When the market is booming, every investment decision seems easy. Continuous green portfolios make everyone believe they fully understand how the market works. But crypto history always repeats one harsh truth: most tokens you hold will disappear or lose over 95 percent of their value when the bear market arrives. This is not a warning but a fact based on historical cycles. This article will directly explore why this happens, how new narratives push old projects out, token models that often collapse, crowd psychology, and how to prepare so you do not become the next victim.

1. Market Project Overview

Most crypto projects today follow a familiar script: announce funding from venture funds, launch campaigns like airdrops, users rush in to grab airdrops and sell tokens immediately, then disappear without a trace, moving on to a new idea and a new project in an endless loop. Looking back at the DeFi farming wave in 2020 makes this clear. Names like Yam Finance, Pickle Finance, and Kimchi once exploded with hundreds of millions in TVL within weeks. But now? Most have ceased operations or have only a few million dollars in liquidity, often less than new emerging projects. Currently, there are over 35 million projects with tokens across the crypto market. According to a recent Coingecko report, more than 50 percent have failed, and the number continues to rise. Alarmingly, the first quarter of 2025 alone saw 1.8 million tokens collapse, accounting for 49.7 percent of all recorded project failures. This sharp drop in token survival is likely linked to broader market turmoil, particularly after President Donald Trump’s inauguration in January 2025, coinciding with the crypto market downturn.

Looking at the top 10 coins by market cap in 2018 versus 2025 illustrates this brutal “weeding out.” Apart from Bitcoin, which has retained its position, only Ethereum and XRP remain. Formerly popular names like EOS, Litecoin, Bitcoin Cash, Stellar, and NEM have all fallen out of the top 10. And that is just the top 10 coins—imagine the fate of thousands of other altcoins outside this list. These statistics reveal a harsh truth: even projects with billion-dollar market caps and hundreds of thousands of believers can vanish within a few years. So what are the chances of survival for the small tokens you hold?

2.Why Most Tokens Disappear During a Bear Market

2.1 Short Lifespan

Most crypto projects have no real revenue, no complete product, and do not exist for more than two years. They are often born to ride trends. When the market drops, the cash flow stops, the team cannot sustain operations, they withdraw, and the token becomes worthless.In a bull market, merely presenting a trending concept is enough to attract capital and liquidity. But in a bear market, investors demand real products, real revenue, and real users. Most projects fail to meet this standard.

Report shows the average lifespan of a crypto project

2.2 Tokenomics Designed to Sell, Not Build

Many projects are created with a single purpose: distributing tokens to the team and early investors by pumping the price and then selling. Tokenomics often have monthly unlock schedules. When the market falls, selling pressure spikes, while buy demand drops, causing token losses of 90 to 99 percent. Most retail investors do not understand this. They only see price increases and buy blindly, while a large number of locked tokens far exceeds circulating supply.

