Summary

MicroStrategy (NASDAQ: MSTR), the world’s largest publicly listed holder of Bitcoin, has become one of the most closely watched Bitcoin proxy stocks in traditional markets. As Bitcoin adoption accelerates, MSTR has evolved into a leveraged play on BTC’s long-term price performance.

TL;DR

- Massive Bitcoin Exposure: MicroStrategy holds over 150,000 BTC, making its stock price highly correlated with Bitcoin’s market movements.

- Trade MSTR on MEXC: MEXC now offers convenient access to MSTR stock futures with up to 5× leverage.

- Key Strategy Tip: Choose leverage according to your risk tolerance — disciplined stop-loss management is crucial for success.

1.MSTR Stock Overview: Understanding MicroStrategy’s Investment Value

1.1 What Is MSTR Stock?

MSTR is the ticker symbol for MicroStrategy Incorporated(NASDAQ: MSTR), a business intelligence company founded in 1989. Originally focused on enterprise analytics software, MicroStrategy transformed under CEO Michael Saylor into one of the most Bitcoin-focused corporations globally.

Since 2020, the company has strategically acquired Bitcoin as its primary treasury reserve asset, positioning itself as a hybrid between a tech firm and a Bitcoin ETF alternative.

1.2 Key Factors Influencing MSTR Stock Price

- Bitcoin Price Volatility: Given Bitcoin’s significant weight on MicroStrategy’s balance sheet, BTC price movements directly impact MSTR’s market cap. Historically, MSTR reacts to BTC trends with amplified volatility.

- Corporate Bitcoin Purchases: Each new Bitcoin acquisition announcement — including details on purchase size, financing, and cost basis — tends to trigger sharp stock movements.

- Macro Environment: Fed monetary policy, inflation expectations, and USD strength indirectly affect MSTR through Bitcoin’s macro correlation.

- Financial Performance: While Bitcoin drives sentiment, MicroStrategy’s software revenue and profitability remain critical for fundamental valuation.

- Market Sentiment: As a leading “Bitcoin proxy stock,” MSTR often trades at a premium during crypto bull runs and discounts during bearish cycles.

2.Why Trade MSTR Stock Futures on MEXC

2.1 About MEXC Exchange

Founded in 2018, MEXC is a global cryptocurrency trading platform known for its wide asset coverage and high liquidity. It provides spot, futures, margin, and stock-linked derivative trading for users in over 170 countries.

Core Advantages:

- Extensive Market Coverage: 2,600+ crypto spot pairs and 1,500+ futures contracts, including U.S. stock futures like MSTR.

- High Liquidity: Daily trading volume surpasses $20 billion, ensuring efficient order execution.

- Low Trading Fees: Maker fees as low as 0%, taker fees from 0.02%, significantly cheaper than traditional brokers.

- Global Accessibility: Multi-language support and fiat-on-ramp options for international users.

- Robust Security: Cold-hot wallet segregation and multi-signature architecture protect user funds.

2.2 Key Features of MEXC’s U.S. Stock Futures

- 24/7 Trading: No restriction to U.S. market hours — trade MSTR anytime, anywhere.

- Flexible Leverage: Up to 50× leverage available (MSTR currently supports up to 25×), allowing strategic exposure scaling.

- Two-Way Trading: Go long or short — profit opportunities in both bullish and bearish Bitcoin cycles.

- Low Entry Barrier: Trade fractional contracts with minimal capital requirements.

- USDT Settlement: All contracts are denominated and settled in USDT, eliminating fiat conversion hassles and currency risk.

- No Brokerage Account Needed: Trade U.S. stock futures directly with crypto collateral — no need for a traditional stock account.

3.How to Trade MSTR Stock Futures on MEXC

3.1 Account Setup and Funding

Visit the MEXC official website or download the mobile app.

Sign up using your email or phone number, enable 2FA for security, and complete KYC verification to unlock full withdrawal limits. Then deposit USDT or transfer funds from your spot wallet to your futures account.

