As Bitcoin consolidates around $114-115K following the October 10 flash crash, a critical question emerges: where will the next wave of crypto gains come from?

The answer lies in altcoins. Bitcoin’s market dominance near 57% still caps broader altcoin outperformance, but a decisive move down toward 55-56% could trigger a stronger rotation into alts. With Q4 historically being crypto’s strongest quarter, positioning now could capture the bulk of gains before year-end.

The top altcoins to buy now are Ethereum (ETH), Binance Coin (BNB), and Solana (SOL), major altcoins supporting smart contracts, decentralized apps, and blockchain ecosystems beyond Bitcoin. But beneath these blue-chips, specific sectors are showing whale accumulation, institutional interest, and technical setups that suggest explosive potential.

Let’s break down the five sectors where smart money is positioning for Q4 2025, and how MEXC traders can access these opportunities.

1.Sector 1: Layer 2 Scaling Solutions – The Infrastructure Play

Layer 2 tokens are leading gains with Mantle up 19% recently, signaling strong momentum in the scaling infrastructure narrative.

Why Layer 2s are outperforming:

Ethereum fee pressure: As ETH network activity increases, Layer 2 solutions become essential for cost-effective transactions, driving adoption and token demand.

Institutional validation: Major DeFi protocols and enterprises are deploying on Layer 2s, creating genuine utility beyond speculation.

Token value accrual: Many L2 tokens now capture fees, participate in governance, and receive staking rewards, creating fundamental value.

Technical breakouts: After months of consolidation, several L2 tokens are breaking resistance with strong volume.

Top Layer 2 opportunities:

Mantle (MNT):

– Recently pumped 19% in days

– Mantle is a major whale favorite heading into October 2025

– Backed by BitDAO’s treasury, providing financial strength

– Growing DeFi ecosystem attracting developers

– MEXC offers deep MNT/USDT liquidity

– Largest L2 by TVL (Total Value Locked)

– Recent upgrade improving transaction finality

– Strong developer activity and dApp growth

– Consolidating at support, technical setup bullish

– SPX, Optimism, and Aptos stand out this week as bullish momentum meets major token unlocks

– Superchain narrative gaining traction

– Base (Coinbase’s L2) built on OP Stack, creating network effects

– Token unlock completed, selling pressure absorbed

Trading strategy for L2s on MEXC:

Accumulate on dips during BTC consolidation periods. L2 tokens often outperform when ETH shows strength. Set stop-losses below recent support levels (ARB ~$0.50, OP ~$1.40, MNT ~$0.60). Take partial profits at 20-30% gains as L2 rallies can be volatile.

2.Sector 2: Whale Accumulation Plays – Following Smart Money

On-chain data shows a large wave of accumulation in specific altcoins, signaling long-term confidence in their growth potential from sophisticated investors.

Why whale accumulation matters:

Whales (large holders) have access to better information, deeper analysis, and longer time horizons than retail traders. When multiple whale wallets accumulate the same assets simultaneously, it often precedes significant price appreciation.

Top whale accumulation targets:

– Worldcoin is once again in the spotlight. In September, the altcoin outperformed many other cryptocurrencies

– Sam Altman’s project gaining real-world adoption

– Biometric identity verification creating moat

– Whale accumulation accelerating in Q4

– High-risk, high-reward profile

– Three altcoins, Worldcoin (WLD), Pump.fun (PUMP) and Mantle (MNT) are major favorites

– Memecoin launchpad platform with real revenue

– Benefits from memecoin mania on Solana

– Whale wallets accumulating aggressively

– Platform token with cash flow generation

– SPX, Optimism, and Aptos stand out this week as bullish momentum

– Move programming language alternative to Solidity

– Parallel execution similar to Solana’s advantages

– Growing ecosystem of DeFi and gaming projects

– Institutional backing from a16z, FTX Ventures

How to trade whale accumulation on MEXC:

Monitor on-chain data through platforms like Nansen or Arkham Intelligence. When whales accumulate, enter positions in tranches (25% at a time). Use longer time horizons (weeks to months) rather than day trading. Whale accumulation is a leading indicator, not immediate signal, patience required.

3.Sector 3: Ethereum Ecosystem – The Altseason Leader

Ethereum, DOGE, and DeFi-linked tokens are leading flows, signaling potential altseason rotation from Bitcoin dominance.

Why Ethereum ecosystem is critical:

The 2025 altseason is not a speculative frenzy but a structural reallocation driven by Ethereum’s deflationary model, yield advantages, and institutional adoption. Whales and institutions are betting on Ethereum as the superior capital-efficient platform.

