Seychelles, April 10, 2025 – MEXC has seen a net inflow of $77.5 million over the past 7 days, becoming one of the few major centralized exchanges (CEXs) to show positive dynamics amid a general market drop, according to DeFiLlama. In total, MEXC’s monthly net inflow surpassed $1.79 billion, reflecting an increase of 12.4% compared to the previous month and demonstrating stable positive dynamics against the backdrop of cautious user behavior in the rest of the market.

According to DeFiLama, MEXC entered the top three exchanges by monthly inflow, with $84.25 million in April alone and a total value locked (TVL) of $2.8 billion as of April 9, 2025. The exchange shows a steady increase in trust and liquidity accumulation despite market volatility.

Inflow and outflow dynamics: comparison with other CEX

| Exchange | 7-Day Net Inflow | 30-Day Net Inflow |

| Binance | +$888 million | +$3.7 billion |

| Bybit | +$564.9 million | +$3.2 billion |

| MEXC | +$77.5 million | +$1.79 billion |

| Kucoin | −$40 million | −$893.5 million |

| HTX | +$402.1 million | +$464.9 million |

BTC and USDT Flows Signal a Rebalancing

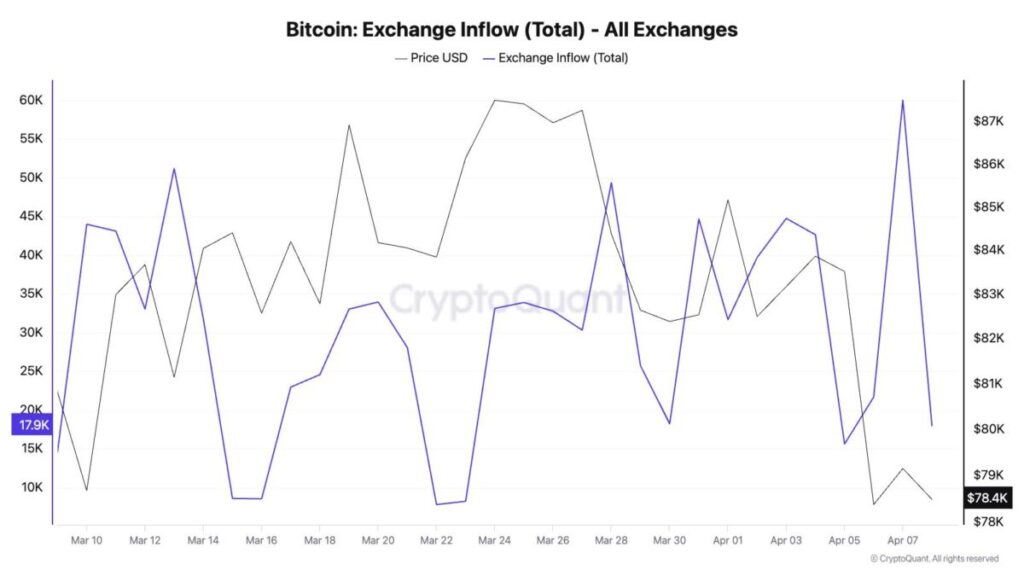

Сapital flow dynamics of recent days indicate a potential shift in short-term investor sentiment. According to analytics platform CryptoQuant, April 7 recorded the largest Bitcoin inflow to centralized exchanges in a month — approximately 60,000 BTC. This surge stands in contrast to previous days, when inflows remained within the 15,000-40,000 BTC range. The increased inflow, amid Bitcoin’s price decline to $79,200, may signal an active selling phase, especially if it was initiated by retail or institutional holders looking to lock in profits or limit losses.

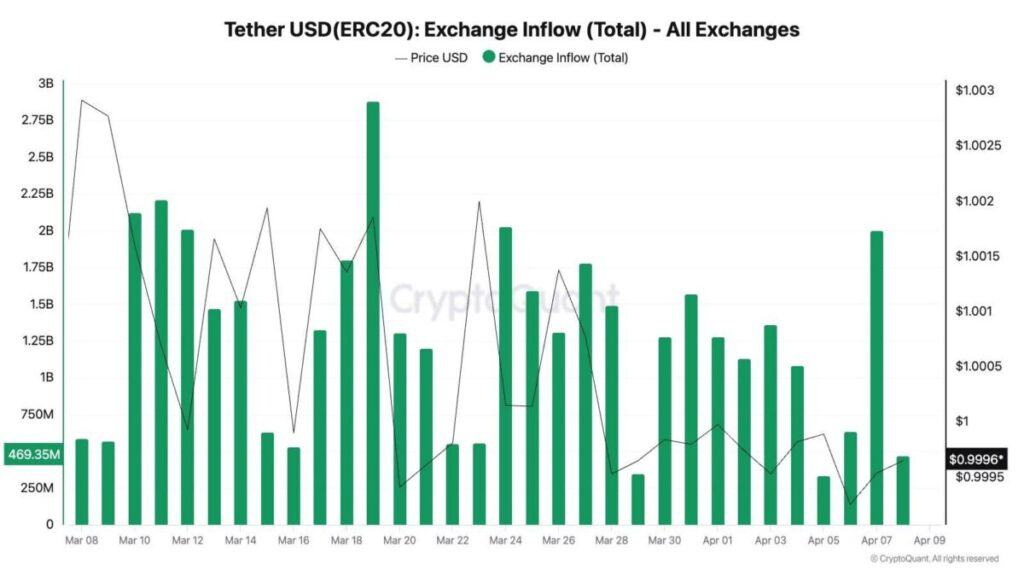

At the same time, the stablecoin inflow chart demonstrated a similar trend. On April 7, almost $2 billion of Tether (USDT) was moved to crypto exchanges, marking one of the highest values in the last 30 days. This may indicate a reverse behavior pattern: market participants are not withdrawing funds, but transferring liquidity to exchanges to buy assets during the correction.

This trend is further supported by the fact that the USDT maintained a stable peg close to $1.00, signaling the absence of panic or forced liquidations. Similar surges in BTC inflow were also observed on March 13 and March 28, but they were not followed by significant price drops, pointing to a potential technical or OTC nature of these transfers. If the inflow was driven by internal exchange operations (redistribution of liquidity or rebalancing of cold wallets), it should not be interpreted as a signal for an aggressive sell-off. The combination of Bitcoin and stablecoin inflows against the background of a moderate price decline may indicate rebalancing and increased readiness for active trading, rather than a potential sell-off or capitulation.

Potential Reversal Scenario

The situation in the crypto market remains tense but not critical. According to Fedwatch, the market expects the Fed to ease its monetary policy as early as June. Therefore, investors may begin to increase their positions in crypto assets in the second half of May ahead of the June meeting, supporting the BTC rate.

Additionally, after reassessing the actual impact of trade restrictions, investors may partially return to digital assets as an alternative to the stock market. With stable liquidity and the absence of new regulatory shocks, the market has the potential to reverse in May.

About MEXC

Founded in 2018, MEXC is committed to being “Your Easiest Way to Crypto.” Serving over 36 million users across 170+ countries, MEXC is known for its broad selection of trending tokens, everyday airdrop opportunities, and low trading fees. Our user-friendly platform is designed to support both new traders and experienced investors, offering secure and efficient access to digital assets. MEXC prioritizes simplicity and innovation, making crypto trading more accessible and rewarding.

MEXC Official Website| X | Telegram |How to Sign Up on MEXC

For media inquiries, please contact MEXC PR Manager Lucia Hu: lucia.hu@mexc.com

Join MEXC and Get up to $10,000 Bonus!

Sign Up