3.2 Executing a Trade

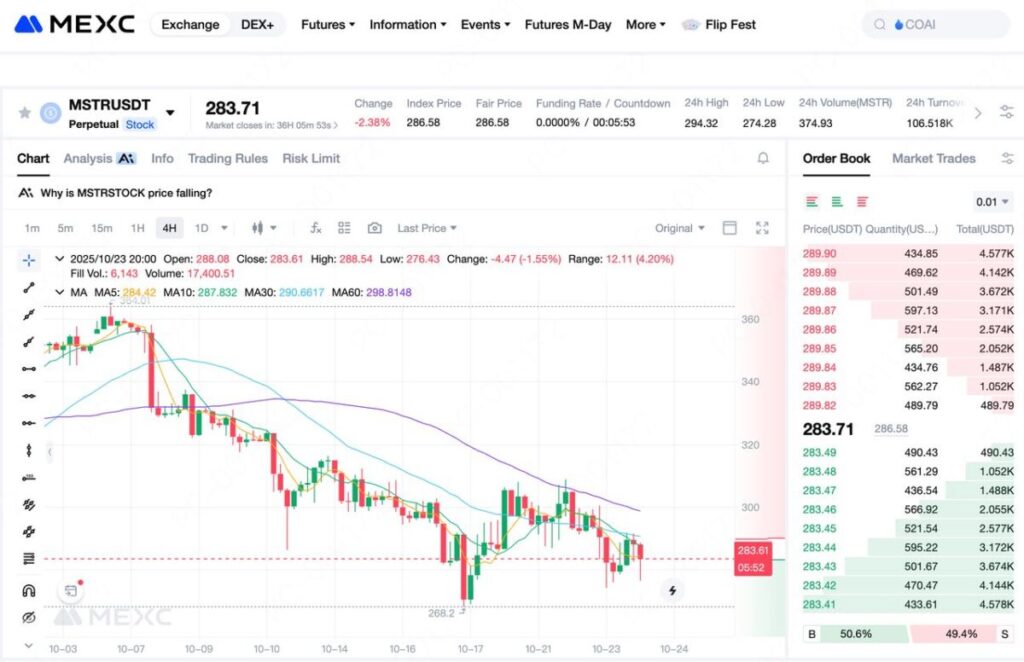

In the futures trading section, search for MSTRUSDT. Choose your order type (limit, market, etc.), set price and quantity, and confirm your position.

3.3 Managing Open Positions

- Set Stop-Loss & Take-Profit: Always define exit points immediately after opening a position to protect capital and lock in gains.

- Monitor Margin Ratio: Keep an eye on your margin level to avoid liquidation during high volatility. Add margin or reduce position size when necessary.

- Scale In Strategically: Avoid all-in entries. Use a pyramid strategy to average entry prices and preserve flexibility.

- Review Performance: Keep a trading journal to refine strategy and reduce emotional decision-making.

4.MSTR Futures Trading Strategies

4.1 Bitcoin-Based Trading Approach

Because MSTR’s price is tightly correlated with Bitcoin, BTC’s chart often serves as a leading indicator.

- Trend-Following Strategy: Go long MSTR when BTC breaks key resistance levels or moves above its 50-day moving average.

- Relative Valuation Arbitrage: Compare MSTR’s implied Bitcoin price with actual BTC market price.

- Volatility Play: Ahead of major catalysts like Bitcoin halving or Fed policy shifts, MSTR futures can amplify BTC’s volatility, offering greater return potential.

4.2 Applying Technical Analysis

- Support & Resistance: Identify historical price levels — buy near supports, reduce or short near resistances.

- Candlestick Patterns: Patterns such as double bottoms, head-and-shoulders, or triangle breakouts often signal key reversals.

- Indicators:Experienced in utilizing core trading indicators like RSI, MACD, and Bollinger Bands to identify market trends and entry points.

- Multi-Timeframe Analysis: Use 15-minute charts for scalping, 4-hour/daily charts for swing trades, and weekly trends for position trading.

4.3 Fundamental Analysis

- Earnings & Filings: Track MicroStrategy’s quarterly earnings reports and Bitcoin holdings disclosures.

- CEO Communications: Michael Saylor’s statements or interviews often move the market — his BTC accumulation updates attract high investor attention.