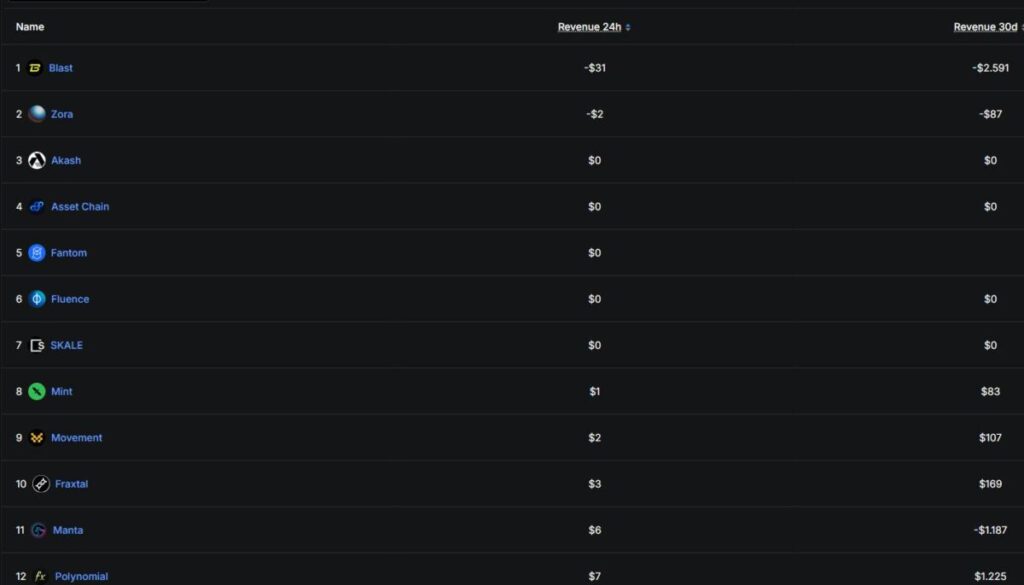

2.3 No Revenue to Sustain Operations

In this market, the projects that survive until the end are those with:

- Real revenue

- Low burn rate

- Teams working persistently for years

- Sustainable business models

The projects with the lowest revenues are the ones with the least activity.Most projects launched in a bull market do not meet these criteria. They rely on marketing and internal funding rounds. When the market crashes, project funding disappears, leading to bankruptcy or closure.

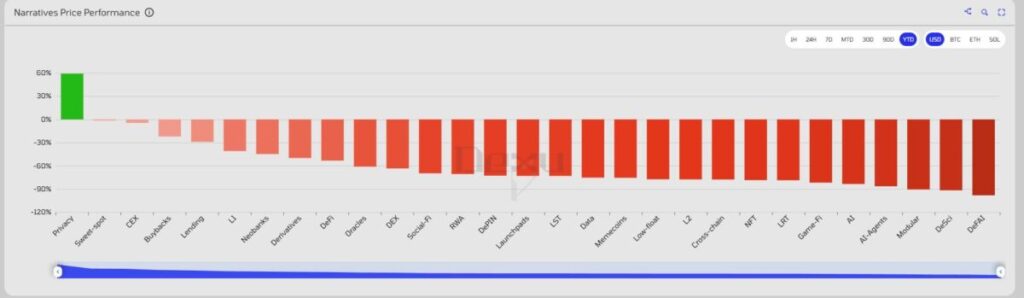

2.4 Constant Emergence of New Narratives

A key reason many tokens die during a bear market is the continuous arrival of new narratives. Crypto is not only technology but also the story that attracts capital and community. When a new narrative emerges, projects tied to old narratives quickly become obsolete and lose appeal.

For example: 2017 was ICOs, 2020 was DeFi, 2023–2024 was new Layer 1s, LSD, and restaking. Projects that fail to adapt lose users, liquidity, and value. The bear market only supports strong narratives, while old narratives and associated tokens drop sharply or disappear entirely.

2.5 Users Drop Significantly in a Bear Market

In a bull market, on-chain users often increase three to five times the normal level. When the market declines, user activity drops sharply or disappears. DeFi, NFT, and SocialFi protocols instantly lose 70 to 95 percent of their users. When users leave:

- Fees decrease

- TVL evaporates

- Token utility disappears

- Narratives are forgotten

Result: Token prices free fall, and projects announce shutdowns.

3.Factors That Help Coins Survive a Bear Market

A recent study shows the difference between a failed project and a long-lasting ecosystem lies in three core factors:

- Incentivizing users to participate: Incentives can include token price increases, buying tokens to earn yields, airdrops from both the main project and the ecosystem. More users participating increases token utility, demand, and attracts new users.

- Retaining users: After attracting users, projects must keep them engaged. Users need to feel that leaving would cause them to lose something. This creates a loyal community.

- Real use case: This is perhaps the most critical reason users continue holding tokens. Simply put, if a coin does not help increase wealth, it is useless.

Ethereum exemplifies all three factors:

- Incentive loop: Its decentralization and security attract developers to build dApps across DeFi, GameFi, NFT, and RWA. Ethereum currently hosts over 5,000 dApps.