Ethereum itself (ETH):

– Recovered from $3,460 flash crash low

– Deflationary since Merge upgrade (burn > issuance)

– Staking yield ~3.5% provides real return

– ETF inflows growing, following BTC pattern

– Target: $4,500-5,000 resistance zone by Q4 end

ETH ecosystem opportunities beyond ETH:

DeFi Blue Chips:

– Aave (AAVE) – Lending protocol with real revenue

– Uniswap (UNI) – DEX leader with fee switch potential

– Lido (LDO) – Largest liquid staking provider

– Maker (MKR) – DAI stablecoin governance

Ethereum L2 tokens: As covered in Sector 1, directly benefit from ETH ecosystem growth

ETH-based memecoins: When ETH pumps, ETH-based memes often outperform (higher beta plays)

Why ETH ecosystem over Solana for Q4:

Ethereum whale accumulation is surging while Solana faces competition from newer chains. ETH’s institutional adoption through ETFs creates sustained buying pressure Solana lacks. DeFi liquidity concentrates on Ethereum, making it the safer ecosystem bet.

MEXC advantage for ETH ecosystem:

MEXC lists virtually all major ETH ecosystem tokens, ETH itself, all major L2s, DeFi blue chips, and trending ETH memes. One platform access to entire ecosystem. Deep liquidity on ETH/USDT pair for core holdings. Fast listing of new ETH ecosystem projects.

4.Sector 4: Solana Ecosystem – The High-Beta Alternative

While Ethereum dominates institutionally, Solana offers higher risk/reward for aggressive traders.

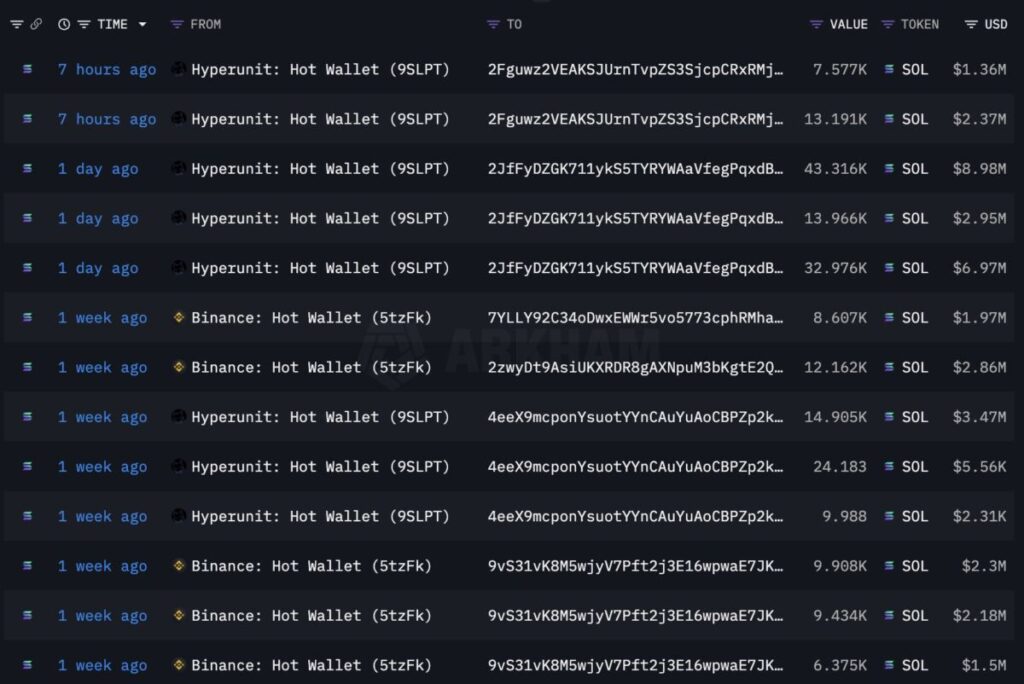

Solana’s $88M whale accumulation over three days signals on-chain confidence and institutional conviction, with a potential road to $250 if momentum continues.

Why Solana ecosystem remains relevant:

Speed and cost: Solana still offers fastest transaction speeds and lowest costs for retail users, driving organic adoption.

Memecoin launchpad: Pump.fun and similar platforms make Solana the memecoin capital, driving constant activity and fees.

Gaming and NFTs: Solana’s speed makes it ideal for gaming applications requiring real-time interactions.

Developer activity: Despite competition, Solana maintains strong developer retention and new project launches.

Solana ecosystem opportunities:

Solana (SOL) itself:

– Whale accumulation of $88M recently

– Target: $180-200 if breaks current resistance

– Higher beta than ETH (bigger moves up and down)

Solana DeFi:

– Jupiter (JUP) – Leading DEX aggregator

– Marinade Finance (MNDE) – Liquid staking

– Kamino Finance – Lending/leverage platform

Solana memecoins:

– Highest velocity, highest risk

– Can 10-50x in days during mania

– Extremely volatile, position size accordingly

Solana vs Ethereum decision matrix:

Choose Ethereum if: You want lower risk, institutional exposure, better liquidity, longer time horizon

Choose Solana if: You want higher risk/reward, faster execution, memecoin exposure, shorter time horizon

Ideal strategy: Hold both, weighted toward ETH (60-70%) with SOL allocation (20-30%) for beta

5.Sector 5: Established Alt Blue Chips – The Foundation

Beyond sector-specific plays, certain large-cap altcoins provide portfolio stability while participating in Q4 upside.

