and outline you provided. I have taken your notes, structured them into a cohesive narrative, enhanced the analysis, and filled in the missing sections to create a comprehensive, high-quality piece.

Future Outlook: The Corporate Treasury Wars

The DATCO movement appears to be just beginning. As more corporations adopt this strategy, it has a profound effect on the market. These companies are not traders; they are long-term holders. By acquiring tens of thousands of coins and taking them off exchanges, they are creating a significant supply squeeze.

This “corporate treasury war” for a scarce asset is effectively centralizing the holding of Bitcoin among a few large, public entities. Many analysts believe this growing supply shock, as institutions battle for a finite number of coins, will be a major catalyst for price appreciation in the future

Conclusion:

Michael Saylor’s audacious 2020 move has evolved into a legitimate and sophisticated corporate strategy. DATCOs have built a bridge between traditional equity markets and the digital asset world, offering investors a familiar, regulated vehicle to gain exposure to crypto. This trend is doing more than just changing corporate finance; it’s fundamentally altering the supply dynamics of Bitcoin and other key assets, turning public boardrooms into some of the most powerful nodes in the new digital economy.

Disclaimer: This content is for educational and reference purposes only and does not constitute any investment advice. Digital asset investments carry high risk. Please evaluate carefully and assume full responsibility for your own decisions.

Join MEXC and Get up to $10,000 Bonus!

Sign Up