- Retaining users: Ethereum attracts whales and individual users in all sectors, from NFTs to memecoins. Recent gas fee reductions also incentivize users to stay.

- Real use case: Beyond price appreciation, ETH holders can earn yield in DeFi. Ethereum remains the DeFi hub, with all components like Staking, Lending, and Liquid Staking originating here. TVL on Ethereum is over 80 billion USD.

4.Review Your Portfolio Now

Only when every user action creates real ecosystem value can a project continue developing even during a bear market. This is the boundary between a short-term speculation token and a long-lasting ecosystem. In your crypto investment journey, always reassess your portfolio. Can it survive the downtrend? How many coins truly meet the three criteria? Which tokens lack one or all factors? If a token lacks real use cases, user retention, and relies solely on airdrops, do not deceive yourself—it is short-term speculation. Recognize it and plan clear profit-taking or stop-loss strategies instead of holding with vague hope.

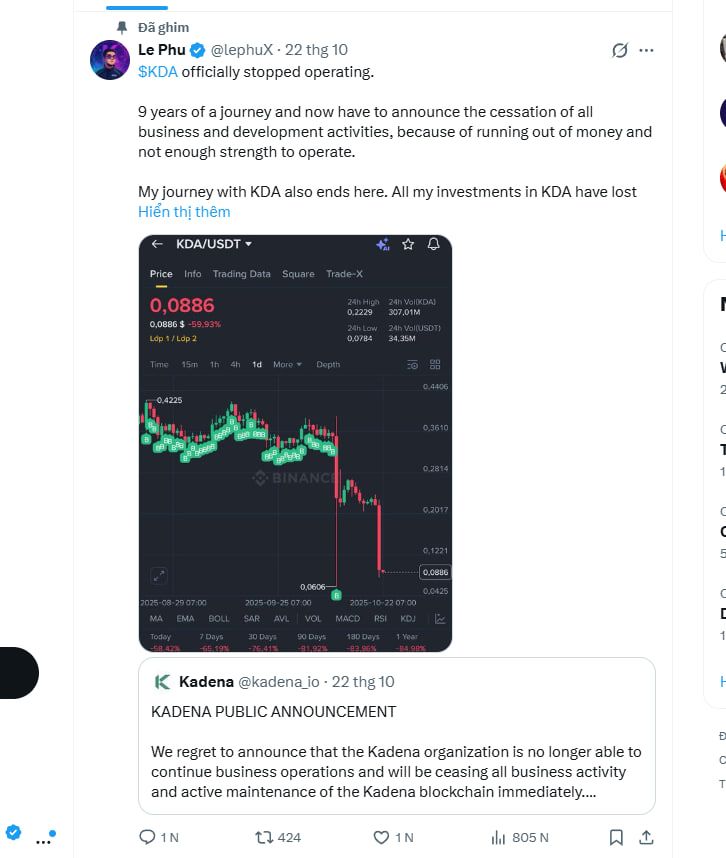

Kadena project shuts down, leaving DCA users hopeless

The difference between investing and speculating is here: investing is putting money into something that creates real value and grows over time, while speculation is hoping to win the lottery. Speculation is fine as long as you do not confuse it with investing. Knowing what you are doing and having a plan is how to survive in the volatile crypto market. Every market cycle introduces hundreds of thousands of new tokens. They come with catchy names, impressive roadmaps, and promises to revolutionize the blockchain industry. But when the bear market hits and cash flow stops, over 90 percent of these tokens will disappear along with the investments you thought would change your life.

5. Conclusion

The bear market exposes the true nature of the crypto market. Most projects without real products, loyal communities, or sustainable revenue will quickly collapse. Tokens you hold are likely to lose value severely or disappear completely. Only projects with real use cases, strong user retention, and long-term value creation can survive. Understanding risks and evaluating your portfolio is the only way to avoid becoming the next victim.

Disclaimer: This content does not constitute investment, tax, legal, financial, or accounting advice. MEXC provides this information for educational purposes only. Always do your own research, understand the risks, and invest respons

Join MEXC and Get up to $10,000 Bonus!

Sign Up