Why blue-chip alts matter in Q4:

Lower volatility than small-caps. Higher liquidity for large positions. Less likely to collapse during corrections. Institutional buyers prefer established projects. Provide portfolio ballast while maintaining upside.

Top blue-chip altcoins for Q4:

Binance Coin (BNB):

– Recently surged to $1,225 (covered in previous MEXC article)

– Benefits from BSC memecoin activity

– Token burns create deflationary pressure

– Institutional backing from Binance exchange

– Target: $1,300-1,500 by year-end

Cardano (ADA):

– Major upgrade (Chang hard fork) completed

– Governance decentralization achieved

– DeFi ecosystem growing steadily

– Often lags but catches up in Q4 historically

Polkadot (DOT):

– Parachain ecosystem maturing

– Interoperability narrative gaining traction

– Technical setup bullish after long consolidation

– Lower downside risk than high-caps

XRP (Ripple):

– Regulatory clarity improving post-SEC case

– Cross-border payment adoption growing

– Recently clawed back from flash crash effectively

– Institutional interest increasing

Avalanche (AVAX):

– Subnet technology unique competitive advantage

– Gaming and enterprise focus differentiating

– Strong technical team and execution

– Consolidating at support, poised for breakout

Portfolio construction framework:

Conservative (lower risk):

– 50% BTC

– 30% ETH

– 20% Blue-chip alts (BNB, ADA, DOT)

Moderate (balanced):

– 40% BTC

– 25% ETH

– 20% Blue-chip alts

– 10% Layer 2s

– 5% Solana ecosystem

Aggressive (higher risk/reward):

– 30% BTC

– 20% ETH

– 15% Blue-chip alts

– 15% Layer 2s

– 10% Solana ecosystem

– 10% Whale accumulation plays

6.Q4 Catalysts: What Could Drive Altseason

Several macro and crypto-specific catalysts could trigger sustained altcoin outperformance in Q4 2025:

Bitcoin dominance drop: BTC dominance declining from 57% to 54-55% would unleash significant capital into altcoins, as historically this signals altseason beginning.

ETH ETF momentum: Following BTC ETF success, growing ETH ETF inflows validate Ethereum and lift entire ecosystem.

Fed rate cuts: If Federal Reserve cuts rates in Q4 (possible given economic data), risk assets including alts benefit disproportionately.

Institutional FOMO: As BTC approaches $130-150K, institutions may rotate into “cheaper” alts for better percentage gains.

Uptober/November seasonality: October and November historically strongest months for crypto, particularly altcoins.

Year-end portfolio rebalancing: Fund managers taking profits on BTC gains, rotating into underperformed alts to boost year-end returns.

Retail return: Mainstream media coverage of BTC ATHs brings retail investors, who typically prefer lower-priced alts.

Crypto-specific catalysts:

– Major protocol upgrades completing (Ethereum Pectra, Solana Firedancer)

– New ETF approvals beyond BTC/ETH

– Regulatory clarity improving (post-election in some jurisdictions)

– Institutional products launching (options, structured products)

The confluence of these catalysts creates Q4 setup where altcoins could significantly outperform Bitcoin.

7.The Bottom Line: Q4 Is Altcoin Season

Q4 2025 presents the strongest altcoin opportunity setup in months, potentially years, driven by:

Technical: BTC consolidating at highs, ready for dominance to drop and capital rotate into alts

Fundamental: Layer 2s gaining adoption, whale accumulation signaling smart money positioning, DeFi resurgence

Seasonal: October-December historically strongest for crypto, particularly altcoins

Macro: Potential Fed cuts, institutional FOMO, year-end portfolio rebalancing

The five sectors outlined, Layer 2s, whale accumulation plays, Ethereum ecosystem, Solana ecosystem, and blue-chip alts, offer diversified exposure to Q4 upside while managing risk through sector and asset diversification.

Key takeaways:

Layer 2s leading with Mantle up 19%, strong fundamentals as Ethereum scales

Whales accumulating WLD, PUMP, MNT signaling confidence in specific projects

ETH ecosystem offering institutional-grade exposure with real yield and deflationary dynamics

Solana providing higher risk/reward alternative for aggressive allocations

Blue-chip alts like BNB, ADA, DOT offering stability with Q4 upside participation

MEXC’s comprehensive listings, deep liquidity, and advanced trading tools position traders to capture these opportunities effectively. Whether you’re conservative, moderate, or aggressive, Q4 2025’s altcoin landscape offers something for every risk profile.

The setup is there. The catalysts are aligned. The question is: are you positioned to benefit?

Disclaimer: This content is for educational and reference purposes only and does not constitute any investment advice. Digital asset investments carry high risk. Please evaluate carefully and assume full responsibility for your own decisions.

Join MEXC and Get up to $10,000 Bonus!

Sign Up