- Macro Indicators: Watch U.S. CPI, nonfarm payrolls, and Fed rate decisions — they impact Bitcoin and MSTR indirectly.

- Industry Trends: Monitor Bitcoin ETF inflows, institutional adoption, and crypto regulation news that can shift sentiment around MSTR.

4.4 Risk Management Principles

- Capital Management Rules:Risk per trade should not exceed 2–5% of total capital. This ensures account longevity even after a series of losses and prevents being wiped out by one or two bad trades.

- Position Sizing:Adjust position size based on signal strength and market clarity. Avoid emotional decisions that lead to overleveraging or doubling down on losing positions. After consecutive losses, take a break and review your strategy instead of trying to win back losses quickly.

- Stop-Loss Discipline:Always follow your predefined stop-loss levels and never widen them out of hope. Once a stop-loss is set, do not adjust it unless the overall market structure changes significantly.

- Diversification:Do not allocate all capital to a single asset such as MSTR. Build a diversified portfolio that includes multiple U.S. stock futures and crypto spot assets to reduce exposure to any single position.

5.MSTR Investment FAQs

Q1: Which performs better — MSTR stock or Bitcoin?

Historically, MSTR’s price swings exceed Bitcoin’s — it tends to outperform in bull markets (1.5–3× BTC’s upside) but falls harder during downturns.

Q2: Is MSTR futures trading suitable for beginners?

Futures trading involves leverage and elevated risk. Beginners should start small with 1–2× leverage and practice via demo or low-capital trades before scaling up.

Q3: What Is the Funding Rate and How Does It Affect Returns?

The funding rate is a mechanism unique to perpetual futures contracts, designed to keep the contract price anchored to the underlying spot market. When the futures price trades above the spot price, longs pay shorts; when it trades below, shorts pay longs.Funding payments are typically settled every eight hours, and the rate is determined by the balance between long and short positions as well as the spot premium. For traders holding positions over a long period, the cumulative funding cost can significantly impact overall profitability.

Q4: How to Determine Whether MSTR Is Worth Investing In?

Evaluation should consider several key factors: the long-term outlook for Bitcoin, the relationship between MicroStrategy’s Bitcoin acquisition cost and current BTC market price, the health of the company’s balance sheet, and whether the stock is trading at a premium or discount relative to Bitcoin’s intrinsic value.

For investors who are bullish on Bitcoin’s long-term trajectory, MSTR offers a regulated and convenient way to gain Bitcoin exposure through traditional equity markets. However, it’s important to remain cautious about potential operational risks, debt levels, and share dilution.For short-term traders, MSTR’s high volatility presents attractive trading opportunities — but it also demands strong risk management discipline and emotional control.

6.Conclusion and Investor Takeaways

As the flagship Bitcoin-exposed U.S. stock, MicroStrategy bridges the gap between traditional finance and the digital asset economy.Trading MSTR stock futures on MEXC allows investors to capture Bitcoin-driven volatility through a regulated, 24/7, and capital-efficient product.

Keys to Successful Trading:

- Preparation: Understand MSTR’s fundamentals and futures mechanics before trading.

- Strategy: Match leverage and trade horizon with your personal risk profile.

- Risk Control: Always set stop-losses and manage position sizes.

- Continuous Learning: Adapt to changing market structures and refine strategies over time.

- Compliance Awareness: Trade within your local regulatory framework.

Investor Profiles:

- Conservative: Low leverage (1–3×) or direct Bitcoin exposure.

- Moderate: Allocate ≤20% portfolio to MSTR futures with 3–5× leverage.

- Aggressive: Higher leverage for short-term trading, but requires strong TA skills and discipline.

Ultimately, capital preservation is the first rule of trading. The goal is longevity — to stay in the market long enough to capture major opportunities. Futures can multiply returns when used wisely, but also magnify losses if mismanaged.

With proper strategy and discipline, MSTR futures on MEXC offer a powerful, flexible way to participate in the intersection of Wall Street and Web3.

Risk Disclaimer: All investments involve risk. Cryptocurrency and leveraged derivatives are volatile instruments. Conduct independent research and trade responsibly.

Join MEXC and Get up to $10,000 Bonus!

Sign Up